AUD/USD ANALYSIS & TALKING POINTS

- How will the RBA react to the latest market re-pricing?

- Australian and US inflation information in focus.

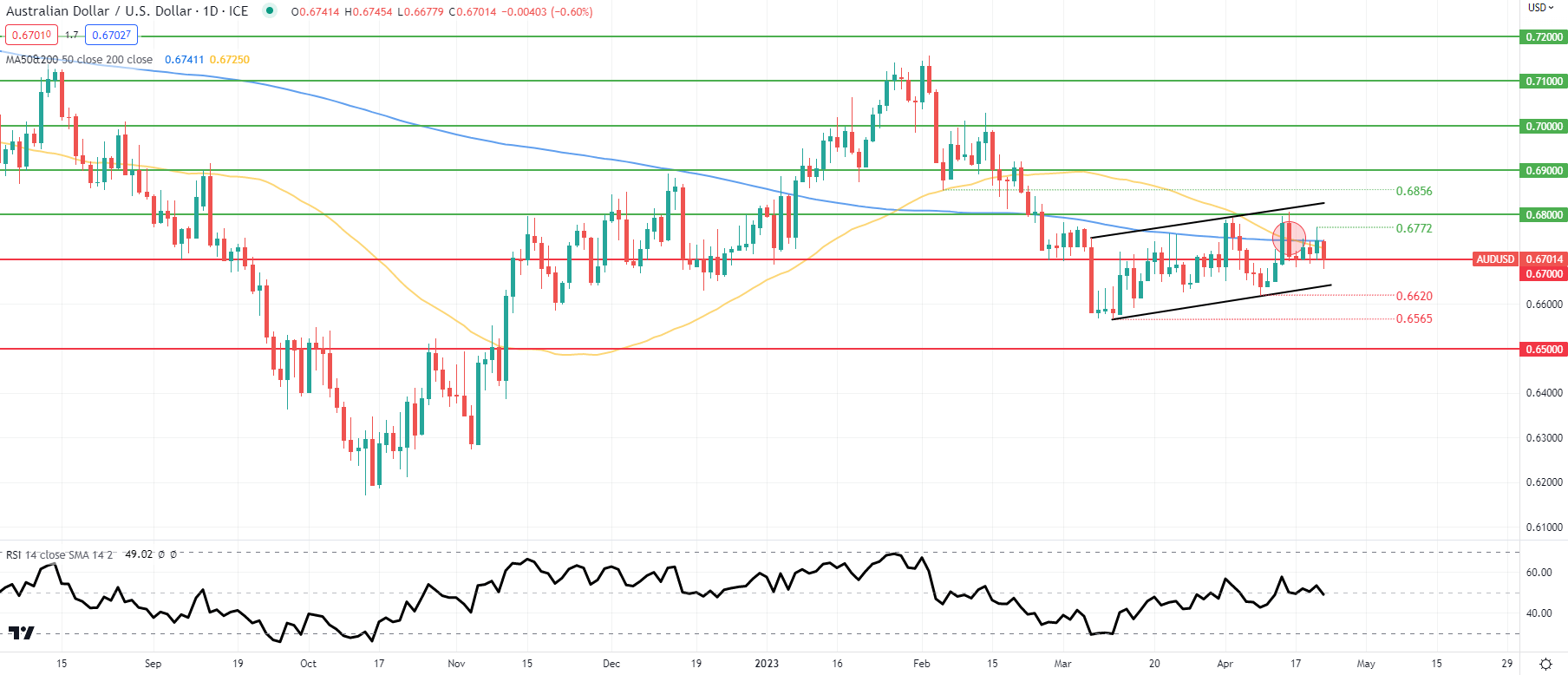

- AUD/USD dying cross, bear flag and shopper sentiment counsel AUD weak spot to return.

Really helpful by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian greenback heads into subsequent week after a reasonably muted week when it comes to worth volatility in opposition to the U.S. greenback. To this point, the Reserve Financial institution of Australia has been grappling with information each domestically and internationally after they determined to pause fee within the earlier rate of interest meet. The newest RBA minutes indicated that the door stays open to additional hikes if wanted and since then the RBA’s rate of interest chance desk beneath has been ramped up by cash markets to incorporate one other potential 25bps hike in 2023 – a stark change from a number of days earlier when no such hike was on the playing cards!

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

RBA INTEREST RATE PROBABILITIES

Supply: Refinitiv

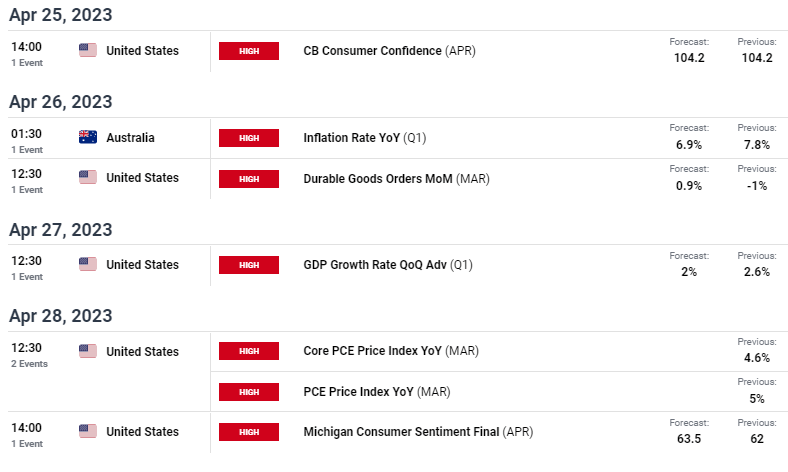

The week forward (see financial calendar beneath) is stacked with excessive impression occasions principally skewed in direction of the US. From an Australian perspective, inflation for the primary quarter is predicted to return in decrease on each YoY and QoQ metrics which may change the above fee chance chart again to no additional hikes ought to inflation are available low.

US information which has been mild of latest, appears to ramp up as soon as extra this week with the US GDP and the Fed’s most well-liked measure of inflation (core PCE) on the calendar. It will likely be attention-grabbing to see how these and others (sturdy items and client sentiment) play into the latest hawkish commentary from Fed audio system.

ECONOMIC CALENDAR

Supply: DailyFX financial calendar

Robust Chinese language GDP final week helped commodity costs rally as demand forecasts had been revised to the upside however since then we’ve seen a deterioration as international recessionary fears achieve traction. The AUD being so closely influenced by commodity exports, decrease costs naturally pressurize the native foreign money.

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart ready by Warren Venketas, IG

Every day AUD/USD worth motion has been growing a bear flag kind chart sample along with the dying cross (purple) early final week. These indicators are ominous for the Aussie greenback however may discover its footing ought to the pair break beneath the 0.6700 psychological deal with. Subsequent week’s elementary information might be the catalyst that both validates/invalidates the bear flag.

Key resistance ranges:

Key help ranges:

- 0.6700

- Bear flag help

- 0.6620

IG CLIENT SENTIMENT DATA: BEARISH

IGCS exhibits retail merchants are at present LONG on AUD/USD, with 73% of merchants at present holding lengthy positions. At DailyFX we sometimes take a contrarian view to crowd sentiment leading to a short-term draw back disposition.

Contact and followWarrenon Twitter:@WVenketas