[ad_1]

Darren415

This text was first launched to Systematic Earnings subscribers and free trials on Oct. 31.

Welcome to a different installment of our Preferreds Market Weekly Overview, the place we talk about most well-liked inventory and child bond market exercise from each the bottom-up, highlighting particular person information and occasions, in addition to top-down, offering an summary of the broader market. We additionally attempt to add some historic context in addition to related themes that look to be driving markets or that traders must be aware of. This replace covers the interval via the final week of October.

You’ll want to try our different weekly updates protecting the enterprise growth firm (“BDC”) in addition to the closed-end fund (“CEF”) markets for views throughout the broader revenue house.

Market Motion

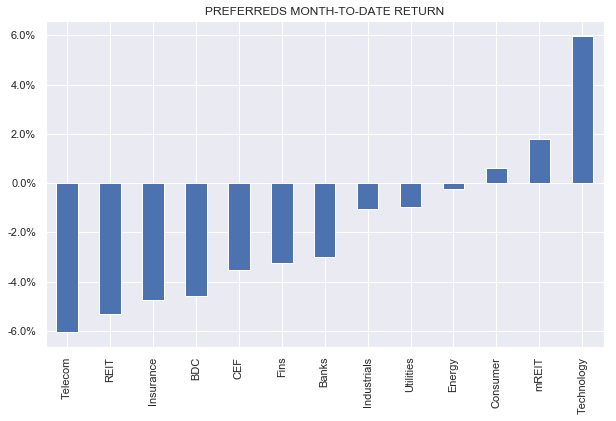

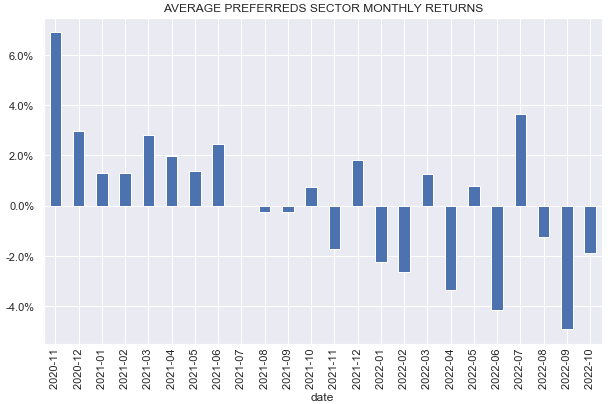

Preferreds had an excellent week with all sub-sectors seeing constructive returns. Over October, nonetheless, most sectors completed decrease.

Systematic Earnings

In contrast to CEFs and BDCs, preferreds delivered a unfavourable return in October – the third unfavourable month-to-month return in a row.

Systematic Earnings

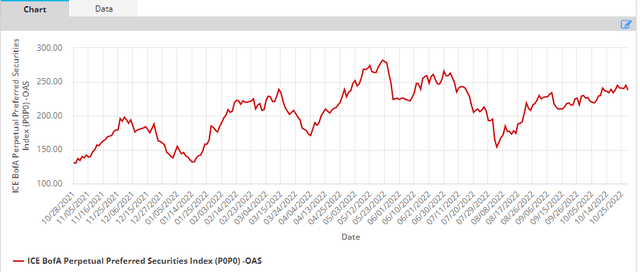

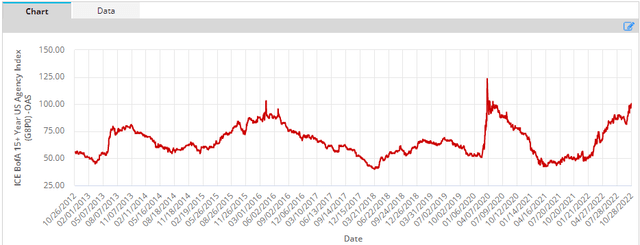

In distinction to BB-rated company bonds, for example, whose credit score spreads have rallied by 0.7% from 3.76% in October, preferreds credit score spreads have really widened in October as the next chart reveals. General, preferreds provide good worth in the meanwhile, notably within the institutional sector which boasts a decrease period.

ICE

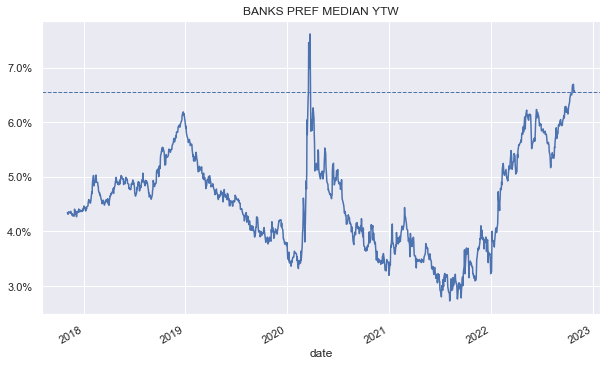

Financial institution preferreds, for example, a lot of that are or are near investment-grade, boast yields near 7%.

Systematic Earnings

Market Commentary

Company mREITs have kicked off Q3 earnings within the sector.

AGNC (AGNC) guide worth fell round 20% – the best tempo within the post-COVID interval and nearly as giant because the 23% drop in Q1-2020. AGNC issued $289m price of widespread through the quarter in addition to $150m of the brand new AGNCL. Web-net, this, along with the guide worth drop, has brought about fairness protection to fall from 5.2x to 4.3x – a far cry from a double-digit stage in 2019.

AGNC Collection C (AGNCN) is at present callable and it does make sense for AGNC to redeem it for two causes. One, the newly issued AGNC Collection L has a a lot decrease coupon proper now than AGNCN and the drop within the firm’s stockholders’ fairness has elevated the burden of preferreds within the capital construction, rising the full financing price of the corporate (since preferreds curiosity expense is above the price of repo).

It’s totally attainable that the corporate is conserving AGNCN alive to maximise their publicity to Companies which, at present valuations, makes a number of sense. It additionally jibes with the truth that leverage has really elevated (to eight.7x) and the MBS foundation sensitivity of guide worth rose to a 3-year excessive determine of 19% (i.e. 19% drop in guide worth for a 25bp rise in Company spreads). When/if the Company foundation begins to revert, AGNCN might really be redeemed and the corporate will then additionally decrease its leverage.

Extra broadly, what’s fascinating is that Company valuations are rather more excessive than the valuations of different fixed-income sectors – they’re buying and selling at their peak this yr and never far off their COVID peaks.

ICE

If valuations transfer to their peak GFC ranges, we might count on a 40-50% guide worth drop for AGNC (leading to fairness protection of round 2x), though it is onerous to think about it getting there (and the Fed not doing something). Based mostly on this, it might probably make sense to obese Company mREIT preferreds relative to different credit score belongings. For example, high-yield company credit score spreads are greater than 1% beneath their 2022 peak, about half their COVID peak ranges and 1 / 4 of their peak GFC ranges.

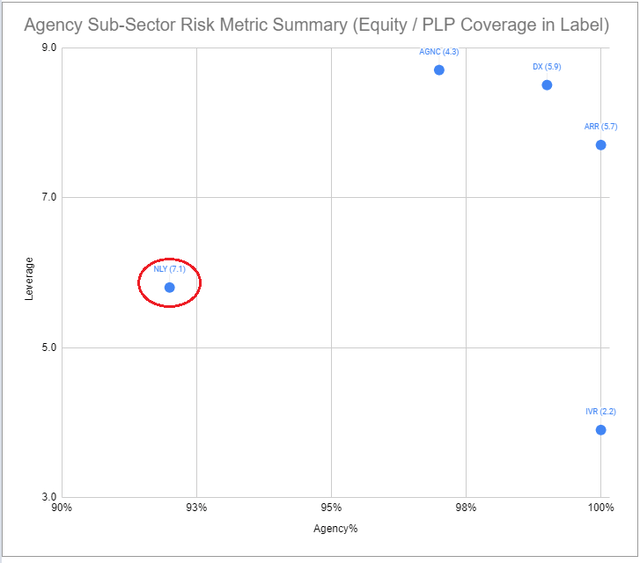

Dynex Capital (DX) noticed fairly related outcomes. It tends to run a lower-leverage portfolio so its guide worth fell a extra modest 16%. Leverage elevated sharply nonetheless to eight.5x from 6.6x. DX tends to be rather more nimble with leverage than different mREITs so this bounce means they’re seeing good worth in Companies. Like AGNC and Annaly Capital (NLY), DX additionally issued widespread shares. Fairness/preferreds protection fell to five.9x.

Annaly additionally declared outcomes. Ebook worth fell round 15% whereas leverage fell as nicely. A really compelling facet of NLY is the convexity in its habits. Particularly, this has to do with the way it responds to giant guide worth drops. In Q3, the corporate issued 16% extra widespread shares. The online result’s that whereas guide worth fell 15%, fairness, which is the factor that really issues to preferreds, fell just one.2%. Because the guide worth has been falling this yr, the corporate grew its widespread shares by an enormous 29%.

AGNC and DX have additionally issued new widespread shares however not practically in as giant quantities. In different phrases, a big guide worth drop causes NLY to problem widespread shares, softening the influence on preferreds. And if we see an enormous rise in guide worth, NLY will seemingly do nothing (i.e. they will not purchase again 29% of their shares), leaving preferreds significantly better off from an natural rise in fairness.

This convexity of little fairness protection loss to the draw back and an enormous potential fairness protection acquire to the upside is a pleasant profile for preferreds to have. On this sense, NLY preferreds provide a lot increased convexity than its counterparts within the sector. There isn’t any assure NLY will preserve being so daring with widespread fairness issuance to the draw back however the reality is that they have been up to now, leaving their preferreds significantly better off than others within the sector.

The opposite factor price highlighting is that NLY tends to be considerably extra conservative. For instance, whereas DX and AGNC elevated their leverage ranges in Q3 (to eight.5x and eight.7x), NLY really moved it decrease considerably from 6.6x to five.8x.

A better stage of leverage is extra engaging for traders in widespread shares who’re bullish Companies. Nevertheless, preferreds holders are rather more serious about draw back threat than upside beneficial properties so, all else equal, they like decrease leverage ranges.

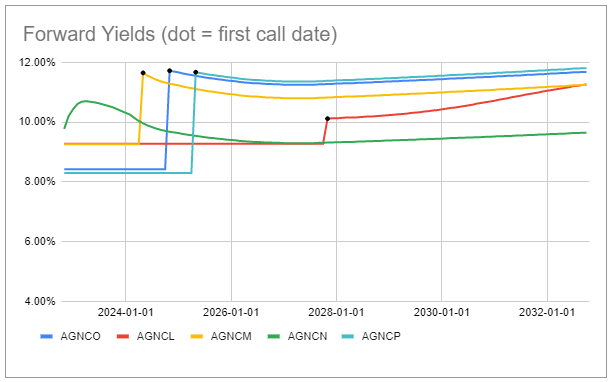

Let’s take a look at what yields are on provide throughout the sector.

The chart beneath reveals ahead yields of the AGNC suite. There isn’t any slam dunk “greatest” inventory right here. Shares with increased yields within the close to time period like AGNCN and AGNCM are anticipated to have decrease yields in the long term and vice-versa. On this sense, the pricing is fairly environment friendly. General, we see worth in AGNCN within the close to time period and AGNCL within the longer-term.

Systematic Earnings Preferreds Device

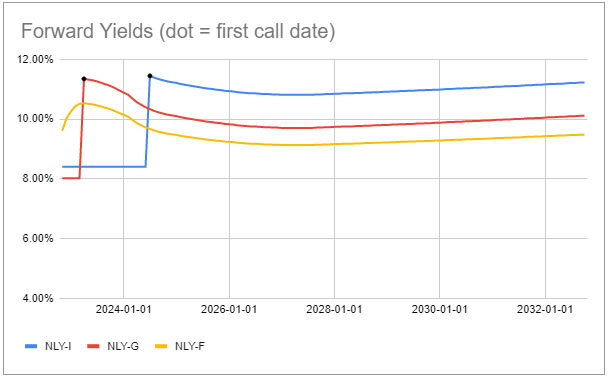

Within the NLY suite we like NLY.PF and NLY.PG.

Systematic Earnings Preferreds Device

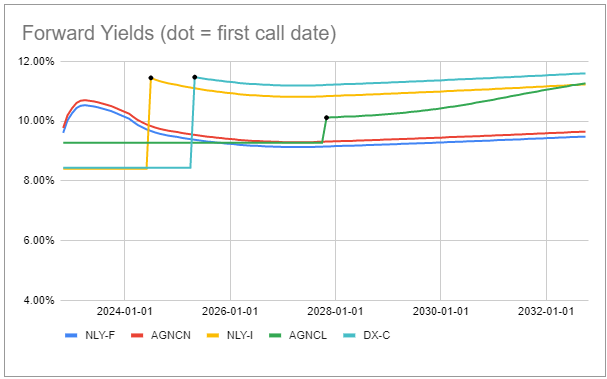

If we mix the shortest name and longest name AGNC and NLY preferreds with DX.PC, we get the next image. Over the longer-term, DX.PC affords a number of worth in our view, nonetheless, Apr-2025 is a long-time to attend for a bump within the coupon and by then Libor might simply be considerably decrease than it’s immediately or what’s priced into Libor forwards.

Systematic Earnings Preferreds Device

In elementary phrases, we proceed to favor NLY within the sector – it has the best fairness/most well-liked protection within the Company mREIT preferreds sub-sector and the bottom leverage. As talked about above, it has additionally been most aggressive in issuing widespread shares, boosting fairness most well-liked protection.

Systematic Earnings Preferreds Device

[ad_2]

Source link