[ad_1]

- Regardless of a long-term downtrend since December 2021, Pfizer’s inventory should still be undervalued

- The corporate is now aiming to ascertain a steady, growth-oriented mannequin following a yr of stagnation

- Pfizer’s general monetary well being has remained stable and the inventory could possibly be on the verge of bottoming out

After experiencing a surge through the pandemic, Pfizer (NYSE:) entered a long-term downtrend in December 2021. The inventory confirmed indicators of a possible restoration within the October-December interval final yr. Nonetheless, it struggled to fend off the persistent promoting strain, in the end ensuing within the value returning near pre-pandemic ranges.

The corporate reaped substantial money stream from the COVID-19 vaccine and Paxlovid gross sales. Nonetheless, as a substitute of resting on its laurels, the New York-based firm selected to put money into its non-COVID-19 product portfolio and pursued development by way of numerous mergers and acquisitions.

Whereas the pharmaceutical big confronted some challenges on this course of, it is clear that it nonetheless maintains vital potential, though the anticipated returns from these investments have not materialized but.

A hiccup in Pfizer’s journey occurred when it needed to halt manufacturing of a drug used within the therapy of kind 2 diabetes and weight problems as a consequence of elevated liver enzyme ranges. However, the corporate has one other drug within the pipeline for these circumstances, which is taken into account a promising various.

Thus far, trials of this various drug, named Danuglipron, haven’t encountered any points. The outcomes of those research are anticipated to be accessible in direction of the top of the yr, and it will likely be fascinating to see how a lot of the market it will probably seize.

Pfizer’s inventory took one other hit in August when the corporate reported unfavourable second-quarter . The report revealed a 54% decline in whole income for the final quarter, primarily as a consequence of decreased gross sales of non-COVID-19 merchandise. This adopted a 28% income decline within the earlier quarter, additional exacerbating issues about pricing and efficiency.

Supply: InvestingPro

As well as, it introduced its earnings per share (EPS) as 0.64 {dollars} within the final quarter, 15% above expectations. Nonetheless, final quarter’s income got here in at $12.73 billion, 5% beneath InvestingPro expectations, creating negativity. The corporate additionally lowered its income forecast for 2023 from $67 – $71 billion to $67 – $70 billion following the newest quarterly information.

What Lies Forward for Pfizer?

After we check out analyst forecasts by way of the InvestingPro platform, it’s seen that 14 analysts have revised their estimates downwards for the Q3 report, which is anticipated to be introduced on October 31. Accordingly, the consensus estimate for the present quarter is $4.88 billion, down 26% year-on-year. Analysts additionally lowered the EPS forecast by 53% to $0.63.

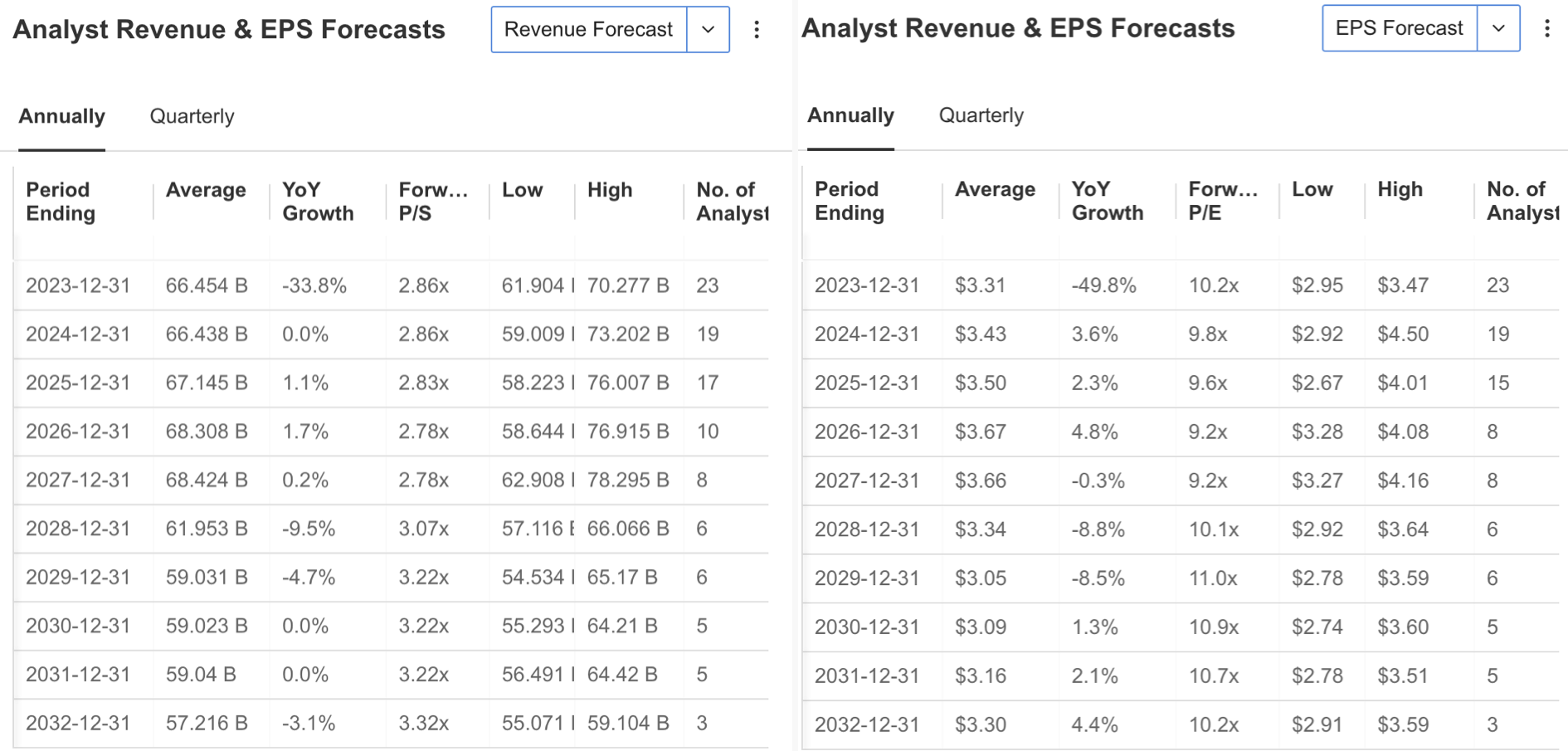

Supply: InvestingPro

longer-term forecasts, EPS for the year-end is estimated at $3.31, down almost 50%. There’s a average upward view for the approaching years. The income forecast for the year-end is $66.45 billion, down near 34%. Whereas Pfizer’s income is anticipated to extend modestly within the subsequent 3 years, a weak outlook is predicted.

Supply: InvestingPro

To reverse the pessimistic outlook, the corporate seems to be centered on establishing a steady and probably growth-oriented mannequin for the long run after a yr of stagnation. Whereas the preliminary outcomes of those efforts, equivalent to a 5% enhance in non-COVID-19 revenues, usually are not but deemed ample, it’s essential for the corporate’s current investments to evolve in a course that can bolster its income within the upcoming durations.

In the newest quarterly report, the corporate acknowledged the lingering uncertainty associated to COVID. Nonetheless, it anticipates that the rise in vaccination charges through the fall and winter months could have a optimistic affect on its earnings till year-end. Moreover, the mixture of the flu and COVID vaccines is anticipated to offer ongoing optimistic contributions within the medium and long run.

PFE Inventory Is Considerably Undervalued

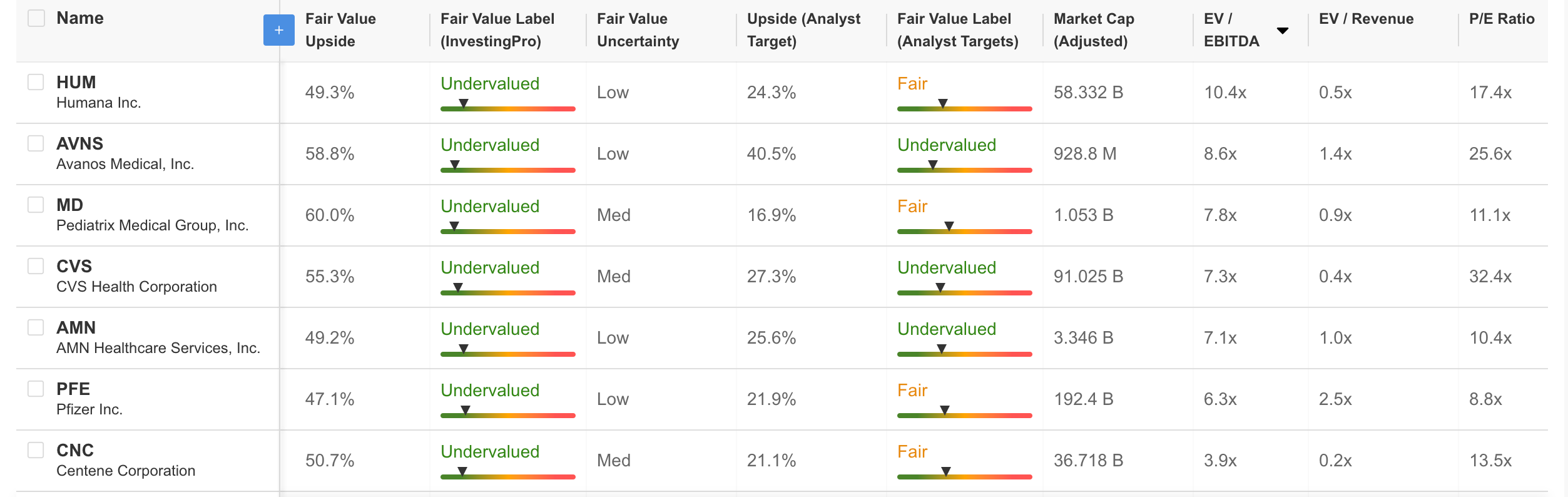

Regardless of the uncertainty surrounding Pfizer’s income margins, PFE’s inventory displays a big upside potential. When evaluating the corporate’s inventory based mostly on components equivalent to truthful worth evaluation, analyst opinions, and value/earnings ratio, it turns into evident that PFE is presently undervalued by 47% by way of truthful worth potential.

Analysts’ assessments recommend that the inventory is buying and selling at a reduction of twenty-two%. Furthermore, Pfizer boasts a decrease EV/EBITDA ratio in comparison with its friends and a decreased enterprise worth relative to income. Moreover, with a value/earnings ratio of 8.8X, the corporate’s inventory value seems fairly low, signaling that PFE might have reached its backside costs and possesses substantial potential for development.

Supply: InvestingPro

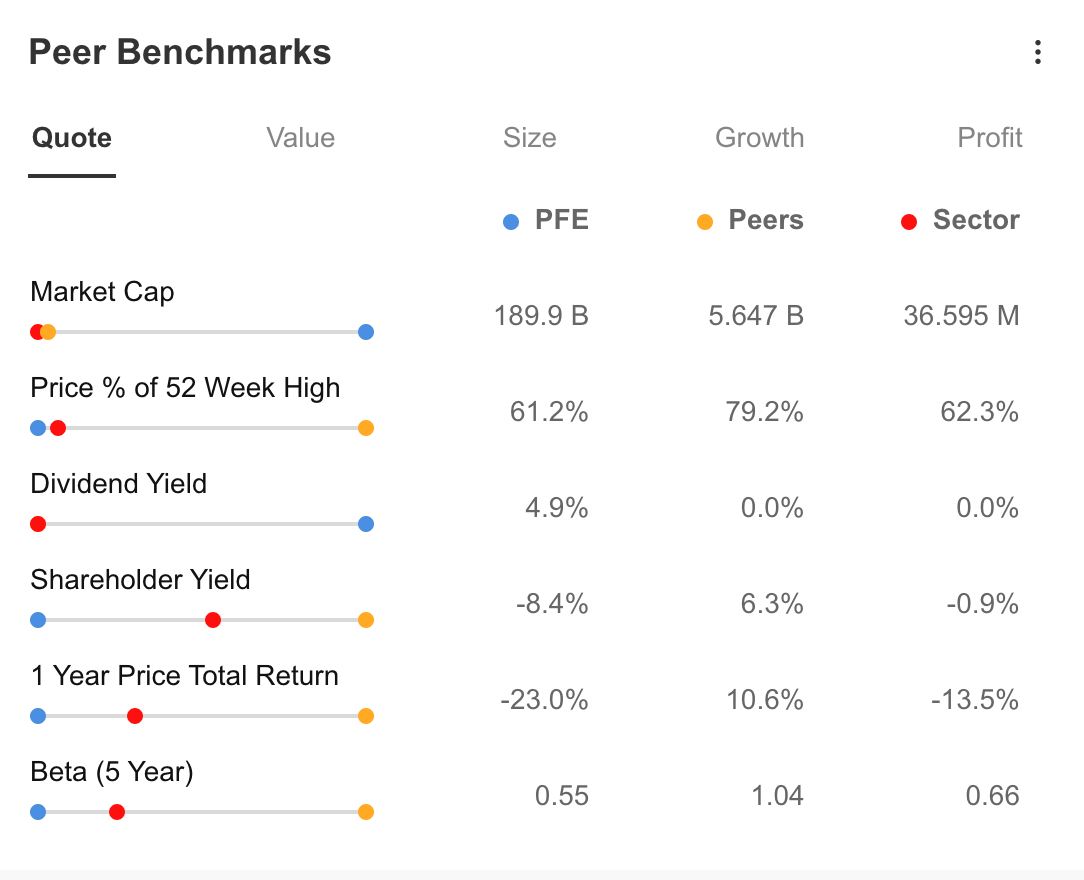

Persevering with with the comparability of Pfizer with its friends and the trade, the corporate stands out with its market capitalization and dividend yield, whereas its shareholder return and whole return during the last 1 yr mirror negativity. Whereas PFE is presently 61% away from its 1-year excessive, the truth that this ratio is near the friends and the sector common offers an vital clue that the issue is attributable to sectoral difficulties.

One other noteworthy element right here is that PFE’s 5-year beta is at 0.55. In accordance with the present beta, PFE inventory is a defensive asset for the funding portfolio with the potential to mirror value actions that diverge from inventory market actions.

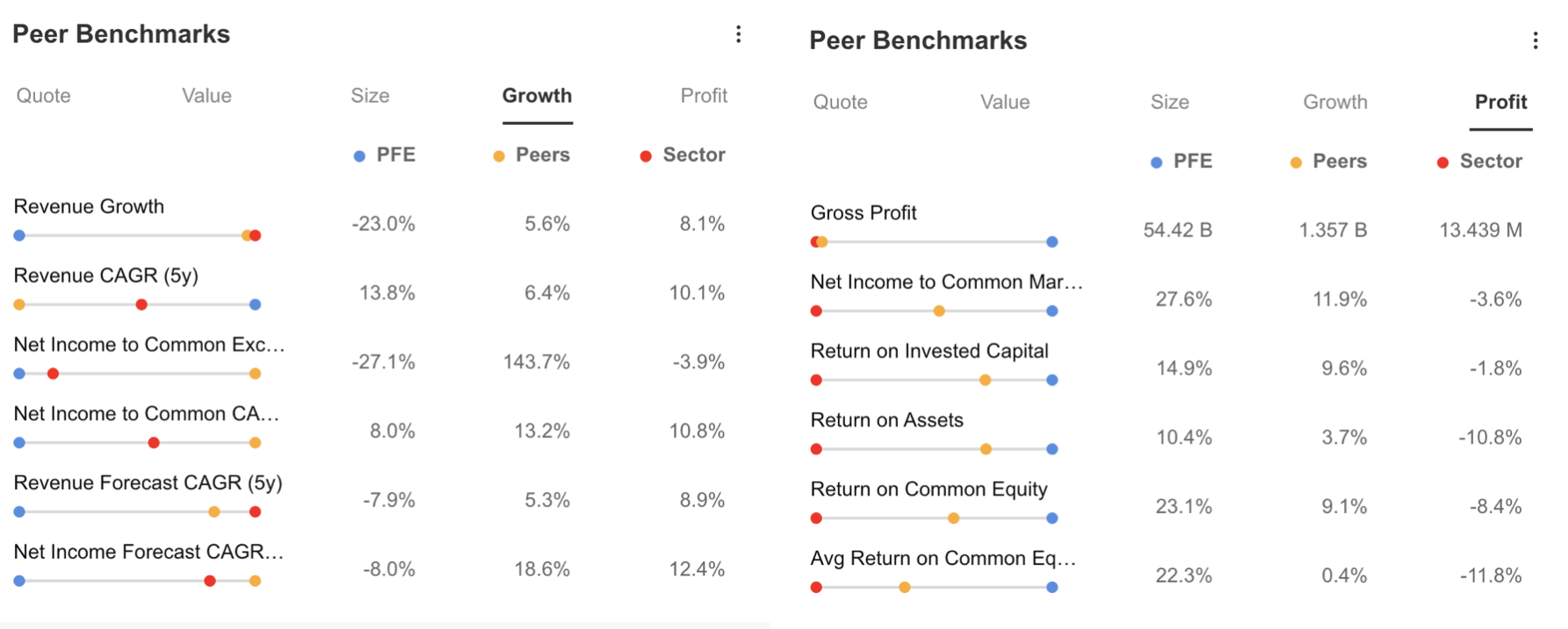

Supply: InvestingPro

Let’s delve right into a comparability specializing in development and profitability. Pfizer’s development indicators look like tougher than these of its friends based mostly on present outcomes. Whereas friends are experiencing a partial upturn in income development, Pfizer is going through a unfavourable development on this regard.

Moreover, income and internet revenue forecasts for the subsequent 5 years do not look notably promising in the mean time. Nonetheless, it is vital to notice that Pfizer’s profitability metrics proceed to outperform these of its sector and peer firms. The corporate would possibly encounter challenges in increasing its income given its present dimension, and its capability to generate speedy earnings from its operations compared to peer firms shouldn’t be underestimated.

Supply: InvestingPro

It’s because the long-term perspective reveals that investments made by way of mergers and acquisitions proceed to mirror a big earnings potential. As well as, in current developments, the FDA has authorized the vaccine, which has been harmonized with the newest COVID variants with Eris, for folks aged 12 years and older. That is one other issue that has the potential to spice up the corporate’s income by the top of the yr, relying on demand.

The corporate’s good monetary well being is summarized by the next factors:

- 12 years of consecutive dividend will increase, making it a gorgeous inventory for long-term traders

- Excessive return on invested capital

- Low volatility of the share value

- Well being of money stream

Pfizer’s general monetary well being is stable. The corporate’s profitability and relative worth are the highlights, whereas its money place, development, and value momentum have additionally carried out properly.

src=

Supply: InvestingPro

Because of this, the truthful worth evaluation means that the inventory is transferring at a forty five% low cost to its present degree of $33.6, reflecting the potential for the inventory to succeed in near $50 with low uncertainty. The consensus view of 23 analysts is that PFE may rise as excessive as $44 within the quick time period.

***

Discover All of the Information you Want on InvestingPro!

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought of as funding recommendation.

[ad_2]

Source link