[ad_1]

“Proud Mary” is a track by American rock band Creedence Clearwater Revival written by John Fogerty. It was launched as a single in January 1969 by Fantasy Data and on the band’s second studio album, Bayou Nation. The track turned a significant hit in the USA, peaking at No. 2 on the Billboard Scorching 100 in March 1969, the primary of 5 singles to peak at No. 2 for the group. (Wikipedia)

The salient lyrics that signify the present market are as follows:

Huge wheel carry on turnin’

Proud Mary carry on burnin’

Rollin’, rollin’, rollin’ on the river

It was clearly a metaphor about leaving painful, demanding issues behind for a extra tranquil and significant life. It is a metaphor for the market breaking out to new highs after 2 years of uneven consolidation of good points. We now have referred to this chart repeatedly as a deterrent from getting too cute/SHORT the market after the flip of the 12 months:

On October 22, 2022, we laid out the case for purchasing equities when everybody was promoting “within the gap.” Right here’s what occurred subsequent:

On November 7, 2023 I joined Liz Claman (on Fox Enterprise) when individuals had been skeptical that the lows had been in, to which I replied “For those who’re a brief vendor proper now, what it’s essential know into year-end is, THE BEATINGS WILL CONTINUE UNTIL MORALE IMRPOVES!”

Now it’s getting trickier. As everybody was calling for an enormous correction after the year-end rally, on 1/8/2024 I joined Charles Payne to say “new highs BEFORE we get a traditional correction”:

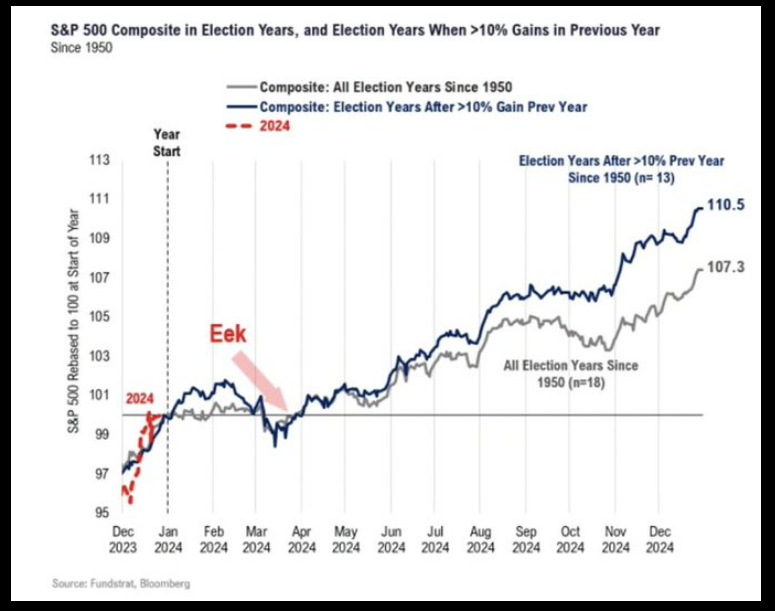

We acquired new highs. So now what? Statistically this shorter time period roadmap from historic information is taking part in out – which might indicate a bit extra upside to attract in all the resistant bears from October 2022 AND 2023 by way of now. As soon as they’ve all flipped a wholesome pullback ought to be so as:

Supply: Fundstrat

For my newest ideas I joined David Lin on Thursday. Yow will discover his channel right here for when the ultimate edited model is uploaded. Within the curiosity of well timed data, right here is the dwell model:

Yesterday I had the privilege to talk on the Sequire Investor Summit in Puerto Rico. It was comprised of many Household Workplaces, Public Firm CEOs and excessive web price traders. You possibly can view it right here:

Video Nonetheless Importing, Test Again Quickly…

3M (NYSE:) Replace:

Market is temperamental on this one. If we see excessive to mid-$80’s we could take the chance so as to add some for the long-term and receives a commission ~6.5% to attend from an organization that has grown the dividend yearly for 65 years (and is producing $6.5-$7B/yr of Working Money Stream) .

Now onto the shorter time period view for the Common Market:

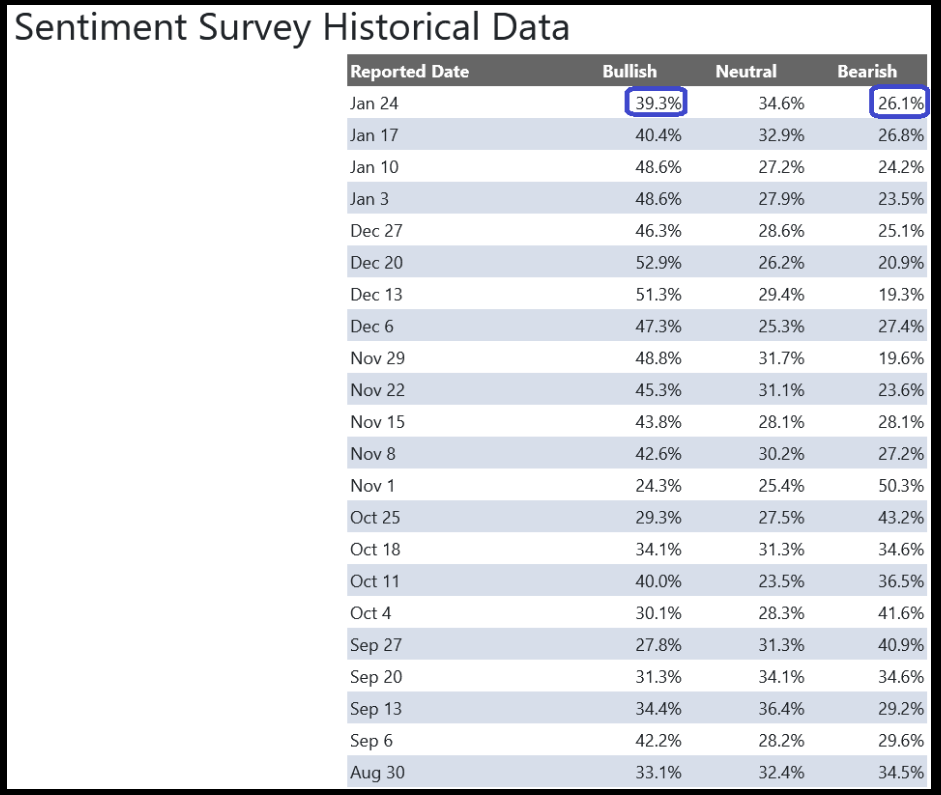

On this week’s AAII Sentiment Survey consequence, Bullish % (Video Rationalization) ticked all the way down to 39.3% from 40.4% the earlier week. Bearish % ticked all the way down to 26.1% from 26.8%. Retail traders are cooling their jets a bit.

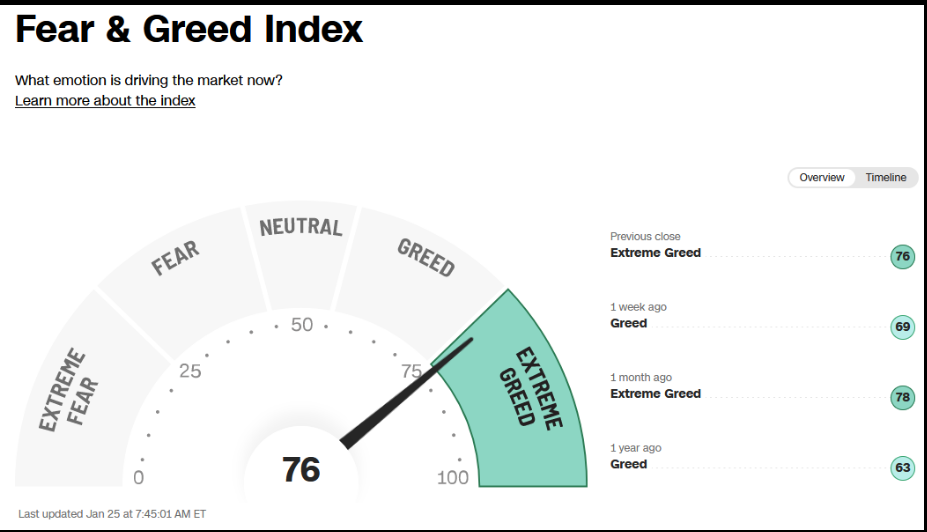

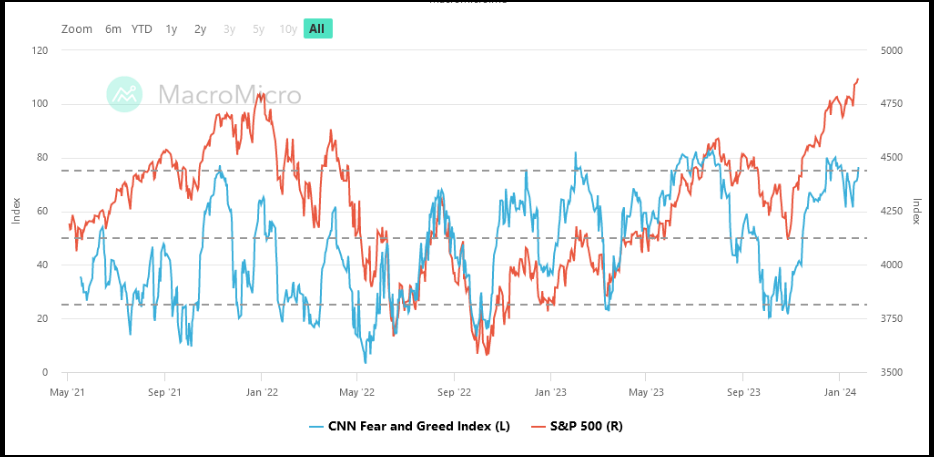

The CNN “Concern and Greed” jumped from 58 final week to 76 this week. By this metric, traders are a bit giddy. You possibly can learn the way this indicator is calculated and the way it works right here: (Video Rationalization)

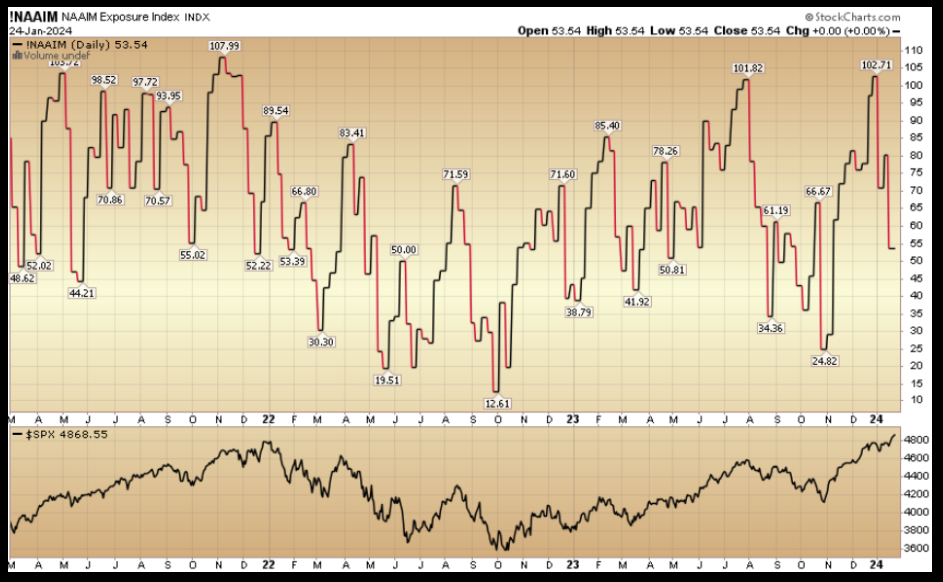

The NAAIM (Nationwide Affiliation of Lively Funding Managers Index) (Video Rationalization) dropped to 53.54% this week from 80.18% fairness publicity final week.

This content material was initially revealed on Hedgefundtips.com.

[ad_2]

Source link