[ad_1]

1 out of 10 American adults or 26M individuals are “credit score invisible”, that means they haven’t any credit score historical past with the key scoring bureaus. One other 21M are thought-about unscorable. Many of those people are newcomers to the US and these folks face challenges accessing credit score irrespective of how their credit score was of their native nations, making a Catch-22 state of affairs the place they’ll’t entry credit score due to a scarcity of credit score historical past, and in flip, many then depend on onerous borrowing schemes, which might negatively influence credit score. Nova Credit score is an alternate credit score knowledge analytics platform that accesses cross-border credit score knowledge and different non-traditional knowledge factors to create a profile of creditworthiness for shoppers. Via its Credit score Passport engine, the corporate helps debtors entry credit score by US bank cards, cellular plans, auto loans, and pupil loans utilizing their overseas previous histories. Companies can leverage Nova Credit score’s Money Atlas™ platform to formulate mortgage decisioning by precisely monitoring an applicant’s earnings and money move. The corporate’s knowledge capabilities enable it to synthesize knowledge factors globally so its options are also efficient exterior of the US market to make credit score accessible for shoppers worldwide.

AlleyWatch caught up with Nova Credit score CEO and Cofounder Misha Esipov to be taught extra concerning the enterprise, the corporate’s strategic plans, newest spherical of funding, which deliver the corporate’s complete funding to $124.4M, and far, far more…

Who have been your buyers and the way a lot did you increase?

Nova Credit score raised $45M in Collection C funding. Canapi Ventures led the spherical and new buyers embody Geodesic Capital, Harmonic Development Companions, Radiate Capital, and Socium Ventures (Cox Enterprises). Present buyers additionally joined the spherical, together with Normal Catalyst, Index Ventures, Kleiner Perkins, Y Combinator, and Avid Ventures.

Inform us concerning the services or products that Nova Credit score gives.

Nova Credit score is an information analytics firm that helps companies develop responsibly by different credit score knowledge. The corporate does this by leveraging its distinctive set of information sources, bank-grade infrastructure and compliance framework, and proprietary credit score experience to assist lenders fill the gaps that exist in conventional credit score analytics. Nova Credit score serves because the bridge between knowledge and credit score excellence, offering a complete suite of options designed to provide lenders a aggressive edge within the open finance period.

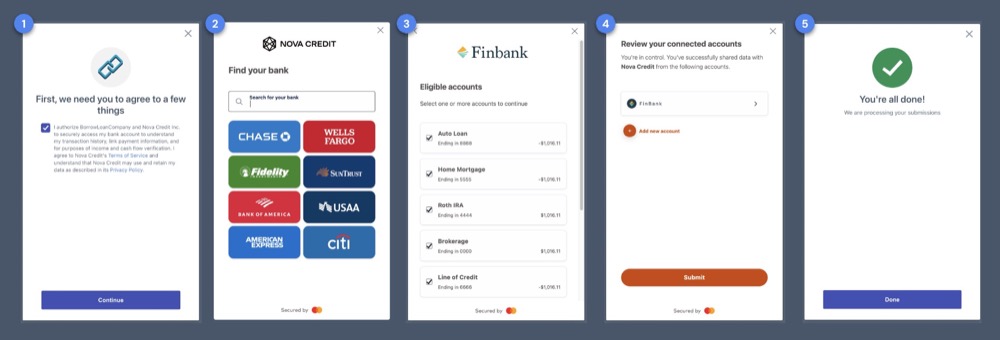

The corporate gives two merchandise that assist companies make extra truthful and knowledgeable selections on tens of millions of ‘skinny file’, no credit score historical past, and new-to-country candidates:

- Credit score Passport® unlocks cross-border credit score bureau knowledge to assist companies underwrite new-to-country newcomer populations.

- Money Atlas™ offers higher perception into the money flows of any applicant, together with verifying their earnings with higher precision than alternate options.

Companies use these merchandise to approve extra candidates with out taking over pointless danger, and shoppers are empowered to place their finest foot ahead of their functions.

What impressed the beginning of Nova Credit score?

For me, the issue dealing with newcomers world wide was private. When my household immigrated to the U.S. from Russia, we rapidly realized how troublesome it was to construct a life within the U.S. with out credit score historical past, and the way a scarcity of entry to credit score merchandise stood in the best way of alternative. A few years later, as graduate college students at Stanford College, my cofounders and I found that the exact same drawback was nonetheless rampant, and nobody had tackled it. Consequently, Nova Credit score was based to assist immigrants overcome the obstacles of making use of for issues like residences or loans with no credit score historical past within the U.S.

How is Nova Credit score totally different?

For greater than seven years, Nova Credit score has constructed knowledge pipelines into credit score bureaus world wide, seamlessly translating a variety of information schemas, attributes, and scores into FCRA-compliant reviews for lenders to achieve new-to-country populations—opening a world of two billion clients worldwide. Nova Credit score is the one firm on the planet with these knowledge sources and capabilities. Alongside the best way, we constructed a proprietary analytics layer that helps credit score professionals extract worth from new knowledge sources, all inside a compliance framework that meets the regulatory and safety requirements of premier monetary establishments. Right now, Nova Credit score has developed the world’s foremost experience in knowledge connectivity, standardization, analytics, and compliance required to unlock the facility of open finance to profit a broader base of shoppers and lender use instances.

What market does Nova Credit score goal and the way large is it?

The US will develop by 40 million folks within the subsequent 3 many years, practically 100% of that progress will come from newcomers. As well as, greater than 60 million skinny and no credit score file shoppers within the US are left behind by the present credit score system, however these shoppers can now be scored utilizing their financial institution transactions utilizing Money Atlas. Importantly for our companions, any US shopper with a checking account might be underwritten with transaction knowledge, even when they have already got a credit score rating – money move underwriting simply dietary supplements current credit score knowledge for a deeper view into an applicant’s creditworthiness.

Exterior the US, the newcomer market is equally necessary and rising. UN inhabitants estimates point out 1 in 30 folks world wide – 281 million – are immigrants, with the first driver for inhabitants progress in lots of nations being solely from immigration.

- The UK is house to ~10M overseas born people, with greater than 1 in 7 residents overseas born.

- Canada’s inhabitants will develop by ~12M over the following 3 many years, and it’s estimated that 100% of the expansion will come from newcomers. Canada goals to develop inhabitants to 100 million by 2100 – with a major quantity from immigration.

- The UAE’s inhabitants will develop by ~2M over the following 3 many years, 80% of the expansion will come from newcomers

What’s your online business mannequin?

Nova Credit score gives Software program-as-a-Service (SaaS) and Knowledge as a Service (DaaS), charging companions for entry to its infrastructure and platforms in addition to consumption of information and analytics from totally different knowledge sources.

What was the funding course of like?

We ran a quick and environment friendly fundraising course of the place we acquired a number of gives from a fantastic group of companions we’re enthusiastic about.

What elements about your online business led your buyers to put in writing the examine?

Jeffrey Reitman, Normal Companion at Canapi Ventures, shared that he was initially interested in Nova Credit score based mostly on the high-quality management crew and the formidable mission to allow newcomers and thin-file shoppers the flexibility to have truthful entry to monetary merchandise. This was coupled with the actual fact that there have been no different firms constructing on this area, which was pushed by the sheer issue of establishing credible supply-side credit score knowledge integrations with worldwide bureaus and distributing that knowledge to massive monetary enterprises. Canapi first invested within the firm alongside Kleiner Perkins within the Collection B in late 2019, and on the time, was very excited concerning the traction Nova was getting with a number of massive monetary establishments like American Categorical. Quick ahead nearly 4 years later and the industrial traction has proven explosive progress. The belief that Jeffrey was in a position to construct with this administration crew through the years, blended with the actual market match throughout the Credit score Passport and Money Atlas merchandise, made Nova a transparent candidate for Canapi to double down by main the Collection C. A lot of Canapi’s banking LPs are in lively dialogues with Nova Credit score to leverage their merchandise to raised serve their clients and that additionally properly aligns with the mission right here at Canapi.

What are the milestones you intend to realize within the subsequent six months?

This capital will enable us to additional broaden our product providing past cross-border credit score reporting, which Nova Credit score is traditionally recognized for, and scale our Money Atlas product to serve all shopper segments. Particularly, we plan to introduce a complete new vary of options that allow extra progress – from new-to-credit and thin-file underwriting to personalized KYC and verification options, a 60m+ shopper alternative within the US alone. This growth will enable companions to develop inside danger urge for food by incorporating an expanded suite of open finance knowledge pipelines, distinctive datasets, and category-defining analytics and compliance functions.

What recommendation are you able to supply firms in New York that don’t have a contemporary injection of capital within the financial institution?

Develop your community – New York is arguably the epicenter of connections, with numerous titles, industries, and verticals all inside shut proximity. A lot of Nova Credit score’s success might be attributed to the community of supporters we’ve constructed, and we proceed to construct that community year-over-year.

Keep the course – we went by a difficult few years, however by perseverance and constructing an exemplary crew and suite of merchandise, we’ve made it to the opposite aspect stronger than ever.

The place do you see the corporate going now over the close to time period?

Whereas cross-border credit score stays crucial to our technique, we’re excited to broaden our providing and sort out a brand new set of trade challenges lengthy unsolved. This new capital fortifies our place to proceed being a reliable associate to the various banks and lenders we serve and accelerates the tempo of innovation.

What’s your favourite fall vacation spot in and across the metropolis?

I grew up within the Princeton space and all the time beloved going to Grounds for Sculpture within the fall.

You might be seconds away from signing up for the most popular checklist in Tech!

Join at this time

[ad_2]

Source link