RBA, AUD/USD, GBP/AUD Evaluation

- RBA Governor reiterates versatile method amid two-sided dangers

- AUD/USD fights again after RBA Governor Bullock highlights inflation worries

- GBP/AUD declines after large spike increased – fee minimize bets revised decrease

Really useful by Richard Snow

Get Your Free AUD Forecast

RBA Governor Reiterates Versatile Strategy Amid Two-Sided Dangers

RBA Governor Michele Bullock attended a query and solutions session in Armidale the place she maintained the deal with inflation because the primary precedence regardless of rising financial considerations, lifting the Aussie within the course of.

On Tuesday, the RBA launched its up to date quarterly forecasts the place it lifted its GDP, unemployment, and core inflation outlooks. That is regardless of latest indications suggesting to the RBA that Q2 GDP is more likely to be subdued. Elevated rates of interest have had a unfavorable affect on the Australian financial system, contributing to a notable decline in quarter-on-quarter progress for the reason that begin of 2023. In Q1 2024, the financial system narrowly prevented a unfavorable print by posting progress of 0.1% in comparison with This fall of 2023.

Australian GDP Progress Price (Quarter-on-Quarter)

Supply: Tradingeconomics, ready by Richard Snow

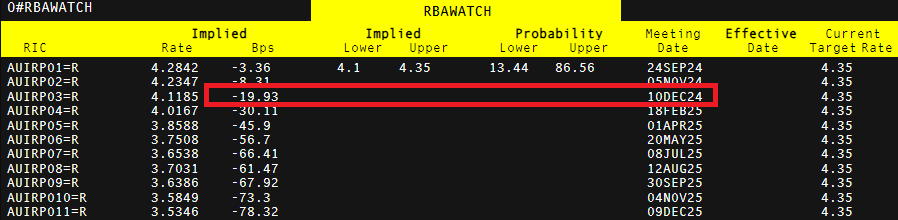

Bullock talked about the RBA thought of a fee hike on Tuesday, sending fee minimize odds decrease and strengthening the Aussie greenback. Whereas the RBA assess the dangers round inflation and the financial system as ‘broadly balanced’, the overarching focus stays on getting inflation all the way down to the two%-3% goal over the medium-term. In line with RBA forecasts inflation (CPI) is predicted to tag 3% in December earlier than accelerating to three.7% in December 2025.

Within the absence of constantly decrease costs, the RBA is more likely to proceed discussing the potential for fee hikes regardless of the market nonetheless pricing in a 25-basis level (bps) minimize earlier than the top of the 12 months.

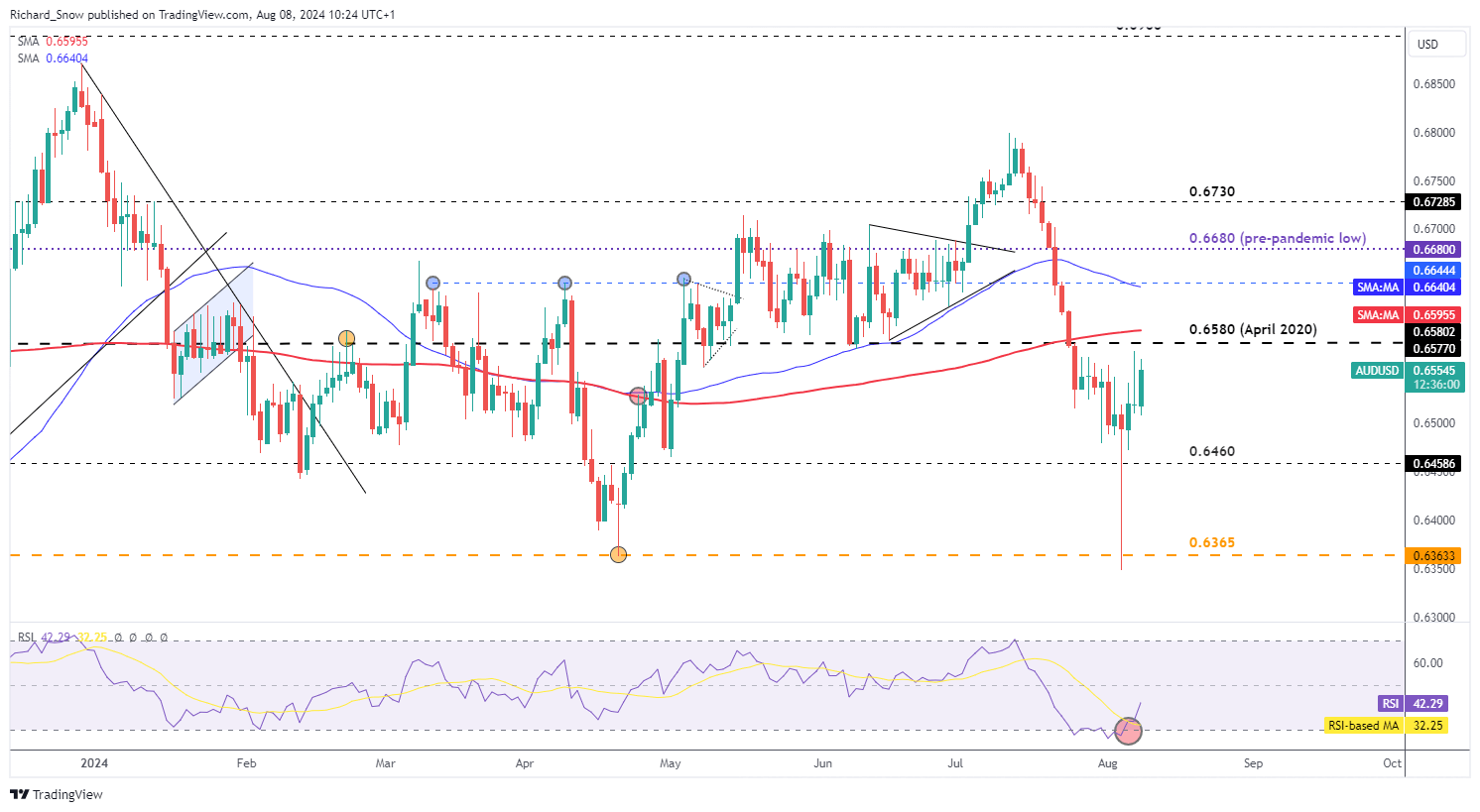

AUD/USD Correction Finds Resistance

AUD/USD has recovered an excellent deal since Monday’s world bout of volatility with Bullocks fee hike admission serving to the Aussie get well misplaced floor. The diploma to which the pair can get well seems to be restricted by the closest degree of resistance at 0.6580 which has repelled makes an attempt to commerce increased.

A further inhibitor seems through the 200-day easy shifting common (SMA) which seems simply above the 0.6580 degree. The Aussie has the potential to consolidate from right here with the following transfer doubtless depending on whether or not US CPI can keep a downward trajectory subsequent week. Help seems at 0.6460.

AUD/USD Day by day Chart

Supply: TradingView, ready by Richard Snow

Really useful by Richard Snow

Easy methods to Commerce AUD/USD

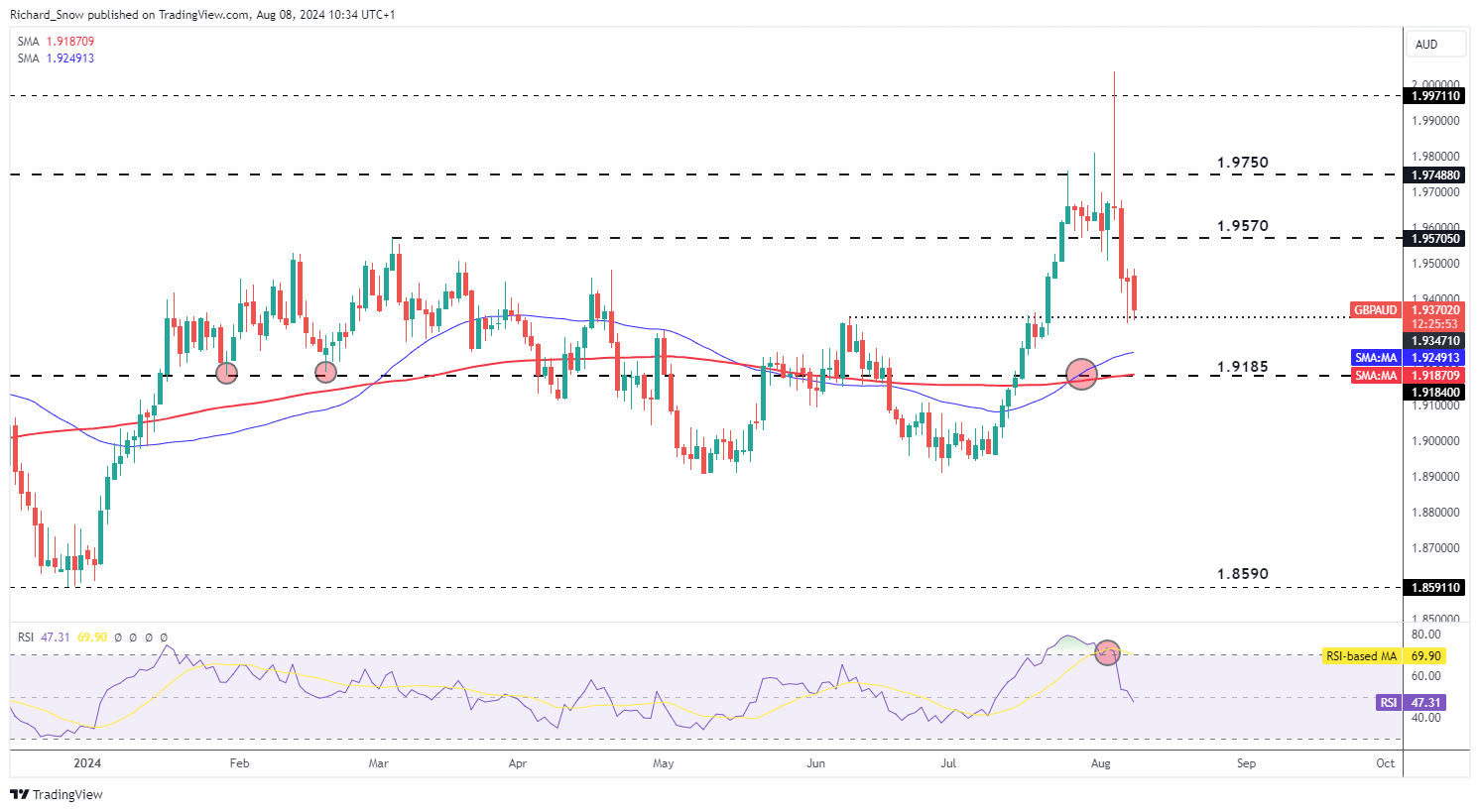

GBP/AUD declines after large spike increased – fee minimize bets revised decrease

GBP/AUD has posted a large restoration for the reason that Monday spike excessive. The huge bout of volatility despatched the pair above 2.000 earlier than retreating forward of the every day shut. Sterling seems susceptible after a fee minimize final month stunned corners of the market – leading to a bearish repricing.

The GBP/AUD decline at the moment assessments the 1.9350 swing excessive seen in June this 12 months with the 200 SMA suggesting the following degree of assist seems on the 1.9185 degree. Resistance seems at 1.9570 – the March 2024 excessive.

GBP/AUD Day by day Chart

Supply: TradingView, ready by Richard Snow

An fascinating statement between the RBA and the overall market is that the RBA doesn’t foresee any fee cuts this 12 months whereas the bond market priced in as many as two fee cuts (50 bps) throughout Monday’s panic, which has since eased to 19 bps.

Supply: Refinitiv, ready by Richard Snow

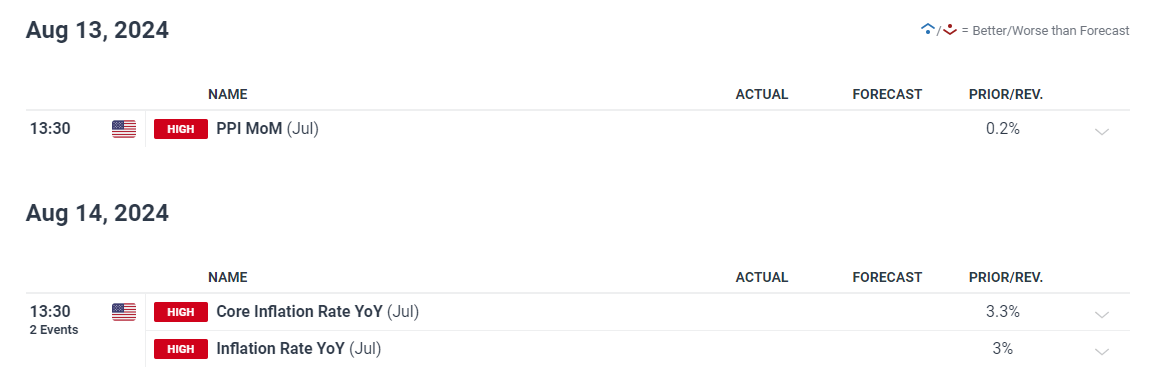

Occasion threat peters out considerably over the following few days and into subsequent week. The one main market mover seems through the July US CPI information with the present pattern suggesting a continuation of the disinflation course of.

Customise and filter reside financial information through our DailyFX financial calendar

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX