ValerieVS/iStock by way of Getty Photos

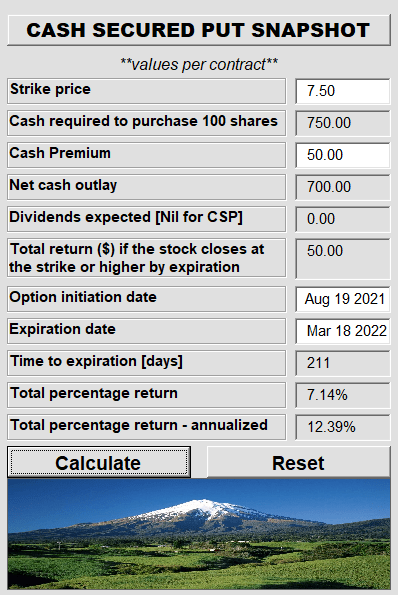

After we final coated The Necessity Retail REIT, Inc. (NASDAQ:RTL) in December, we had a mildly constructive opinion on the whole return prospects of the inventory. Again then, our pondering was that the inventory was unlikely to go up however the yield was protected. We additionally felt that the inventory provided an excellent probability at excessive earnings by way of money secured places or coated calls. The inventory did a giant dive in early March and presently is 9% beneath the place we wrote that article. After all, as choice writers, our risk-reward was a lot better. Since we had chosen the $7.50, strikes and RTL ended March 18, 2022 above $7.50, we pocketed your complete premium and made a 12.39% annualized yield.

Commerce 198 (Conservative Revenue Portfolio)

This usually is one of the best end result. The one the place a inventory drops, so much however ends above your strike at choice expiration. It’s because you then get to do one other spherical of choices at even higher premiums due to proximity of the strike and the upper implied volatility. We, nonetheless, took a cross.

Why The Change?

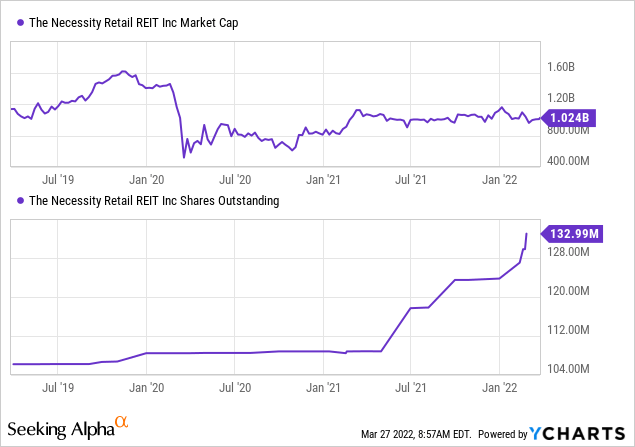

RTL introduced a significant set of acquisitions shortly after our article they usually bought $1.3 billion price of properties whereas concurrently disposing $261 million price. The tendencies had been constructing leased to Sanofi (SNY). There are a few factors we wish to make about that. The primary being that this can be a actually massive buy for RTL. The market capitalization was nearly $1.0 billion when this occurred, so including one other $1.0 billion in properties clearly strikes the dial. The majority of this was financed by property stage debt, though there was a small quantity of direct fairness issuance to the sellers ($53 million). We might observe although that RTL had ready for this by furiously issuing fairness earlier than the occasion (observe share will increase) in order that further leverage enhance could be modest.

In response to RTL, that is accretive to adjusted funds from operations (AFFO) and can elevate close to time period leverage.

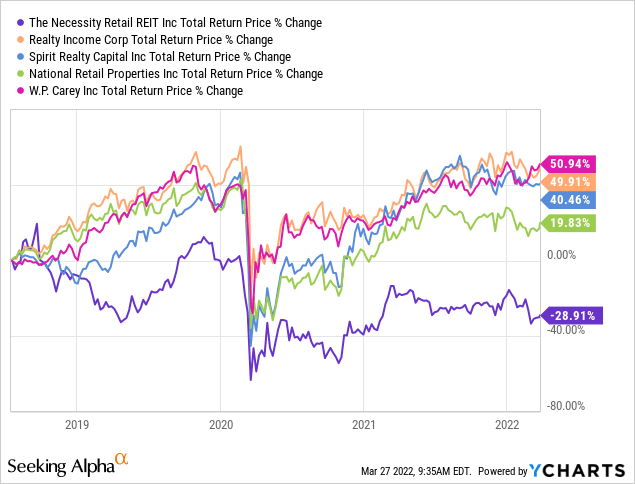

We’re fairly conversant in this exterior mannequin of administration the place development in dimension of the portfolio is emphasised over all different metrics. This can be a nice mannequin for exterior administration and it’s a nice mannequin for writing defensive money secured places because the inventory just about by no means goes up. It’s a unhealthy mannequin for purchase and maintain buyers.

The important thing cause is that for those who situation sufficient shares at any value, that finally turns into your NAV. That’s simply the mathematics of it. We anticipate externally managed REITs to do that. That mentioned, we nonetheless anticipate some discretion and a few consideration to NAV/value when issuing shares. We have now about 30% of widespread shares issued at higher than 40% low cost to NAV. This pace erodes the margin of security and makes it troublesome to even time trades on melting ice cubes. We might additionally take that “accretive” phrase within the press launch with an oz of salt (hypotension runs within the household). That refers solely to the transaction itself at a 7.13% money cap charge which is financed predominantly by debt. It utterly ignores the tens of millions of shares that had been issued earlier than that at a 12% AFFO yield to permit this transaction. That’s the reason estimates for subsequent yr’s (2022) AFFO are down 5% vs. the place they had been in June 2021.

Most popular Shares

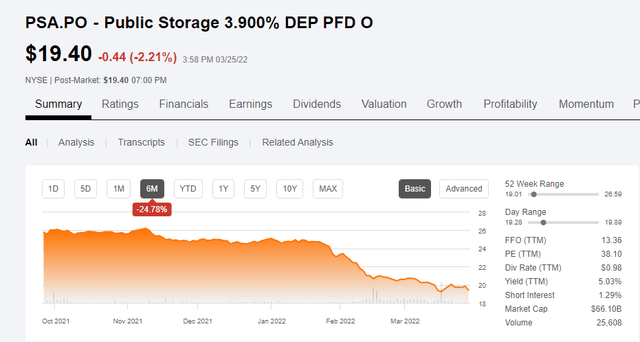

Again in September 2021 we had been repeatedly warning buyers in regards to the dangers of rising rates of interest. We urged that the excessive yield of The Necessity Retail REIT, Inc. 7.375% CUM PFD C (NASDAQ:RTLPO) and The Necessity Retail REIT, Inc. 7.50% PFD A (NASDAQ:RTLPP) had been wonderful bulwarks towards the approaching storm.

One side we like about each these is that yield on par is reasonably robust and within the case of regularly rising rates of interest these two won’t be damage as a lot. That is fairly the alternative of say Public Storage 3.900% DEP PFD O (PSA.PO), which has a coupon of three.9% and presently yields simply 3.3%.

Supply: RTL Most popular Shares Supply Good Buffer For Rising Charges

That suggestion labored like a allure. Whereas each RTLPP and RTLPO have delivered a few 2% unfavorable whole return, they’ve demolished the low yielding, PSA.PO and numerous different yield traps.

PSA.PO shares (Looking for Alpha)

Verdict

RTL’s tempo of dilution has caught us a bit off guard right here. Whereas this probably slows down sooner or later, we’re nonetheless being cautious. If we needed to get lengthy RTL, it could nonetheless be by way of the $7.50 money secured places or coated calls. At the moment there are additionally plenty of high quality REITs which might be higher threat adjusted bets in our opinion and therefore we didn’t reinitiate positions.

The popular shares RTLPP and RTLPO, nonetheless provide worth and the massive share rely dilution alongside a much bigger property base, add to the enchantment of those shares. Each are much less relative values as we speak, as even in the popular share house, way more points are engaging as we speak versus 7 months again.

Please observe that this isn’t monetary recommendation. It could look like it, sound prefer it, however surprisingly, it isn’t. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.