graphicola/E+ through Getty Photographs

Co-Produced with Treading Softly

I really like an excellent deal. Is there something extra pleasurable than discovering one thing on sale? Generally you might be fooled right into a deal. Some shops have “gross sales” perpetually the place they mark up the value to one thing that no person ever paid, solely to cut back it for a sale.

This observe is misleading, however luckily, the ability of the web may also help us really comparability store. You may Google your required merchandise and see what numerous retailers are promoting it for. This implies you may quickly see what the “market” value is for one thing and know if the “sale” value is definitely beneath the going fee. On this approach, the web really helped hold inflation in test for just a few many years as comparability purchasing not meant climbing onto your horse, driving into numerous cities to see the costs in particular person, and scribbling them down in your trusted notepad. Occasions have modified, however the thrill of an excellent deal hasn’t. It has simply change into more durable to search out them.

Trying into the market, we not need to learn the morning newspaper and see our favourite tickers, and even name our brokerage to get them to present us the latest quote. We are able to bounce on our favourite apps and see the costs at any given second. We have now highly effective instruments to see the previous value actions and see what is perhaps “on sale” versus the previous value.

Usually buyers make the error of merely shopping for based mostly on value actions of corporations and never trying beneath the hood. They’re going to be in such a rush to snag the “deal” earlier than it disappears that they do not do their due diligence.

Figuring out why costs could have moved – aka evaluating elementary dangers – is crucial to know when an excellent deal is true in entrance of you.

Right this moment, I’ve two wonderful alternatives which are on sale and nicely price shopping for closely – as soon as you’ve got determined through your due diligence to get them!

Decide #1: MMP – Yield 9%

Oil costs are within the $90s and pushing the $100 barrier for the primary time since 2014. One thing that many scoffed at after we predicted it a few years in the past. Within the wake of COVID, we have seen a way more accountable method within the vitality sector than we noticed within the decade from 2004 to 2014. Firms are increasing extra cautiously and with a watch in direction of managing their stability sheets. For revenue buyers, because of this the midstream house is a beautiful stability of dividend progress, capital upside, and far much less danger than we noticed over the past growth.

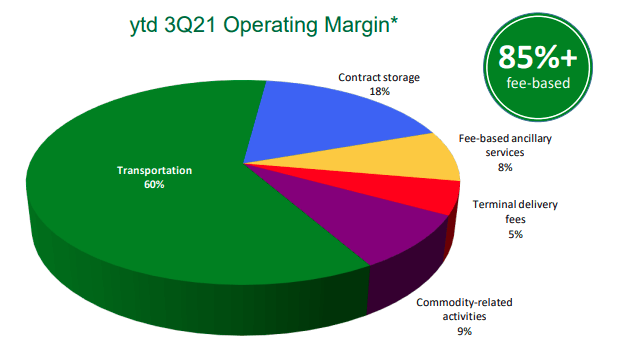

Magellan Midstream Companions (MMP) is an MLP that focuses on refined merchandise (diesel, gasoline) and crude oil, with a couple of 70%/30% cut up in favor of refined merchandise. As a “midstream” firm, MMP owns the infrastructure that transports and shops these merchandise from producers to refiners and wholesalers. – Supply: MMP December 2021 Investor Presentation:

MMP December 2021 Investor Presentation

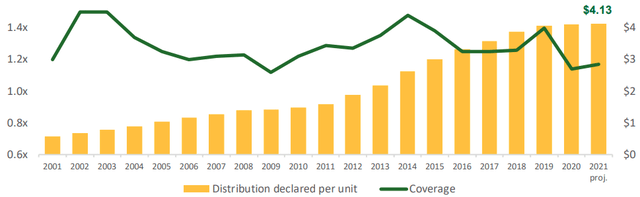

Regardless of the turmoil within the vitality sector, MMP has been capable of enhance its distribution yearly for the previous 20 years. It has been capable of obtain this resulting from its conservative investment-grade stability sheet and prudent danger administration.

MMP December 2021 Investor Presentation

Along with beneficiant distributions, in 2021 MMP took benefit of the market’s mispricing to purchase again over $500 million in items. Prior to now two years, MMP has purchased again about 7% of its items excellent. With share costs low, administration said its intention to proceed to do buybacks with free money circulation after capex and distributions.

Any firm touching fossil fuels, usually, has obtained a damaging reception from a lot of Wall Road wrapped up in “ESG” investments. At the same time as they proceed to be large producers of money circulation.

Some institutional buyers are beginning to notice the worth being left on the desk. Wall Road will solely flip a blind eye to money circulation for therefore lengthy, particularly in an inflationary surroundings. By the point they’re shifting in, we’ll have already got full allocations and fortunately acquire our revenue!

When in search of vitality alternatives, we wish to search for high quality stability sheets, a monitor document of robust distributions, and stability even via the final oil crash and COVID. MMP checks all these containers!

Observe: MMP points a Ok-1 at tax time.

Decide #2: PDO – Yield 8.3%

PIMCO Dynamic Earnings Alternatives Fund (PDO) is the latest bond fund from PIMCO, the very best bond CEF supervisor on the market. PDO is roughly modeled on PIMCO Company & Earnings Alternative Fund (PTY), PIMCO’s greatest performing fund of all time.

PDO’s portfolio composition is:

- about 1/third of belongings invested in high-yield company credit score,

- 1/4th of belongings invested in worldwide bonds (of which half is in developed and half in rising markets)

- just below 1/third in mortgages (of which roughly half is non-agency residential and half industrial MBS).

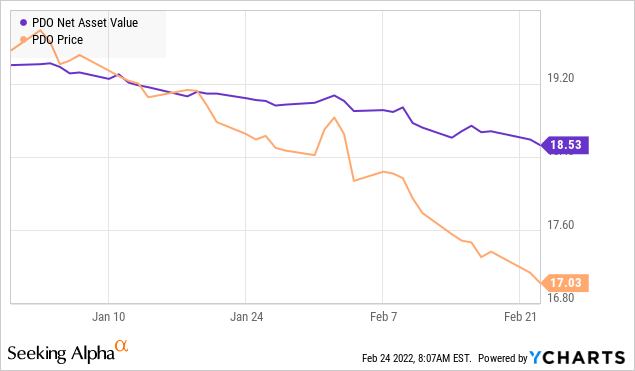

PDO, like most fastened revenue, has bought off within the face of rate of interest fears. Nicely, one investor’s concern is an revenue buyers acquire! Over the previous month, one thing occurred that we very hardly ever see: A PIMCO bond fund buying and selling at a reduction to NAV!

As we’ve been discussing, rising rates of interest are a headwind to the valuation for bonds, but in addition imply that yields are greater when bonds mature and the capital is reinvested. Over time, greater charges drive greater revenue. If you’re like me, you want greater revenue!

Why can we put money into PIMCO CEF’s? As a result of within the bond house PIMCO has a confirmed monitor document as one of many savviest managers, actively positioning the portfolio to profit from altering circumstances. Momentary twists and turns cannot be prevented, however an excellent supervisor can place a portfolio to profit in the long term as circumstances change. Rising charges do not shock anybody, when the Fed’s goal fee is at 0%, it does not take a bond guru to inform you that sometime rates of interest will in all probability go up!

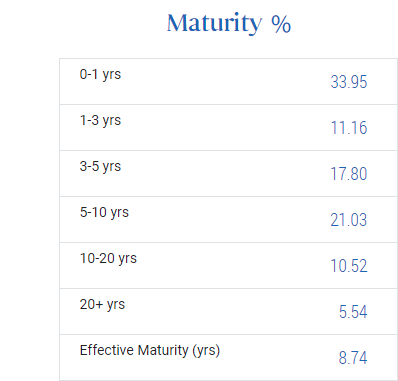

Nicely, PIMCO has positioned itself to be very versatile. Within the subsequent 12 months, practically 34% of PDO’s investments mature, which means that PDO will likely be redeploying that capital based mostly on the route the Fed takes.

PIMCO

PDO has simply lined its dividend, with net-investment revenue offering dividend protection of over 140% previously six months. As rates of interest rise, PDO will be capable to redeploy capital at greater charges, enhance dividend protection much more and supply us with one other wholesome particular dividend at year-end!

When a high quality PIMCO CEF is buying and selling at a reduction to NAV, do not assume twice! Purchase the revenue, sit again and acquire your month-to-month dividends!

Dreamstime

Conclusion

PDO and MMP are each buying and selling at a reduction in comparison with historic costs. For MMP its low cost has been round because the 2020 market crash and has continued to this present day. Total MMP is benefitting from rising oil costs and a really unitholder-friendly administration group. PDO is promoting off over considerations about rising charges, whereas really being positioned to profit from them.

I see each as on sale, bargain-priced securities worthy of including to my portfolio or rising my place. That is how I maximize the revenue in retirement and my portfolio’s output of revenue. I really like paying much less cash, for high-quality revenue.

This manner my retirement bills are taken care of and all I’ve to determine is the best way to spend all my great hours of free time. Do you’ve some hobbies you’ve got been wanting to take a look at? Locations to go see? Outdated mates to reconnect with? Earnings investing can free you from hours of worrying and attempting to time the market.

That is a profit that no different sort of investing can present you in my humble opinion.