[ad_1]

imaginima/E+ via Getty Images

Introduction

Houston-based Occidental Petroleum (NYSE:OXY) released its fourth-quarter and full-year 2021 results on February 24, 2022.

1 – 4Q21 and full-year 2021 Snapshot

Thanks to solid production and higher realized prices, the company posted a better-than-expected fourth quarter. Occidental Petroleum reported a fourth-quarter 2021 adjusted income of $1.48 per share compared to a loss of $0.65 in the same quarter a year ago.

Oil and gas prices continue to make a definite difference again. I expect oil prices to be around $97 per barrel in 1Q22, another 29% up sequentially.

Finally, on the dark side of the coin, I was disappointed that the company increased the quarterly dividend to only $0.13 this quarter, probably because the company did not reach the $25 billion net debt.

CEO Vicki Hollub said in the conference call:

We have the ability to grow oil and gas cash flow through higher production, but also have multiple investment opportunities across our other businesses. As evidenced by our guidance for 2022, we do not intend to grow production in 2022. At the point where it is appropriate to invest in future cash flow growth, we will only do so if supported by long-term demand. Any future production growth will be limited to an average annual rate of approximately 5%.

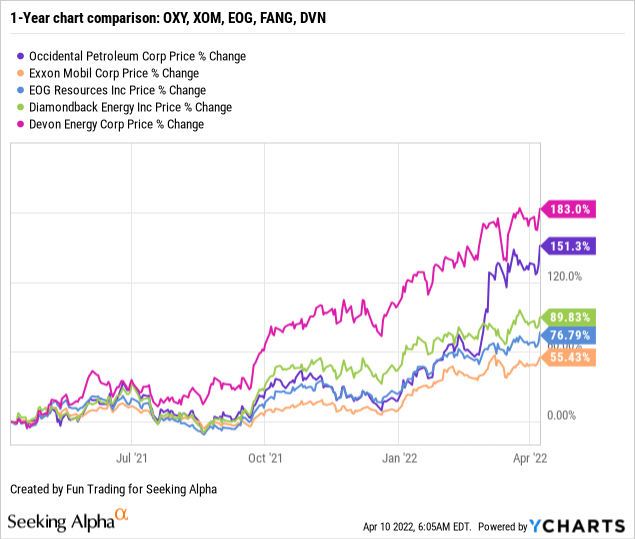

2 – Stock Performance – Outstanding recovery

Occidental Petroleum is up 151% on a one-year basis. The remarkable recovery was led by higher commodity prices and Buffett’s renewed interest.

3 – Investment Thesis

The investment thesis has changed evidently with the recent boom in oil prices. I was not anticipating such a drastic rally and did not think Putin was stupid enough to invade Ukraine. Still, he did, unfortunately at the cost of numerous civilian deaths, destructions, and a world on its way to a potential global recession.

However, the oil prices boom that we have experienced in the past few weeks could reverse if the economy can’t keep up with the massive inflation that brings most modern economies to a deadlock.

The pendulum will race towards the other side if demand drops, and oil prices may rapidly retrace.

The saying that the cure for high oil prices might be higher prices has been proven right in the past and could work wonderfully again.

Hence, the best answer is to trade short-term LIFO about half of your OXY position and take advantage of the oil volatility, which will stay with us for a very long time. Keep a core long-term position that you could grow using your short-term gain only.

Occidental Petroleum – 4Q21 Quarterly Financial Table: The Raw Numbers

| Occidental Petroleum | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Revenues in $ billion | 4.16 | 5.29 | 5.96 | 6.79 | 7.91 |

| Total Revenues and others in $ Billion | 3.35 | 5.48 | 6.01 | 6.82 | 8.01 |

| Net income in $ Million | -1,312 | -146 | 103 | 828 | 1,537 |

| EBITDA $ Million | 401 | 2,783 | 2,720 | 3,582 | 4,381 |

| EPS diluted in $/share | -1.41 | -0.37 | -0.10 | 0.65 | 1.37 |

| Operating cash flow in $ Million | 1,404 | 910 | 3,314 | 3,118 | 3,092 |

| Capital Expenditure in $ Million | 408 | 654 | 717 | 645 | 757 |

| Free Cash Flow in $ Million | 996 | 256 | 2,597 | 2,473 | 2,335 |

| Cash and cash equivalent $ Billion | 2.01 | 2.27 | 4.57 | 2.06 | 2.76 |

| Total debt in $ Billion | 35.75 | 35.47 | 35.35 | 30.92 | 29.43 |

| Dividend per share in $ | 0.01 | 0.01 | 0.01 | 0.01 | 0.13 |

| Shares outstanding (diluted) in Million | 933.0 | 947.9 | 934.2 | 957.7 | 972.6 |

| Oil Production | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Oil Equivalent Production in K Boe/d | 1,170 | 1,117 | 1,203 | 1,160 | 1,189 |

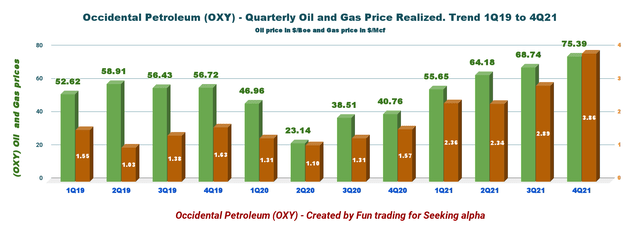

| Global oil price (world) ($/b) | 40.77 | 55.65 | 64.18 | 68.74 | 75.39 |

| Global Natural gas price (world) ($/MMBtu) | 1.57 | 2.36 | 2.34 | 2.89 | 3.86 |

Source: Occidental Petroleum and Fun Trading

Analysis: Revenues, Free Cash Flow, Net Debt, and Oil & Gas Production

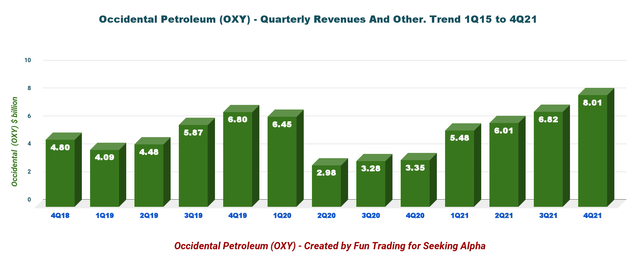

1 – Quarterly revenues and others were $8.01 billion in 4Q21 (net sales were $7.91 billion)

OXY: Chart Revenues history (Fun Trading)

Occidental Petroleum’s 4Q21 total revenues and others were $8.01 billion, up significantly from $3.35 billion a year ago and up 17.4% QoQ.

OXY: 4Q21 Performance Presentation (Occidental Petroleum)

Occidental posted an income of $1,537 million or $1.37 per diluted share. The adjusted income was $1.48 per diluted share compared to a loss of $0.65 in 4Q20. Also, Occidental’s total expenses for the fourth quarter were $6,120 million, up 19.8% year over year.

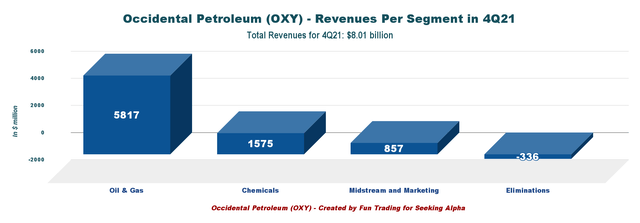

Below are the revenues per segment:

OXY: Chart Revenues per segment (Fun Trading)

Details:

- The fourth quarter’s oil and gas revenues were $5,817 million, up 17.3% sequentially.

- Chemical revenues for the quarter were $1,575 million, up 12.8% sequentially.

- Midstream and marketing revenues for the quarter went up sequentially to $857 million from $702 million the preceding quarter.

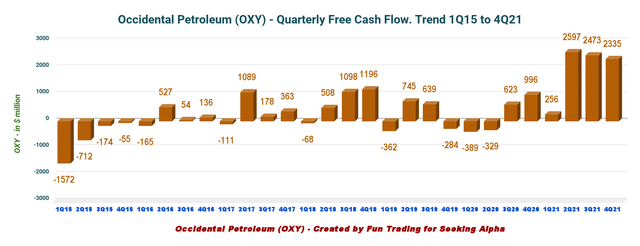

2 – The free cash flow was a record of $2,335 million in 4Q21

Free cash flow was $2,335 million in 4Q21 compared to $996 million in 4Q20. Trailing 12-month free cash flow is $7,661 million.

OXY: Chart Free cash flow history (Fun Trading)

The free cash flow is calculated by subtracting CapEx from cash from operating activities. However, Occidental Petroleum has a different way of calculating the free cash flow and indicates $2.930 billion in 4Q21.

The difference is that the company includes “working capital and other, net,” totaling a loss of $636 million, and I calculate CapEx by adding “capital expenditure” and “changes in capital accrual.”

The generic free cash flow that I have indicated is a better way of calculating free cash flow and comparing it to other peers.

The company raised the dividend to $0.13 per share or a yield of 0.83%, which is disappointing.

Also, Occidental Petroleum reactivated its buyback program and increased it to $3 billion worth of shares. I consider this move a complete waste of cash that will not benefit shareholders, whereas it is often viewed as a positive.

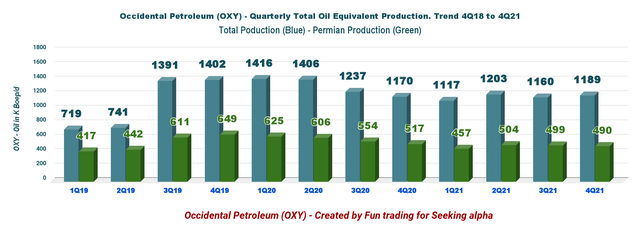

3 – Quarterly production was 1,189K Boepd in 4Q21

3.1 – The total output was 1,189K Boepd in 4Q21. The Permian operations accounted for about 41.2% of the company’s total production. OXY’s production was up 1.6% compared to the same quarter a year ago.

OXY: Chart total and Permian oil equivalent production History (Fun Trading)

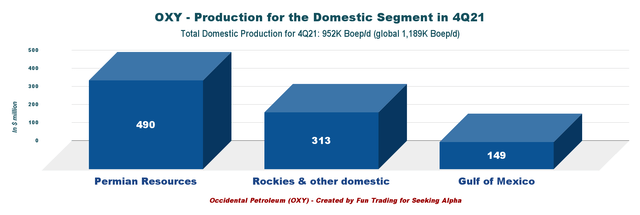

3.2 – Production in the USA totaled 952K Boepd (including the Permian Basin production).

OXY: Chart US Production detailed 4Q21 (Fun Trading)

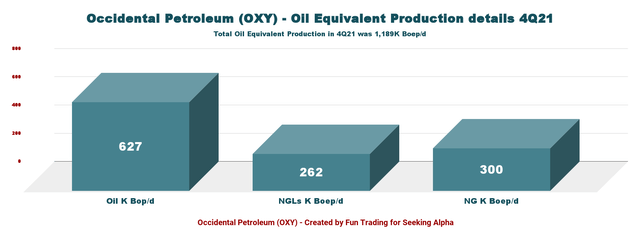

3.3 – Production for the fourth quarter was 52.7% of oil.

OXY: Chart oil equivalent Production details Oil, NGL, NG in 4Q21 (Fun Trading)

3.4 – Realized oil prices in 4Q21 were $75.39 per barrel compared to $40.76 last year. Natural gas was $3.89 per Mcf, up from $1.57 in the previous year. NGL price was $36.52 per Boe, up from $14.95 last year.

OXY: Chart Prices history oil and gas (Fun Trading)

Note: Total production in the Permian Basin includes the Permian Resources and the Permian EOR, which are now consolidated. The total production in the USA is 952K Boepd. It consists of the Gulf of Mexico, the Permian Basin, the DJ Basin in Colorado, and others.

3.5 – Guidance full-year 2022

OXY: Presentation 1Q22 and full-year 2022 guidance (Occidental Petroleum )

Occidental expects the fourth-quarter production between 1,125K and 1,155K Boepd and Permian production between 472K and 482K Boepd. The company expects exploration expenses to be $105 million for the fourth quarter.

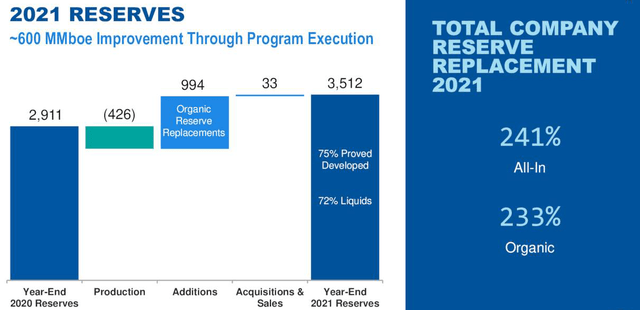

3.6 – 2021 Reserves. Improving by 600 MMBoe to 3,512 MMBoe.

OXY: Presentation 2021 Reserves (Occidental Petroleum)

CEO Vicki Hollub said in the conference call:

Our reserves for year-end 2021 increased to 3.5 billion BOE, representing a reserve replacement ratio of 241%. Our reserves position means that we have a vast supply of low breakeven projects and inventory available.

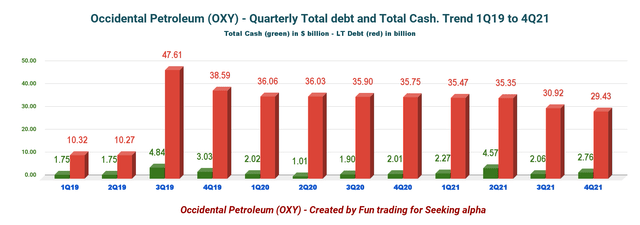

4 – Net debt is down to $26.67 billion at the end of December 2021

The debt continues to be the main issue for Occidental Petroleum.

OXY: Chart Cash versus Debt history (Fun Trading )

The company’s net debt is now $26.67 billion as of December 31, 2021. I believe the company has completed its $10 billion cuts in debt and announced that it would reduce debt by another $5 billion. It indicates a new milestone goal of $20 billion in net debt. OXY repaid $2.2 billion in debt in 4Q21.

However, the debt is still massive and includes the $10 billion advanced by Warren Buffett to acquire Anadarko Petroleum, announced on August 8, 2019, for $35.7 billion. As I said earlier, the debt to equity ratio is still very high now at 1.43 compared to 0.27 for Exxon Mobil (XOM).

Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B) bought $10 billion of Occidental preferred stock in August 2019 to allow Occidental to conclude the transaction.

These preferred stocks carry an interest of 8% payable every quarter and can be paid either in cash or in shares. Also, what is little known is that Warren Buffett’s Berkshire Hathaway was awarded warrants for 83.9 million at an exercise price of $59.624 per share. Is there a correlation with what happened recently?

I am not sure if Buffett has exercised the warrants yet, but he will profit $182 million if he exercises them now. On March 16, 2022, we learned that:

Berkshire Hathaway purchased 18.1 million shares from Monday through Wednesday to bring its stake to 136.4 million shares, a 14.6% interest in Occidental Petroleum.

On a positive note for shareholders: To compensate shareholders (I was one of them) for such a dilution, on June 26, 2020, Occidental stockholders received 1/8th (125 shares for 1,000 shares) of a warrant for every share of common stock of which they were the record holder as of July 6, 2020. The warrants can be exercised from August 3, 2020 to August 3, 2027 with an initial exercise price of $22 per share of common stock.

The best part is that the warrants are tradable under the ticker OXY-WS (OXY.WS) on the NYSE and trade at about $40 per share.

CEO Vicki Hollub said in the conference call:

As we expect net debt to fall below $25 billion by the end of the first quarter, our focus has expanded to returning capital to shareholders, beginning with the increase in our common dividend to $0.13 per share and the reactivation and expansion of our share repurchase program.

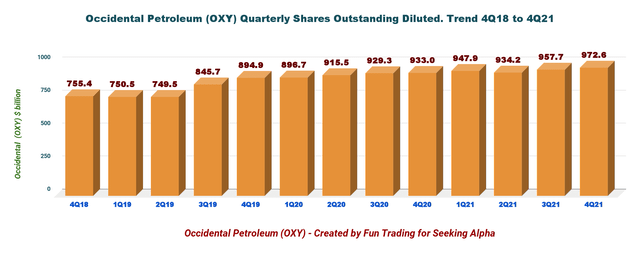

5 – Shares outstanding diluted are increasing and are now 972.6 million. A jump of 1.6% this quarter.

OXY: Chart Cash versus Debt history Fun Trading)

Commentary and Technical Analysis (Short Term)

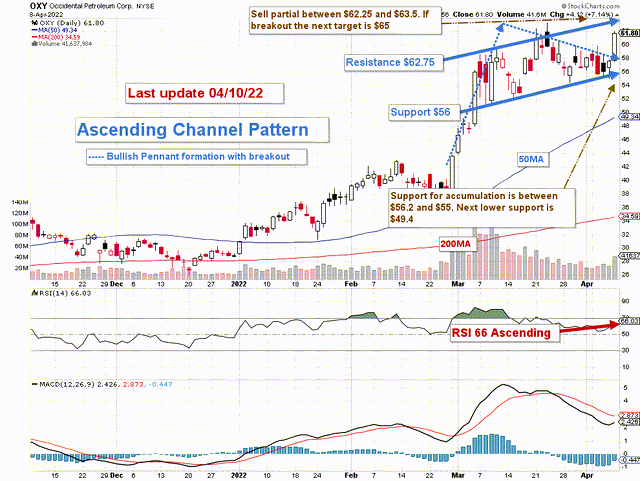

OXY: TA chart short-term (Fun Trading)

Note: The chart is adjusted for the dividend.

OXY forms an ascending channel pattern with resistance at $62.75 and support at $56. We could also look at the recent pattern formation as a bullish pennant with a breakout on Friday.

The trading strategy is to take profits (25% seems reasonable) between $62.25 and $63.50 and wait for a retracement back to $58-$55 or a breakout to $65, which is the new higher resistance in a bullish rally.

I recommend trading OXY LIFO, which lets you keep a core position for a much higher target.

Watch oil prices like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

[ad_2]

Source link