Author’s Note: This article is a reduced version of an original piece published on iREIT on Alpha back in late March of 2022.

RobsonPL/iStock Editorial via Getty Images

Dear readers – that’s Neste (OTCPK:NTOIF) (OTCPK:NTOIY), not Nestlé (OTCPK:NSRGY)

Neste is a company that many of you probably haven’t even heard about.

The company is Finnish, commands a €28B+ market cap, has markets around the entire world, operates two large refineries in the Nordics which account for almost 20% of the Scandinavian production capacity, and has an appealing overall profile.

It’s not the greatest yielder, but this company is a grower, and it might very realistically grow even further – and massively so.

In this company I’ll show you why I bought $5,000 in Neste a few years back – and why I’m looking to buy more.

Neste – A company profile

Neste is a Finnish company that focuses on the refining and marketing of premium, low-emission traffic fuel. In a sense, the company is the world’s leading producer of renewable diesel.

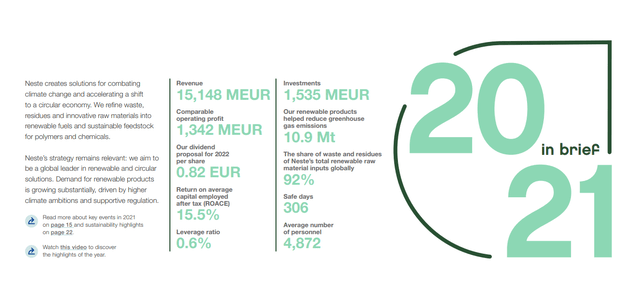

Neste was once part of the Finnish company Fortum (OTCPK:FOJCF) and was split off around 17 years ago. It’s still owned to 40%+ by the Finnish state, and as such, has a near-majority shareholder. The company hasn’t applied for credit rating scores from any agency, and thus holds none. The company carries minimal debt, around 0.15X net debt/EBITDA, with over 70% of borrowings in bonds at an average maturity of 3-4 years.

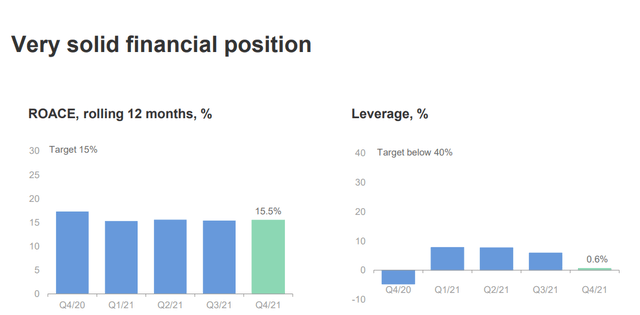

Neste Financials (Neste IR)

The company has a yield level of around 1.5-2% on an annual basis, which means it’s one of the lower yielders in the oil industry. It’s also a company that structures its dividend directly in line with profits, meaning there’s no dividend growth safety – you get a percentage, and that’s it.

The company’s fundamental upside is its capacity, expertise, and market position. Neste operates two large refineries, the Porvoo, with a 205kbbl/d capacity, and the Naantali refinery, at 56kbbl/d capacity. This is around 20% of the capacity in all of the Nordic regions, and the company’s main markets are for the moment, found in Scandinavia.

Neste Company results (Neste IR)

Aside from its Scandinavian capacity, the company balances traditional with renewable refining, and all of its products are in the “premium” space. The company owns the world’s largest renewable Diesel plants in Singapore, known as NExBT (New generation biofuel) as well as Rotterdam, with a combined capacity of 1600kt/y. The company also has a 45% stake in a 400kt/y base oil plant in the nation of Bahrain.

It’s important to note at this point that Neste has agreed to sell much of its legacy operations to Chevron (CVX). While they’re still part of the company, and the legacy refineries will be subject to offtake agreements, Neste will no longer have a base oil/legacy refinery business in the mid-term future. (Source). The estimated completion of some of these deals will be 1Q22.

Neste has invested massive amounts of CapEx to get here over the few years, and its EPS trends are subject to heavy volatility due to policy risks from various environmental agencies around the globe.

At its heart, the use of biofuels is a solution to the current ongoing energy shift – and most northern European nations have hopped on board this train for the past few years. Demand for biofuel is expected to grow at single to double digits annually. The major difference between the EU and US space here is the market-based US approach, which incentivizes biofuel producers.

Neste owns over 800 fuel stations in Finland and 266 stations in Baltic countries (as well as Russia) with the station division acting as an outlet for the company’s products.

On a high level, the company manages sales of €10-€15B per year, with a 33/33/33 split between Oil Products, Renewable Fuels, and Marketing & Services. This makes up the company’s split. The company has major geographical exposure to Finland with 40% of its sales, EMEA at 20%, and Americas at no more than 13.5%. The remainder is split among various geographies. The baltic states and Russia together make up for around 11.1% of company sales, putting Russia at a relatively low exposure for Neste. The company has already replaced almost all of its crude inputs with Baltic sea oil or different inputs. (Source)

Over the past few years, the renewable performance that the company has seen has highlighted the increased appeal that the company’s products have. With oil gaining, all of the company’s segments have been firing on all cylinders, and the company calls its strategy execution “on track”.

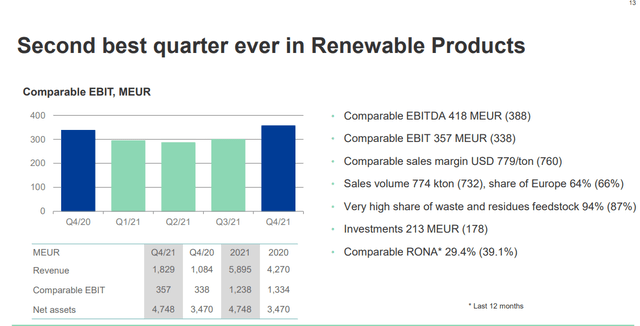

YoY quarterly EBIT is up, margins are up, and even weaker USD couldn’t do more than slightly dent the annual YoY EBIT, with FX, some volume, and fixed cost impacts. What’s more, the quarter spelled the second-best renewable product quarter – ever.

Neste Renewable Results (Neste IR)

So, despite the company’s exposure to some environmental policies, results have been very steady. What’s been going up is the company’s feedstock pricing. Neste uses a mix of soybean, rapeseed, palm oil, and animal fat – the prices for all of these feedstocks have been going up much like the price for crude oil. Once the calculation here goes awry in how much money someone can make by switching to biofuel instead of legacy fuel, company sales go down – and in some geographies, Neste doesn’t control some of the primary differentiators (such as the Californian low carbon fuel standard/LCFS credit price).

However, the company is a successful hedger, and despite increased prices, margins are stable. Legacy oil product performance was higher – and will likely keep climbing in the environment we’re currently in.

The primary limitations to Neste’s global success are capacity-related. The company seeks to scale up its expansion plans in Singapore, with a start-up planned in early 2023. Given the company’s low debt, the company has funds with which to fund its expansions, and the plans that have been implemented are, for the moment, working very well. The company expects sales volumes to be on a similar level – though this was before Ukraine – and the markets to remain tight, with margins of around $650-$725/t, as well as a utilization rate of its asset of over 93%.

On a high level, and in my calculations, a $50 margin change in either direction affects the EBIT by around $150M in either direction. Neste solves this through hedging on a 12-month basis, using vegetable and fossil oil products as proxies. The company has a 3Mton capacity on an annual basis, set to increase to 4.5Mton in 2022-2023 with the aforementioned Singapore expansion online.

The company’s margins are a function of its EU and US (mainly California) sales. In the past and until 2018, Neste broke down renewable margins the same way that traditional oil refineries would do. They’d use a sort of benchmark combined with an extra contribution. The benchmark would use conventional biofuel products, such as FAME margins (FAME – palm oil + $70/t freight ARA) for Europe and SME margins (SME – palm oil + $70/t freight ARA) for the US, together with the California Low Carbon Fuel Standard credit (LCFS).

The Biodiesel Tax Credit (BTC) brings an additional margin to US sales, as well as RIN D4 prices. The additional margin comes from Neste’s ability to adjust its sourcing (e.g. waste vs palm oil) and its commercial position. Because of the company’s ability to sell essentially 100% renewable Vegetable-oil based Diesel (HVO), this makes Neste more resilient to market price fluctuations from crude flows.

While benchmark comparisons were being made to FAME/SME biodiesel, HVO diesel is actually very different. It took me about half an hour to understand the chemical difference here, but the fact is that HVO does not face certain issues inherent to biodiesel, because instead of oxygen molecules, HVO has hydrogen. This means that the product does not face a “blend wall”, which means that vehicles using HVO is not negatively affected and can only use up to a certain percentage (such as 10%) of biofuels before being negatively affected.

Because HVO does not suffer this problem, Neste stopped benchmarking to SME/FAME.

Neste sources primarily from China, Australia, and the Netherlands, and expects its input pool to grow to 35Mt by 2030, in line with demand growth for its sustainable fuels. It’s important to mention that the company’s products are not limited to cars, but aviation fuel as well. The company produces using essentially waste products from other industries, and in 2019-2020, the company recycled/processed near-on 3Mt on waste and residue, with an ever-increasing target for collections as well as new ways for processing new feedstock into diesel (such as Algae oil, which is actually about to happen).

The company can use ten different types of feedstock (animal fats, used cooking oil, residues from vegetable oil processing). Palm oil was the major input at the start but now has, a lesser, variable weight (waste and residues account for around 80% of the company feedstock). Neste has acquired several companies to strengthen its collection of used cooking oil.

With the increased exposure of battery-powered electric cars, aviation fuel is rapidly becoming a target market for Neste. While it may no longer seem unrealistic that cars will be 90%+ EVs by 2030 (at least new sales), the same cannot be said realistically for commercial aviation. There is an absolute lack of low-carbon alternatives in aviation applications for larger planes, and the company has estimated the demand for renewable fuels in the sector at 5Mt today, growing to over 20Mt by 2030. The Singapore market is expected to target this.

So, on a high level, this is a part-legacy, heavy-renewable fuel producer that’s set to pivot its sales towards aviation and commercial fuel applications – though it still has plenty of ICE exposure. Its capacity expansions are on track, it’s partially state-owned, and it’s extremely well-capitalized.

I argue that the combination of its products and specifics all but insulates this company from the wilder swings so otherwise typically inherent to the oil/energy sector – though it also doesn’t have the massive yield you might associate with energy at only 2.2% at today’s valuation.

However, fundamentally, I view this as a very sound business with a bright future.

Neste’s Risks

Neste’s risks come in two forms, as I see them. There’s the risk of competition if instead of just going for renewable energy sources like wind and solar, other players move heavily into biofuels as well. There’s also the risk of the eventual drawdown of car biofuel sales declining in line with the ICE sales ban in many geographies starting in 2030. The company still has plenty of work to do in securing supply contracts with major airlines and service companies, as well as securing the feedstock contracts for capacities beyond 3-5Mt per year.

These are the two company-specific risk areas I would keep a close eye on when investing in Neste. Aside from this, the company of course has some FX risks as well as some issues related to crude production. Some of the company’s refining assets are still focused/built for legacy, which is a risk for the longer term, as Neste’s future seems to be a pure renewable producer.

Some might see the state ownership as a risk – but take it from me that the Finnish state is much like the Norwegian one. They act as independent shareholders and place a high value on dividends, stability and responsibility. Overall, I would trust them more than I would most individual shareholders, and that is why my ownership of Finnish and Norwegian companies is very high, while my ownership of partially-state-owned Swedish businesses is very low.

Neste’s valuation

We move from positive into more positive. Neste is currently significantly undervalued.

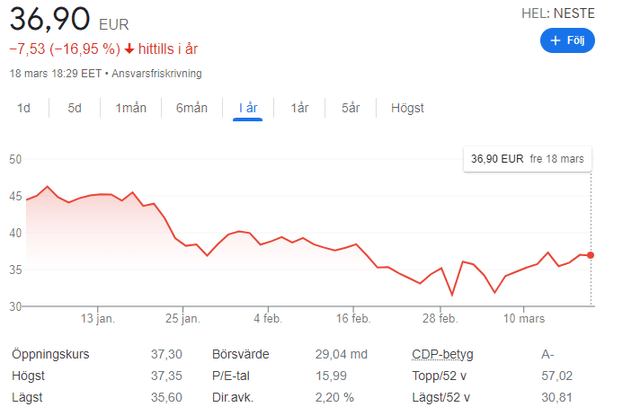

Unlike some companies where you can say that it’s undervalued from a growth perspective, or a NAV perspective, or a peer perspective, or an analyst perspective, but not all – Neste is undervalued on every single basis. This following a 1-year 20%+ drop in valuation and share price. The reason for this decline is the strategic change for Neste for almost a decade. The company was a major oil producer that went into and started focusing on renewable diesel. Initially, this was a large-scale “science project” for the company, but the market appreciation for this recycled product has been massive.

This means that some of its valuations are dependent on the continued appreciation for renewable fuel – which I see as likely given where the world is going. The margins for the company’s renewables are almost ridiculous, and I’m not kidding around here.

Converting Neste’s output to oil barrel equivalent, the net margin (EBIT / output) in renewables was c. $80/bbl in 2019, against a mere $5/bbl for the oil products division.

Beginning with a DCF, we apply a historically correct 5-7% Sales and EBITDA growth estimate for the next 10 years given the increase in demand for biofuel, and a slightly less 4-6% annual growth in CapEx. The company has a WACC of 7.8%, and a terminal growth rate of 2%, in line with Finnish GDP, in this model. Based on these expectations and inputs, we come out with an implied EV range of €40-€50/share. The current share price for the company is €36.9.

I would not in any way consider a 6-7% annual sales growth to be outlandish, given the demand implications for the company’s products we’re seeing, not even mentioning the expansion plans.

Peers are nigh-impossible to find. No oil major really does what Neste does, and straight comparisons against majors defeats the purpose we see in the margins, sourcing, and market resilience of the company. I choose to value the company against Danish renewable leader Ørsted A/S (OTCPK:DOGEF).

Peer valuations put it at an average of 25X P/E, endemic for this complex, renewable-heavy sector, which puts Neste at a discount at below 23X P/E, though some may argue this is still incredibly high, and compared to most legacy refiners, it certainly is. Still, compared to its peer group, the company’s book values, yields, and EV/EBITDA multiples are below where other renewable-heavy businesses here are.

Because this is very hard to estimate, however, I would not consider this all that valid in the overall weighting of valuation – which is why I assign this method of peers is a very low relevance. I want to highlight it to you, however, as to how this looks.

NAV is a lot better. We value Renewables, Marketing, and Oil at a range of 9-16X EV/EBITDA, with oil at the very lowest and renewables at the highest. This brings us to total assets, given the almost no debt, of between €30,500-€32,000 on the high end, coming to a NAV/share of €40 on the low end and €41.8 on the high end. Based on these methods, we have a decent estimate and perspective of where Neste should be, and it’s above its current €36-€37 share price.

All of these estimates are fairly conservative, especially with DCF, which might see far higher growth numbers than the ones we’ve calculated for. Neste isn’t an easy company to evaluate, but my methods here have brought fruits as to what I would consider accurate for the company in the longer term.

Current S&P Global analyst valuation targets are far higher than mine. From a range of €37 on the low end and €75/share on the higher end, 20 analysts come to an average of €49.28. 11 analysts are at “BUY” or “Outperform”. This comes to an undervaluation of 33.5% of the analyst estimate.

I land somewhere between my NAV and DCF at around €45, conservative. I believe going above €50/share starts to be somewhat optimistic, and as for that €75/share, I’d love to see what renewable demand scenarios of double-digit growth that analyst has.

For me, I’m at €45.

But even to the most conservatively-adjusted targets, Neste is definitely cheap here.

Thesis

The specifics as to how this company is valued should be clear to you following this. Higher targets factor in demand growth on the renewables side, which seems likely. The question is the amount of demand growth we could consider as being “fair”, and as to that, that’s one of the differentiators between these targets.

Anything less than 5-7% underestimates this company’s potential, in my view. With the situation around the world as it is now, and with demand for fuel likely to go up in the face of the current geopolitical situation in Russia, I believe a company like Neste will see significant upside until 2030. Not only does Neste not share a dependence on classic crude, but it uses waste to produce what is essentially a fuel alternative. As I described in earlier segments, this allows Neste to operate outside of typical margin situations inherent to the energy sector.

This, and its fundamentals are what make the company a solid “BUY” here for me. While I only own a few thousand dollars at this time, I’m willing and looking into expanding this position over the coming few months. I have a need to allocate tens of thousands of dollars of incoming capital, and Neste is on that list for fresh investments.

The relevant ADR for Neste is NTOIY. It’s a 0.5X ADR, and it’s unfortunately thinly traded to the degree that I would recommend investors to look at brokers that allow for the native trading of NESTE, the Helsinki ticker. The company hasn’t exactly been on a smashing run for the past year, and Russia has pushed it lower.

Neste 1-year Graph (Google Finance)

But that is of course what we want to see when we’re looking to invest. Over longer periods, this company delivers astounding levels of RoR. The company’s 15-year returns go over 600%, and my position is up in the triple digits as well.

Neste has, in my view, the very real potential to become an even more major player in alternative fuels. What we need to look at is the company securing both input/feedstock contracts as well as new refining and generation capacity.

As long as Neste does this, we can almost assume RoR will be excellent.