[ad_1]

AUGUST LABOR MARKET REPORT

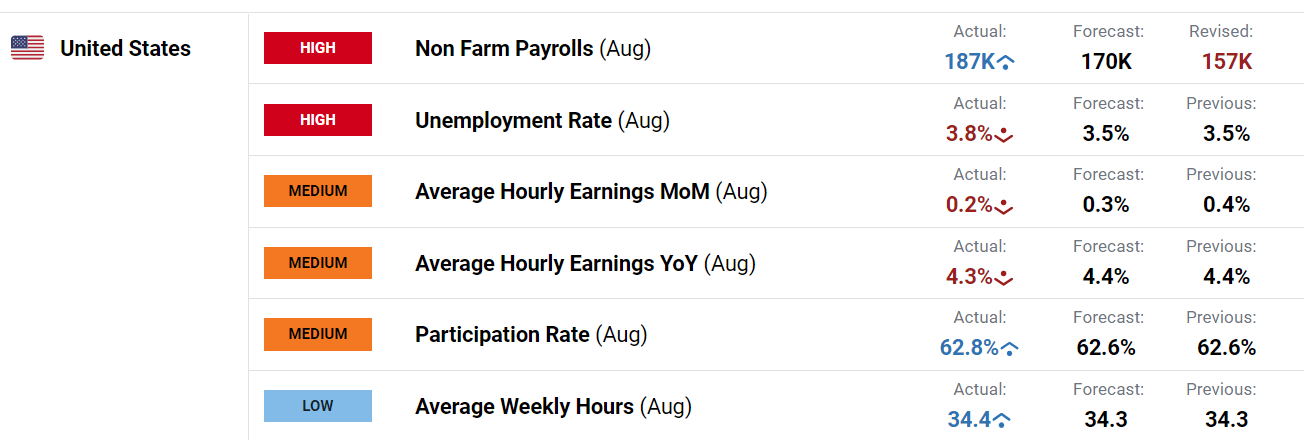

- August U.S. nonfarm payrolls enhance by 187,000 versus 170,000 anticipated

- The unemployment price rises to three.8%, because the participation price ticks as much as 62.8% from 62.6%

- Common hourly earnings rise 0.2 % m-o-m and 4.3% y-o-y, one-tenth of a % beneath estimates in each instances

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

Most Learn: Indices on Observe for Second Week of Features – FTSE 100, Nasdaq 100, DAX 40

U.S. employers added to their workforce vigorously final month regardless of the superior stage of the enterprise cycle, undeterred by the Federal Reserve’s most aggressive tightening marketing campaign in a long time, underscoring the labor market’s distinctive resilience and its means to supply assist to the broader economic system throughout the latter a part of 2023.

In response to the newest figures from the Bureau of Labor Statistics, the nation created 187,000 jobs in August, exceeding the 170,000 anticipated by Wall Avenue analysts, following a downwardly revised 157,000 enhance in July. In the meantime, the unemployment price ticked as much as 3.8% regardless of robust hiring exercise, because the participation degree jumped to 62.8% from 62.6%, indicating a greater stability between provide and demand for staff (labor pressure elevated by 736K).

UNEMPLOYMENT RATE AND NONFARM PAYROLLS

Supply: BLS

Elsewhere within the nonfarm payrolls survey, common hourly earnings, a robust inflation gauge intently tracked by the Federal Reserve, rose by 0.2% month-to-month, bringing the annual price to 4.3% from 4.4% beforehand, one-tenth of a % beneath consensus estimates in each instances, a welcome improvement for policymakers.

Advisable by Diego Colman

Get Your Free Prime Buying and selling Alternatives Forecast

LABOR MARKET DATA AT A GLANCE

Supply: DailyFX Financial Calendar

Advisable by Diego Colman

Get Your Free USD Forecast

The moderation in pay development coupled with resilient hiring brings optimistic information for the Fed, as they sign that value stability could also be restored with out sacrificing the economic system to the altar of a 2% inflation goal. This case presents the FOMC with the chance to engineer a tender touchdown, one thing that has traditionally been difficult to realize when aggressive tightening measures had been applied.

On the Jackson Gap Symposium, Fed Chair Powell indicated that the establishment will “proceed fastidiously” in any additional transfer after having already delivered 525 foundation factors of tightening since 2022. Right this moment’s knowledge reaffirm the decision for circumspection, giving the financial institution cowl to stay cautious and decreasing the chance of further hikes.

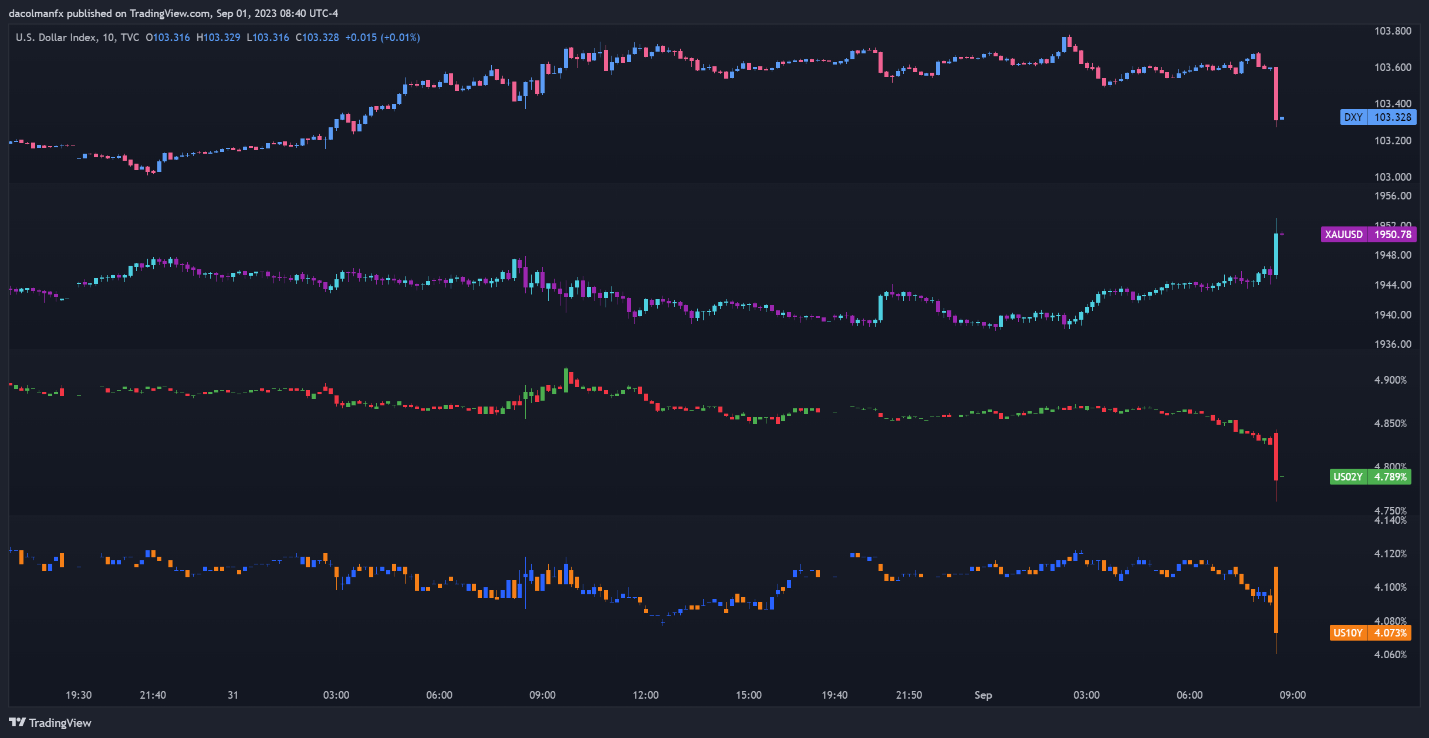

Instantly following the discharge of the employment report, the U.S. greenback, as measured by the DXY index, deepened its session’s pullback, dragged decrease by falling Treasury yields. In the meantime, gold costs accelerated greater, gaining as a lot as 0.7%, bolstered by the strikes within the fixed-income area. These market dynamics might acquire momentum in September.

Advisable by Diego Colman

Get Your Free Gold Forecast

US DOLLAR, GOLD & YIELDS CHART

Supply: TradingView

[ad_2]

Source link