[ad_1]

Dallas, Texas, is without doubt one of the fastest-growing metropolitan areas within the nation, with a big, diversified, and rising economic system. With dwelling costs beneath the nationwide common and stable money circulate potential, Dallas has many traits that assist favorable long-term circumstances for actual property traders.

Inhabitants and Labor Market

Situated in Northeast Texas, the Dallas metropolitan space is definitely composed of two massive cities and one small metropolis: Dallas and Fort Value, after which the smaller metropolis of Arlington that lies between them. Mixed, the Dallas metropolitan space has a inhabitants that’s rising effectively above the nationwide common. The median age of residents in Dallas is slightly below 33 years previous, which is true across the peak homebuying and family formation age—which signifies sturdy and sustainable demand for housing within the area.

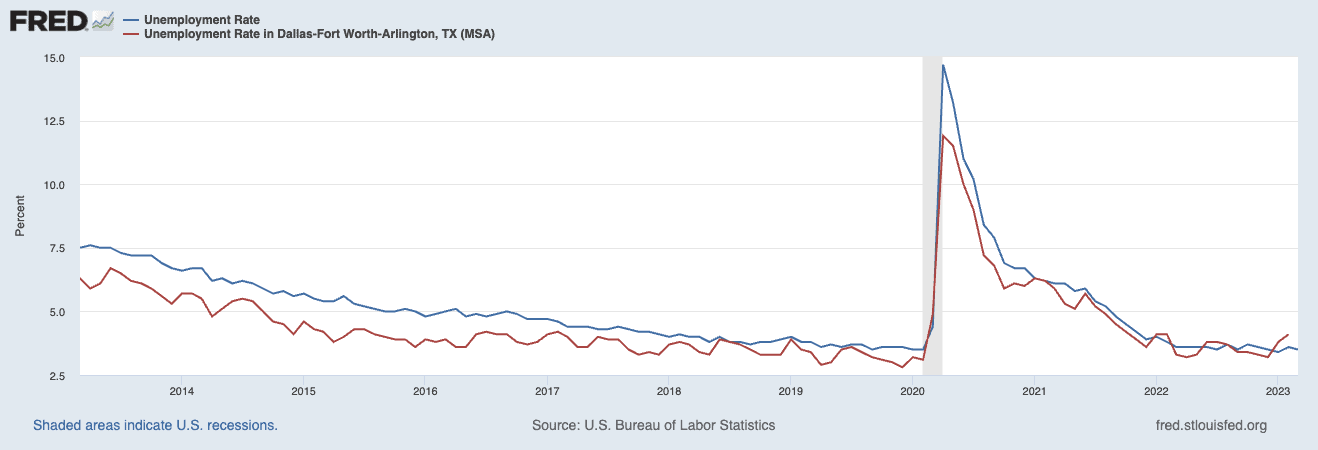

Dallas’ massive and numerous economic system helps insulate it from financial downturns. The realm has massive medical and academic establishments and a big airline presence anchored by American Airways and Southwest Airways. The unemployment charge is low however barely above the nationwide common and has ticked up barely of late.

Dwelling Costs

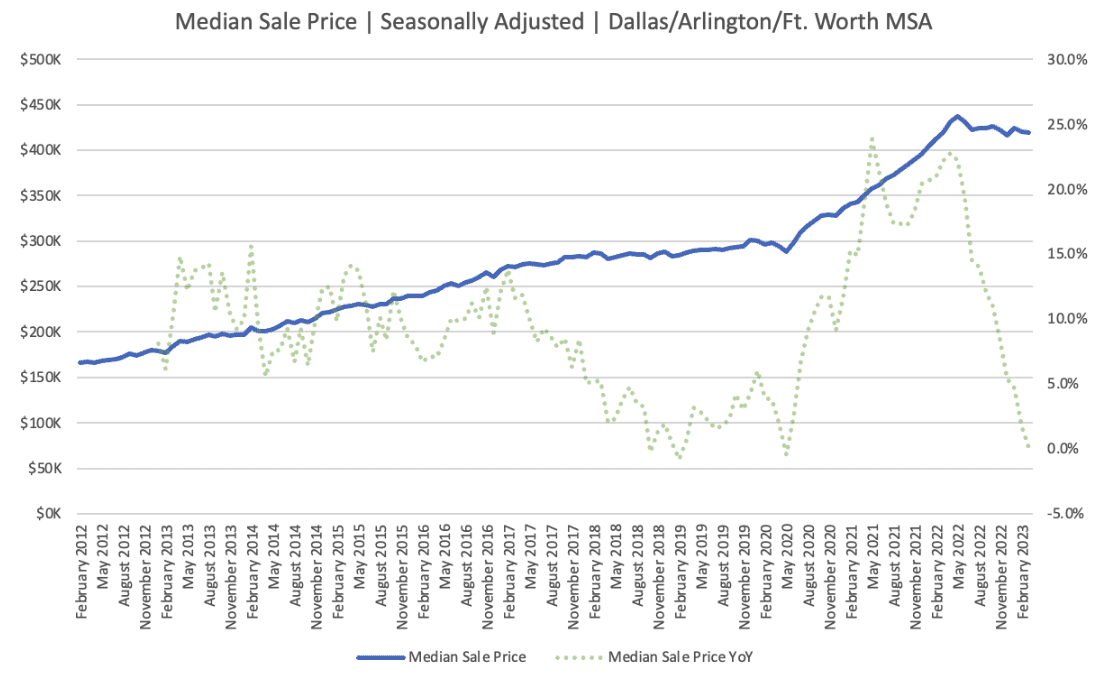

Regardless of sturdy demand and a robust economic system, investing circumstances in Dallas stay enticing. As of this writing, the median gross sales value within the Dallas space is simply above $400,000—which is comparatively near the nationwide common however beneath that of cities with equally sized economies.

It’s essential to notice that whereas costs in Dallas have been comparatively flat over the past a number of months, the tempo of development has come down significantly. That is to be anticipated, given the macroeconomic local weather, nevertheless it’s value noting that appreciation in Dallas, as a complete, is prone to be modest and even barely unfavorable within the coming months.

Hire Development and Money Circulation

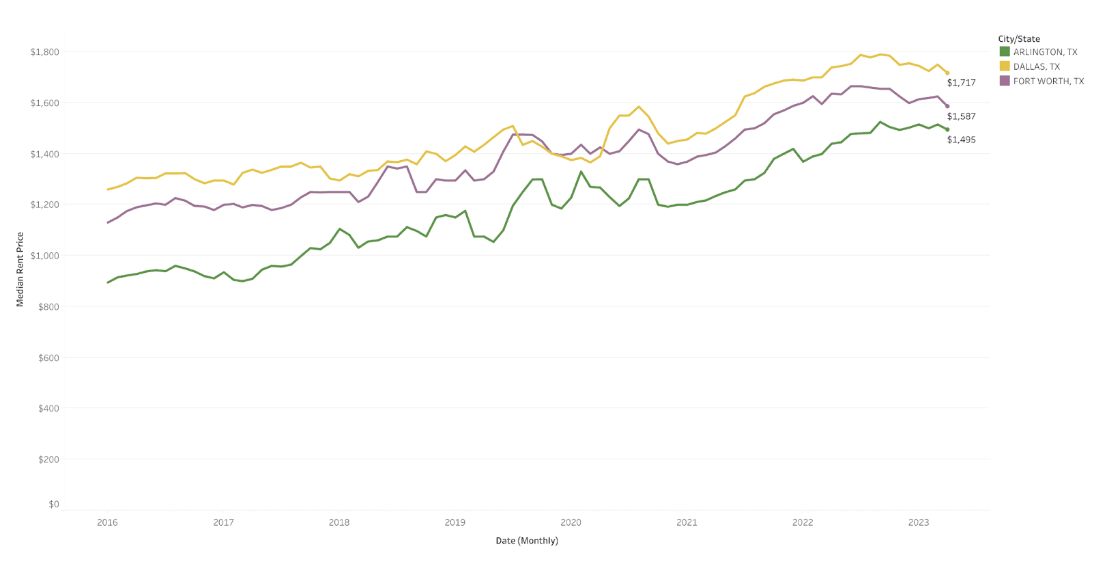

Hire development has adopted comparable patterns to housing however varies barely by metropolis inside the metropolitan space. Rents in Arlington, for instance, have remained flat over the past six months, whereas rents in Dallas and Fort Value have come down modestly. Some decline in lease shouldn’t be regarding, given the fast tempo of lease development in recent times, and most knowledge helps that lease declines can be minimal.

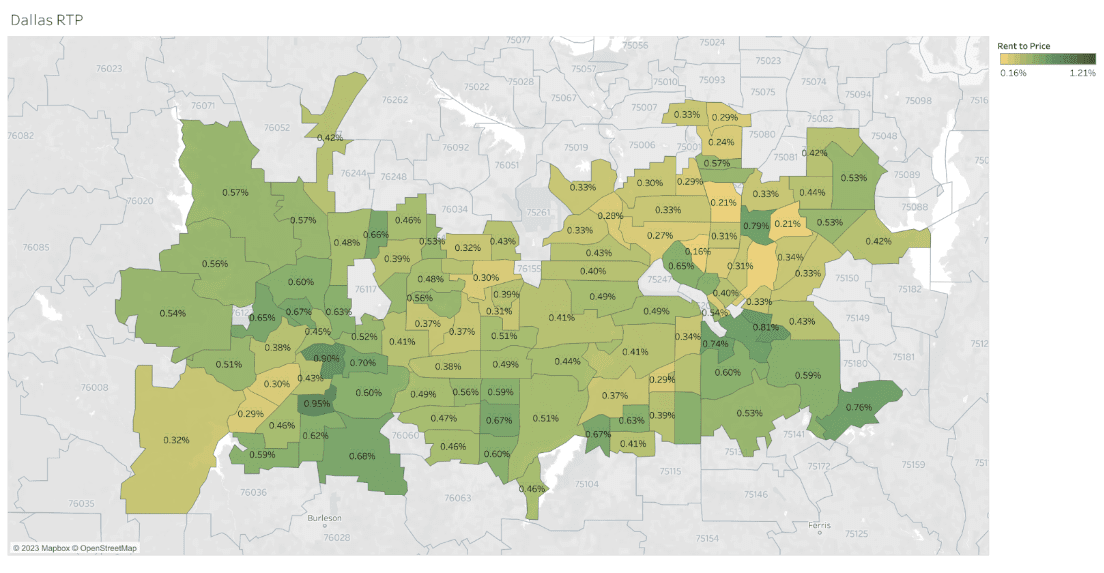

When money circulate prospects for Dallas, it varies significantly by location inside the metropolitan space. Areas close to Fort Value and south of Dallas have rent-to-price ratios (a superb proxy for money circulate) close to 1%—which is an efficient signal for money circulate potential. Nonetheless, North Dallas and many of the space between Dallas and Fort Value have rent-to-price ratios that counsel money circulate can be tough to seek out. General, there’s stable money circulate prospects for a metro space of this dimension!

Stock and Market Well being

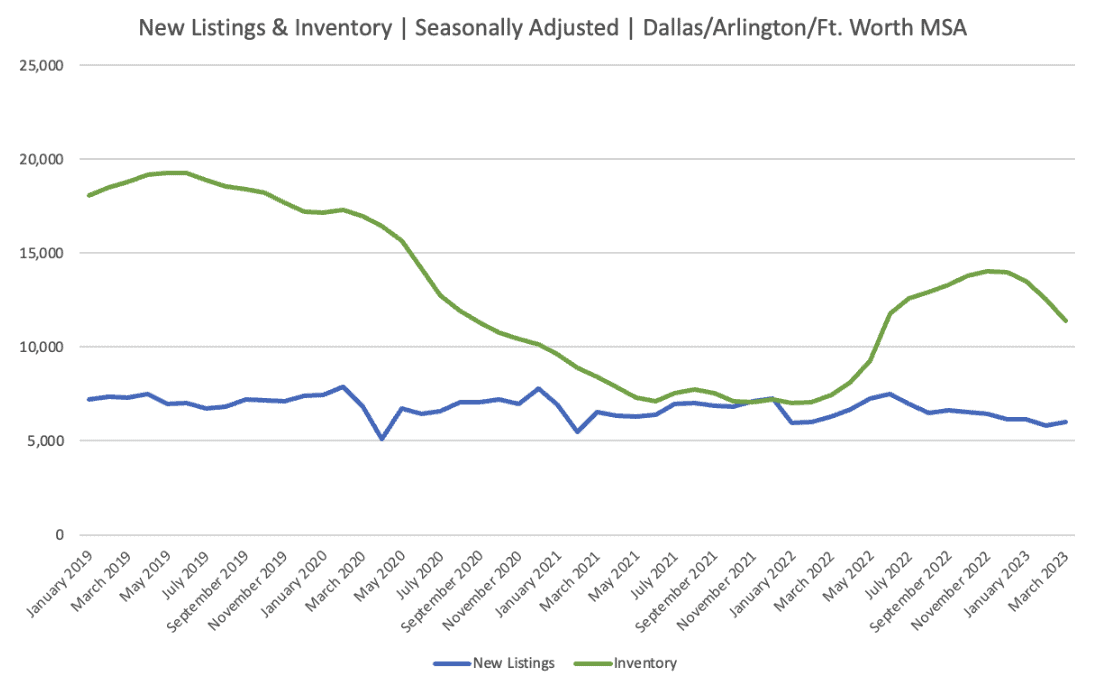

Wanting forward, there are indicators that though the housing market in Dallas has loosened up—it’s nonetheless on pretty sturdy floor. New listings are declining, and though stock is up from its pandemic lows, its truly fallen over the past a number of months. This factors to a market with pretty sturdy competitors for properties and even perhaps a vendor’s market.

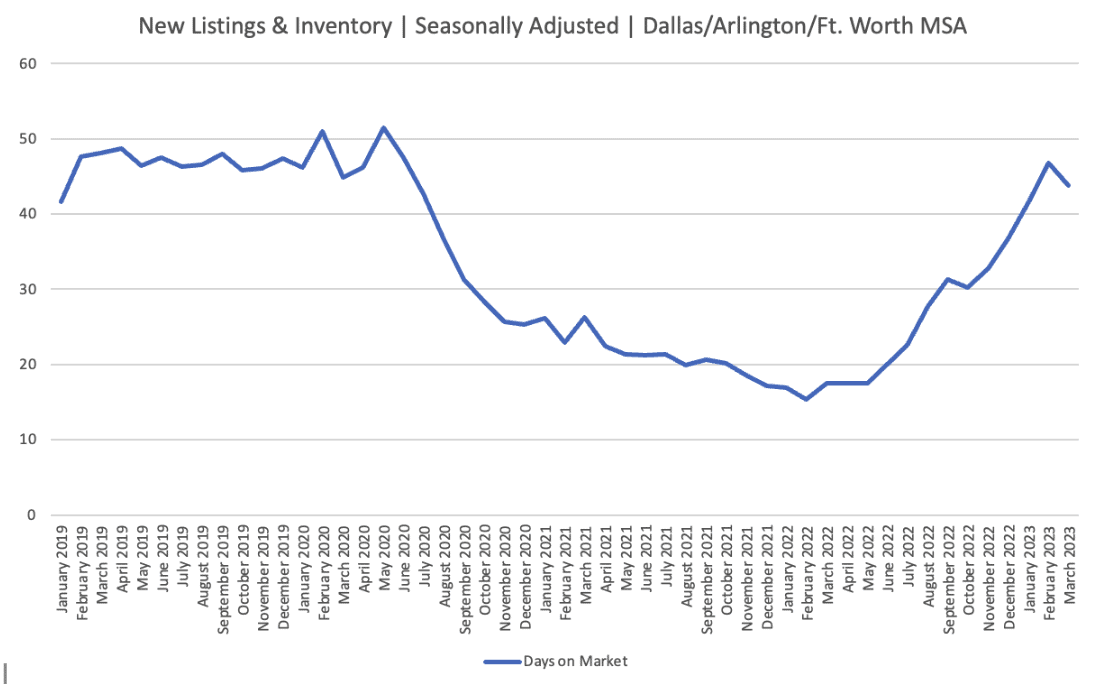

Moreover, though days on market (DOM) has nearly returned to pre-pandemic ranges, they dropped in the latest studying. One new knowledge level doesn’t make a pattern, so this can be an essential metric to observe within the coming months.

Profitable Methods

General, Dallas is a sturdy all-around marketplace for actual property traders. It has an inexpensive value level, stable money circulate potential, and a robust economic system to assist future development. Whereas the nationwide housing market experiences a correction, Dallas is holding up comparatively effectively. Costs have been comparatively flat, and key lead indicators counsel that the market can be one of many extra steady housing markets within the nation over the approaching months.

Victor Steffen, an investor-friendly actual property agent within the Dallas space, says, “The traders we see successful proper now are leaning into B.E.A.F properties. BEAF stands for break-even appreciation-focused. Our most profitable traders goal areas with growing populations, growing numbers of jobs, and growing median incomes. We goal for an entry value 10-20% beneath the earlier market excessive, and we need to see at the moment’s lease charge cowl the PITI. At this level available in the market cycle, when most retail patrons are sitting on the sidelines our traders have extra alternative than ever to choose up high-quality B+ and even A-grade, turnkey stock. It’s a kind of uncommon market cycles the place traders are among the final gamers available in the market. We will decide up ‘blue chip’ property at reductions with out competing towards a dozen retail patrons.”

Should you’re concerned about studying extra about investing in Dallas, companion with an area investor-friendly actual property agent like Victor Steffen, who can information you thru which methods, techniques, and neighborhoods to deal with.

Right here’s how one can contact Steffen on Agent Finder:

- Search “Dallas, Texas”

- Enter your funding standards

- Choose Victor Steffen or different brokers you need to contact

Steffen ranked #22 of 86,000 brokers at EXP Realty by sale quantity and #5 within the state of Texas. He and his spouse are energetic actual property traders, proudly owning quite a lot of cash-producing property together with rent-by-room housing, lengthy, mid, and brief time period leases. They plan to proceed constructing their portfolio with an emphasis on new building property and 20-50 unit complexes in 2023.

Discover an Elite Agent in Minutes

Use Agent Finder to attach with native market specialists like Victor Steffen, Kim Meredith-Hampton, and Matthew Nicklin.

- Search goal markets like Dallas, Tampa, or Atlanta

- Enter funding standards

- Choose investor-friendly brokers that suit your wants

Be aware By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.

[ad_2]

Source link