NicoElNino/iStock by way of Getty Photographs

Thesis

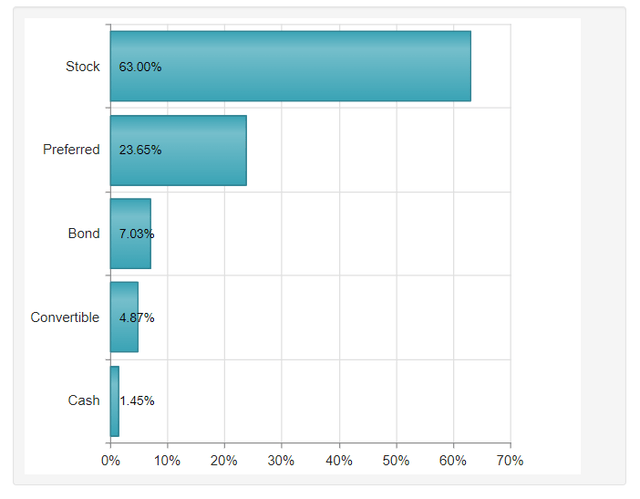

The John Hancock Premium Dividend Fund (NYSE:PDT) is a closed finish fund which has excessive present revenue as its fundamental aim, and modest development of capital as a secondary one. The fund invests in a diversified portfolio of dividend paying widespread shares and most popular securities. The present break up reveals a 63% widespread inventory weighting and an approximate 24% most popular possession, with the remainder allotted between convertibles and bonds. The fund focuses on corporations the place the senior debt is rated funding grade, with a goal of 80% of the fund’s complete belongings to return from such issuers. The fund is defensively set-up, with over 51% of its present composition coming from the utilities sector.

The car comes from the identical suite of merchandise because the a lot better recognized DNP Choose Earnings Fund (DNP) and has achieved comparable long run outcomes, albeit with a bit extra volatility. PDT exposes a 5-year Sharpe ratio of 0.43 and a normal deviation of 16.3 versus a 5-year Sharpe of 0.48 and a normal deviation of 16.38 for DNP. On a trailing complete return foundation we see 5- and 10-year returns right here that stand at 9.1% and 10.8% respectively for this fund. The fund has a pretty big leverage ratio of 33%, which magnifies returns in the long run but additionally contributes to the next volatility and deeper downturns. Outdoors the Covid downturn, the fund often exposes a -15% regular cycle drawdown and displays a bit extra volatility than its DNP counterpart because of the portfolio composition. The fund has traded at a premium to par up to now 7 years, and is presently in the course of the vary for its historic premiums to NAV.

Coming from a premier asset supervisor PDT is a closed finish fund specializing in the utilities, financials and power widespread and most popular shares house as a way to extract dividends. The fund presently has a 7.13% distribution fee which has traditionally been absolutely lined by the asset base. The fund is now buying and selling at a 8% premium to NAV, which sits in its historic vary. We like this fund and its sturdy long run returns, however we don’t really feel the present analytics warrant a purchase sign. For retail traders already within the title it is a Maintain, whereas new cash trying to enter the house could be effectively suited to attend for a greater entry level.

Holdings

The fund holds a mixture of widespread inventory and most popular securities:

Segmentation (CefConnect)

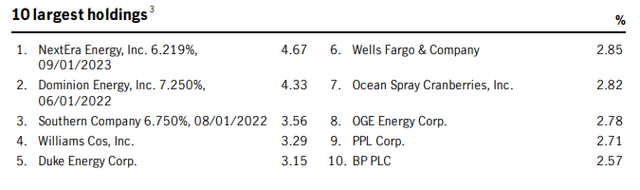

The highest holdings for the fund are as follows:

Largest Holdings (Reality Sheet)

The fund isn’t overly concentrated in any title, with the highest holdings by no means exposing a portfolio share bigger than 5%.

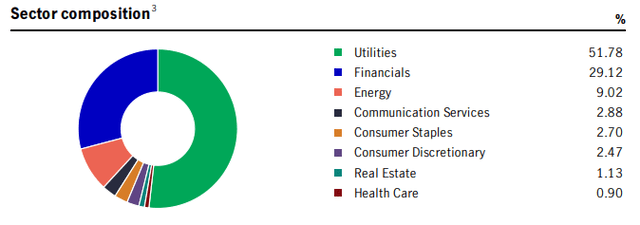

Utilities and Financials are the highest sectors presently for the title:

Sector composition (Fund Reality Sheet)

The defensive tilt we see within the fund is highlighted right here by way of the substantial utilities focus, though the fund isn’t solely investing on this space. From a efficiency standpoint we’ll see within the subsequent part that such a allocation, whereas long run displays good returns, does are likely to have deeper drawdowns than a pure utilities portfolio.

Efficiency

On a 5-year foundation PDT benchmarks very favorably to DNP, though with a deeper drawdown throughout Covid:

Whole Return 5-12 months (In search of Alpha)

On an extended, 10-year timeframe PDT tends to overperform its peer:

Whole Return 10-12 months (In search of Alpha)

As highlighted above PDT isn’t an solely Utilities targeted fund, therefore the bigger downward volatility we see within the fund in instances of market misery. Additionally notable, however not accessible within the truth sheet, is the truth that PDT appears to run the next belongings period than DNP, with the value motion witnessed because the rise within the yield curve being destructive versus the DNP worth motion:

YTD Efficiency (In search of Alpha)

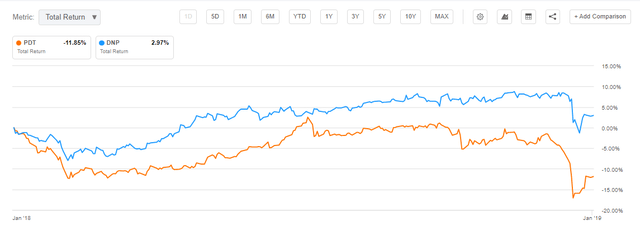

On a year-to-date foundation PDT is marginally down whereas DNP is considerably up. Over the past aggressive Fed cycle we witnessed an analogous efficiency the place DNP overperformed:

Jan 2018 – Jan 2019 Efficiency (In search of Alpha)

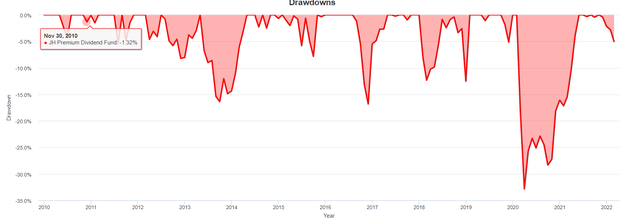

In the course of the pandemic the fund sustained a considerable -33% drawdown:

Drawdown (PortfolioVisualizer)

We are able to additionally see from the above chart that outdoors exogenous occasions similar to Covid, the drawdown right here is pretty effectively restricted at a -15% stage up to now decade. The drivers for the historic drawdowns outdoors of Covid have been credit score unfold widening occasions such because the 2018 risk-off surroundings and the 2015-2016 Oil worth collapse downturn.

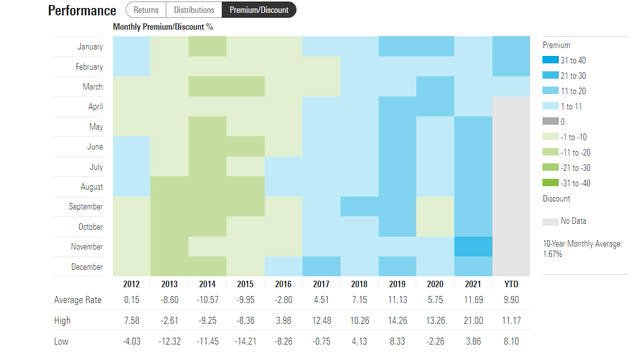

Premium / Low cost to NAV

The fund has been buying and selling at a premium to NAV up to now few years:

Premium to NAV (Morningstar)

The fund is presently buying and selling at a 8% premium to NAV which is in the course of the vary for the previous few years. We are able to discover an attention-grabbing shift in investor conduct up to now 7 years, with a big re-allocation of monies to this fund, which has resulted in a constant premium to NAV for the CEF ever since 2016. An identical take a look at the DNP chart reveals us that that fund has been buying and selling at a premium to NAV for the previous decade.

Distributions

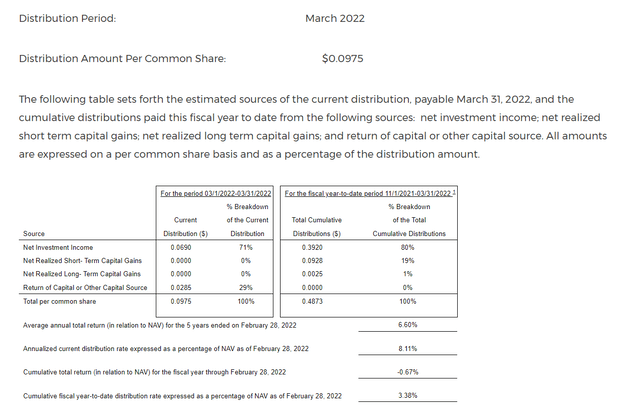

From the newest Part 19(a) we are able to see the fund has a reasonably effectively lined distribution schedule:

Part 19(a) (Fund Doc)

Over an extended time frame the fund covers its distribution from funding revenue and capital features, whereas over shorter interval of instances it tends to make the most of ROC to make-up for timing points. We consider these are the indicators of a well-run portfolio and a really apt administration workforce that accurately navigates the asset class and its buying and selling mandate to realize the acknowledged goal of the fund.

Conclusion

PDT is a CEF specializing in widespread and most popular securities from the utilities, financials and power sectors. The fund has revenue as its main goal and it has proven sturdy long run complete trailing returns which sit at above 9% on each a 5- and 10-year lookback interval. The fund compares favorably with its a lot better recognized counterpart DNP relating to complete returns throughout the previous decade. PDT is presently yielding slightly bit over 7% and is buying and selling at an approximate 8% premium to NAV. We like this fund and its sturdy long run returns, however we don’t really feel the present analytics warrant a purchase sign. For retail traders already within the title it is a Maintain, whereas new cash trying to enter the house could be effectively suited to attend for a greater entry level.