[ad_1]

YinYang/E+ via Getty Images

STORE Capital (NYSE:STOR), which gets its name from an acronym for Single Tenant Operating Real Estate, is a popular REIT that buys mostly retail properties and leases them back to tenants via long-term triple net leases. I have largely been bearish on STOR due to its formerly extravagant valuation, but after a 23% drop over the last year, its earnings multiple has become attractive and I am now bullish. When a stock becomes attractive from a valuation perspective, it warrants further due diligence to see if it is worth buying in the 2nd Market Capital High Yield Portfolio (2CHYP) which we actively manage for Portfolio Income Solutions.

Our fundamental analysis is specific to individual REIT subsectors of which there are 21. In this article, I will walk you through how we analyzed STOR. Ideally, it will be useful to those considering investing in STOR and serve as a guide for investing in the triple net sector in general.

Triple nets: a strong business model with lots of key subtleties

Triple nets are a seemingly simple business model. The REIT becomes a capital provider for a property operator via a sale leaseback. This is often a value creating transaction because the REIT can use its low cost of capital and tax advantages to finance the property more efficiently than the operator can. The economic savings can then be split between the entities such that both are coming out ahead.

The triple net stream of income the REIT receives in the form of rent provides stable cash flows that grow over time from 3 main sources:

- Escalators built into the lease

- Delta to lease rate upon renewal (positive or negative growth)

- Accretion to earnings from new property acquisitions at a spread over cost of capital

It is simple and effective, leading to triple nets being a highly successful sector historically, delivering outsized returns to investors.

Despite the simplicity of the basic business model, there are quite a few differences between the triple net REITs. Some are far more effective than others and here are the things I look for to differentiate the good from the bad.

The checklist for investing in triple net REITs

- Tenant/property underwriting

- Resiliency in a recession

- Are spreads sufficient to drive sustainable AFFO/share growth assuming some mishaps?

- Do they issue only when accretive?

- price paid for real estate relative to value of real estate

- Are leases at, above or below market rates?

- Is the REIT an originator or a price taker?

- Is occupancy artificially high due to selling vacant assets?

- Valuation

Tenant/property underwriting

Some REITs underwrite the tenant such that they think it is highly unlikely the lease will be defaulted on. Most of the big triple nets are trying to increase their percentage of tenants that are investment grade rated.

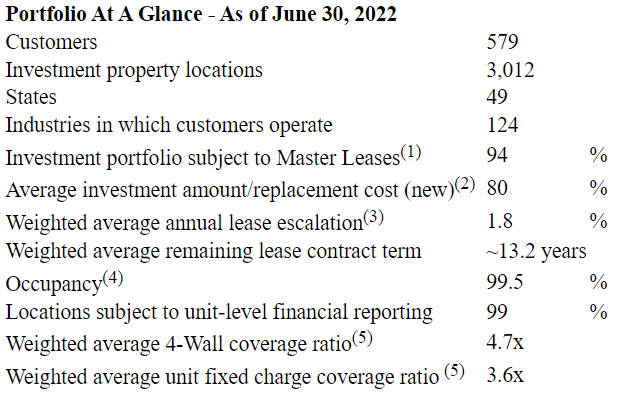

STOR takes a different approach. They are willing to accept tenants of lower credit so long as the property itself is strong. Ideally the tenant does not default on the lease, but if they do, the property is strong enough to be re-leased at equal or better terms. The primary metric STOR looks at is 4-wall lease coverage ratio, or the amount of NOI the property generates for the tenant as a multiple of the lease expense. The higher the multiple the more easily the property can be leased at that rate. STOR’s average property 4-wall rent coverage is 4.7X.

To my knowledge, STOR is the only triple net REIT that specifically focuses on this metric. This makes it a differentiated strategy that comes with some benefits. Since most other buyers are looking at the tenant rather than the building, STOR can buy at higher cap rates averaging around 7.2% whereas high credit tenants would typically go for closer to 5.5% today.

Externally it is hard to know how much additional risk STOR is taking on with smaller tenants, so I look to history as a guide.

Resiliency in a recession

If STOR’s underwriting is operating properly, there would be some tenant default in a recession, but they would also be able to re-lease or successfully sell the vacated assets due to property level strength. If the location itself had great foot traffic and was generating strong NOI, a new tenant would likely want the space.

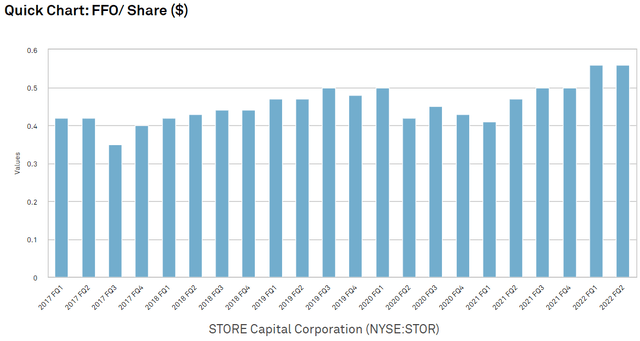

Well, COVID provided a nice test to STOR’s strategy. Indeed, the pandemic did lead to some tenant defaults but STOR had reasonable success in re-leasing its properties. FFO took a hit during the recession but quickly bounced back to above pre-pandemic levels.

S&P Global Market Intelligence

4-wall coverage of rent has remained at a healthy level in the post-pandemic environment.

Logically STOR’s acquisition desiderata make sense and it has now been battle tested by the pandemic.

Spreads

Off-the-beaten-path acquisitions give STOR a nice head start on spreads as it is much easier to make spreads work with a 7.2% cap rate than a 5.5% cap rate.

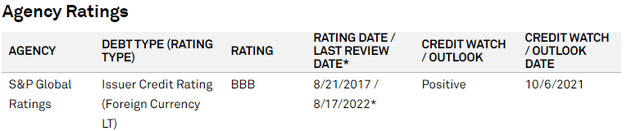

Cost of capital is the other side of the equation and it of course consists of the weighted average cost of debt and equity. STOR looks solid on the debt side with a reasonably clean balance sheet and an investment grade rating:

S&P Global Market Intelligence

This affords fairly cheap debt even in this now higher interest rate environment. In 2Q22, STOR was able to raise $600 million of medium term debt at a cost of 3.68%. Per the earnings release:

“Closed on an aggregate $600 million of five-year ($400 million) and seven-year ($200 million) unsecured bank term debt at a weighted average interest rate of 3.68%”

Equity is a bit trickier because it is largely out of the company’s control.

Early in STOR’s history as a public company it bagged Warren Buffett as a significant investor and his imprimatur led to a fairly bloated stock price. When news hits of Buffett buying something, the stock will often ride up 10% or so, and while his ownership is a nice vote of confidence, it doesn’t actually change the fundamental value of the company.

It was this overvaluation that has made me bearish in the past.

The upside to overvaluation, however, is that it provides a cheap cost of equity capital. When a REIT is trading at a premium to NAV and a high FFO multiple, issuing equity actually increases NAV and comes with a low dilutive cost such that the spreads for STOR were quite nice.

Despite the advantages of overvaluation to a company’s spreads, I do not endorse buying overvalued REITs. Market prices can fall at any time, so if a company was relying on its pricey stock to generate spreads not only will it lose its growth engine, but investors will be sitting on significant losses. Equity markets are fickle and STOR has fallen from grace.

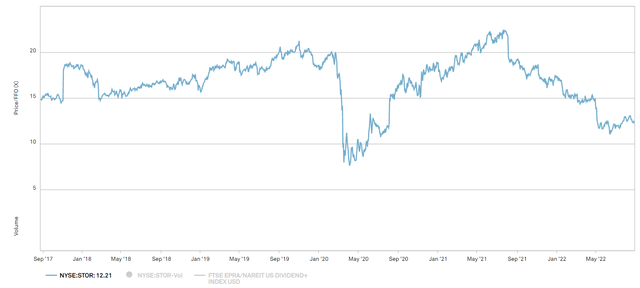

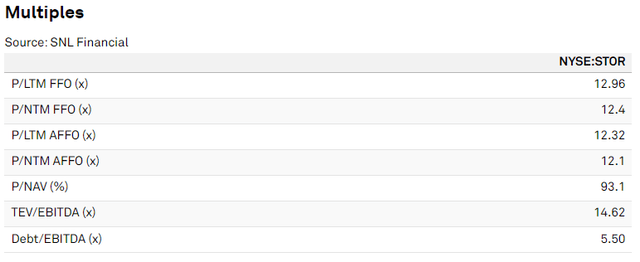

Its FFO multiple has dropped to just over 12X, a low not seen since the depths of the pandemic.

S&P Global Market Intelligence

At this price, the cost of equity capital is significantly higher. I have seen some calculate cost of equity as the dividend yield, but this is wrong. Beyond the incremental dividend the company will have to pay out there is a dilutive cost to earnings. Thus, a better way to estimate equity cost of capital is the inverted FFO multiple. In this case 100/12 X 100% = 8.3333%.

This makes STOR’s spreads a bit tighter. 7.2% acquisitions are still mildly accretive when one blends 40% debt at 3.68% and 60% equity at 8.33% (WACC or ~6.5%), but that is a narrow spread.

Acquisition cap rates are calculated based on contractual terms and usually do not include underwriting costs. They also do not factor in things going wrong and in the real world things do go wrong. As such, I like to see acquisition spreads over cost of capital closer to 200 basis points. The very narrow 70 basis point spread at which STOR is currently acquiring does not leave much margin for error.

Disciplined use of equity capital?

REITs of course cannot control their market price, but they can control when they issue. Most large REITs have shelf registrations that allow them to issues at-the-market. These are often called ATM programs and they are nice for 2 reasons:

- It reduces underwriting expense of offering.

- It provides on-demand capital to match-fund acquisitions

The key with these is for management to be disciplined – issuing plenty of capital when stock price is high and not issuing when prices are low. Each share issued below NAV and at low FFO multiples is probably going to dilute shareholder value.

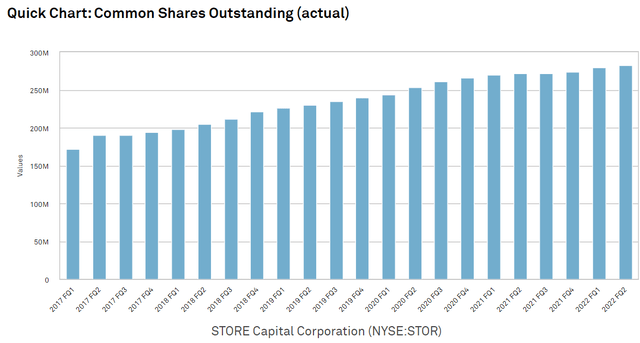

This is a bit of a yellow flag for STOR. They did a great job of issuing at high prices back in the Warren Buffett imprimatur days, but they have failed to stop issuing now that the market price is below NAV. Note the $84 million issued around 6/30/22 when market prices were significantly below NAV.

S&P Global Market Intelligence

This sort of indiscriminate issuance is often accompanied by shares outstanding charts that look like this.

S&P Global Market Intelligence

I consider this just a yellow flag rather than a red flag because the 70 basis point spread on acquisitions over WACC makes is ever so slightly accretive, but there are better ways.

I would much rather a company lever up slightly to fund acquisitions when their market price is not cooperating.

Price paid for real estate relative to value of real estate

A word of caution regarding sale leasebacks: Sometimes they are part lease and part loan.

For example, a REIT can buy a $500,000 property for $1 million with the extra $500,000 plus interest being paid back over the initial lease term. If one does not know the actual property value, this leaseback is going to look fantastic. The cap rate is going to be juiced by the loan portion of the leaseback so it could be far above market.

Many REITs do this. The most extreme example is Innovative Industrial (IIPR) where their purchase price of warehouses is around $300 per square foot while the facilities are often worth half that. Another REIT I have found to do this was ARCP/VEREIT before they got bought by Realty Income (O).

It is totally legal and even financially viable in some cases. It is not even necessarily dirty or a trick. It is merely an elective decision to merge a loan with a lease. It just means the REIT should trade at a low multiple because those leases are going to be far above market and roll down upon lease expiry.

So, does STOR do this given that its cap rates are quite high?

No, STOR’s average purchase price is 80% of replacement cost.

STOR

Thus, it is quite clear that there is not a loan built into the purchase.

Lease rates versus market lease rates

Since STOR does not build loans into their sale leasebacks their lease rates were initially at market rate.

With roughly 17 year initial terms, the lease rate relative to market rate will be a function of how market rates have changed over those 17 years.

As a predominantly retail triple net REIT, STOR’s market rates moved down during the retail downturn that began before COVID and accelerated during COVID, but have since rebounded sharply. As such I think market rates are quite close to lease rates today. By the time STOR’s leases expire in a weighted average 13.2 years, I think market rates will be slightly higher than lease rates due to fundamental strength in single tenant retail assets (undersupply due to minimal construction).

I view this as neutral to valuation as it is in-line with most other triple net REITs.

Lease originator or price taker?

Anyone can buy a triple net leased property. They are listed and sold based on cap rate of the in-place lease. Buying through this means is what I refer to as price taking as you will simply get the cap rate offered by the market. It leaves little room for value creation.

I much prefer lease originators such as W. P. Carey (WPC) Gladstone Commercial (GOOD) and a few others. STOR is also a lease originator, buying properties directly from the tenant, and originating the triple net lease. I think being an originator is a clear positive as long as the company has strong acquisition underwriting. As we explored in a previous section, I think STOR does it well.

Occupancy: naturally high or artificially high by disposing of vacancies

STOR’s occupancy is extremely high at 99.5%.

Natural occupancy for triple net is probably closer to 95%-98% due to frictions and transitionary periods.

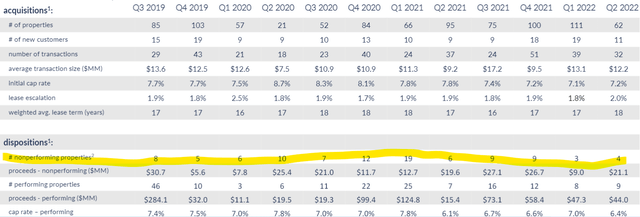

This 99.5% is maintained through disposition of vacant assets that cannot be accretively re-leased and STOR discloses this practice quite clearly in their presentation.

STOR

As you can see, the dispositions of vacant assets are usually at a loss since the properties are being sold for roughly $5 million each whereas acquisition costs were roughly $13 million each.

That is normal business for a triple net REIT. Sometimes selling a vacancy is the best financial option. When a REIT buys 1000 properties, some of them are going to perform better than expected and others will fail. Whether or not this should be worrying depends on the failure rate.

As of 6/30/22, STOR had 3012 properties. 4 non-performing assets in 2Q22 is an annual rate of 16 properties or an annual failure rate of 0.5%. In previous years it was closer to 1%.

That strikes me as quite normal and perhaps even a bit favorable given the high acquisition cap rates.

Valuation

STOR’s market price drop in 2022 has made it rather cheap at 12.4X forward FFO, 12.1X forward AFFO, and 93.1% of NAV.

S&P Global Market Intelligence

This compares favorably to its peer triple net retail REITs O, ADC and NNN which trade closer to 17X, 19X and 14X FFO, respectively. The peers also trade at or above NAV.

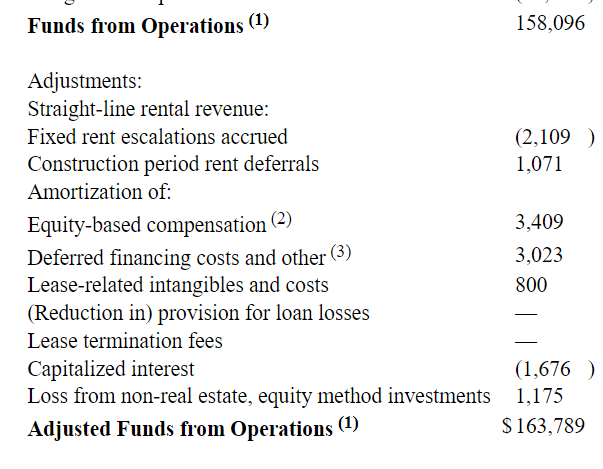

As part of valuation it is often wise to adjust for certain items such as stock comp. In this case it was $3.409 million for the quarter.

Earnings Release

Wrapping it up

Collectively these are the factors that determine future cash flow stability and the triple net REIT’s ability to grow its dividend going forward.

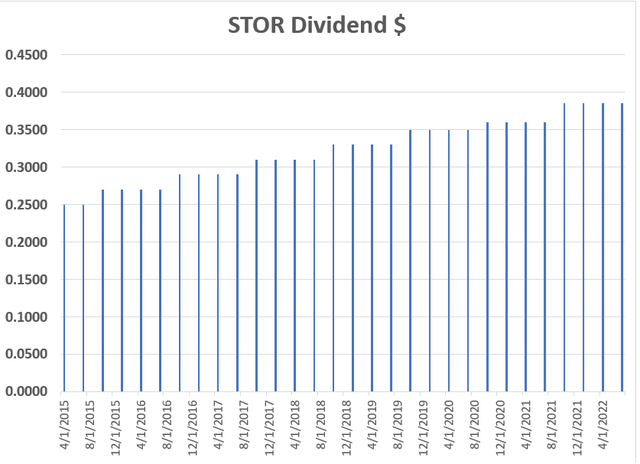

Absent from this list is dividend history. Quite simply, dividend history is not a fundamental factor and it is grossly overvalued by the investment community. When deciding whether to invest today, it is future dividend growth that matters, not historical. For what it’s worth, here is STOR’s dividend history:

2nd Market Capital

It looks like a straight line up and to the right, but that does not mean it can be extrapolated. Future dividend growth can only happen if there is future AFFO/share growth and that is largely determined by the factors discussed above.

Overall, STORE is quite solid. Its valuation is attractive and I think it will provide an above market return.

[ad_2]

Source link