[ad_1]

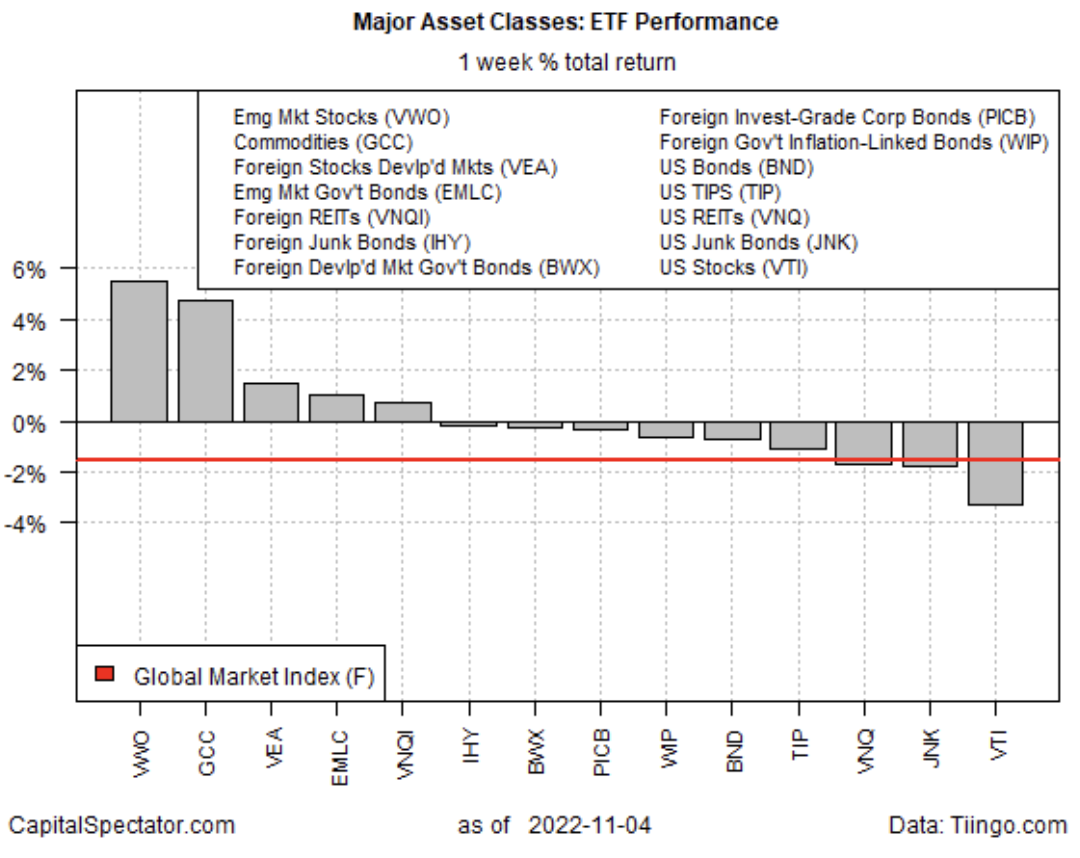

The latest rally in world markets thinned out final week as commodities and international shares rose whereas U.S. belongings retreated, primarily based on a set of ETF proxies.

Shares in rising markets posted the main efficiency for the main asset lessons within the buying and selling week by means of Friday’s shut (Nov. 4). The 5.5% surge in Vanguard FTSE Rising Markets Index Fund ETF Shares (NYSE:) is spectacular, however the ETF continues to replicate a bearish development and so the newest pop doesn’t the change the fund’s destructive outlook.

A key headwind for VWO and different emerging-markets funds: China, which continues to endure economically from its zero-COVID coverage. For instance, the nation reported month-to-month declines in exports and imports for October. “The weak export progress possible displays each poor exterior demand in addition to the availability disruptions as a result of COVID outbreaks,” says Zhiwei Zhang, chief economist at Pinpoint Asset Administration.

China is VWO’s high nation allocation with a roughly 33% weight within the nation. That’s been a big headache as China’s inventory market has considerably underperformed world equities this yr. The iShares MSCI China ETF (NASDAQ:) is down 34.6% yr so far, nicely beneath the 21.1% haircut for Vanguard Complete World Inventory Index Fund ETF Shares (NYSE:) this yr.

However some analysts predict that China might quickly ease its lockdown insurance policies. Goldman Sachs economists advise in a analysis notice:

“We estimate {that a} full reopening may drive 20% upside for Chinese language shares primarily based on empirical, top-down, and historic sensitivity analyses.”

The likelihood {that a} coverage change could also be close to seems to be an element within the newest pop in China shares.

U.S. shares posted the deepest loss for the main asset lessons final week. Vanguard Complete Inventory Market Index Fund ETF Shares (NYSE:) slumped 3.3%, the fund’s first weekly loss up to now three. The downturn reaffirms the bearish development that continues to weigh on the ETF this yr.

Final week’s combined outcomes for markets delivered a loss for the World Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com. This index holds all the main asset lessons (besides money) in market-value weights through ETFs and represents a aggressive measure for multi-asset-class-portfolio methods general. GMI.F shed 1.5% final week, the benchmark’s first weekly loss up to now three (pink line in chart beneath).

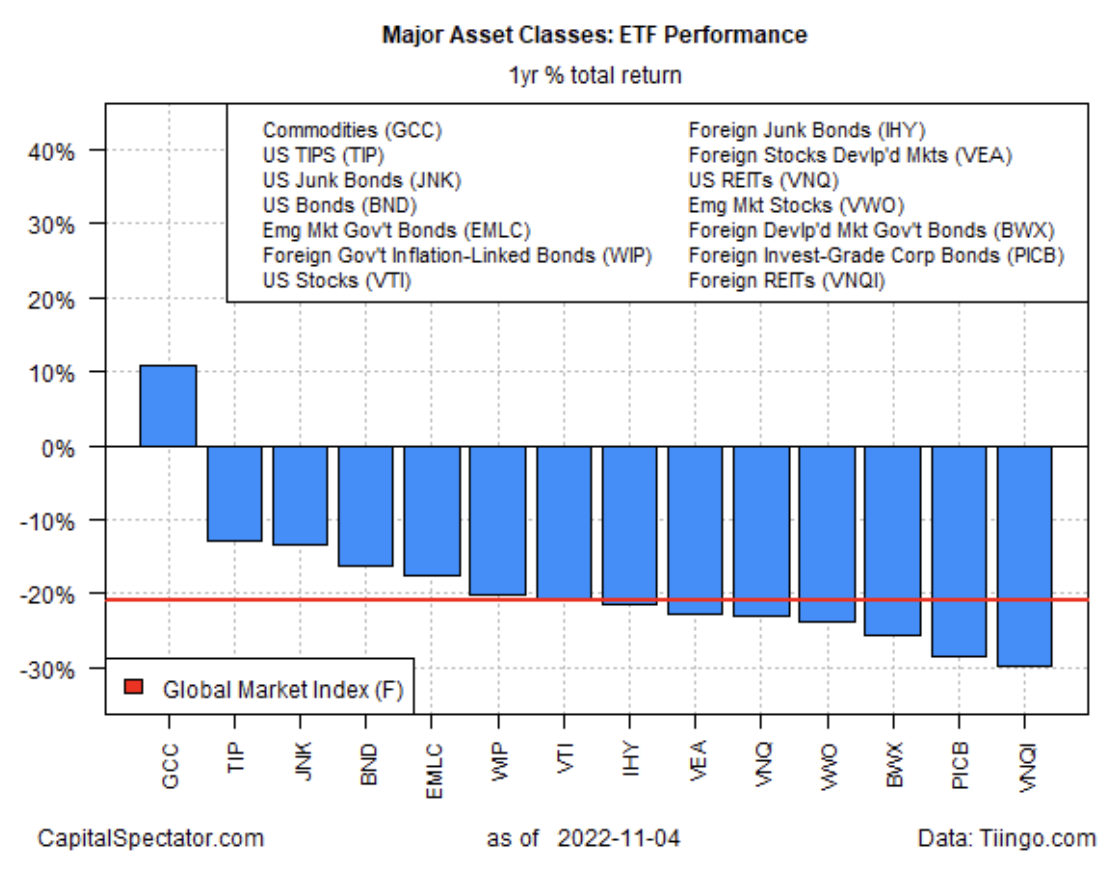

For the one-year change, commodities (through WisdomTree Steady Commodity Index Fund (NYSE:)) stay the one winner for the main asset lessons. In any other case, losses prevail over the previous 12 months by means of Friday’s shut.

GMI.F’s one-year change: simply shy of a 21% loss.

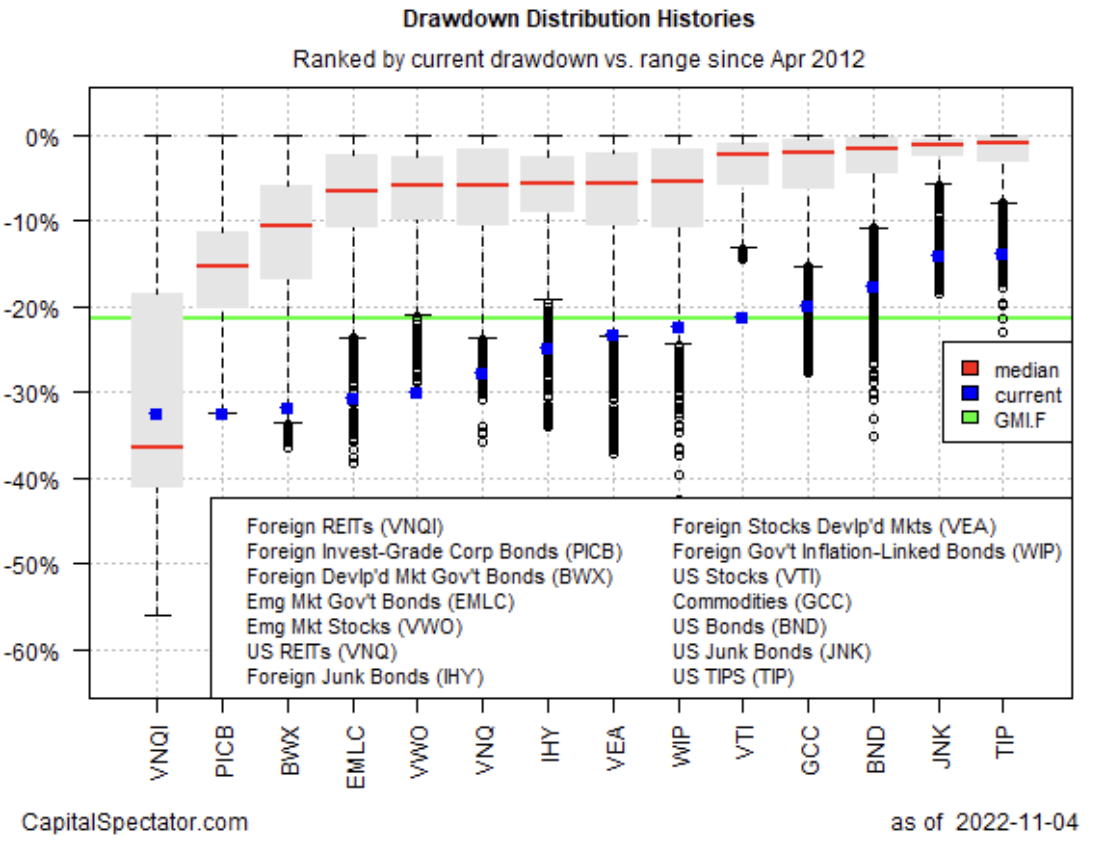

Reviewing the main asset lessons by means of a drawdown lens continues to point out steep declines from earlier peaks. The softest drawdown on the finish of final week: inflation-indexed US Treasuries (through iShares TIPS Bond ETF (NYSE:)) with a 14% peak-to-trough decline. The deepest drawdown is in international actual property shares (through Vanguard World ex-U.S. Actual Property Index Fund ETF Shares (NASDAQ:)) with a roughly 33% slide.

GMI.F’s drawdown: -21.3% (inexperienced line in chart beneath).

[ad_2]

Source link