Markets managed to carry on to early lows with out the promoting stress from earlier final week.

Whereas the shopping for was comparatively modest, it nonetheless wasn’t sufficient to see a return above 20-day MAs for indexes, though there’s a good likelihood for a second chew of the cherry this week.

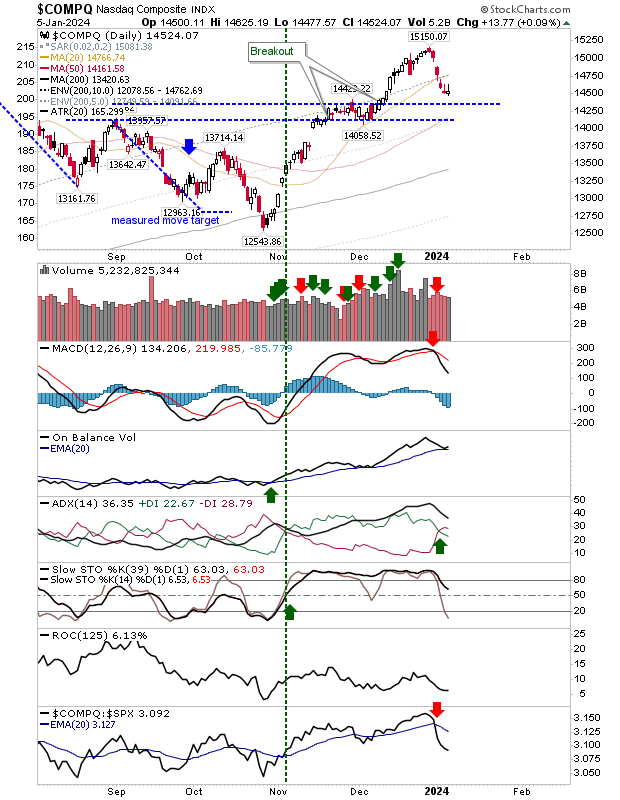

For the () there was an “inverse hammer” at oversold near-term stochastics, however not at mid-level intermediate stochastics – a stage typically related to assist throughout bull markets.

There are ‘promote’ indicators within the MACD and On-Steadiness-Quantity to beat however different technical helps are wholesome.

IWM-Each day Chart

The is caught midway between its 20-day MA and assist outlined by the slim November consolidation.

Whereas this can be a little bit of a ‘no-mans’ land, I nonetheless like the present stage for a rally, however do not be shocked if there may be an intraday spike right down to the November congestion stage.

There’s solely (a well-established) MACD ‘promote’ set off to beat, whereas the relative underperformance to the is much less of a priority.

COMPQ-Each day Chart

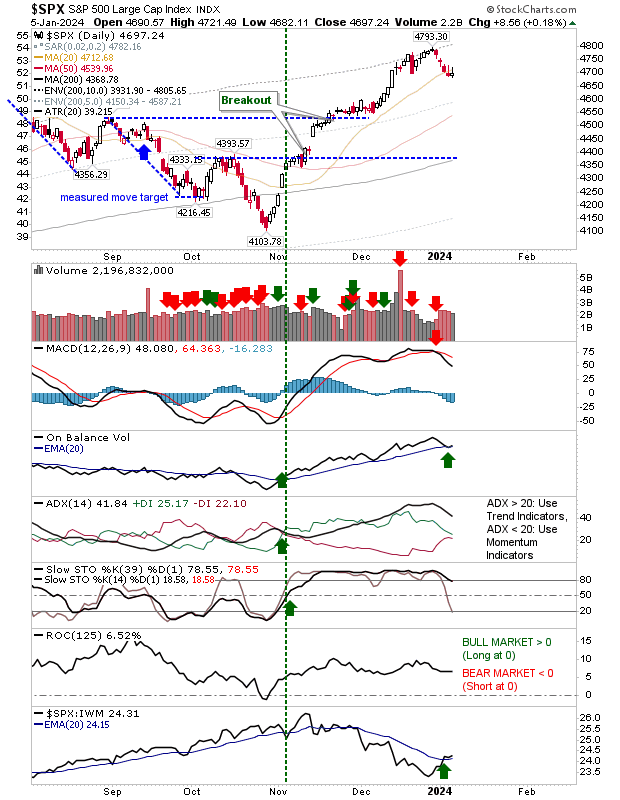

The S&P 500 has been the dominant index for the latter a part of 2023 and is gaining relative efficiency to look indexes in 2024.

The index is effectively above November congestion and solely has the 20-day MA to contemplate.

And of the core indexes, it is the very best positioned to recuperate the shifting common. As with the Nasdaq and Russell 2000, it has a MACD set off ‘promote’ to beat, however different technicals are all in good condition.

SPX-Each day Chart

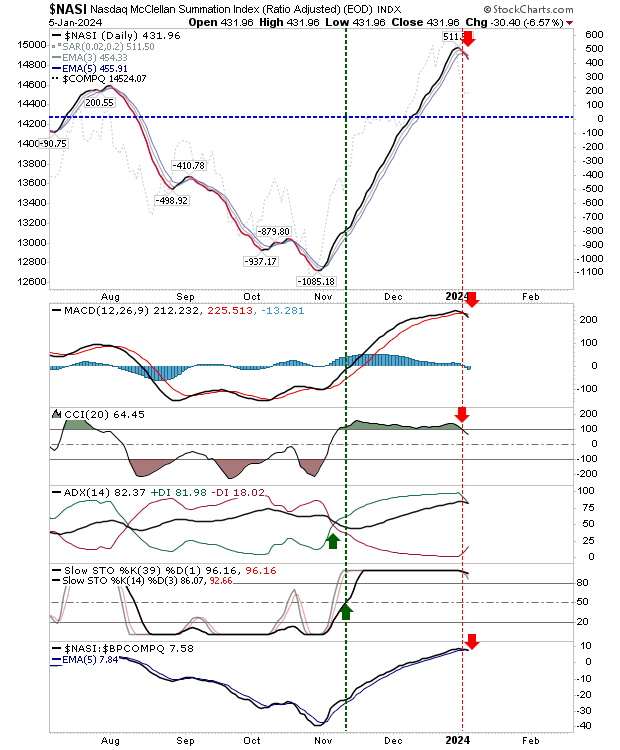

One metric I will be watching is the Nasdaq Summation Index ($NASI). It is a dependable sign set off and after a interval of constant power since November, it has switched to a ‘promote’ set off at a stage usually related to Nasdaq tops.

It could not result in any important decline within the Nasdaq, however a interval of sideways motion wouldn’t be stunning.

NASI-Each day Chart

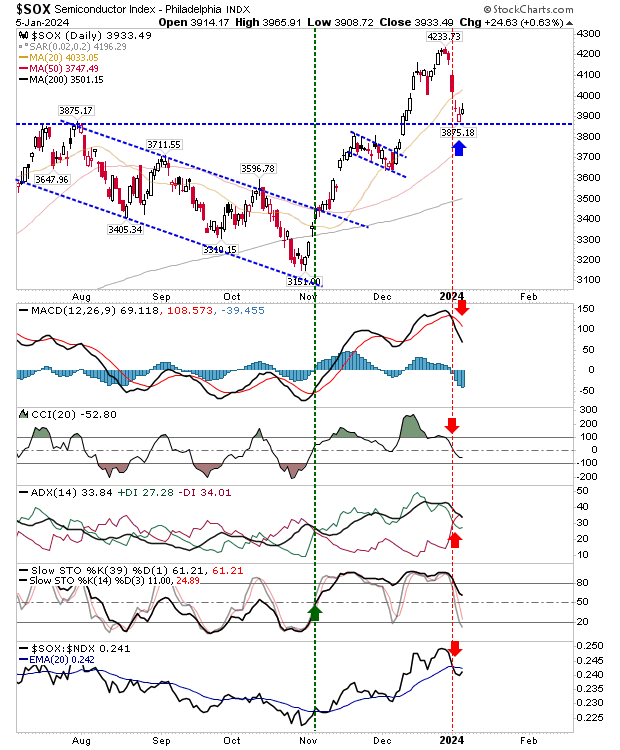

The opposite index to observe is the . It has come again to July breakout assist and bounced off it, however not very strongly.

If it falls beneath 3,875, then look ahead to a transfer again to the prior swing low at 3,150, which might tie in with the above ‘promote’ sign within the Nasdaq Summation Index.

SOX-Each day Chart

For this week, look ahead to weak spot in Tech indexes that would profit the S&P 500 with rotation out of speculative Tech shares, though a falling tide sinks all ships.

If indexes can get above their 20-day MAs, then we’re wanting on the challenges of current swing highs.