Markets Week Forward: Nasdaq Slips, Gold Steadies, Central Banks on Faucet

Really useful by Nick Cawley

Constructing Confidence in Buying and selling

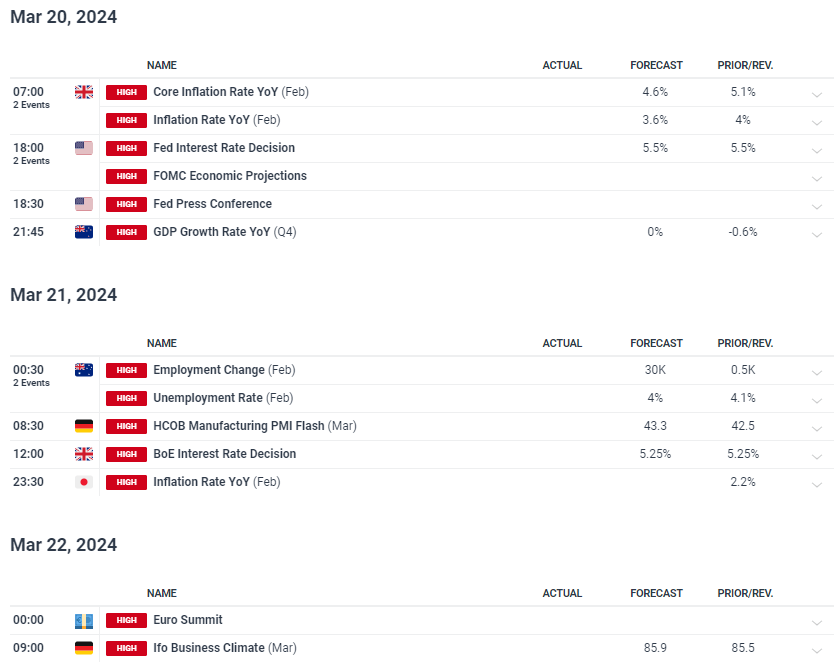

The financial knowledge and central financial institution calendars are packed full subsequent week with a variety of probably market-moving releases. 5 central banks will announce their newest financial coverage choices, with the Financial institution of Japan probably the most fascinating. Markets presently see a 40% likelihood that the BoJ will hike charges by 10 foundation factors as the most recent Japanese wage negotiations present giant hikes to employees’ pay throughout numerous industries.

Japanese Wages Rise to a 30-Yr Excessive, Fuelling BoJ Charge Hypothesis

Together with the central financial institution bulletins, there are vital knowledge releases all through the week with UK inflation, German Manufacturing PMIs, and Euro Space sentiment PMIs the standouts.

For all market-moving financial knowledge and occasions, see the DailyFX Calendar

The US greenback rallied Thursday after the most recent US PPI knowledge confirmed wholesale worth inflation growing. Because it stands, it’s unlikely that this launch will overly fear the Federal Reserve but it surely serves as a reminder that worth pressures stay sticky within the US.

US Greenback Soars on Inflation Dangers as Fed Looms; EUR/USD, GBP/USD, USD/JPY

Markets Overview – Gold, Nasdaq, Nvidia, MicroStrategy

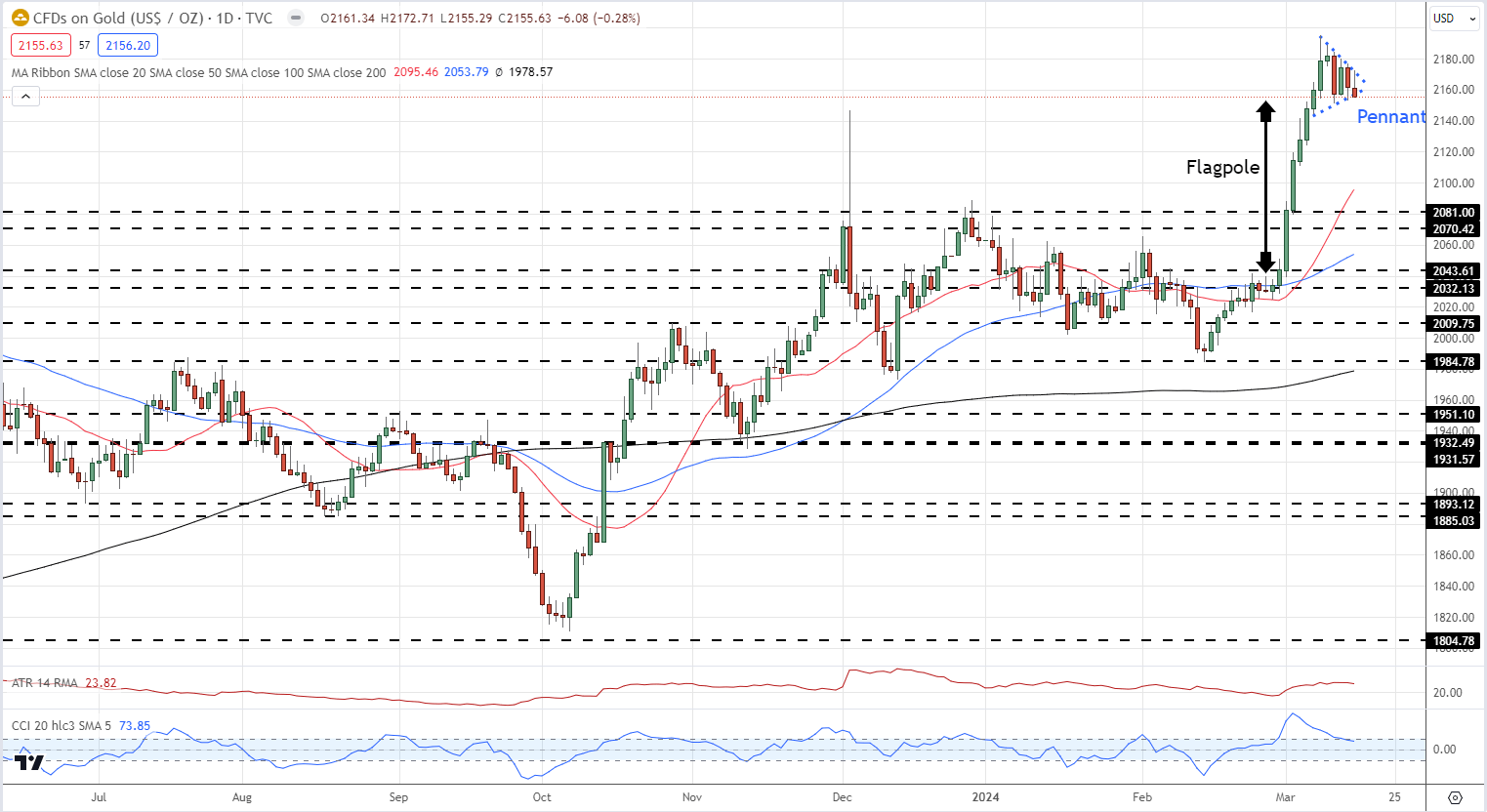

Gold has been underneath strain this week as a result of US {dollars} rebound, though the dear steel stays close to a multi-decade excessive. Technical analysts will probably be intently watching a Bullish Pennant formation that’s almost full. The following few days will see if this sample performs out.

Gold Each day Worth Chart

Discover ways to commerce gold with our complimentary information:

Really useful by Nick Cawley

Commerce Gold

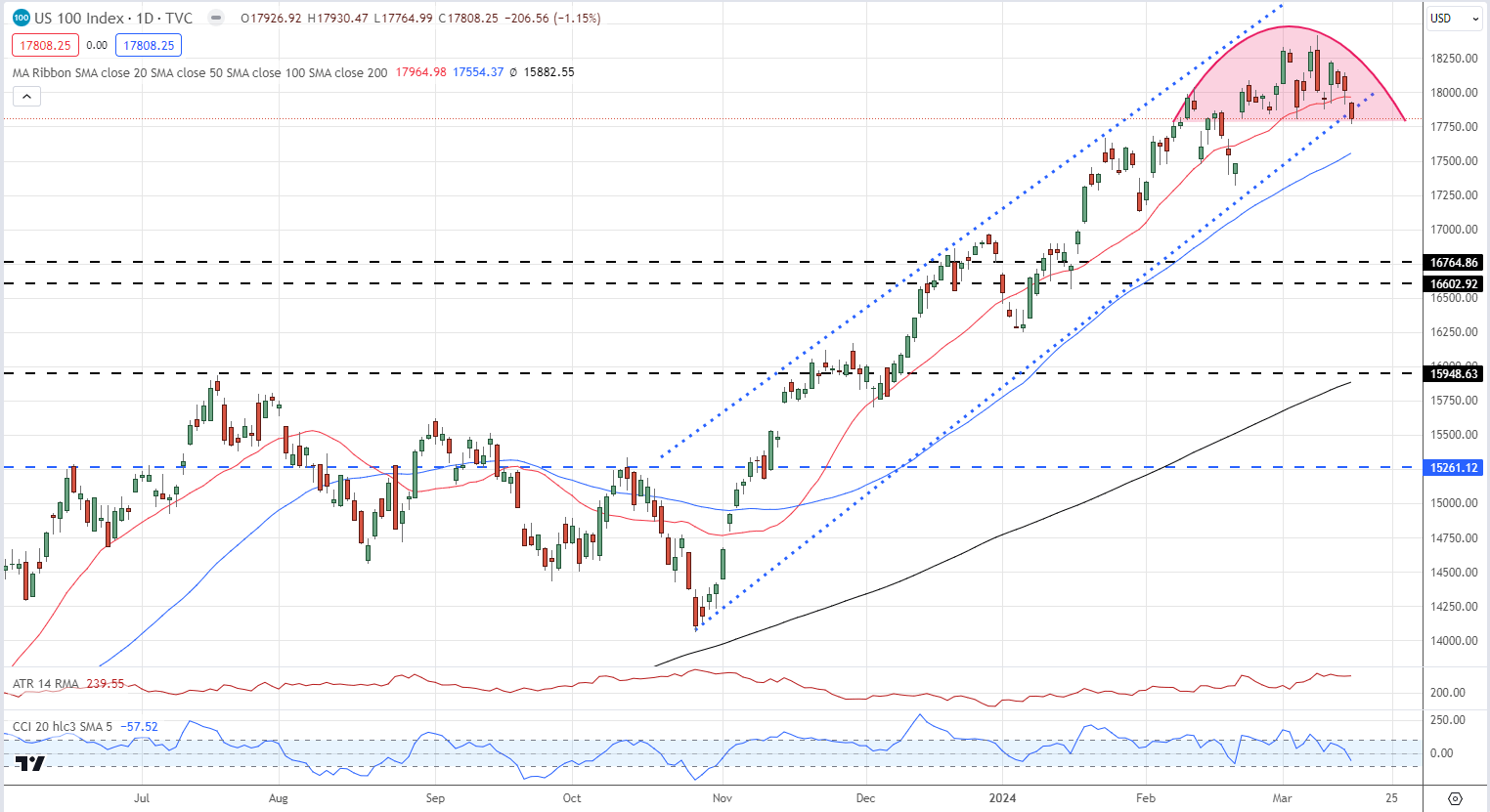

The Nasdaq ended the week decrease and is beginning to fall out of a multi-month ascending development. The tech bellwether can also be exhibiting indicators of topping out and except Fed Chair Powell turns dovish on the FOMC assembly on Wednesday, the Nasdaq might proceed to battle.

Nasdaq 100 Each day Worth Chart

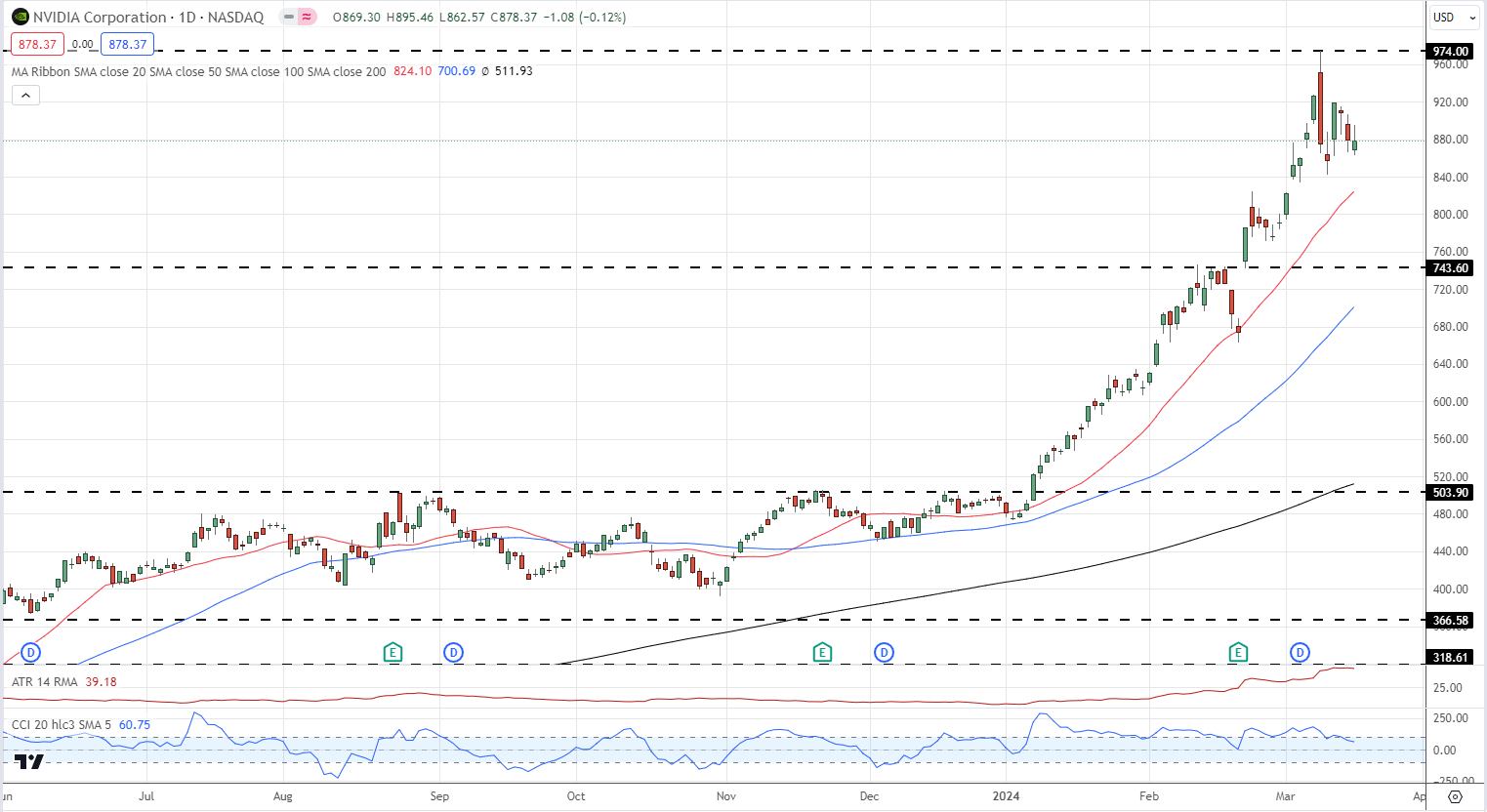

One of many largest corporations within the Nasdaq, Nvidia, can also be struggling. The chip big balked at just below the $1,000 degree on March eighth and regardless of a few short-term rallies, Nvidia ended decrease on the week.

Nvidia (NVDA) Each day Worth Chart

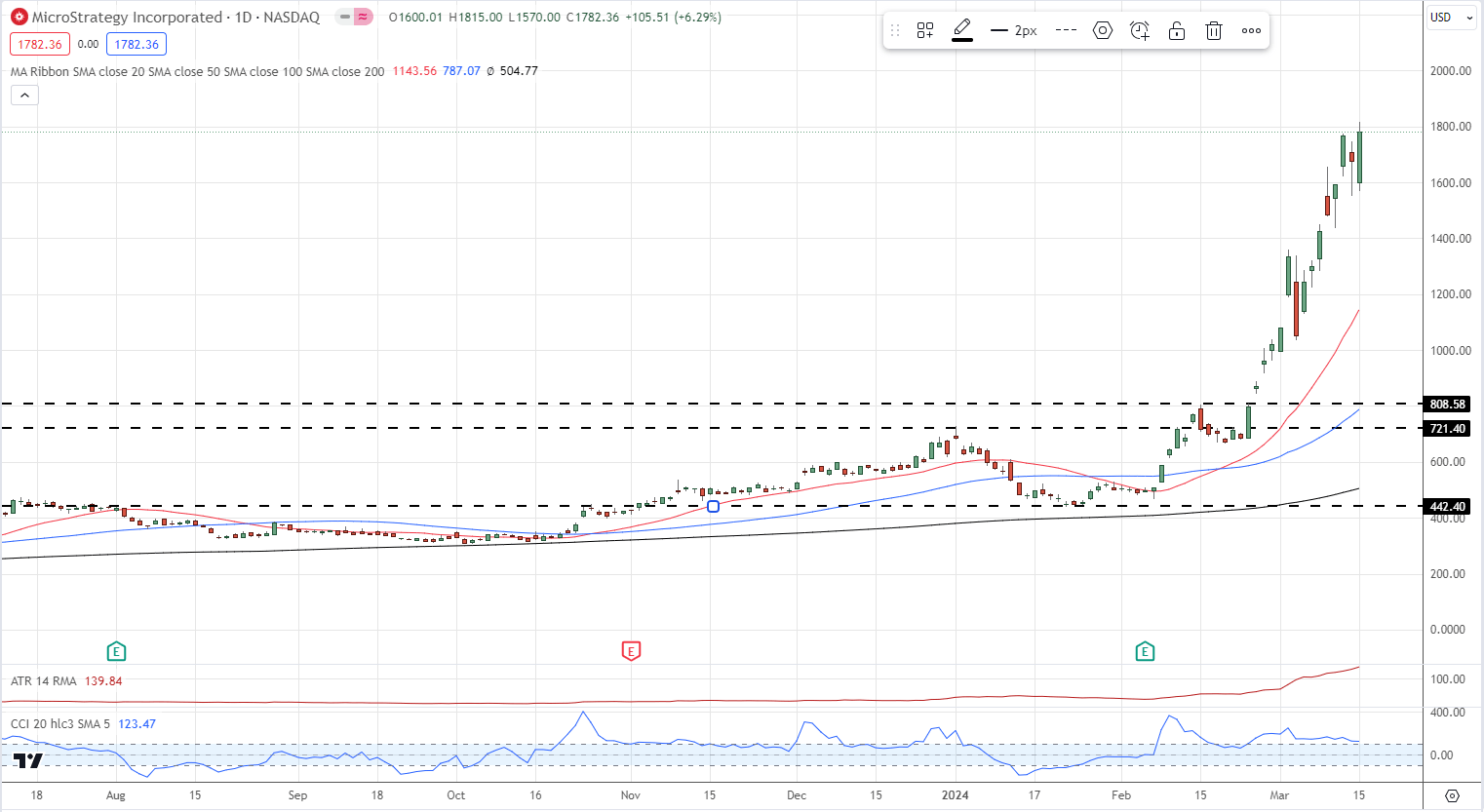

MicroStrategy has been rallying laborious in current weeks, on the again of heavy ETF demand for Bitcoin. MicroStrategy holds in extra of 200,000 Bitcoin on its books and continues to purchase BTC regularly. MSTR posted a contemporary excessive once more on Friday, regardless of Bitcoin promoting off with speak {that a} short-squeeze could also be taking place after merchants piled in on the brief MSTR/lengthy BTC arbitrage. These positions are underwater and merchants’ losses are mounting up.

MicroStrategy (MSTR) Each day Worth Chart

All Charts utilizing TradingView

Really useful by Nick Cawley

Traits of Profitable Merchants

Technical and Basic Forecasts – w/c March 18th

British Pound Weekly Forecast: GBP/USD May Wrestle as Charge Setters Convene

This week will deliver coverage choices from central banks on either side of GBP/USD.

Euro (EUR/USD) Forecast – Fed and BoE Will Drive EUR/USD and EUR/GBP Worth Setups

Euro merchants will probably be wanting on the Federal Reserve and the Financial institution of England this week to assist gauge EUR/USD and EUR/GBP future worth ranges.

Gold Worth Forecast: Fed in Highlight – Bullish Explosion or Crash Forward?

The Federal Reserve’s resolution and financial coverage steerage within the coming week would be the focus of monetary markets. A hawkish consequence may very well be constructive for the U.S. greenback and yields, however bearish for gold costs.

US Greenback Forecast: FOMC in View – Setups on EUR/USD, GBP/USD, USD/JPY

The FOMC will ship updates on financial coverage and reveal the most recent ‘dot plot’ which can affirm whether or not Fed officers keep their prior stance of three cuts in 2024

All Articles Written by DailyFX Analysts and Strategists