[ad_1]

Lemon_tm

INVESTMENT PERFORMANCE (%) as of September 30, 2023

|

Complete Return |

Annualized Return |

|||||

|

Inception |

Quarter YTD |

1 Yr |

3 Yr |

Inception |

||

|

Palm Valley Capital Fund |

4/30/19 |

0.56% |

5.26% |

9.32% |

6.02% |

7.22% |

|

S&P SmallCap 600 Index |

-4.93% |

0.81% |

10.08% |

12.11% |

5.45% |

|

|

Morningstar Small Cap Index |

-4.56% |

5.71% |

14.22% |

9.02% |

4.75% |

|

|

Efficiency information quoted represents previous efficiency; previous efficiency doesn’t assure future outcomes. The funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be price roughly than their authentic value. Present efficiency of the Fund could also be increased or decrease than the efficiency quoted. Efficiency of the Fund present to the newest quarterend will be obtained by calling 904-747-2345. As of the newest prospectus, the Fund’s gross expense ratio is 1.53% and the web expense ratio is 1.28%. Palm Valley Capital Administration has contractually agreed to waive its administration charges and reimburse Fund working bills by no less than April 30, 2024. |

Legends of the Fall

“She was just like the water that freezes within the rock and splits it aside.”

Pricey Fellow Shareholders,

The 1994 Oscar successful movie for Greatest Cinematography was Legends of the Fall, a Western drama set within the early 20th century starring Brad Pitt and Anthony Hopkins. In a narrative unfolding over many years, three brothers fall in love with the identical lady, fracturing their bond. Brad Pitt performs the center brother Tristan, who’s most snug with the Montana wilderness and Native American tradition that surrounds the household. In the beginning of the movie, a 12-year-old Tristan, searching for to show his bravery, gently locations his palm on a sleeping grizzly bear and is slashed throughout the arm. Within the film’s last scene fifty years later, a grizzly assaults Tristan within the woods. Like each market cycle, it’s a story bookended by bears.

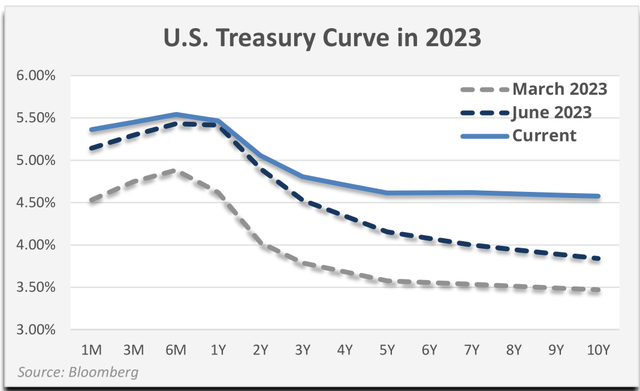

As leaves quickly start to show orange with autumn, we’re reminded of a inventory market legend spawned at first of the present Fed mountaineering marketing campaign—that rates of interest would quickly fall to assist highflying equities. Besides they haven’t. The ten-year Treasury yield is 4.6%. It was 3.8% on the finish of June and three.5% in March. It was under 2.0% on New Yr’s Eve of 2019, earlier than the noise of the pandemic stimulus, again when inflation was an afterthought and buyers believed ZIRP was sustainable. CCC-rated bonds, whereas off latest lows, are yielding over 13% in comparison with a backside of 6% in mid-2021. But, regardless of increased charges, the 21x P/E ratio of the S&P 500 is similar because it was on the finish of 2019. Ditto for cyclically adjusted earnings multiples, like Shiller CAPE. Due to this fact, whereas bonds have seen a step change in yields, most fairness buyers have caught a finger in every ear, scrunched their eyes shut, and are repeating loudly, “I CAN’T HEAR YOU.”

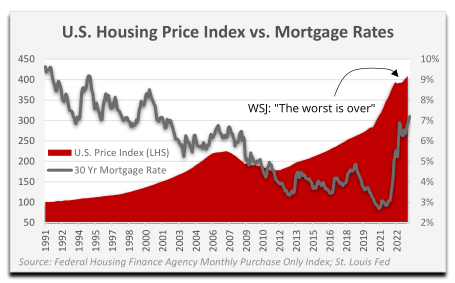

Greater rates of interest are just like the water that freezes in an overleveraged economic system and splits it aside. Charges have definitely immobilized the housing market, the place exercise is at multidecade lows, costs are on the highs, and owners are clinging for pricey life to their low fastened price mortgages. On September 10th, The Wall Road Journal wrote, “The worst is probably going over for the U.S. housing market.” We’ll see about that.

Housing affordability is the bottom for the reason that 80s. In keeping with the California Affiliation of Realtors, solely 16% of the state’s residents can afford to purchase a median-priced house. Insurance coverage prices are skyrocketing in disaster-prone states like Florida and California. But, the BLS bizarrely claims nationwide owners’ insurance coverage charges are up lower than 1% over the past 5 years at the same time as alternative prices grew over 50%. If demand for AirBnB and VRBO listings contracts in a saturated trip market, overcommitted rental homeowners might be the straw that breaks the again of U.S. house costs.

Housing market stasis can not persist indefinitely.

|

From Bloomberg Information on August 18, 2023 |

|

|

“All around the globe, bond merchants are lastly coming to the belief that the rock-bottom yields of latest historical past is perhaps gone for good.” |

“The person who coined the time period ‘bond vigilantes’ has a message for Wall Road in regards to the surge in longerterm US Treasury yields. Sure, the bond vigilantes are again, and no, this isn’t the tip of the world for shares.” |

|

“BofA’s Warning of a ‘5% World’ Sinks In As Bond Yields Surge” |

“Yardeni Says Shares Can Deal with the Bond Vigilantes” |

Financial carnage has been forestalled by fastened price debt excellent and vital deficit spending, together with “inexperienced” manufacturing, Worker Retention Tax Credit, focused pupil mortgage forgiveness, and financial institution bailout services. Amazingly, deficits are approaching the identical share of GDP that they have been through the Nice Monetary Disaster of 2008-2009.

There may be growing monetary stress amongst indebted companies and residents who don’t personal property. “As a result of increased burden of curiosity expense, tighter lending circumstances and extra restricted capital entry ensuing from stress within the banking sector and inflation uncertainty,” Fitch initiatives a excessive yield default price of 4.5%-5% to finish 2023, up from 1.3% final yr and 0.5% in 2021. The bomb dropped on a number of retailers through the newest quarter. Foot Locker is within the damage locker. Extra pandemic “financial savings” (handouts) have been depleted. The bank card delinquency price has crept as much as post-credit disaster ranges, and for debtors from small banks, the metrics are worse than 2009 and 2020. Retail theft is rampant. On account of increased shrink and price inflation, greenback shops aren’t doing so sizzling, however pawn outlets are thriving. The working-class anthem “Wealthy Males North of Richmond” reached the highest of the music charts. One particular person fighting the rising value of debt funds lamented to The Wall Road Journal, “The one place to chop corners is primary human actions.”

No matter our moralizing remark that inventory buyers are pricing in a legendary fall in charges that clearly hasn’t occurred, we additionally really feel strongly the Fed’s propensity is to chop. They relished the expediency of utilizing asset costs as their major financial lever. The September dot plot, upwardly revised from June, exhibits a median anticipated Fed funds price of 5.125% on the finish of subsequent yr, 3.875% in 2025, 2.875% in 2026, and a pair of.5% long term. Whereas Fed members have typically pledged their dedication to maintain charges increased for longer till inflation is vanquished, Chairman Powell threw out chum at a July presser: “You’d cease elevating lengthy earlier than you bought to 2 p.c inflation. And also you’d begin chopping earlier than you bought to 2 p.c inflation too.”

At this superior stage of the financial cycle, we don’t see decrease Fed funds charges as a catalyst for actual worth creation. Eradicating this as a key enter in figuring out fairness valuations is sort of therapeutic. We goal a low double-digit required return influenced by a enterprise’s distinctive dangers versus unpredictable short-term price forecasts.

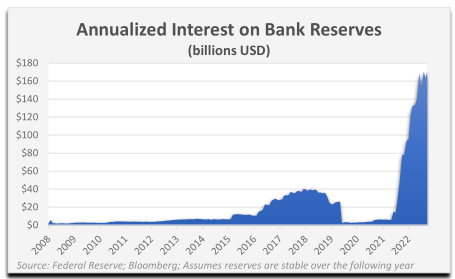

Apart from anticipated future financial easing, a stabilization of the banking system for the reason that March panic has helped drive the restoration in general fairness costs. The Fed has showered the monetary sector with assist through the present enterprise cycle, predating this Spring’s bailout program. In 2008, the Fed started paying curiosity on financial institution reserves for the primary time to exert management over rates of interest.

Roughly $3 trillion of reserves created by QE stay within the system, and at present charges, banks are receiving a whopping $175 billion of annualized curiosity on their reserves held on the Fed! This statistic received’t be marketed. As compared, the entire income for FDIC-insured establishments over the previous yr have been $296 billion. It rubs many the unsuitable method that lenders are getting 5.4% risk-free from the Fed whereas the banks are nonetheless paying depositors a mean price of 0.45% on financial savings accounts (supply: FDIC). You possibly can’t blame depositors for not searching for yield when cash heart banks can exploit their perceived Too Large To Fail standing on deposit charges.

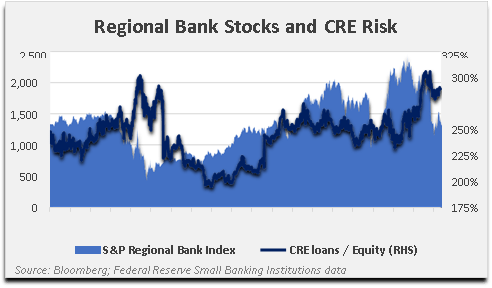

We consider smaller cap banks stay on the mercy of the industrial actual property (CRE) cycle, the place property values are sinking. One actual property magnate not too long ago quipped, “We’re in a Class 5 hurricane.” In keeping with Inexperienced Road, workplace values are down 31% from the height, however even much less troubled sectors like residences and self-storage have seen values fall 22% and 14%, respectively. Misery ranges in industrial actual property are nonetheless nowhere near the final recession, however the mixture of structural adjustments to demand for workplace area and persistently increased charges suggests circumstances will proceed to deteriorate. Industrial properties again 44% of loans for smaller lenders, and this equals 289% of their combination fairness. Small cap banks, already buying and selling at depressed ranges, would endure mightily from a CRE meltdown.

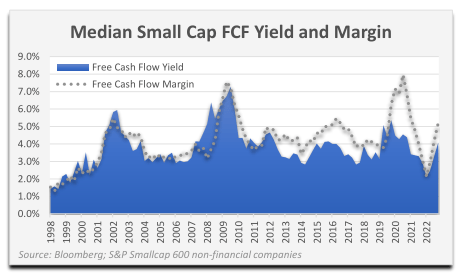

The standard small cap is buying and selling at a 4% free money circulate yield—close to the center of the historic vary, bolstered by above- common free money circulate margins, that are notoriously fickle. The group is buying and selling at a princely median EV/EBIT a number of of 20x. Nonetheless, in the event you eat monetary media, you’ll have learn that small caps haven’t been this low cost versus giant caps in over twenty years. Small caps have underperformed giant caps significantly for the reason that center of 2018, however context is required.

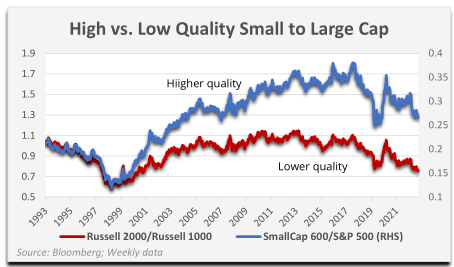

Small caps loved an extremely robust run from the cycle lows in March 2009 by August 2018 (the S&P 600/S&P 500 ratio peak), with the SmallCap 600 surging 575% and outperforming the S&P 500 by 160%. Since then, smaller names have appreciated one other ~14%, whereas giant caps are up an additional ~64%. One’s alternative of small cap index may additionally affect their views on efficiency. The Russell 2000 seems way more traditionally depressed relative to its bigger analog (Russell 1000) than the S&P Indexes.

Unprofitable firms constituting over 40% of the Russell 2000 have underperformed considerably and are down 30% year-to- date, on common, versus a -6% median return for worthwhile constituents. There are actually over two dozen debt-free biotechs within the Russell buying and selling for lower than tangible e book worth, though that carries much less weight when your enterprise mannequin is dependent upon burning money. Palm Valley is just not backside fishing for chronically unprofitable small caps.

We consider many fairness buyers are accurately making use of relative reductions for monetary and working danger. The place they’re failing, in our opinion, is of their evaluation of an applicable valuation reference level. Given inflated multiples and close to peak margins, in the present day’s S&P 500 doesn’t match the invoice.

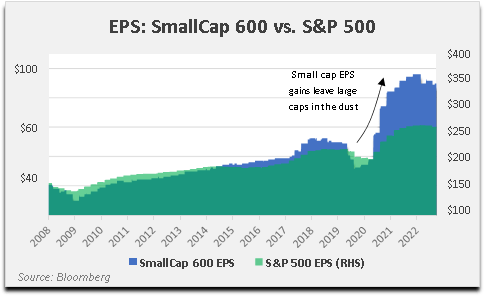

Small cap earnings vaulted increased through the pandemic, far outpacing the speed of revenue features for big caps. We consider small cap buyers are correctly discounting the sustainability of earnings progress for components of the market, however they is probably not discounting closely sufficient. In lots of instances, we predict it’s apparent that progress has been cyclical in nature. Vitality is fingers down the biggest sector contributor to SmallCap 600 EPS features from Spring 2020 (proper earlier than earnings dipped) to now. Many vitality companies took giant impairments throughout early 2020, wiping away income then however benefiting them prospectively, and better oil costs have boosted web revenue. Shopper Discretionary is the second largest supplier to SmallCap 600 revenue progress for the reason that pandemic, powered by automotive sellers and homebuilders. Nevertheless, earnings for this sector have dropped sharply not too long ago. Egg producer Cal-Maine took the highest prize for Shopper Staples, reporting $750 million of TTM web revenue versus a loss three years earlier. Banks delivered stable earnings features over the interval, though some high particular person Monetary sector contributors for the SmallCap 600 have been insurance coverage firms that acknowledged huge spinoff features tied to name choices on the S&P 500 and rising rates of interest—ironic given the subject material of our letter, however not a permanent supply of revenue.

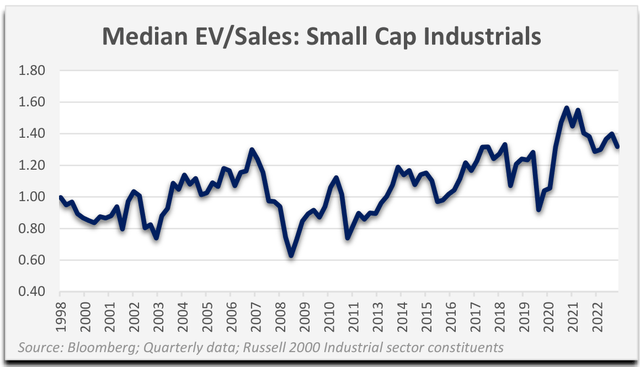

Whereas we’re reluctant to single out one sector, this chart displaying the median Enterprise Worth to Gross sales ratio for small cap Industrials (the broadest sector) displays our basic opinion of in the present day’s valuation local weather for good firms. It’s not the most costly ever, however it’s fairly darn excessive. Charts for Shopper Staples and Info Know-how firms look comparable. Alternatively, the Vitality and Financials sectors are nearer to a historic backside relative to income. Shopper Discretionary is someplace in between. Though a selloff in a inventory is often a prerequisite for us to think about shopping for it, within the case of Financials, we really feel there’s an excessive amount of steadiness sheet danger for us to reliably decide valuations for many banks proper now. For Shopper Discretionary corporations, our job is to find out normalized outcomes after a interval distorted by stimulus spending. We’re on the lookout for undervalued names with the monetary energy to outlive a recession.

A lot of the equities we’ve seen that look like bargain-priced resulting from extreme underperformance nonetheless have significant draw back potential, in our judgment. That doesn’t imply the shares will preserve falling— solely that we consider there are fairly possible situations the place the shares proceed to bleed from deteriorating fundamentals. Usually, the time to purchase these pockmarked firms is when there may be widespread investor despair, not when one-day lottery tickets account for half of choices buying and selling quantity. Whereas extremely speculative investments and people with appreciable working and monetary danger have bought off since 2021, we consider high quality stays costly. The pullback in equities in September did little to appropriate imbalances. Valuations will not be reflecting in the present day’s rates of interest or a decrease progress future that’s per overindebted economies like ours.

For the quarter ending September 30, 2023, the Palm Valley Capital Fund elevated 0.56%, whereas the S&P SmallCap 600 and Morningstar Small Cap Index declined 4.93% and 4.56%, respectively. The fairness securities within the portfolio misplaced 0.78% through the quarter, earlier than the damaging impression of fund bills and constructive impact of curiosity revenue. At quarter finish, the Fund held 81% in money equivalents.

These levitating rates of interest which can be threatening to freeze up and break up open the U.S. economic system have had the alternative impact on the dormant portion of our portfolio, offering a good yield whereas we wait. One hedge fund titan who famously quipped that “money is trash” in January 2020 now favors money over most funding courses. To be truthful, there’s a huge distinction between 0% then and a 5% yield now. With the previous, your buying energy is certainly retreating. With the latter, you’re no less than treading water. For an absolute return technique striving to keep away from everlasting impairments of capital, the appropriate occasions to carry money typically don’t correspond with when the yields on it are most favorable. Fortuitously, the riskfree stars are aligned for us at this time, with shares typically unappealing and money fairly the alternative.

We not too long ago got here throughout an fascinating analysis paper: Do Shares Outperform Treasury Payments?

(Bessembinder). In keeping with the research, the vast majority of widespread shares since 1926 have lifetime returns under one-month T-bills, and that proportion has been worse in latest many years resulting from dodgier new listings. It may be dangerous investing in small public firms, and within the absence of a compelling concept, traditionally it has made sense to go away funds in risk-free devices. First, do no hurt.

|

High 10 Holdings (9/30/23) |

% Property |

|

Sprott Bodily Silver Belief (PSLV) |

2.99% |

|

Lassonde Industries (OTCPK:LSDAF) |

2.89% |

|

Sprott Bodily Gold Belief (PHYS) |

1.73% |

|

Crawford & Firm (CRD.A, CRD.B) |

1.56% |

|

WH Group (ADR) (OTCPK:WHGLY, OTCPK:WHGRF) |

1.28% |

|

Avista (AVA) |

1.23% |

|

Kelly Providers (KELYA, KELYB) |

1.18% |

|

Hooker Furnishings (HOFT) |

0.82% |

|

Gencor Industries (GENC) |

0.80% |

|

Amdocs (DOX) |

0.79% |

The Fund’s high contributors within the third quarter have been Lassonde Industries (ticker: LAS/A CN) and Miller Industries (MLR). We elevated our Fund’s weighting in Lassonde in Q2 when the shares touched multiyear lows despite enhancements in working efficiency. Worth will increase have helped the corporate catch as much as accrued value inflation and have greater than compensated for quantity declines. Lassonde continues to outperform the fruit juice and drink class in Canada, and U.S. outcomes have begun to enhance after restructuring actions.

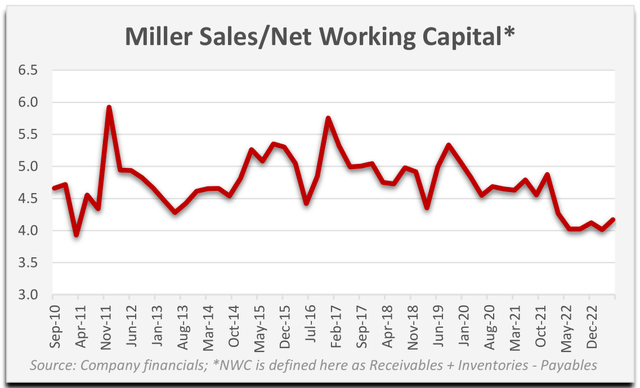

Miller Industries delivered extraordinarily robust second quarter outcomes. Revenues elevated 49% year-overyear to a report, demand is resilient, and backlogs are regular. The agency’s working capital lurched increased as a result of robust gross sales progress, and SG&A elevated as a share of income due to Miller’s beneficiant new government compensation plan. Administration stated the agency’s high priorities for capital allocation are to cut back debt and put money into stock to service clients. We predict present outcomes are above normalized ranges; nonetheless, a discount in income ought to deliver the discharge of great working capital. We diminished our place weighting because the shares appreciated in Q3.

Throughout the third quarter, the Fund had three positions that detracted from efficiency by greater than 10 foundation factors: Crawford & Co. (ticker: CRD/A, CRD/B), Advance Auto Elements (ticker: AAP), and TrueBlue (ticker: TBI). Crawford reported stable second quarter outcomes that benefited from a excessive stage of disaster exercise from insurers. Working revenue earlier than amortization jumped 86%, and the agency’s trailing profitability is now according to our normalized assumptions. This displays a interval of above-average disaster claims offset by weak 2022 efficiency in Crawford’s Worldwide section. The corporate’s inventory had a robust run for a lot of this yr, and we consider the selloff this quarter was most likely resulting from buyers attempting to recreation the probability of a significant hurricane boosting outcomes.

Advance Auto Elements is in the midst of a turnaround to deliver working efficiency nearer to friends. Second quarter revenue was wanting expectations as pricing didn’t cowl value inflation, however comparable retailer gross sales improved into quarter finish. Whereas the agency skilled a credit standing downgrade, the steadiness sheet is supported by vital owned actual property.

TrueBlue gave again its second quarter share appreciation after reporting leads to late July. The corporate skilled a decline in income that was just like different public staffing suppliers, together with ones we personal within the Fund. Employers who struggled to seek out assist through the pandemic are holding on to everlasting workers even with indicators of financial uncertainty, whereas staffers are dealing with income stress. After we bought TrueBlue, we have been ready for fundamentals to deteriorate with the economic system. The corporate has managed to keep away from working losses throughout prior recessions and has a wonderful debt-free steadiness sheet. The inventory is buying and selling for lower than 7x our estimate of normalized working revenue.

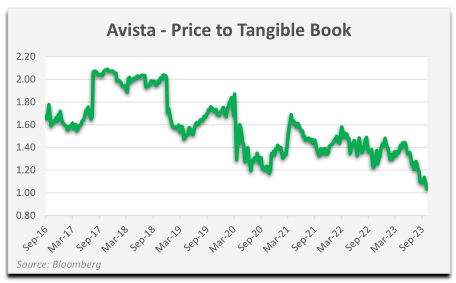

We didn’t totally promote any positions through the third quarter. We bought 4 new names: Avista Company (ticker: AVA), Farmland Companions (ticker: FPI), Fairness Commonwealth (ticker: EQC), and SSR Mining (ticker: SSRM). We consider these alternatives materialized as a result of increased rates of interest are disproportionately impacting investor sentiment towards sure sectors, at the same time as capitalizationweighted, tech-heavy indexes have powered by the headwinds.

Based in 1889, Avista is a regulated utility with operations in Washington, Idaho, Oregon, Alaska, and Montana. Avista offers electrical energy to 411,000 clients and pure gasoline to 377,000 clients. As rates of interest have elevated, utility shares have considerably underperformed the broader inventory market. Avista’s inventory has additionally been below stress as wildfires have develop into a extra apparent danger for buyers. We consider Avista is at present producing under normalized earnings. Roughly half of Avista’s electrical energy is produced from low-cost hydroelectric era. Climate circumstances over the past yr diminished the corporate’s hydroelectric output and elevated its value of manufacturing. Moreover, we additionally anticipate earnings to lag in 2023 as a result of the corporate’s final authorized price improve in Washington was inadequate to cowl the following surprising rise in inflation. Avista filed a brand new Washington price case in June 2023 that takes increased prices into consideration and, if authorized, ought to go into impact in 2025.

Avista is promoting at 14x 2023 anticipated earnings and 13x our normalized estimate. Moreover, at 1.05x tangible e book worth, the agency is at a substantial low cost to its historic web asset valuation. We anticipate Avista’s earnings to succeed in our normalized estimate by 2025 and consider the corporate’s long-term progress goal is achievable given its territory’s giant capital funding wants. Whereas utilities will not be risk-free, at Avista’s present valuation, we consider we’re being adequately compensated for danger.

We purchased a small place in Farmland Companions (FPI) through the quarter. FPI is an actual property funding belief (REIT) targeted on farmland. As of June 30, 2023, FPI owned 159,000 acres of farmland with a e book worth of $1.1 billion. FPI’s inventory has declined year-to-date as increased rates of interest have elevated its borrowing value and pressured earnings. Administration believes the worth of its farmland, web of debt, exceeds its market capitalization, they usually have been repurchasing inventory. The corporate intends to promote $190 million of farmland in 2023 and can use the proceeds to purchase again extra inventory and scale back debt. Whereas rising rates of interest are a danger to FPI’s near-term earnings, the inventory is buying and selling at a reduction to reported e book worth and our increased web asset valuation.

Fairness Commonwealth (EQC) is one other actual property funding belief we bought in Q3. The corporate focuses on industrial actual property and owns properties in Denver, Washington D.C., and Austin. Over the previous 9 years, EQC has been busy promoting its portfolio of business actual property, producing $6.9 billion in proceeds. It used these funds to cut back debt, purchase again inventory, pay dividends, and construct a big money steadiness. On the finish of June, Fairness Commonwealth had $2.15 billion in money that it intends to make use of to purchase actual property at enticing valuations. Much like our funding technique, Fairness Commonwealth is affected person, opportunistic, and is keen to carry a big money steadiness when alternatives are scarce. EQC is buying and selling under e book worth and at a stage equal to the corporate’s money steadiness.

SSR Mining is again within the Fund after a quick hiatus. SSR is a treasured metals producer with 4 mines positioned in the USA, Turkey, Canada, and Argentina. The corporate is promoting at a significant low cost to its tangible e book worth and our calculated web asset worth. SSR has a really robust steadiness sheet with extra cash than debt and $4.6 billion in stockholders’ fairness. Moreover, the agency has a historical past of producing free money circulate, shopping for again inventory, and paying a sustainable dividend.

“I’ll see it after I consider it.”

In early August, the Web went abuzz when a video was shared of a bear at a zoo in China that was performing very human-like. The Malaysian solar bear stood upright and waved to the group, with nonetheless images capturing a saggy bottom that led some Web sleuths to suspect it might be an individual in a dressing up. Zoos from the East and West have been fast to debunk the conspiracy theories by explaining that these habits have been regular for solar bears, the smallest bear species. In keeping with Nationwide Geographic, feminine solar bears have even been “noticed cradling a cub of their arms whereas strolling on their hind legs.” Apart from, based on a Hangzhou Zoo worker, temperatures reached 104 levels Fahrenheit on the zoo that day, so a human couldn’t survive very lengthy in a bear costume.

If this explicit bear had been videoed within the U.S., Germany, or Japan, we marvel if the story would have caught hearth. But it surely’s China, which has developed a status for an absence of transparency. If China routinely steals overseas IP to advance its pursuits and stops sharing financial information to steer public opinion, then absolutely it will put a zookeeper in a bear costume to quickly fill in for the actual bear, proper? It wasn’t a loopy idea, particularly in the event you solely noticed the images and never the video.

We’re formed by our experiences and by the narratives we’re fed. At this time’s inventory bulls have latest expertise and highly effective narratives supporting their positioning. The Fed has repeatedly rescued buyers from deflating bubbles, and the responses have come sooner with every new disaster. At the moment, the mainstream narrative is for a gentle touchdown with cooling inflation that allows a slackening of financial coverage. It’s all sunshine for the prosperous, whose wealth accumulation from monetary property is supposedly only a lucky byproduct within the pursuit of maximizing employment. In the meantime, the working class wonders why it appears tougher than ever to make ends meet.

There was an previous legend that if short-term charges ever went up meaningfully, shares would shortly fall and keep down for some time. Then it occurred, they usually didn’t. The brand new legend is that rates of interest will fall to take away resistance for inventory costs. The brand newest legend is that shares can survive and thrive with increased charges. Name it the Peter Pan Precept: Should you consider it, you may make it so.

One factor we’ve discovered from a few years on this {industry} is that monetary justice operates by itself timetable. Important endurance and restraint are wanted to keep away from committing funding errors when they’re offered as finest practices by nearly everybody within the enterprise. At this time, we see a divided panorama the place ache has been distributed to riskier shares, whereas valuations stay excessive for high quality firms.

Regardless of the general resilience of the inventory market to date, our debt laden economic system is way from impervious to increased charges. This may develop into obvious as waves of refinancings crash over us. Leaping totally into the fray now appears untimely. We’re as keen as anybody for a return to enticing small cap valuations. In any case, it’s getting somewhat heat on this bear go well with.

Thanks on your funding.

Sincerely,

Jayme Wiggins Eric Cinnamond

|

Mutual fund investing entails danger. Principal loss is feasible. The Palm Valley Capital Fund invests in smaller sized firms, which contain further dangers resembling restricted liquidity and better volatility than giant capitalization firms. The power of the Fund to satisfy its funding goal could also be restricted to the extent it holds property in money (or money equivalents) or is in any other case uninvested. Earlier than investing within the Palm Valley Capital Fund, you must fastidiously contemplate the Fund’s funding goals, dangers, prices, and bills. The Prospectus incorporates this and different vital data and it could be obtained by calling 904-747-2345. Please learn the Prospectus fastidiously earlier than investing. Previous efficiency is not any assure of future outcomes. Dividends will not be assured and an organization’s future potential to pay dividends could also be restricted. An organization at present paying dividends might stop paying dividends at any time. Fund holdings and sector allocations are topic to vary and will not be a advice to purchase or promote any safety. Earnings progress for a Fund holding doesn’t assure a corresponding improve out there worth of the holding or the Fund. The S&P SmallCap 600 Complete Return Index measures the small cap section of the U.S. fairness market. The index is designed to trace firms that meet particular inclusion standards to make sure that they’re liquid and financially viable. The Morningstar Small Cap Complete Return Index tracks the efficiency of U.S. small-cap shares that fall between ninetieth and 97th percentile in market capitalization of the investable universe. It’s not potential to speculate instantly in an index. The Palm Valley Capital Fund is distributed by Quasar Distributors, LLC. Opinions expressed are these of the writer, are topic to vary at any time, will not be assured and shouldn’t be thought of funding recommendation. Definitions:BLS: Bureau of Labor Statistics CAPEShillerP/E:The cyclically adjusted price-to-earnings ratio is a valuation measure often utilized to the S&P 500. It’s outlined as worth divided by the typical of ten years of earnings, adjusted for inflation. CFO: Chief Monetary Officer Dot Plot: Chart that information every Fed member’s projection for the Federal Funds Charge. Worker Retention Tax Credit: A refundable tax credit score for companies that had workers and have been affected by the COVID-19 pandemic. EPS (Earnings per share): Web revenue divided by shares excellent. Fairness: An organization’s complete property minus complete liabilities (web property). EV/EBIT:Enterprise Worth of an organization (Market Capitalization – Money + Debt) divided by its trailing twelve- month Earnings Earlier than Curiosity and Taxes (i.e., working revenue). EV/Gross sales: Enterprise Worth (Market Cap + Debt – Money) divided by Income. FDIC (Federal Deposit Insurance coverage Company): Authorities company created to take care of stability and confidence within the U.S. banking system. Federal Funds Charge: The rate of interest that banks cost one another for lending cash on an in a single day foundation. Federal Housing Finance Company Month-to-month Buy Index: A broad measure of the motion in U.S. single household house costs that tracks repeat gross sales on the identical properties. Free Money Movement: Money from Working Actions minus Capital Expenditures. Free Money Movement Margin: Free Money Movement dividend by Income. Free Money Movement Yield: Free Money Movement divided by Market Capitalization. GDP: The overall worth of products produced and companies supplied in a rustic throughout one yr. Web asset worth: The worth of an entity’s property minus its liabilities. Quantitative Easing (QE): Financial coverage the place a central financial institution purchases authorities bonds or different monetary property to create liquidity in an economic system. Worth to Earnings (P/E) Ratio: A inventory’s worth divided by its earnings per share. Reserves: Financial institution reserves are the minimal quantity of vault money or deposits on the Federal Reserve {that a} financial institution will need to have to satisfy the necessities of the central financial institution. ROE: Return on fairness, which equals web revenue divided by shareholder’s fairness. Russell1000:An American inventory market index based mostly in the marketplace capitalizations of the biggest 1,000 firms within the Russell 3000 Index. Russell2000:An American small-cap inventory market index based mostly in the marketplace capitalizations of the underside 2,000 firms within the Russell 3000 Index. S&P500:The Customary & Poor’s 500 is an American inventory market index based mostly in the marketplace capitalizations of 500 giant firms. S&P Regional Financial institution Index: Shares within the S&P Complete Market Index which can be categorized within the GICS Regional Banks sub-industry. Tangible e book worth: Shareholders’ fairness, or complete property excluding goodwill and different intangibles minus complete liabilities. TTM: Trailing Twelve Month Treasury Curve: A line that plots the rates of interest of Treasury bonds with completely different maturity dates. ZIRP (Zero Curiosity Charge Coverage): Describes a financial coverage of Federal Reserve to maintain short-term rates of interest close to zero. |

Unique Put up

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link