US Greenback Market Replace:

Commodity Overview – Gold & Oil bounce again from help

Over the previous two years, the financial implications of the Covid-19 pandemic has compelled central banks to implement quantitative easing measures in an effort to keep away from a world recession.

As rates of interest fell to near-zero, commodity provide constraints and hovering power costs have resulted in elevated ranges of inflation, decreasing the buying energy of shoppers.

Go to the DailyFX Academic Middle to find the affect of politics on world markets

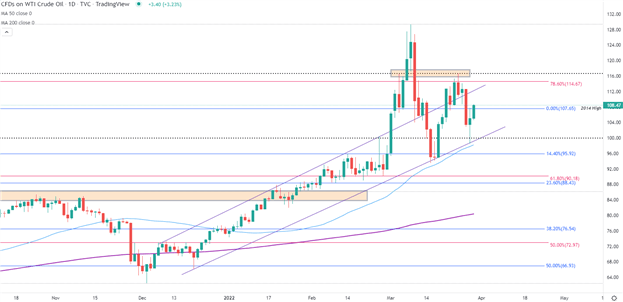

Whereas this stays a outstanding theme for 2022, the invasion of Ukraine and sanctions towards Russian merchandise (together with oil and fuel) has bolstered demand for commodities, permitting cimpolite oil costs to discover help above the important $100 p/b mark.

After getting slammed by potential developments within the Ukraine-Russia peace talks yesterday, WTI rebounded again to the 2014 excessive (107.65) with the following degree of resistance holding on the key psychological degree of $110.00. With the present battle nonetheless unresolved, gold value motion stays muted with the 23.6% Fibonacci degree of the 2020 transfer offering help at $1,921.

Oil (WTI) Every day Chart

Chart ready by Tammy Da Costa utilizing TradingView

USD underneath strain as focus shifts to financial knowledge

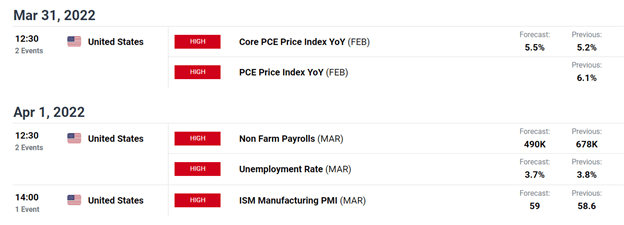

As mentioned by Justin McQueen earlier right this moment, USD/CAD has fallen under prior help at 1.245 (YTD) low with bearish continuation bringing the 1.230 deal with into play. With a weaker USD lifting each EUR/USD and GBP/USD, USD/JPY has shifted focus to US financial knowledge which may drive value motion in both course.

Supply: DailyFX financial calendar

S&P, Nasdaq and Dow pause at resistance

After a powerful rally in equities, S&P 500 ran right into a wall of resistance at 4650 earlier than falling again in the direction of the 18 January excessive of 4632. With NADSAQ (US Tech 100) and DJI (Wall Avenue 30) following swimsuit, the CCI (commodity channel index) stays in overbought territory (for all three indices) with divergence suggesting that bullish momentum could also be shedding steam.

Chart ready by Tammy Da Costa utilizing TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707