[ad_1]

martin-dm

In Jan 2021, I published an article describing the similarities in the set-up of General Growth Properties (GGP), a formerly bankrupt mall REIT that Bill Ackman famously made 14x his money on in 2008/2009, and Pennsylvania Real Estate Investment Trust (NYSE:PEI) in 2021. I advocated for a small speculative position in the common stock. Since that article, the common stock is down ~90% and the preferred stock is down ~80%. The preferred stock, particularly Pennsylvania Real Estate Investment Trust 7.375% Series B Cumulative Redeemable Perpetual Preferred Shares (NYSE:PEI.PB), now offers a compelling risk-reward ratio with 10x upside to par value and 12x upside to par value + accrued dividends. I believe the preferred shares have been largely de-risked at this price, with even extremely conservative valuation assumptions implying massive upside.

Overview of PEI.B

The Series B shares are the highest on the capital stack, with Series C and Series D below them. The Series C shares have a liquidation preference of $197.7M, and the Series D shares have a liquidation preference of $137.9M. Combined there is a significant $335.6M buffer in liquidation preference between the Series B and Series D shares.

The following is an overview of the Series B shares.

| Price | $2.45 |

| Par value | $25 |

| Accrued dividends (9 quarters unpaid) | $4.15 |

| Par value + Accrued dividends | $29.15 |

| Dividend yield on issuance | 7.375% |

| Dividend yield on cost today | 75.2% |

Underlying Business Continues to Improve

In 2019, PREIT recorded $227.7M in NOI, which dropped dramatically to $158.6M in 2020. 2021 marked a strong recovery from 2020, with NOI recovering to $200.5M. NOI growth so far in 2022 has been slower than I expected at 1.7%, with $93.1M in H1 2022 vs $91.5M in H1 2021. Applying this 1.7% NOI growth rate to the full year, we get $204M in NOI for 2022. I believe this is conservative given the strong leasing volume this year.

Core mall occupancy is now at 93.8% as of the end of Q2 2022, compared to 89.2% at the end of Q1 2021.

PREIT Valuation

In my previous article, I outlined a net asset valuation of $165 a share ($11 per share before the reverse split) for the common shares based on an 8% cap rate on 2019 NOI. I continue to believe that PREIT is on the path to fully recovering to 2019 NOI, with the strong recovery in 2021 and occupancy rising strongly. This valuation may seem far-fetched given the decline in the stock price. As such, I want to provide a deeper dive into the assumptions made in my valuation on a mall-by-mall basis in order to illustrate just how absurd the current market valuation is.

My view continues to be that PREIT is a largely class A and A- mall REIT, with the bulk of its asset value coming from its top 6 malls which are Class A and A- malls and produce 45% of NOI.

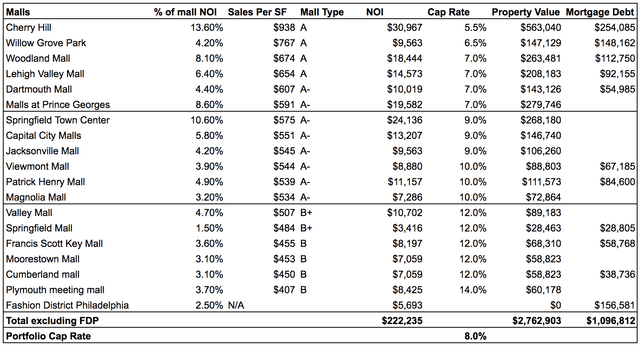

The following is a property-by-property view of this valuation and cap rate assumptions made. The 8% portfolio cap rate is within the reasonable range when looking at the below mall-by-mall breakdown and recognizing that the vast majority of value is driven by the top half of malls in the portfolio.

PREIT Filings and Author’s Calculations

In demonstrating the margin of safety for the preferred shares implied with today’s pricing, I will use a more conservative NOI of $204M, just 1.7% above 2021’s NOI.

The Absurdity of Today’s Pricing

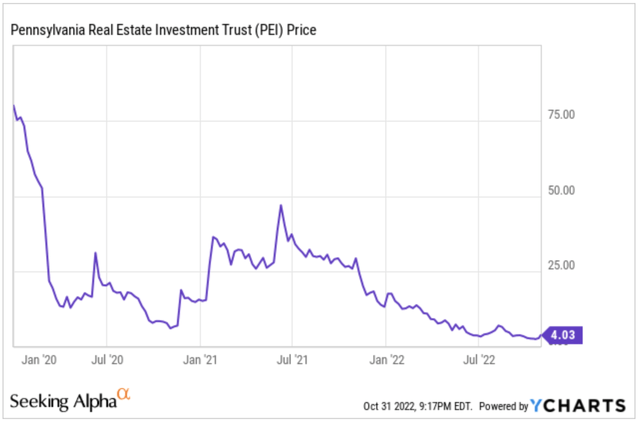

In its COVID lows of $4.95 (split-adjusted), PEI had severely depressed earnings and had just filed for Ch 11 bankruptcy. The common stock is now trading below its COVID lows, as are the preferred shares, despite massive improvement in the underlying business.

YCharts Seeking Alpha

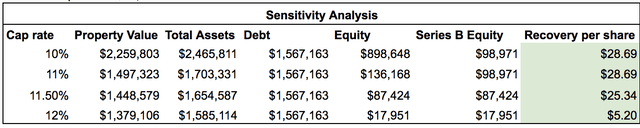

I believe that shareholders of the Series B Preferred would receive a full recovery of par value plus accrued dividends at $28.69 even at an 11% portfolio cap rate, would receive $25.34 at an 11.5% portfolio cap rate, and would receive $5.20 at a 12% cap rate.

When you start to apply ridiculously conservative cap rates to the portfolio, you end up with scenarios where many malls are worth less than their mortgage debt. In these scenarios, PREIT can boost NAV by strategically defaulting and handing the keys of these properties back to their lenders. Bill Ackman highlights this in Pershing Square’s 2010 Investor Presentation on GGP as a benefit of property-level non-recourse mortgage debt.

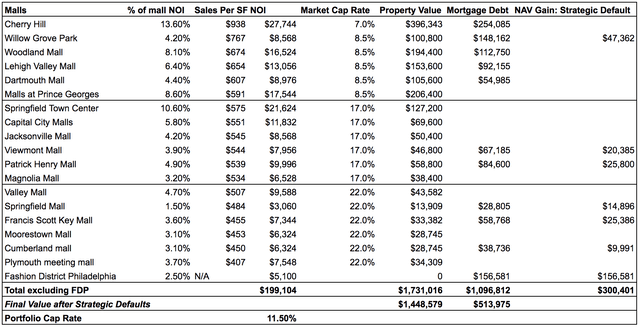

An 11.5% portfolio cap rate scenario, at which PEI.B shareholders would still likely 10x their money, looks ridiculously conservative as seen below.

PREIT Filings and Author Calculations

This scenario assumes a 50% haircut to the valuation of the portfolio’s crown jewel, Cherry Hill Mall, which was valued at $786M in 2018. This also assumes an 8.5% cap rate for the remaining A/A- malls in the top third of PREIT’s portfolio, a ridiculous 17% cap rate for the A- malls in the middle third of PREIT’s portfolio, and a 22% cap rate for the bottom third of the portfolio. Additionally, Fashion District Philadelphia is valued at $0 and management’s projected $200M in land/outparcel sales are discounted 25% to $150M. It also factors in a terminal NOI of $204M, which is still $23.7M shy of 2019’s NOI despite rapidly improving occupancy.

In this 11.5% cap rate scenario, 7 malls are worth less than their mortgage debt and can be turned back to lenders, increasing NAV in a theoretical world of extremely elevated cap rates. In this extremely bearish case, the 7 malls (Willow Grove Park, Viewmont Mall, Patrick Henry Mall, Springfield Mall, Francis Scott Mall, and Cumberland Mall, and Fashion District Pennsylvania) are worth a combined $282M with $582M of mortgage debt. Turning back these 7 malls would, in this scenario, wipe out of $582.8M in debt and reduce asset value by $282.4M, increasing NAV by $300.4M.

The following is the breakdown of the Series B equity value at an 11.5% cap rate.

|

Property Value (11.5% cap; $282.4M reduction from default) |

$1.45B |

| Other Assets ($150M held for sale + cash + restricted assets) | $206M |

| Total Assets | $1.65B |

| Debt ($2.15B – $582.8M reduction from default) | $1.57B |

| Series B Preferred Equity | $87.4M |

| Series B Liquidation Preference | $99M |

| Series C Preferred Equity | $0 |

| Series D Preferred Equity | $0 |

| Implied PEI.B Value (88% of par + accrued dividends) | $25.34 |

In actuality, I expect that all malls are worth substantially more than the mortgage debt and that there will be zero strategic defaults. This would mean a full recovery for all levels of preferred shareholders, and a substantial gain for common shareholders. However, when analyzing the bear case where malls are underwater, which would happen at anywhere north of a 9.5-10% portfolio cap rate, it is important factor in strategic defaults which would limit the downside scenario.

Sensitivity Analysis

In any 10%+ bear case cap rate scenario, all 7 of the aforementioned malls end up being underwater from a value perspective. As such, the $582M in debt and $282M in asset value would still be extinguished via strategic defaults.

Author’s Calculations

Even if malls were liquidated at an even more disastrous 12% cap rate scenario, PEI.B shareholders would still double their money. Any liquidation at a cap rate in the range of 12.3%+ range would entirely wipe out shareholders at all levels.

PJT, Cygnus Capital, and Capital Structure Optimization

Investor’s primary frustration with PREIT is their slow movement in improving the balance sheet. While debt was reduced by ~$100M since the beginning of the year as of Q2, investors are hoping for more asset sales in order to reduce leverage. There are now two parties assisting with improvement of the Balance Sheet.

In January 2022, PJT Partners were retained by PREIT:

To assist the Board of Trustees and management team in pursuing strategic and financial options that will strengthen the Company’s balance sheet, PREIT has engaged PJT Partners, a premier global advisory-focused investment bank.

Cygnus Capital, who own 8.9% of the Series B Preferred, 5.9% of the Series C Preferred, 8.6% of the Series D Preferred, and 2.1% of the common equity, had two representatives elected in August 2022 to represent Preferred shareholders on the PREIT Board.

The following is their view on the preferred and common equity, and what they believe they can do to unlock shareholder value.

Cygnus believes that PEI has valuable underlying assets but is trading at a significant discount because it is highly leveraged. Cygnus believes its Nominees can work constructively with the other members of the Board to find new ways to improve the Trust’s balance sheet and market valuation. In Cygnus’ view, expanding the Board to include two highly seasoned and experienced professionals to the Board is a necessary and important step at this time and will benefit all shareholders – not just holders of the Outstanding Preferred.

My main point of frustration with the PREIT management team is that they are not actively marketing malls for sale. On the Q2 earnings call, management was asked about the possibility of selling one of PREIT’s mall to pay down debt. This was the response, which I view to be weak.

We do have over $200 million of assets sales pending. Our top priority is maximizing value for all of our stakeholders and we will consider all options to achieve this. It’s noteworthy that we recently sold our 25% interest in Gloucester Premium Outlets. From our perspective, all options are on the table.

I would like to see a more aggressive approach to selling assets including income-producing malls, as $200M in land and outparcel sales are not going to move the needle on $2.15B in debt. With the introduction of Cygnus Capital, I am hopeful that mall sales would be more seriously considered.

Primary Risks: Rising Rates and Potential Dead Money for a Long Time

Some investors are concerned with the possibility of a forced liquidation if the company is not able to extend some of its upcoming debt maturities. Given that a liquidation scenario at an overly conservative 11.5% cap rate would result in 10x upside to shareholders of the Series B Preferred, I would actually prefer a liquidation over the status quo. I believe the primary risk of this investment is that management will continue their current approach to asset sales, focusing on land and outparcels that will not move the needle on debt reduction.

PREIT is now just slightly positive on cash flow from operations, and a significant upward movement in rates would put PREIT into negative cash flow territory as their ~$1B of term loans are variable and are already at high interest rates (8-9.25% as of Q2). If PREIT does not sort out its approach to asset sales, then interest payments will keep chipping away at the company’s underlying value.

[ad_2]

Source link