There are many cases wherein new traders would experience a beginner’s luck when they first start trading the forex markets. In these cases, new traders would experience a string of winning trades. It might be because they came across a good trading strategy or it may just purely be luck. In most cases, these traders would start to feel that they are invincible and that they could accurately predict where the market will go, or worse they would think that they could dictate the forex market.

The forex market is the biggest trading market in the world. It has an estimated average daily volume of about $5.1 trillion. Predicting what these thousands or even millions of traders will do is already a feat in itself. Thinking that one could dictate the flow of the market with this size is insane. There is no way a retail trader’s volume can dictate the flow of the forex market. Seasoned traders know for a fact that this is impossible and are humble enough to accept a loss whenever they read the market direction wrongly.

Retail traders have one job and that is to go with the flow of the market. One of the best ways to go with the market’s flow is by trading with the momentum of the market. Markets or currency pairs with strong momentum are very difficult to stop and are more likely to continue the direction of the momentum price move.

PUX CCI Momentum Breakout Forex Trading Strategy is a momentum strategy which allows traders to identify strong momentum breakout price action. This allows traders to enter the trade as the new momentum is confirmed. Traders could then ride with the trend or flow of the market which was initiated by the momentum price move.

Quantile Bands

The Quantile Bands indicator is a technical indicator which is based on the theory of probabilities in statistics. Quantiles are basically cut points that divide the range of a probability distribution into a contiguous distribution with equal probabilities. The number of groups created would always be one more than the quantiles that divide the probability distribution. In the case of this indicator, the range of highly probable price movements cut by one quantile thus creating two groups or areas.

The Quantile Bands plot three lines. The midline is the quantile. This is based on a modified moving average. The outer bands signify the range of highly probable price movements. These three lines form a band like structure with two areas.

Trend direction or bias is usually identified based on the slope of the midline. Volatility is observed based on the contraction and expansion of the bands. The momentum of the trend is also identified based on the expansion of the outer line where the direction of the momentum is strengthening.

PUX CCI

PUX CCI is a custom technical indicator which is based on the Commodity Channel Index (CCI) indicator.

Despite its name, the CCI indicator can be used in any tradeable asset or forex currency pair. The CCI was developed in order to spot long-term changes in trend direction or bias, however it could also be used in the lower timeframes.

The CCI is an oscillator type of technical indicator which plots a line that could either be positive or negative. This line is based on the difference between the Typical Price and a Simple Moving Average (SMA), then divided by the product of 0.15 and the Mean Deviation.

PUX CCI modifies the original CCI indicator by adding another line derived from the main CCI line. The CCI line is characteristically very jagged. This is because the CCI line is very sensitive to price movements. However, it also makes it susceptible to price spikes. The second line derived from CCI line is a smoother line which is less susceptible to price spikes.

Positive lines indicate a bullish directional bias, while negative lines indicate a bearish directional bias.

Trading Strategy

This trading strategy is a momentum trading strategy which trades on breakouts from market congestions.

First, the directional trend bias is identified using the PUX CCI indicator. Trends are identified based on the general location of the two lines in relation to the midline which is zero.

Then, as soon as the direction bias is identified, we could then look for breakouts from congestion zones using the Quantile Bands indicator. We could identify congestion zones based on the congestion of the Quantile Bands. Momentum breakouts are identified based on a momentum candle closing strongly outside of the Quantile Bands.

Indicators:

- Quantile_bands 3

- PUX_CCI

- CCI Period: 60

- TCCI Period: 18

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

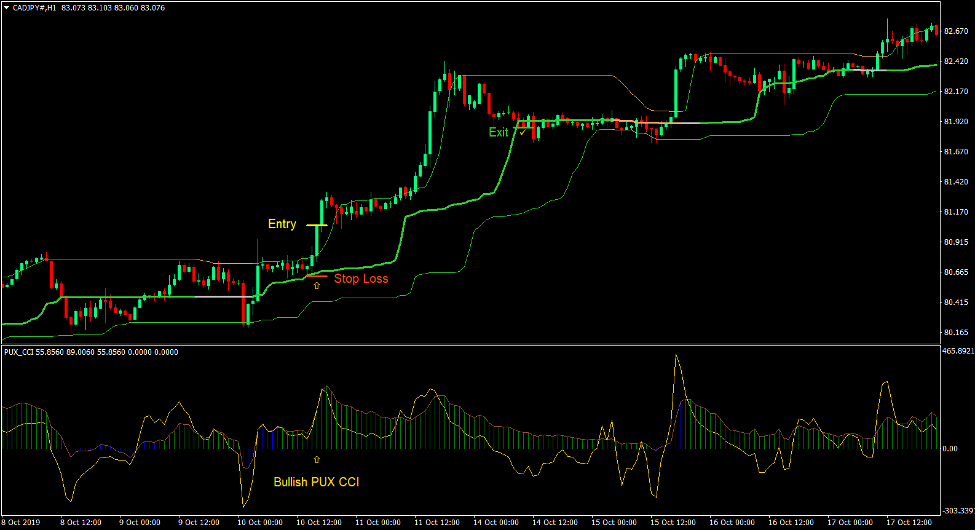

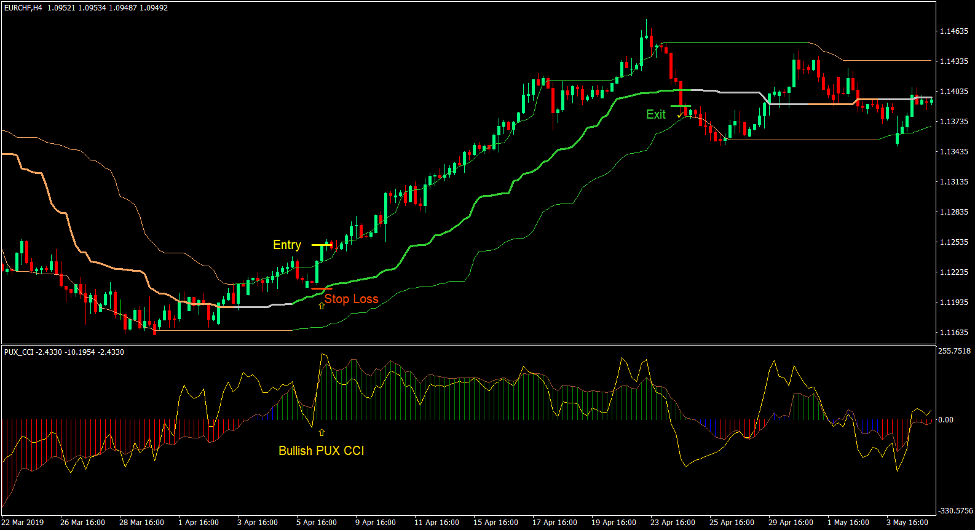

Buy Trade Setup

Entry

- The PUX CCI lines should be generally positive.

- The Quantile Bands should enter a congestion phase.

- A bullish momentum candle should close strongly above the upper Quantile Bands line.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price closes below the middle line of the Quantile Bands.

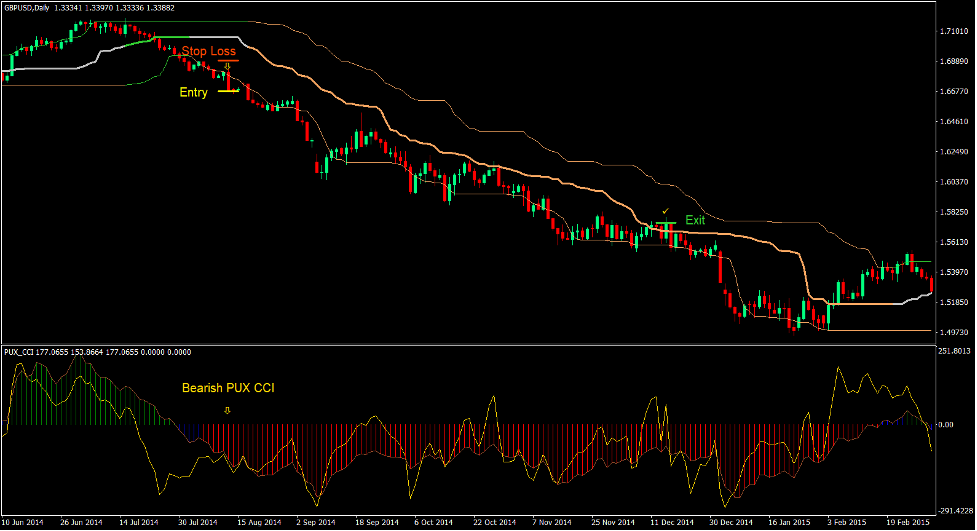

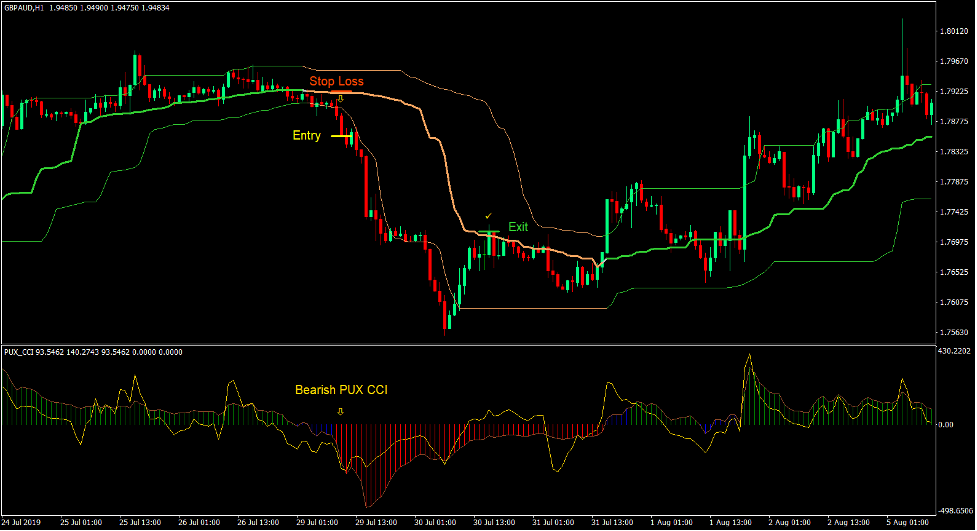

Sell Trade Setup

Entry

- The PUX CCI lines should be generally negative.

- The Quantile Bands should enter a congestion phase.

- A bearish momentum candle should close strongly below the lower Quantile Bands line.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price closes above the middle line of the Quantile Bands.

Conclusion

This trading strategy is a good momentum breakout type of strategy. This is because traders could first filter out trades that are not aligned with the directional bias of the trend. Traders could also objectively identify valid momentum breakouts using the Quantile Bands.

Momentum breakouts using band like structures such as the Quantile Bands are a working trading strategy. However, traders should also be careful not to keep chasing price as momentum candles take shape. If price has already moved too far, it is best to let go of the trade instead of chasing it.

Traders who could identify good momentum trading opportunities based on momentum price action can make use of this strategy to profit from the market.

Forex Trading Strategies Installation Instructions

PUX CCI Momentum Breakout Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

PUX CCI Momentum Breakout Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

Recommended Options Trading Platform

- Free +50% Bonus To Start Trading Instantly

- 9.6 Overall Rating!

- Automatically Credited To Your Account

- No Hidden Terms

- Accept USA Residents

How to install PUX CCI Momentum Breakout Forex Trading Strategy?

- Download PUX CCI Momentum Breakout Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select PUX CCI Momentum Breakout Forex Trading Strategy

- You will see PUX CCI Momentum Breakout Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Get Download Access