[ad_1]

imaginima

Description

My purchase score for Pegasystems (NASDAQ:PEGA) stays unchanged following the discharge of 1Q23 outcomes, because the inventory value has but to replicate the intrinsic worth I attribute to the corporate. Particularly, PEGA’s ACV progress has been sturdy repeatedly, and it’s now rising above its personal ACV progress information. The success of PEGA’s gross sales workforce, which has executed a superb job of penetrating the corporate’s present base of enormous clients, is an enormous cause for the corporate’s constant success, in my view. The first progress indicator for subsequent quarters (backlog) additionally elevated, reaching 14% progress, a full 1000bps above 4Q22 progress. In my view, it is a testomony to the success of the transfer to Pega Cloud, which ought to stay a driving pressure behind future growth. Income and profitability got here in under consensus, which can clarify why PEGA inventory value didn’t react as strongly as I had hoped. Nevertheless, in my view, the miss in earnings was purely optical and never structural. Based mostly on my evaluation, I consider that the income combine shift to Pega Cloud primarily contributed to the poor term-license income efficiency. As soon as the transition is finished, I anticipate a surge in exercise just like Pega Cloud’s explosive growth. In sum, I’m heartened by the environment friendly operation, and I believe the present valuation represents alternative for long-term buyers who’re prepared to be affected person.

Enterprise mannequin benefit

I’ve briefly touched on PEGA aggressive benefit beforehand, which was its capacity to make the most of AI to automate processes and is very adaptable and able to digitizing most enterprise processes. I believe it is vital to enter extra depth about AI due to the latest surge in curiosity in it (thanks, ChatGPT). With its model-driven method, I believe PEGA has a leg up on the competitors in terms of the subject of generative AI. On the present stage, PEGA fashions and software program are being knowledgeable by generative know-how, which simplifies answer implementation and developer help. PEGA can also be taking strategic steps to reinforce its capabilities on this space, integrating Bedrock from AWS and instruments from different main cloud suppliers. This integration empowers builders to effectively construct and scale Generative AI functions within the cloud. Of notable significance is PEGA’s proactive method to mitigate the potential influence of accelerating automation on its buyer base. The corporate has efficiently transitioned from user-based pricing to an outcome-based income mannequin, which administration anticipates will ultimately dominate the corporate’s income streams, presently comprising 75% of its enterprise. This shift gives insulation towards potential challenges arising from the adoption of AI, guaranteeing a secure and sustainable income stream for PEGA. Total, I consider the worth of this generative AI capacity lies in its basic capability to stimulate additional demand. That is very true for PEGA, as its platform permits for complicated workflows to be completed with little to no programming.

Pega Cloud

My opinion is that the income and revenue shortfall in comparison with the consensus just isn’t trigger for alarm as a result of it’s primarily an optical subject (i.e. P&L doesn’t replicate the underlying change in enterprise precisely). The miss was primarily pushed by a 39% decline in time period license income, which is of course anticipated as PEGA is shifting purchasers to cloud. Mathematically, income will decline as cloud recognition occurs throughout a time frame whereas time period licenses are one-off. The identical logic applies to income as effectively. Whereas some would possibly argue that Pega Cloud didn’t carry out in addition to it ought to have, I’d level out that the 19% progress Pega Cloud confronted a tricky comp final yr. It is also price noting that PEGA has been placing most of its effort into tapping into its current (albeit solely 10% penetrated) buyer base. As PEGA pursues new logos within the coming months, I anticipate a progress spurt within the close to future.

Macro weak point

Regardless of my confidence within the firm and the inventory, I’m cautious of the macro setting, which reveals no indicators of bettering quickly. Fortuitously, PEGA seems to be dealing with this era effectively, and administration famous that it has not seen the macro setting worsening the enterprise in 1Q23. It seems that PEGA’s underlying clients are resonating effectively with the corporate’s transition to the cloud, and most significantly, PEGA’s gross sales groups have executed effectively to seize this demand. Subsequently, I proceed to have some hope that PEGA will make it by means of this era unscathed.

Valuation

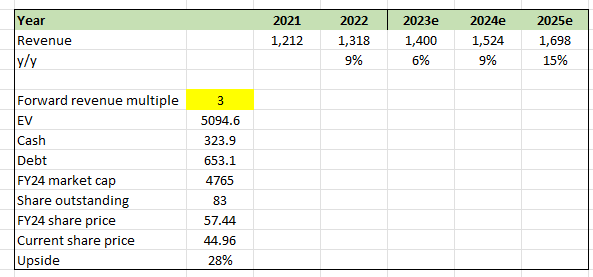

PEGA’s valuation stays interesting at 2.8x income if buyers are prepared to attend for progress to inflect because the transition to Pega Cloud is accomplished. Utilizing the FY23 guided income determine and my assumption of accelerated progress, PEGA ought to generate round $1.7 billion in income in FY25. Even when we assume that income multiples don’t inflect, as I consider they may, the upside from the present share value continues to be very interesting at 28%.

Creator’s mannequin

Abstract

In conclusion, my purchase score for PEGA stays unchanged based mostly on the latest 1Q23 outcomes. PEGA’s sturdy ACV progress and the rise in backlog and the profitable transition to Pega Cloud reveal the potential for future progress. Whereas income and profitability fell under consensus, I consider it is a short-term optical subject pushed by the shift to Pega Cloud. PEGA’s model-driven method and integration of generative AI know-how place the corporate favorably out there. The transition to an outcome-based income mannequin insulates PEGA from potential challenges arising from growing automation. Regardless of macroeconomic uncertainties, PEGA has navigated this era effectively, and its gross sales groups have executed successfully. Lastly, the present valuation of PEGA presents an interesting alternative for long-term buyers, with potential upside as progress accelerates and the transition to Pega Cloud is accomplished.

[ad_2]

Source link