Michael Vi

Funding Thesis

Once I sat right down to analyse Palantir (NYSE:PLTR) I used to be anticipating to search out the identical outdated story of a younger cash-burning extremely overvalued software program firm promoting its world-disrupting imaginative and prescient to hopeless traders attracted by buzzwords like bees to honey, whereas in actuality, it was nothing however empty speak.

Properly, I couldn’t be extra unsuitable.

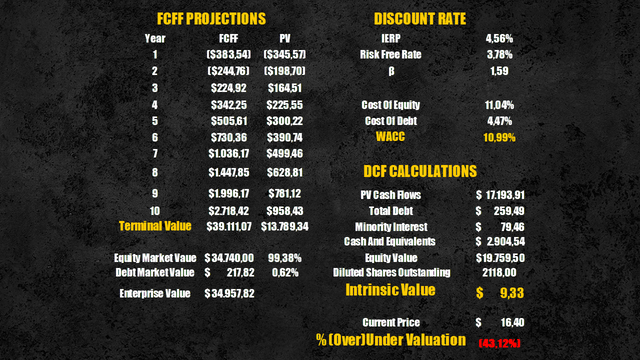

To be sincere, I used to be proper on the overvalued a part of the story as a result of, primarily based on my evaluation, Palantir’s present market value is 43% increased than its intrinsic worth, however this was not all the time the case.

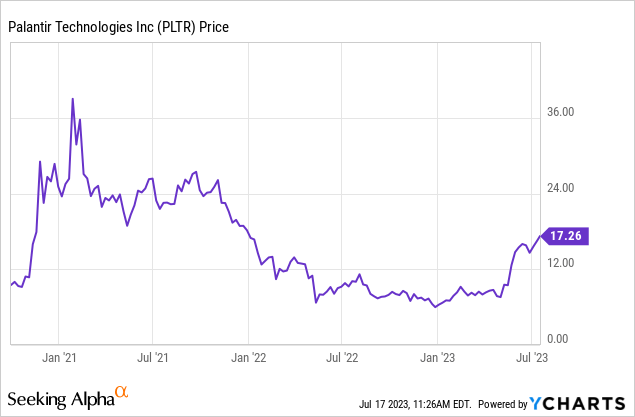

Within the final two months, Palantir’s shares climbed greater than 120%, reaching a $34 billion market capitalization, nonetheless, after the massive value correction occurred in late 2021 and early 2022, the corporate traded round its intrinsic worth of $20 billion for roughly one yr – from Could 2022 to Could 2023 – earlier than skyrocketing as quickly as Q1 outcomes got here out.

I believe Palantir is an ideal instance of how inventory markets could be inefficient within the brief time period and the way being a affected person investor – who waits to purchase an excellent firm solely when it trades beneath its intrinsic worth – can repay in the long term.

The worry of lacking out is a horrible enemy for traders. Those that purchased Palantir on the peak of the 2021 bubble are nonetheless struggling great losses, whereas those that patiently waited for a value correction had greater than a possibility to leap in when the corporate was buying and selling beneath its honest worth and now are sitting on terrific good points.

Palantir appears on the verge of delivering great progress and income – as we are going to see later – nonetheless, my funding thesis is to be affected person and await any form of value correction catalyst – from lacking exaggerated EPS expectations to the FED’s additional elevating rates of interest – which might give traders the prospect to purchase the corporate round its intrinsic worth.

Enterprise Mannequin

Palantir develops data-driven operation and decision-making software program, and earlier than I fully lose your consideration, let’s break down this agglomerate of buzzwords.

Traders, amongst others, ought to simply perceive the utility of Palantir’s merchandise because the funding business has all the time been properly conscious of the significance of knowledge to make knowledgeable selections, even earlier than the time period Massive Information was first coined.

Put in easy phrases, Palantir has developed a set of software program options which organizations – whether or not governmental or industrial – can use to interpret the large quantity of knowledge produced to enhance the chance of reaching their operational targets whether or not they’re to remove potential threats or obtain higher effectivity and market shares.

At present, Palantir gives 4 completely different software program options known as platforms or working programs:

- Gotham, a platform devoted to the federal government sector.

- Foundry, a platform devoted to the industrial sector.

- Apollo, a platform to soundly deploy and replace different software program options.

- AIP, the newest arrived, which powers the present platforms with giant language fashions (LLM) facilitating the interplay between people and machines due to generative AI.

Firm MOAT

Over the previous 20 years, slightly than creating commoditized software program options – which could be applied simply and shortly by hundreds of organizations – Palantir developed customizable software program options actively in search of to resolve complicated and capital-intensive issues which the vast majority of its rivals had been refusing to resolve as a result of excessive dangers concerned.

Given the excessive prices to implement Palantir’s options – $50.9 million on common for its high 20 clients and $2 million for the others – its 391 purchasers account for the most important organizations on this planet like main Western governments and enterprises from the Fortune International 500 record.

Whereas the technique chosen by Palantir pressured the corporate to face many points up to now – slowing down scalability together with the power to soak up prices and attain profitability – now that the significance of data-driven decision-making software program options, or vulgarly AI, has been widely known, Palantir has an amazing benefit over its rivals which would require years, and billions invested in R&D, earlier than closing the hole.

Regardless of Palantir’s merchandise are usually not extremely scalable by way of implementation – as organizations require skilled consultants to completely perceive the platform capabilities earlier than utilizing it – its options are extremely scalable by way of what they’ll do.

Whether or not the aim is to detect the actions of navy convoys, assist aerospace firms manufacture plane, or win a Formulation 1 Grand Prix, organizations can use Palantir options to hunt patterns in knowledge and improve the chance of success.

However isn’t just the large potential of its options which is able to grant Palantir a big moat, the market by which the corporate function is characterised by increased boundaries to entry if in comparison with the broader software program business.

Governments – given the labeled nature of their operations – solely depend on trusted contractors and Palantir itself struggled for a few years earlier than being acknowledged among the many few of them. Enterprises alternatively – given the excessive prices and possibilities of failure – are usually not keen to wager on dangerous options, which could or may not work, preferring to stay with merchandise that already proved to have the ability to ship outcomes.

Having been available on the market for over 20 years and being a pioneer within the AI software program software business, Palantir has already gained the belief of many governments and enterprises and now that the world has seen what AI applied sciences are able to, Palantir is able to capitalize on these alternatives whereas its rivals are nonetheless catching up.

Revenues Projection

What unites Palantir’s clients is the capability to afford custom-made software program options – which requires loads of capital assets – and having the ability to truly profit from its options, often mature firms in search of to enhance their effectivity and market shares.

Authorities establishments apart, solely the most important enterprises on this planet can match this description.

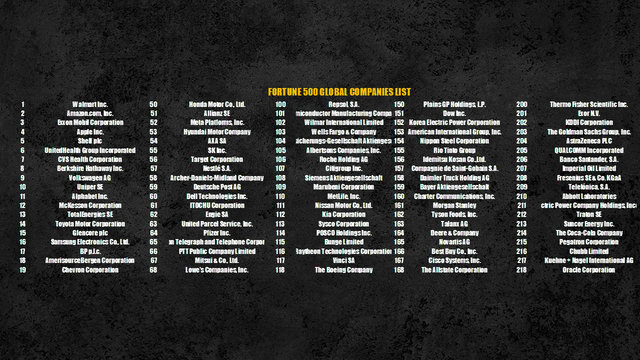

Utilizing revenues to find out the dimensions of enterprises, I gathered a pattern of the five hundred largest international enterprises – excluding Chinese language and Russian ones as Palantir doesn’t function there – representing Palantir’s potential clients.

Largest enterprises by revenues (Private Information)

Collective, these firms generated revenues of $30 trillion in 2022. Utilizing the US 10 Yr Treasury Bond yield of three.78% as a proxy for future progress fee – because it incorporates the anticipated inflation and progress for USD-denominated belongings – revenues generated by the highest 500 firms on this planet are anticipated to be round $43.5 trillion by 2032.

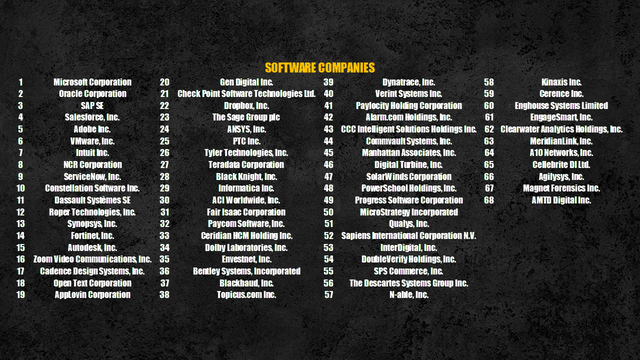

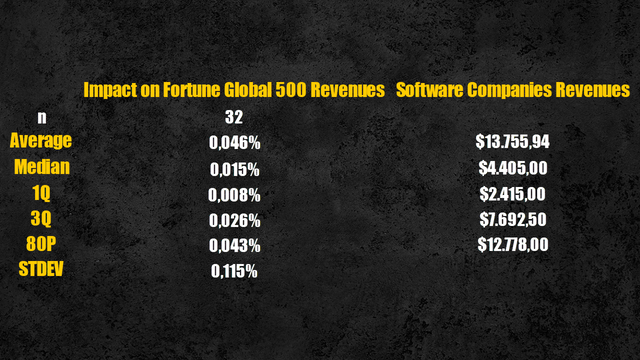

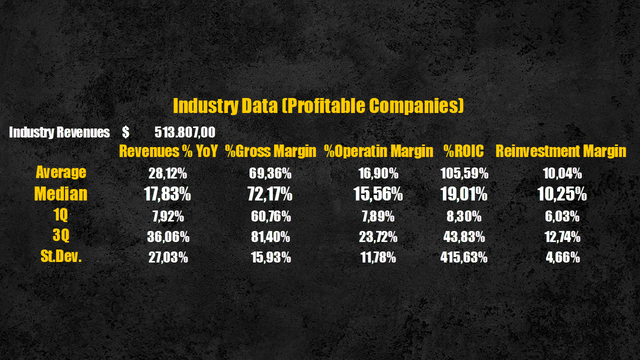

Taking a pattern of the foremost software program firms on this planet as a substitute – which often generate revenues by promoting their software program options to different enterprises – we get hold of that, on a median worth, their software program options account for 0.015% of the revenues generated by the highest 500 firms on this planet. On the lookout for the top-performing software program firms, the 80th percentile accounted for 0.043%.

Main software program firms (Private Information) Proportion of revenues spend on software program purposes by the most important enterprises on this planet (Private Information)

However now you is perhaps considering “Why are you giving us this data?” “Why ought to I care what proportion of revenues giant enterprises spend on software program options?”

Properly, in my narrative I see Palantir turning into one of many top-performing software program firms on this planet promoting its merchandise to the foremost enterprises on the market, and by realizing what proportion of revenues these enterprises spend on software program options – together with assuming Palantir’s options impression – I can fairly forecast Palantir’s future revenues.

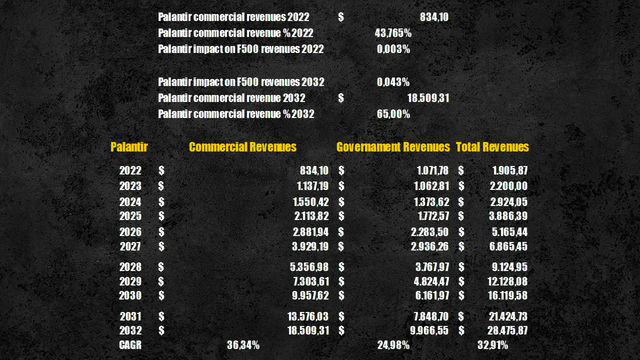

At present, Palantir’s industrial revenues of $834 million account for 0.003%, however assuming Palantir reaches the extent of the highest performing software program firms, accounting for 0.043%, by 2032 industrial revenues could be equal to $18.5 billion, a whopping 36.4% CAGR.

In 2022, industrial revenues represented 44% of complete revenues – equal to $1.9 billion – whereas authorities revenues accounted for 56%.

By 2032, I count on industrial revenues to outweigh authorities ones as an increasing number of enterprises will perceive the advantages that Palantir’s merchandise can have on their backside traces and in addition as a result of authorities contracts often take longer to be finalized on account of strict bureaucratic procedures.

Assuming the industrial section will account for 65%, the federal government line will generate an extra $10 billion with Palantir’s complete revenues reaching a virtually 15x return by 2032, rising at a CAGR of 32.9% and sitting round $28 billion.

Palantir revenues projection (Private Information)

Effectivity & Profitability

Transferring on to effectivity and profitability, in Q1 Palantir lastly reached operational profitability with an working revenue of $4.12 million, whereas if we capitalize R&D bills – slightly than treating them as working bills – already in 2022, the corporate managed to show its enterprise mannequin worthwhile reaching an working revenue of $4.7 million.

The administration expects to proceed reaching profitability for the remainder of the yr, and in a current interview Alexander Karp – Palantir CEO – confessed that the variety of month-to-month calls they’re receiving from clients now is the same as the identical quantity of calls they used to obtain in a whole yr up to now and that Palantir’s clients itself are selling its options to their very own clients as a proof of how efficient they’re.

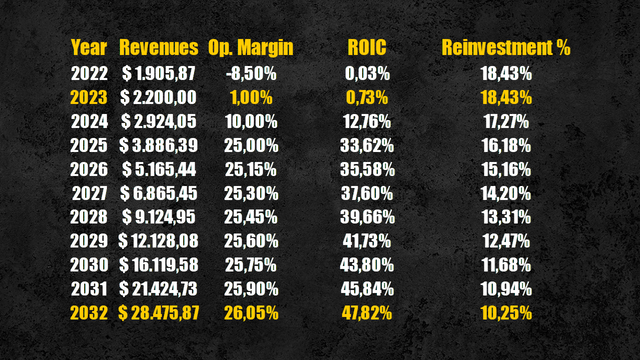

With that mentioned, within the coming years, I fairly see Palantir ramping up profitability in a short time and reaching an working margin of 26%, once more, on par with the top-performing software program firms on the market.

Nevertheless, such great progress would require substantial reinvestments to be supported. In 2022, Palantir reinvested 18% of its revenues, and I count on the reinvestment margins to stay round this stage within the foreseeable future, to then slowly come down till reaching the business median worth of 10.25% as the corporate enters a extra mature part.

Palantir future effectivity and profitability (Private Information) Software program business knowledge (Private Information)

With these assumptions, Palantir will obtain a return on invested capital (ROIC) of almost 48%, barely increased than the threerd quartile business worth of 44%, persevering with my narrative of Palantir establishing itself as a top-tier software program firm.

Money Flows Projection

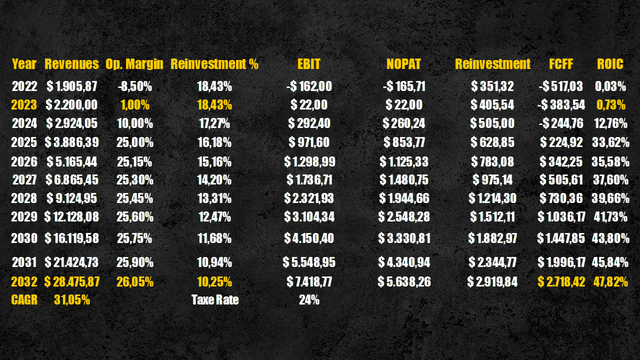

Combining operational profitability rising and reinvestment wants declining over time as Palantir will get greater, we will count on the corporate to begin delivering constant free money flows to the agency (FCFF) to its shareholders.

Regardless of FCFF being anticipated to stay detrimental within the subsequent couple of years – because the reinvestments will erode the preliminary income generated by the corporate – by 2025 we will doubtless see Palantir begin delivering constructive FCFF of round $200 million whereas ten years from now, given my assumptions, FCFF are anticipated to take a seat round $2.7 billion, reaching a 12x return in 8 years.

Palantir money flows projection (Private Information)

Valuation

Making use of a reduction fee of 10.99%, calculated utilizing the WACC, we get hold of that the current worth of those money flows is the same as $19.7 billion or $9.3 per share.

In comparison with the present costs, Palantir’s shares consequence overvalued by 43.12%.

Palantir intrinsic worth (Private Information)

Dangers

Although I assumed great progress and excessive profitability ranges, at as we speak’s value, Palantir nonetheless outcomes overvalued, however as mentioned within the introduction, this was not all the time the case.

Investing in Palantir proper now, after the inventory surged greater than 120% in solely two months and whereas AI shares are victims of market euphoria, would expose traders to monumental dangers when the “AI bubble” will finally burst because the AI hype fades away because it occurred with cryptos or EV shares.

My funding thesis is to attend for any potential catalyst – not associated to a worsening of the corporate’s fundamentals – that may set off a value correction. It could actually take the type of lacking analysts’ expectations – the market tends to overestimate the potential of younger rising companies and any outcomes even barely beneath the consensus may generate important drawdowns – or a detrimental improvement in macroeconomic components.

Over the long run, these sentiment-induced market fluctuations are irrelevant, however within the brief time period can create engaging entry factors to take a protracted place within the firm and, over your entire life span of the funding, are essential for its general success or failure.

Conclusion

So to conclude, Palantir is a superb firm however on the present costs doesn’t symbolize an excellent funding alternative. Don’t be influenced by the worry of lacking out on potential short-term good points and be a affected person investor ready for the correct alternative to leap in.

Editor’s Word: This text was submitted as a part of Searching for Alpha’s Finest AI Concepts funding competitors, which runs by means of August 15. With money prizes, this competitors — open to all contributors — is one you don’t need to miss. If you’re involved in turning into a contributor and collaborating within the competitors, click on right here to search out out extra and submit your article as we speak!