[ad_1]

Oracle Company (NYSE:) simply wrapped up its fiscal 12 months ending Could, 2023, recording whole income of almost $50B. Together with Nvidia (NASDAQ:) and Microsoft (NASDAQ:), Oracle is one other member of the Massive Tech household whose share worth has not too long ago benefitted from the AI hype. In truth, the inventory greater than doubled between October, 2022, and mid-June, 2023.

The corporate doesn’t draw back from touting its synthetic intelligence capabilities. It talked about AI 17 occasions in its newest earnings name, saying that its “exploding AI demand” leaves it “vital upside.” College students of economic markets historical past know that Wall Avenue doesn’t want a lot to get overexcited a few fancy new expertise. So when the CEO of a significant company begins utilizing phrases like “exploding”, buyers higher watch out.

There’s nothing unsuitable with being optimistic about your organization’s prospects. Accountable CEOs, nonetheless, desire to err on the aspect of warning. In spite of everything, it took Oracle inventory 17 years simply to recoup its Dot-com crash losses. The thrilling new expertise again then was the web. And it really did ship an actual revolution within the early-Twenty first century. Nonetheless, bubble-era Oracle buyers did poorly all through all of it. We predict they’re making the identical mistake now with AI.

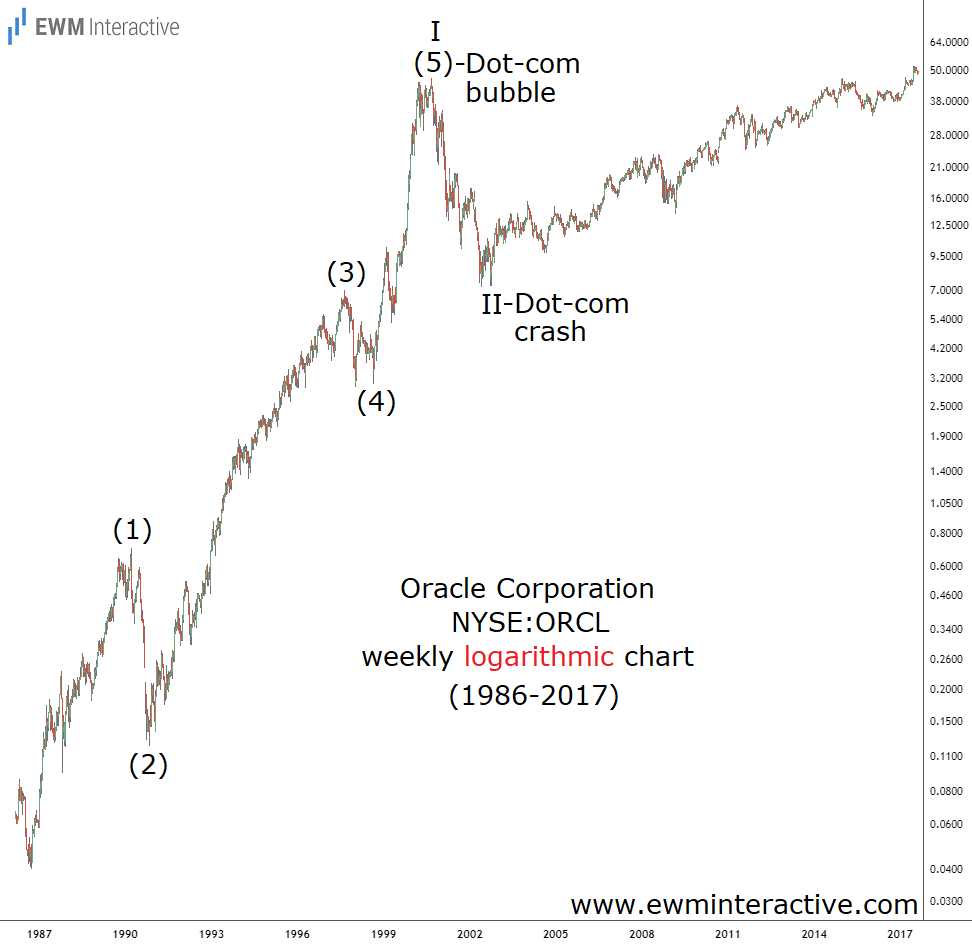

Oracle Company (NYSE:) went public in 1986. Regardless of the 84% dot-com crash and the 43% correction in 2022, the inventory has usually been in an uptrend for 37 years now. That uptrend, nonetheless, appears to be on the verge of finishing a five-wave impulse sample. We’ve marked it I-II-III-IV-V, the place the 2001-2002 and the 2022 selloffs match within the positions of waves II and IV, respectively.

The issue for the bulls is that the Elliott Wave principle states that a three-wave correction follows each impulse. Moreover, it normally erases all the fifth wave. Making use of this to the weekly chart of Oracle leads us to conclude that when wave V is over, the inventory might roughly halve. A decline from over $130 to the $60s appears to be like doubtless.

To not point out that the corporate is predicted to make simply $5.6 per share this 12 months. Given the very excessive likelihood of a 2024 recession, it would prove that Oracle is buying and selling at 21 occasions peak-cycle earnings. That’s a demanding a number of regardless of the way you slice it.

The choice is, after all, that we’re unsuitable and that “this time it’s completely different” because of AI. We wouldn’t wager on it, although. In spite of everything, the Dot-com crash itself was additionally preceded by a five-wave impulse sample. Have a look.

The weekly logarithmic chart permits us to see the five-wave construction of wave I, which culminated within the Dot-com bubble. It’s labeled (1)-(2)-(3)-(4)-(5) and implies that the next crash, albeit spectacular, was nothing greater than a pure wave II correction. The Dot-com plunge dragged Oracle inventory down from $46.47 to $7.25, erasing many of the beneficial properties made by wave (5) of I.

Historical past by no means repeats itself, but when this evaluation is right, it’s about to rhyme as soon as once more quickly.

Authentic Publish

[ad_2]

Source link