Elementary Forecast for the US Greenback: Impartial

- US Treasury yields proceed to rise in accordance with quickly escalating Fed fee hike odds, underpinning US Greenback power.

- The March US nonfarm payrolls report on Friday could also be dwarfed by the continued commentary from Federal Reserve policymakers {that a} 50-bps fee hike is coming at their subsequent assembly.

- In line with the IG Consumer Sentiment Index, the US Greenback has a blended bias heading into the final week of March.

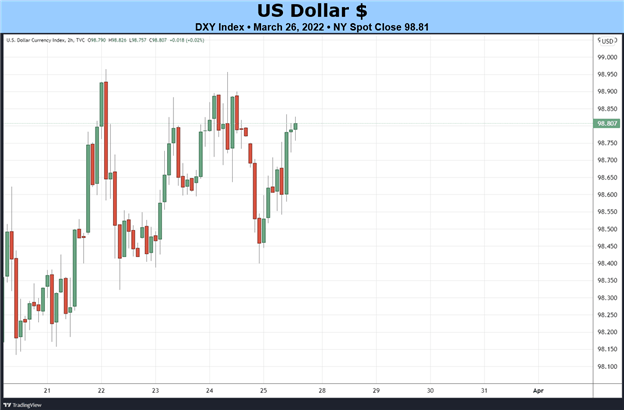

US Greenback Week in Assessment

The US Greenback shrugged off a poor efficiency in mid-March, closing final week greater by +0.59%, its sixth weekly achieve over the previous seven weeks total. However the headline achieve masks a extra sophisticated story: the US Greenback misplaced floor in opposition to most currencies final week. GBP/USD charges had been up by +0.03%, USD/CHF charges misplaced -0.13%, and USD/CAD charges dropped by -1.02%. As an alternative, the heavy lifting was carried out by EUR/USD and USD/JPY charges, with the previous shedding -0.62% and the latter including a powerful +2.47%.

US Financial Calendar in Focus

Like for many of the previous month, it stays the case that US financial information usually are not a big issue within the US Greenback’s latest success or failures. Markets are paying extra consideration to what Federal Reserve policymakers are saying, insofar as they’ve been ‘foaming the runway’ for a 50-bps fee hike after they meet subsequent in Might, roughly neutering the significance of information releases till then. Furthermore, greater commodity costs and interbank market funding stresses ensuing from Russia’s invasion of Ukraine and the following sanctions by the European Union and the USA retain important sway over market circumstances.

With that mentioned, right here’s the US financial information due out within the coming days:

- On Monday, March 28, the February US items commerce steadiness and the February US retail inventories (ex-autos) might be launched at 12:30 GMT.

- On Tuesday, March 29, the January US home worth index might be revealed at 13 GMT, adopted by a speech by New York Fed President John Williams. March US client confidence figures might be in focus at 14 GMT.

- On Wednesday, March 30, weekly US mortgage functions figures might be launched at 11 GMT adopted by the March US ADP employment change report at 12:15 GMT. Shortly thereafter, the ultimate 4Q’21 US GDP report might be revealed.

- On Thursday, March 31, a plethora of information releases are due out at 12:30 GMT: the February US PCE report; weekly US jobless claims; February US private earnings figures; and February US private spending figures. At 13 GMT, New York Fed President Williams will give remarks.

- On Friday, April 1, the March US nonfarm payrolls report might be revealed at 12:30 GMT, as will the March US unemployment fee. The March US ISM manufacturing PMI and February US building spending information might be launched at 14 GMT.

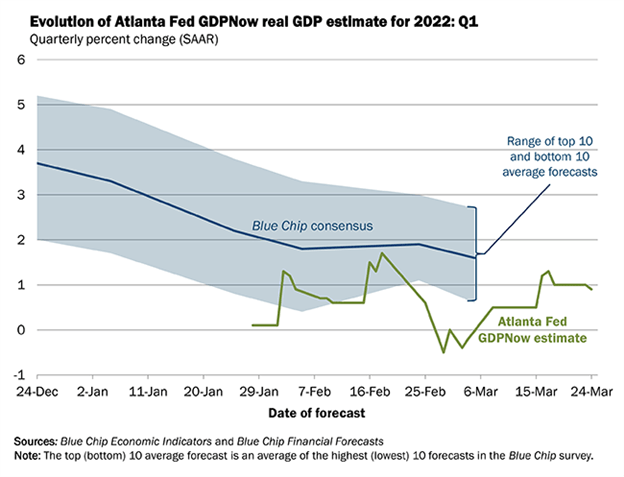

Atlanta Fed GDPNow 1Q’22 Development Estimate (March 24, 2021) (Chart 1)

Based mostly on the information acquired up to now about 1Q’22, the Atlanta Fed GDPNow progress forecast is now at +0.9% annualized, down from +1.3% on March 17. The downgrade was a results of “actual gross personal home funding progress [decreasing] from -4.2% to -5.8%.”

The subsequent replace to the 1Q’22 Atlanta Fed GDPNow progress forecast is due on Thursday, March 31 after the February US private earnings and spending information.

For full US financial information forecasts, view the DailyFX financial calendar.

Fed Turns Up Hawkish Rhetoric

A slew of hawkish feedback over the previous week, led by Fed Chair Jerome Powell himself, have dramatically escalated expectations that not solely will the FOMC raises charges by 50-bps after they meet subsequent in Might, however will represent an much more aggressive financial tightening effort over the approaching months.

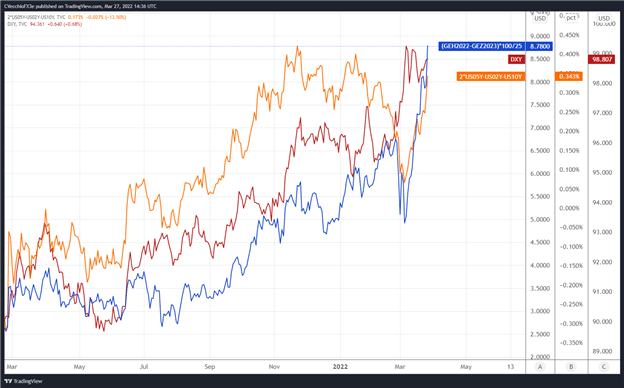

We are able to measure whether or not a Fed fee hike is being priced-in utilizing Eurodollar contracts by inspecting the distinction in borrowing prices for industrial banks over a selected time horizon sooner or later. Chart 2 under showcases the distinction in borrowing prices – the unfold – for the March 2022 and December 2023 contracts, with a view to gauge the place rates of interest are headed by December 2023.

Eurodollar Futures Contract Unfold (March 2022-December 2023) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: Each day Timeframe (March 2021 to March 2022) (Chart1)

By evaluating Fed fee hike odds with the US Treasury 2s5s10s butterfly, we will gauge whether or not or not the bond market is appearing in a way in line with what occurred in 2013/2014 when the Fed signaled its intention to taper its QE program. The 2s5s10s butterfly measures non-parallel shifts within the US yield curve, and if historical past is correct, because of this intermediate charges ought to rise quicker than short-end or long-end charges.

There are now eight25-bps fee hikes discounted by means of the tip of 2023. Rates markets are discounting a78% likelihood of 9 25-bps fee hikes by means of the tip of subsequent yr. Concurrently, the 2s5s10s butterfly has widened sharply in latest weeks. Each of those developments are in line with sustained US Greenback power, significantly in opposition to decrease yielding counterparts just like the Euro and the Japanese Yen.

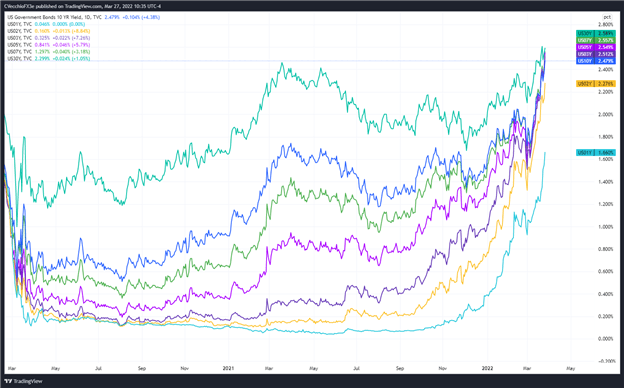

US Treasury Yield Curve (1-year to 30-years) (March 2020 to March 2022) (Chart 3)

The widening of the 2s5s10s butterfly coupled with rising US Treasury yields helps reinforce US Greenback power. The continued rise in US inflation expectations (as measured by the 2y2y and 5y5y inflation swap forwards) coupled with proof of liquidity stresses persisting counsel that the US Greenback will stay resilient, no matter what’s occurring on the financial calendar. Bonds proceed to commerce as if the Fed will elevate charges for not simply a number of conferences in a row, but additionally in 50-bps increments.

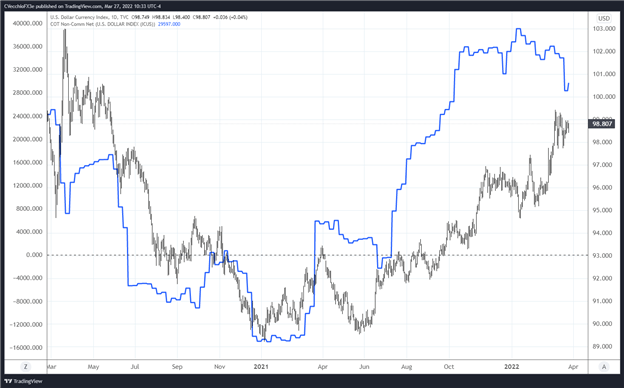

CFTC COT US Greenback Futures Positioning (March 2020 to March 2022) (Chart 4)

Lastly, positioning, in line with the CFTC’s COT for the week ended March 22, speculators elevated their net-long US Greenback positions to 29,597 contracts from 28,345 contracts. Internet-long US Greenback positioning has rebounded from its lowest stage because the first week of October 2021, however stays -24% under its excessive of this yr.

— Written by Christopher Vecchio, CFA, Senior Strategist