cyano66/iStock through Getty Photographs

Time destroys the hypothesis of males, however it confirms nature. – Marcus Tullius Cicero.

The inventory market is a posh ecosystem fueled by quite a few elements, an important of which is investor psychology. In all my years on this profession and in learning markets, I’ve by no means seen recency bias as sturdy as it’s right this moment in the best way “traders” understand the longer term. And it might be time to remind folks that previous efficiency shouldn’t be indicative of future outcomes.

Twitter

Understanding Recency Bias

Recency bias is a psychological phenomenon the place people give extra significance to current occasions or info than these from the previous. This cognitive bias tends to affect our decision-making course of, significantly in areas reminiscent of funding methods.

Traders affected by recency bias typically make funding choices based mostly on the latest efficiency of a inventory or a market development, overlooking long-term efficiency knowledge or historic market traits. This bias can result in irrational funding choices, reminiscent of shopping for into asset bubbles or panic promoting throughout bear markets.

The Position of Recency Bias within the Inventory Market

Throughout a bull market, traders might change into overly optimistic, believing that the upward development will proceed indefinitely. This perception typically results in overinvestment in high-performing shares, leading to an inflated market bubble and important intermarket divergences. Conversely, throughout a bear market, traders might change into overly pessimistic, promoting off shares attributable to a concern that the downward development will persist. This conduct can exacerbate market declines and result in panic promoting (capitulation). The one commonality between inventory market tops and inventory market bottoms is overconfidence, and that will get fueled by recency bias.

Recency Bias, QQQ, and Nvidia

I’ve used the road earlier than on Twitter that “you understand you are proper when the counter-argument is an insult.” I’ve been within the pre-election 12 months melt-up camp because the first week of January after arguing that “the top of the world is the bull case” in October. The sentiment right this moment by the bulls is not any totally different than the sentiment by the bears again then, significantly purchase Nvidia Company (NVDA) acolytes unable to see past a vertical value chart that will go the best way of Cisco Techniques (CSCO) put up late-Nineteen Nineties.

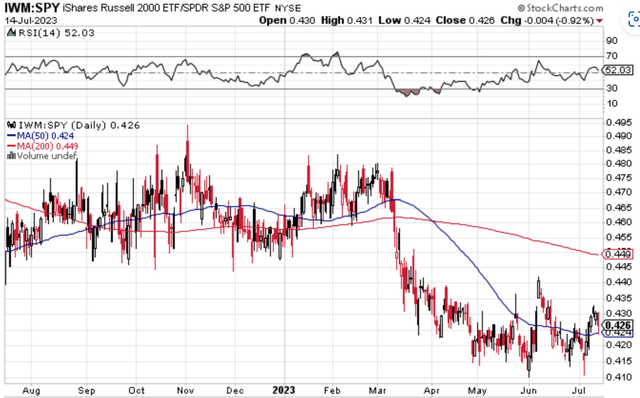

AI mania has run wild, however the narratives are merely following value. If I have been mistaken on something this 12 months, it is within the melt-up argument given small-cap (IWM) relative underperformance towards large-caps (SPY). To argue that “breadth is widening” is irrelevant if small-caps, which ARE breadth, aren’t really outperforming.

Stockcharts.com

I famous in The Lead-Lag Report Investing Group right here on Searching for Alpha that the chance triggers I am recognized for that traditionally warn of circumstances favoring a inventory market accident are starting to ship some early warning indicators. This is not about me being a perma-bear by any means, however the inventory market is just not following the melt-up script given the best way mania has overtaken a choose group of mega-cap shares that are appearing like meme-coins from 2021.

Conclusion: The Inventory Market Humbles Us All, Simply Not All at As soon as

Overcoming recency bias requires a disciplined and systematic funding method. Traders must give attention to long-term traits and historic efficiency knowledge, relatively than being swayed by current market occasions. I am a giant fan of systematic rules-based investing for this very motive.

This has been a difficult 12 months from a rotation standpoint, given simply how one-sided the momentum has been within the Invesco QQQ Belief ETF (NASDAQ:QQQ). On the finish of the day, value is pushed by feelings within the quick time period, and fundamentals in the long run. We’re at peek greed now, and peek greed typically punishes uneducated speculators once they least anticipate it.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you bored with being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis software designed to provide you a aggressive edge.

The Lead-Lag Report is your each day supply for figuring out threat triggers, uncovering excessive yield concepts, and gaining worthwhile macro observations. Keep forward of the sport with essential insights into leaders, laggards, and every part in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report right this moment.

Click on right here to achieve entry and check out the Lead-Lag Report FREE for 14 days.