[ad_1]

US NFP AND JOBS REPORT KEY POINTS:

- The US Added 339,000 Jobs in Could, Surpassing the Common Forecast of 190,000 New Payrolls. Aprils Determine In the meantime Was Revised Greater to 294,000.

- The Unemployment Charge Rises to three.7%, a 7-Month Excessive.

- Common Hourly Earnings Got here in at 0.3% MoM with the YoY Print Dropping to 4.3%.

- To Study Extra About Worth Motion, Chart Patterns and Shifting Averages, Try the DailyFX Training Part.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

Hiring within the US accelerated by means of Could because the economic system added 339K jobs in Could 2023, beating forecasts of 190K and following a upwardly revised 294K in April. In accordance with the U.S. Bureau of Labor Statistics employment continued to pattern up in skilled and enterprise companies, well being care, building, transportation, warehousing, and social help.

Customise and filter reside financial information through our DailyFX financial calendar

The unemployment fee is at 3.7% (a 7-month excessive) with the variety of unemployed individuals now as much as 6.1 million. It is very important notice the unemployment fee has ranged from 3.4% to three.7% since March 2022, will unemployment lastly tick greater?

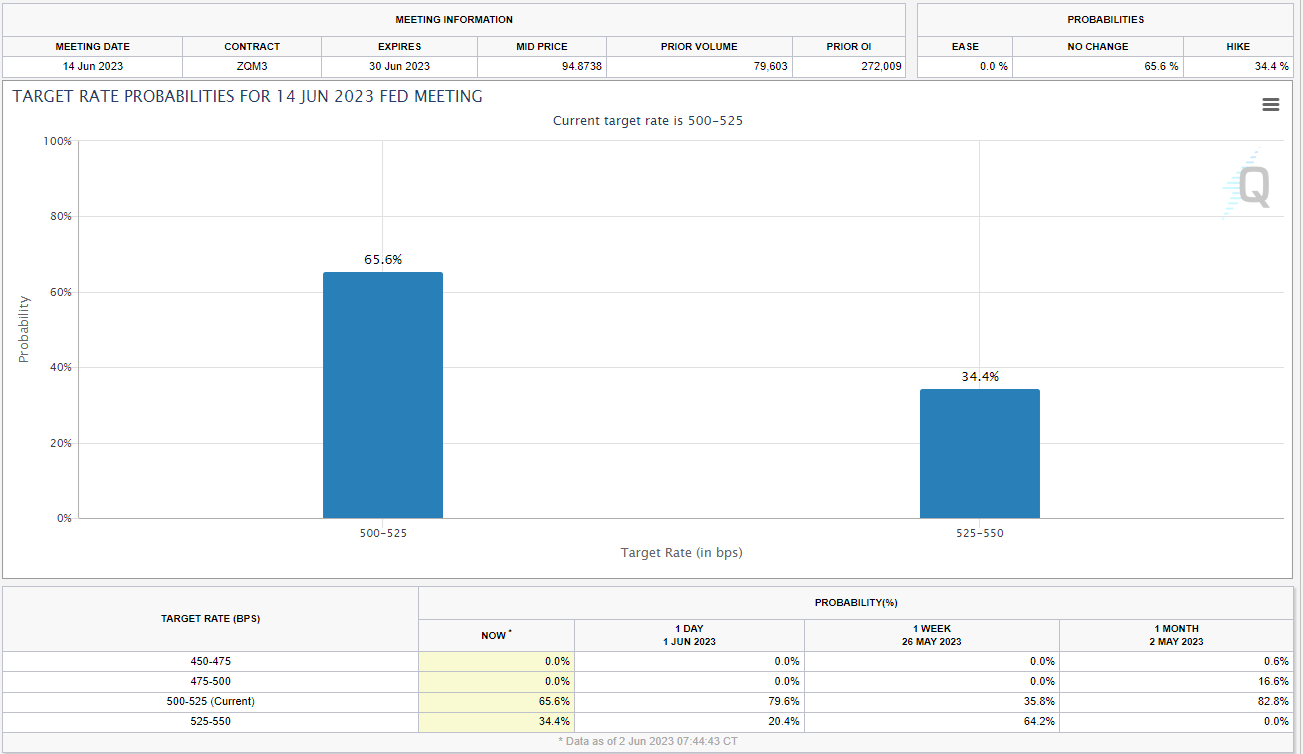

Trying extra carefully on the employment survey, common hourly earnings which stays a robust inflation gauge for the Fed, elevated by 0.3% MoM the identical as April, bringing the annual fee again to 4.3% from 4.4% beforehand. This print is maybe the one optimistic for the Federal Reserve as regardless of the strong job numbers, earnings isn’t popping off and unlikely so as to add additional stress on service costs as we head into the summer season months. The information has seen the speed hike possibilities for a 25bps hike in June rise to 34% up from 25% forward of the discharge.

Supply: CME FedWatch Software

FEDERAL RESERVE AND THE WAY FORWARD

The debt ceiling deal which had solid a big cloud over markets of late is basically resolved because it makes its solution to the desk of US President Joe Biden. Markets have reacted positively so far with danger belongings catching a bid as soon as the debt ceiling settlement handed by means of the home and senate and the US greenback weakening as many had anticipated.

The US Greenback decline nonetheless may be attributed to rising chatter concerning a potential pause from the Federal Reserve in June. There are some policymakers who consider a pause could also be acceptable as markets appear to be feeling the pressure of late because the impact of fee hikes filter by means of to the economic system. Nonetheless, information has remained a priority with the Core PCE (Feds most well-liked gauge of inflation) ticking greater and the general inflation image remaining a priority. As talked about above the typical hourly earnings is a plus for the Fed and the inflation image as a complete whereas the uptick in unemployment could also be trigger for a pause from Federal Reserve. It will permit the Central Financial institution a while to higher assess the impression of fee hikes because the “lag impact” lastly seems to have run its course.

The Greenback itself does seem rife for a pullback at this stage. The greenback could discover some assist due to greater greenback deposit charges which might stop a big selloff within the dollar, nonetheless a pause by the Fed in June might make the Greenback Index (DXY) weak for a push towards the psychological 100.00 mark.

Really useful by Zain Vawda

Buying and selling Foreign exchange Information: The Technique

MARKET REACTION

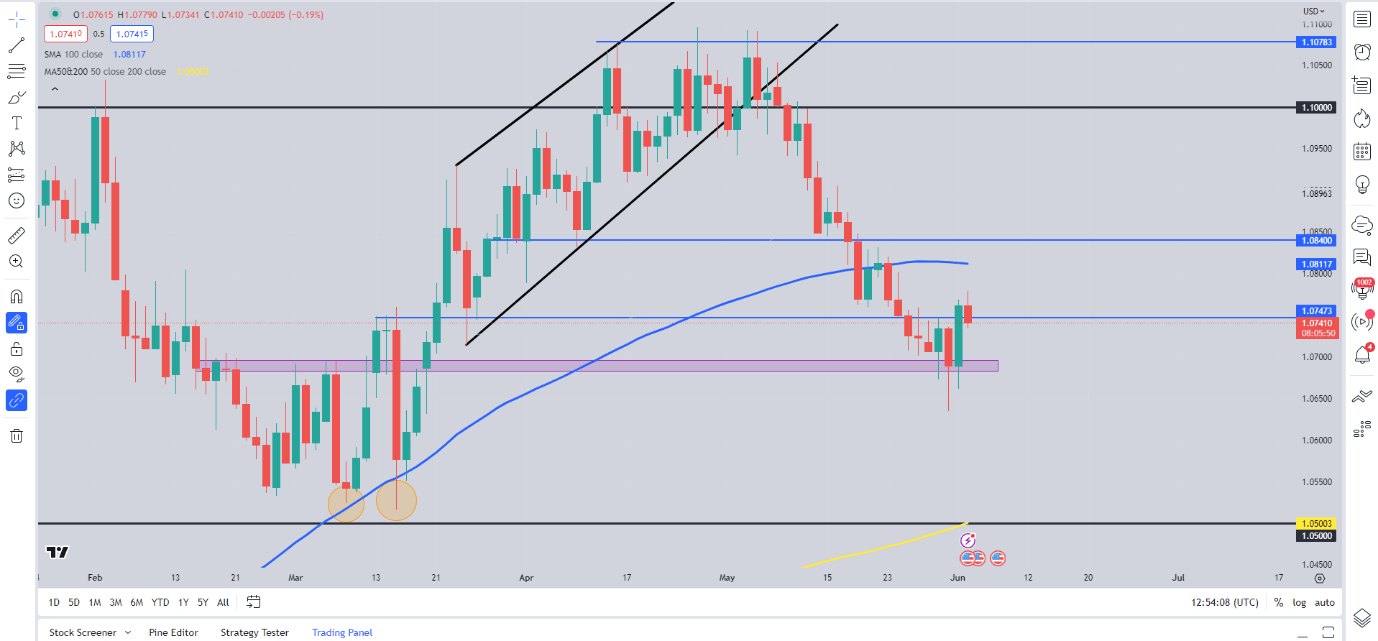

EURUSD Each day Chart

Supply: TradingView, ready by Zain Vawda

Preliminary response on the EURUSD noticed the greenback strengthen and acquire roughly 30 pips to commerce again under the 1.0750 stage. Trying on the greater image EURUSD loved a wonderful Thursday because the US Greenback rally lastly seemed to be fading. The 1.0680-1.0700 deal with has been key of late because it has continued to supply assist with yesterday’s bullish engulfing shut hinting at additional upside and a deeper retracement.

Key Ranges Value Watching:

Assist Areas

Resistance Areas

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda

[ad_2]

Source link