[ad_1]

Coinbase is a digital forex change platform that permits customers to purchase, promote and retailer numerous cryptocurrencies resembling Bitcoin, Ethereum, Litecoin, and so forth. It was established in 2012 and, since that yr, has turn into one of the crucial in style and extensively used cryptocurrency change firms worldwide. The corporate is the preferred in its sector in america and has a market capitalisation of $23.13B.

Coinbase plans to report its earnings for the fiscal second quarter ending June 2023 on Thursday, August 3, after the market closes.

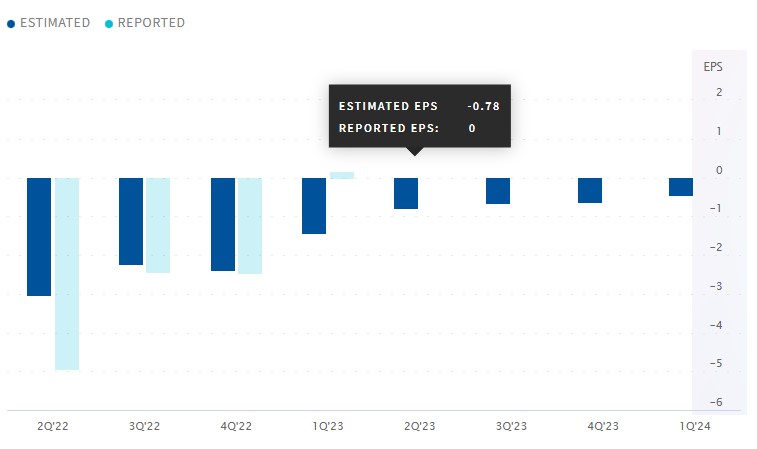

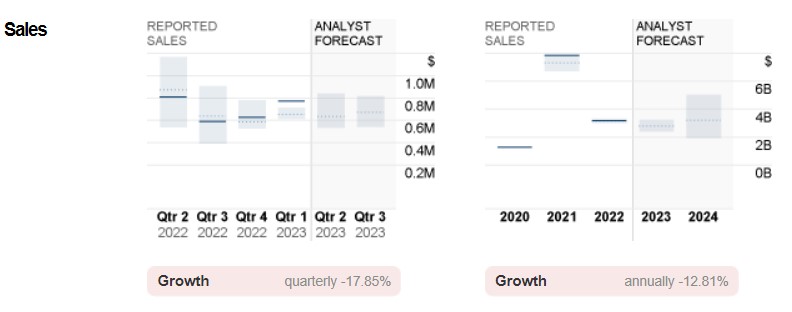

Zacks ranks Coinbase “Rank #3 – Maintain” within the High 9% at #22/251 within the Shares & Equities business. For this report, EPS is anticipated to be $-0.78 (identical for Nasdaq) with an ESP of -3.68%, marking an 84.24% enhance from -$4.95 in the identical quarter final yr. Revenue of $643.36M is anticipated, which might be a drop of -20.41% YoY from $808.33M.

The estimate has 4 downward revisions and 1 upward revision within the final 60 days. The corporate has reported 6 outcomes beneath the estimate of 9 it has revealed, the final quarter optimistic with a shock EPS of 110.42%.

Final quarter the corporate reported EPS of $0.15 and income of $772.53M.

Concerning Coinbase’s inventory value forecast for the subsequent 12 months, we’ve got the bottom forecast with a -71.3% drop at $27.00, the very best expectation is discovered with a +112.3% enhance at $200.00, whereas the typical value is discovered at -31.0% at $65.00.

Parts to contemplate

In June 2023, Coinbase revealed that it had obtained a digital asset buying and selling licence from the Bermuda Financial Authority. This licence will permit the corporate to supply its providers in Bermuda and different areas because it continues to broaden globally.

On the regulatory entrance, Coinbase continues to face regulatory scrutiny from the US Securities and Change Fee (SEC). In July 2023, the SEC ordered Coinbase to delist all tokens besides Bitcoin because of the regulator’s assertion that 13 tokens traded on Coinbase qualify as securities. Following the SEC’s request, Coinbase eliminated sure tokens from its platform.

Nevertheless, the corporate introduced that it could proceed to supply a few of the disputed cryptocurrencies, claiming they weren’t securities, a transfer primarily based on regulatory precedent from the RippleLabs case, the place a federal choose dominated that the Ripple Labs token was not a safety when bought to members of most of the people on cryptocurrency exchanges, which despatched Coinbase’s inventory hovering not too long ago.

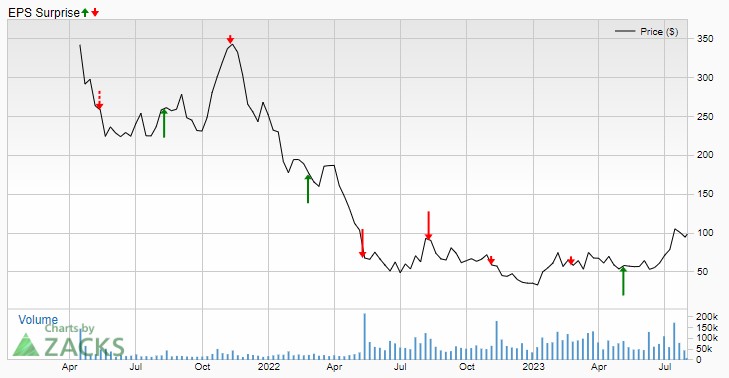

To date this yr, COIN are up 198.42%. Traders perceived that call as doubtlessly beneficial information for Coinbase, which had been sued by the SEC earlier within the yr.

“We actually had no selection on the time, divesting all belongings apart from bitcoin, which is actually not what the regulation says, would have meant primarily the top of the crypto business in america” – Brian Armstrong, CEO of Coinbase.”

Coinbase’s consumer metrics, together with the variety of month-to-month energetic customers and the quantity of belongings held on the platform, are intently monitored. It’s anticipated that the variety of customers and belongings might enhance as folks proceed to undertake cryptocurrencies, the most recent This autumn-22 rely was at 110 million verified customers managing a traded quantity this quarter of $145B. Nevertheless, it will likely be fascinating to see how regulatory developments, such because the removing of sure tokens, have an effect on these metrics.

Regardless of regulatory stress, Coinbase continues to push ahead with new initiatives and choices. In Might 2023, the change revealed its intention to purchase again 0.50% convertible senior notes due 2026, with the goal of decreasing future dilution and optimising the capital construction. As well as, Coinbase participated within the Piper Sandler World Change & FinTech Convention in late June 2023, the place CEO Brian Armstrong led a dialogue on the way forward for digital currencies.

Technical Evaluation – Coinbase D1 $94.15

Through the first quarter Coinbase rose 177.75% to $87.63 from its lows at $31.55 earlier than closing the quarter at $67.57. Within the second quarter, the value dropped to a low of $46.43 in June for a 61.47% enhance to shut the quarter at $71.55. From the second quarter to the current, the value continued the momentum and reached highs at $114.43 (a stage we’ve got not seen since August 2022) giving a complete enhance of 146.46%.

Presently, the value has fallen beneath the important thing $100 stage on retracement taking assist on the every day 20 interval SMA closing at the moment with a Hammer candle awaiting its outcomes.

Ought to the pullback proceed we’ve got 3 fascinating zones: The primary, which is the final excessive zone across the Fibo50% at $80.32 comprising from $75.75-$84.50. The second, the highs previous to the second quarter low comprising from the Fibo78.6% at $60.94 to the 70% low cost at $66.77. And lastly, the lows across the psychological stage of $50 and as much as $46.44.

Within the occasion of additional upside, we might first must regain and maintain the psychological $100 stage, check and break the present highs at $114.43 with a view to search the March 2022 highs close to the psychological $200.00 stage at $206.79.

RSI crossed the 70 overbought stage downwards and is at present at 56.10 marking the top of the momentum and exhibiting the retracement. ADX at 24.52 with the +DI at 18.31 and the -DI at 23.76 marking the autumn within the power of the uptrend and awaiting additional upward or downward momentum. 50 interval every day SMA at $73.98 and 100 interval every day SMA at $68.06, marking a “Golden cross” on the 14th of July.

Click on right here to entry our Financial Calendar

Aldo W. Zapien

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link