[ad_1]

Financial institution OZK

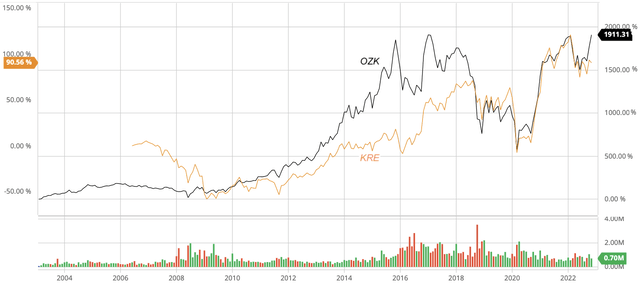

Banking shares have been torn between rising rates of interest, which is seen as a bullish issue for the sector, and worries over a world recession amid the speed hikes by the central banks. Such a confusion will be seen in the SPDR S&P Regional Banking ETF (KRE) (Fig. 1).

Fig. 1. Inventory chart of SPDR S&P Regional Banking ETF (KRE), as in contrast with Financial institution OZK (NASDAQ:OZK), dividend back-adjusted (modified from Barchart and Searching for Alpha)

On this article, I intend to investigate Financial institution OZK (OZK), a Little Rock, Arkansas-headquartered industrial financial institution. Financial institution OZK is among the 23 regional banking shares within the elite group of dividend champions.

From Jasper to Little Rock and past

Financial institution OZK traces its origin to 1903 in Jasper, Arkansas. It might have been simply one other group financial institution within the small city, had George G. Gleason II – an Arkansas lawyer – not purchased the management of it, with $10,000 in money, a $3.6 million mortgage, and the household farm and household belief as collateral.

In 1979, when Gleason acquired the financial institution on the age of 25, it solely had $28 million in belongings. He slowly grew the financial institution to 5 branches. By 1995, Gleason appears to have been prepared for larger issues; he modified the title of the financial institution to “Financial institution of the Ozarks” and moved the headquarters to Little Rock. Two years later, the financial institution went public with $300 million in belongings. With development capital from the general public itemizing, the financial institution expanded to North Carolina and Texas, respectively, in 2001 and 2003.

The worldwide finance disaster supplied a golden alternative for Gleason to broaden. Making the most of an FDIC program that was designed to help sound banks to take over failing friends, Gleason purchased seven banks by 2011. Six extra banks have been acquired over the following 5 years.

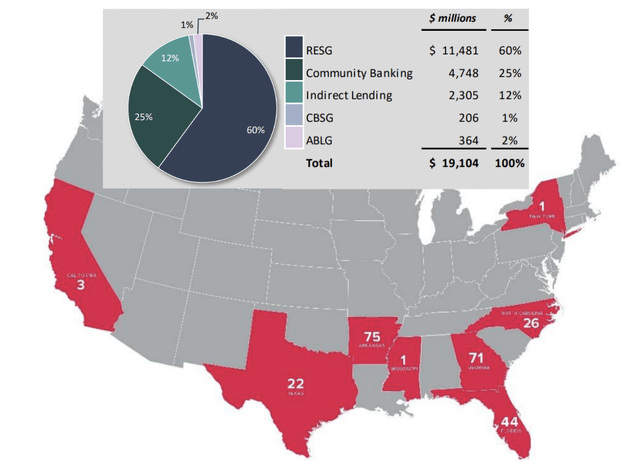

By 2020, when the financial institution moved into a brand new 225,000 sq-ft workplace constructing in West Little Rock, it had $27.2 billion in belongings, working in 8 states with 243 places of work (Fig. 2).

Fig. 2. The footprint of Financial institution OZK, proven with non-purchased loans by lending group as of September 30, 2022 (modified from Financial institution OZK)

Worthwhile development

As a industrial financial institution, OZK takes cash from trusting depositors in its community of 231 branches, and loans the cash out primarily to industrial shoppers in actual property improvement (60% of non-purchased Loans), and small companies and customers (25%). OZK pays the depositors at a particular charge of curiosity however collects from debtors a better charge than what’s paid to depositors, thus pocketing the unfold between the rates of interest and producing enormous returns on its tangible capital.

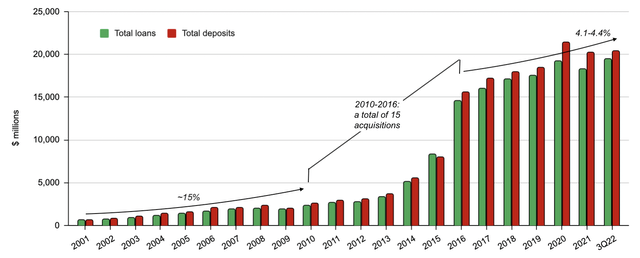

From 2001 to 3Q2022, Financial institution OZK grew deposits from $678 million to $20.4 billion at a CAGR of 16.9%, and expanded loans from $616 million to $19.5 billion at a CAGR of 17.2% (Fig. 3).

- It’s price mentioning that a lot of the expansion was completed within the 7 years instantly following the worldwide monetary disaster when OZK made 15 acquisitions.

- Since 2016, deposits and loans have been rising at average annual charges of 4.1% and 4.4%, respectively. Now a a lot larger enterprise, OZK apparently was not in a position to publish ~15% per-year natural development because it had finished in 2001-2009.

Fig. 3. Complete deposits and loans of Financial institution OZK at interval finish from 2001 to 3Q2022 (Compiled by Laurentian Analysis for The Pure Assets Hub based mostly on monetary filings of Financial institution OZK and Searching for Alpha)

Profitability

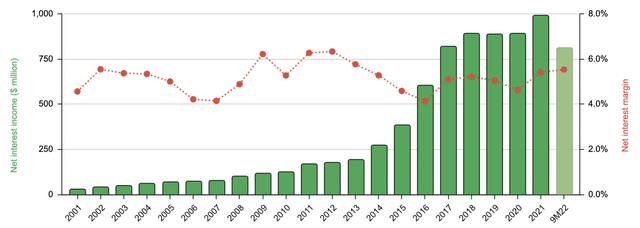

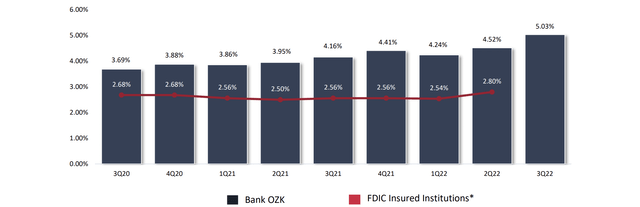

OZK was in a position to obtain a web curiosity margin – i.e., the unfold between the rates of interest of the loans and the deposits – between 4.0% and 6.3% (Fig. 4). Such excessive web curiosity margins left the {industry} common within the mud (Fig. 5).

Fig. 4. Internet curiosity earnings (lhs) and web curiosity margin (RHS) of Financial institution OZK (compiled by Laurentian Analysis for The Pure Assets Hub based mostly on monetary filings of Financial institution OZK and Searching for Alpha) Fig. 5. Financial institution OZK in contrast with the {industry} when it comes to web curiosity margin (Financial institution OZK)

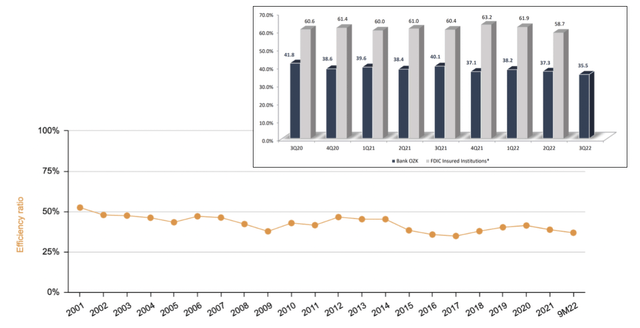

Whereas the web curiosity margin highlights how a financial institution is doing in attracting low-cost deposits and lending out cash to debtors who’re prepared to pay greater rates of interest, the effectivity ratio is utilized by monetary analysts to measure how effectively a financial institution runs its operations. The effectivity ratio is derived by dividing non-interest bills, together with G&A, with income so the decrease it’s, the extra effectively the financial institution is being operated.

- Financial institution OZK averages 38.0% in effectivity ratio since 2016; in different phrases, it prices OZK solely 38 cents to tug in each greenback of income. OZK once more compares favorably with the banking {industry} common, which has an effectivity ratio round 60% (Fig. 6).

- Higher but, the effectivity ratio has been declining over the previous 22 years, due to economies of scale and an increasing buyer base.

Fig. 6. The effectivity ratio of Financial institution OZK, as in contrast with that of the {industry} (inset) (compiled by Laurentian Analysis for The Pure Assets Hub based mostly on monetary filings of Financial institution OZK and Searching for Alpha, with the inset from Financial institution OZK)

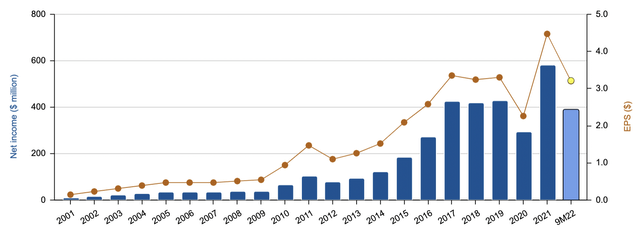

Curiosity earnings accounts for ~80% of the whole income of Financial institution OZK. Between the excessive web curiosity margin (Fig. 4), low effectivity ratio (Fig. 6) and increasing enterprise (Fig. 3), OZK was in a position to publish rising web earnings and earnings per share (or EPS), as illustrated in Fig. 7.

Fig. 7. Internet earnings and EPS of Financial institution OZK for 2001-2021 and the primary 9 months of 2022 (compiled by Laurentian Analysis for The Pure assets Hub based mostly on monetary filings of Financial institution OZK and Searching for Alpha)

Dividends

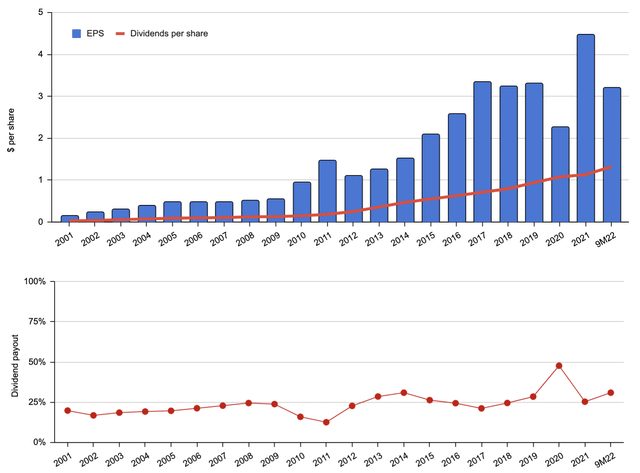

Financial institution OZK has been elevating dividends for 25 consecutive years and is a member of the dividend champions, as I mentioned beforehand. From 2001 to this point, OZK has been elevating dividends at a CAGR of 19.2%; since 2016, nonetheless, the dividend development charge moderated to a CAGR of 11.6% (Fig. 8). On the 11.6% dividend development charge, the two.85% ahead yield will compound to eight.53% in 10 years.

- It’s price emphasizing that the dividends of OZK are seemingly secure, not solely due to the high-quality belongings but additionally due to the low payout. During the last six years, the payout ratio averages solely 29%. Even in 2020, an particularly powerful yr, dividend funds have been greater than adequately coated by the earnings.

Fig. 8. Financial institution OZK earnings and dividends per diluted widespread share (higher) and dividend payout (decrease) (compiled by Laurentian Analysis for The Pure Assets Hub based mostly on monetary filings of Financial institution OZK and Searching for Alpha)

Valuation

Financial institution OZK is valued at 1.30X of guide worth, 1.54X of tangible guide worth, and 10.58X of earnings. During the last 13 years, nonetheless, the P/B of OZK was between 0.49X and three.87X with a median at 1.89X; the P/Tangible guide worth was between 0.63X and 4.89X with a median at 2.36X; and the P/E was from 6.12X to 27.90X with a median at 14.86X. Subsequently, OZK seems to be undervalued relative to the median historic multiples. Regardless of it being a higher-quality enterprise with an ROE of 12.11%, OZK is valued at comparable multiples to its friends.

Assuming an annual dividend development charge of 11.6% for extra 10 years adopted by a terminal interval of zero development, I arrived at an intrinsic worth estimate of ~$71 per share, which suggests the present share value carries a 35% low cost.

Dangers

Warren Buffett stated,

“In the long run, banking is an excellent enterprise except you do dumb issues. You get your cash terribly low-cost and you do not have to do dumb issues. However periodically banks do it, and so they do it as a flock, like worldwide loans within the Nineteen Eighties. You do not have to be a rocket scientist when your uncooked materials price is lower than 1.5%.”

Based on Buffett, for banks the best danger lies in that they could observe different bankers into making in style loans that may finally turn into dangerous.

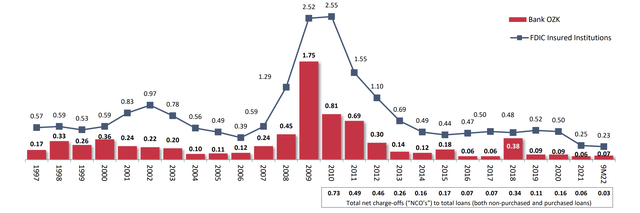

That appears to not be the case for Financial institution OZK. Since 1997, its annual web charge-off ratio has averaged solely ~1/3 of that of the {industry}, outperforming the {industry} common in each single yr (Fig. 9).

Fig. 9. The annual web charge-off ratio for Financial institution OZK, as in contrast with {industry} common (Financial institution OZK)

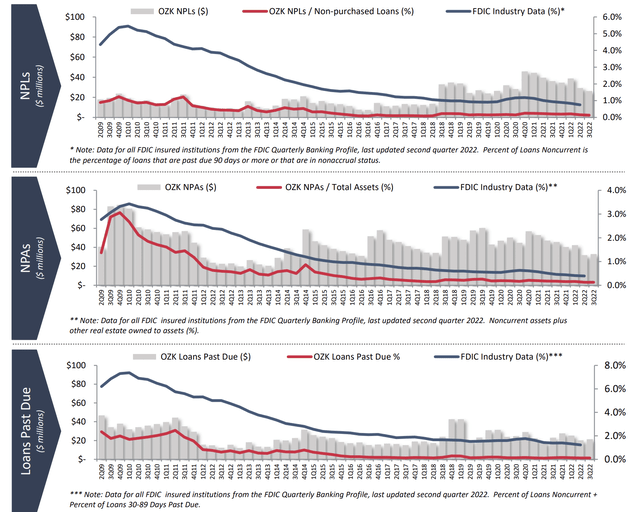

The industry-leading web charge-off ratio resulted from OZK’s prudent lending apply. Its ratios for non-performing non-purchased loans, non-performing belongings (excluding bought loans), and non-purchased loans overdue 30+ days (together with non-accrual non-purchased loans) all outperformed {industry} averages (Fig. 10).

Fig. 10. The NPLs/Non-purchased loans, NPAs/Complete belongings, and Loans overdue ratios of Financial institution OZK, as in contrast with {industry} averages (Financial institution OZK)

Chairman and CEO Gleason has been on the job for 45 years; nonetheless, he appears to be getting but higher, as will be seen by OZK’s industry-leading web curiosity margin, declining effectivity ratio, and asset high quality. Gleason runs a decent ship, sustaining the effectivity ratio at ~38.0%. For instance, OZK closed its retail banking department in New York Metropolis in August 2021. A tough employee since boyhood, Gleason stated,

“I inform the individuals who work carefully with me day by day, if you wish to work for the Financial institution of the Ozarks, you have to be prepared to come back to the workplace and run up Mount Everest day by day. Nonetheless nicely we did one thing yesterday, we need to attempt to do it higher at the moment and even higher tomorrow. It’s a fixed quest for enchancment.”

It’s nice to have an owner-CEO working the present. The insiders personal some 6.3% of the shares excellent, which partly explains why the corporate has been so faithfully elevating dividends yr in, yr out for some 25 years. On November 14, 2022, OZK introduced it will repurchase a further as much as $300 million of its excellent shares.

Investor takeaways

From its spectacular asset high quality, profitability and natural development monitor file, I imagine that Financial institution OZK is among the best-run regional banks in America.

With ahead dividends of $1.32 per share and a dividend yield of two.85%, OZK could appear to not be so fascinating to high-yield earnings buyers. Nonetheless, as a banking inventory with an ROE of 12.11%, it might appeal to dividend development buyers beneath the next situation.

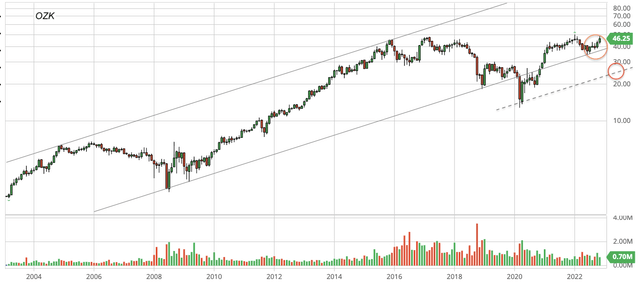

To fortress-like OZK, a recession will most likely hand Gleason one other M&A chance. Ought to a recession certainly happen, I’m ready to choose up shares of OZK within the $20s neighborhood, the place the ahead yield will probably be ~6% and the margin of security will probably be for my part, enormous (Fig. 11).

Fig. 11. Inventory chart of Financial institution OZK, dividend back-adjusted (modified after Barchart and Searching for Alpha)

[ad_2]

Source link