[ad_1]

The US recession forecasts persist for some analysts, however the begin date retains shifting ahead as incoming financial information continues to replicate power. The development is mirrored in at the moment’s upwardly revised nowcast for the upcoming third-quarter report.

The federal government is anticipated to report on Oct. 26 that US output accelerated in Q3 to a 3.7% annualized tempo within the July-through-September interval, based mostly on the median estimate through a number of sources compiled by CapitalSpectator.com. The estimate markets a robust enchancment over the two.1% rise for Q2.

US Actual GDP Change-Q3

Right this moment’s Q3 estimate of three.7% additionally displays an upward revision from the , when the median nowcast was 3.2%.

The primary takeaway: the latest persistence of three%-plus median nowcasts at this late date means that the Q3 information due later this month will nearly actually point out a pickup in financial exercise.

The continued financial resilience has defied the warnings in some circles from earlier within the yr {that a} recession was a digital certainty by this level. As economist Paul Krugman says:

Till fairly just lately there was a close to consensus amongst forecasters that the US financial system was headed for a recession. In reality, it’s been precisely one yr since Bloomberg declared that, in accordance with its fashions, the chance of a recession by October 2023 — that’s, now — was one hundred pc.

Oops.

Most, maybe, all recession forecasts in latest historical past have been a type of want casting to a point. Why? A broad measure of information has persistently indicated that recession threat has remained low this yr after rebounding from 2022’s short-lived dip.

Sure, a distinct outlook was highlighted if you happen to cherry-picked indicators. You may at all times see what you wish to see if you happen to deal with particular information units. However that’s a misguided technique to analyze recession.

A greater methodology (or maybe it’s greatest to say the least-worst methodology) is to attenuate noise and maximize sign by operating the analytics over a variety of indicators that, within the combination, current a extra dependable profile.

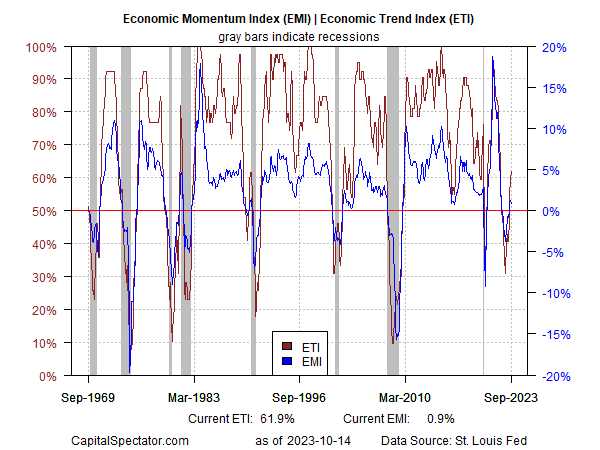

, for instance, a set of proprietary indicators utilized in The US Enterprise Cycle Danger Report continued to replicate low odds that an NBER-defined recession had began or was about to start out. This week’s version of the publication tells an analogous story, as proven within the chart under.

EMI-ETI Chart

Some forecasters insist {that a} downturn continues to be approaching. Within the grand scheme of enterprise cycle analytics, they’re proper. But it surely’s hardly productive to easily push recession begin dates ahead whereas ignoring the sign for a broad, diversified set of financial and monetary indicators.

Sure, there’s one other recession on the horizon. The important thing distinction: For the time being, it’s not on the near-term horizon. Some analysts say that wanting past the following a number of months tells a distinct story. Possibly. The issue is that past two or three months, analyzing the trail for the financial system is kind of complete guesswork.

To be truthful, the potential of an financial shock might seriously change the evaluation in a flash. The escalation of the Israel-Hamas battle is on the brief checklist of threats in the intervening time. However evaluating this threat, a lot much less quantifying it, is difficult, to say the least. When/if this, or another threat, turns into a essential issue for the draw back, we’ll see it within the numbers. In the meantime, recession nowcasting utilizing a broad set of inputs stays the one sport on the town.

[ad_2]

Source link