The undercut its 50-day MA as technicals edged internet bearish. Nevertheless, stochastics [39,1] solely simply dropped beneath the 50 mid-level (on the each day timeframe), so this may very well be a bullish pullback ‘purchase’; an in depth above 19,350 would successfully verify a brand new ‘bear entice’.

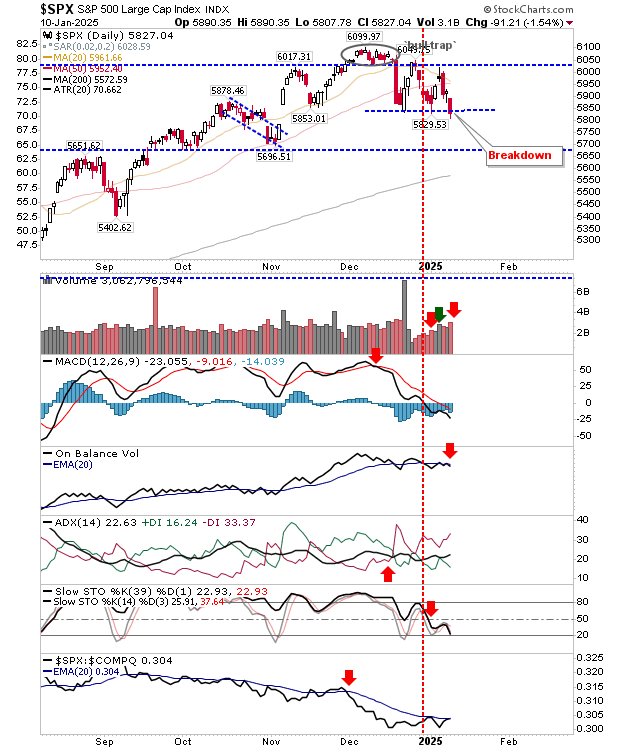

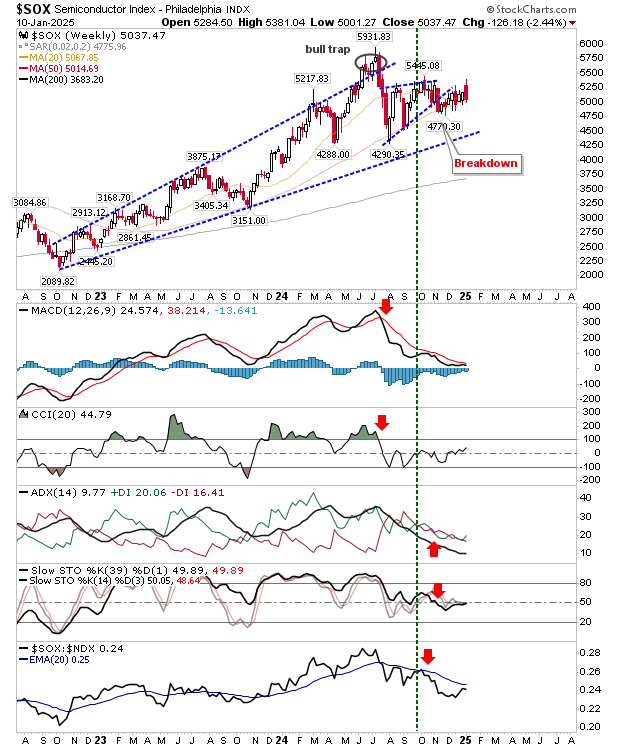

The undercut the December swing low with a brand new breakdown on increased quantity distribution. Subsequent goal is the November swing low close to horizontal assist of 5,670.

Technicals are internet bearish, though stochastics should not absolutely oversold and weak spot within the MACD histogram is increasing – so tomorrow may see additional draw back.

Finish-of-week breakdowns for the () and ($DJIA) put strain on averages for the week forward.

There is a chance for ‘bear traps’ subsequent week however follow-through losses at present would probably kill that likelihood off.

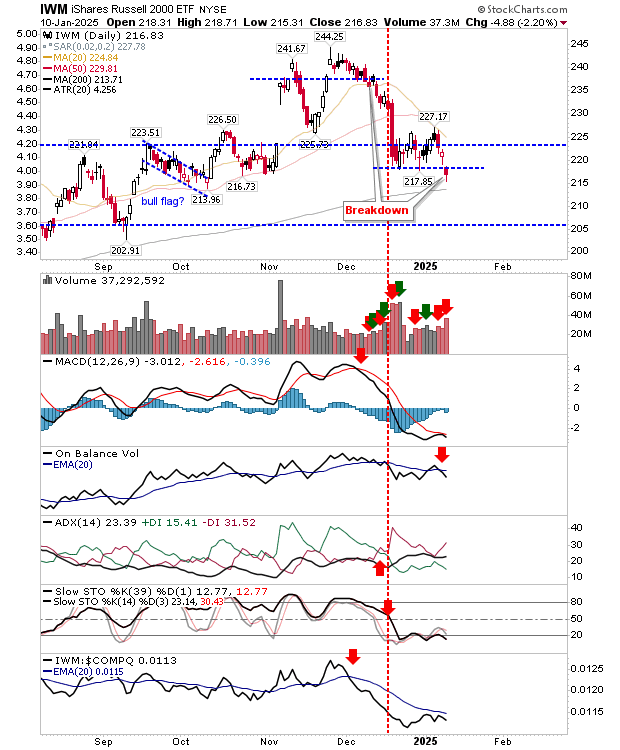

The Russell 2000 has the perfect likelihood to ship on the ‘bear entice’ given the proximity of the 200-day MA.

Technicals are internet bearish, however the MACD is on the right track for a weak ‘purchase’ sign. An in depth above $219 would verify the entice, however a sustainable reversal will not come till there’s a break of the 20-day MA.

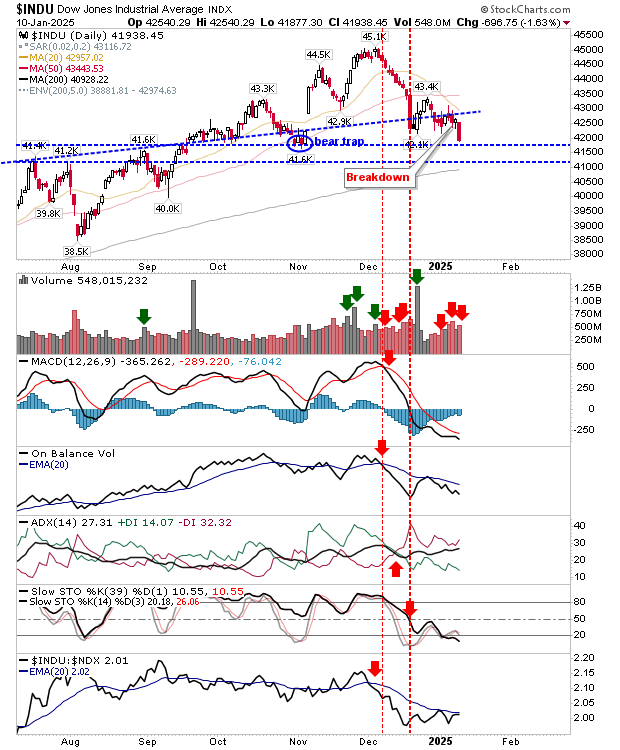

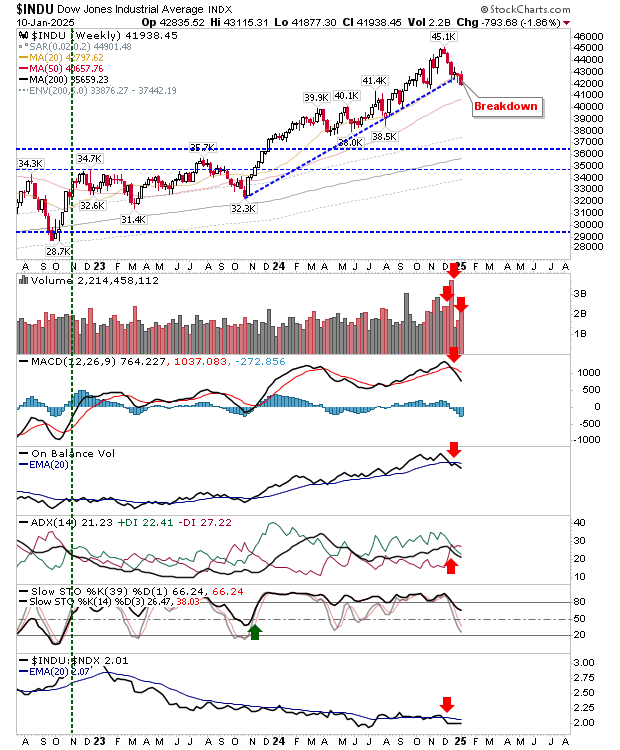

An unpleasant day for the Dow Industrials led to the breakdown within the weekly timeframe. There’s a likelihood the November swing low (a ‘bear entice’) will play as assist, though increased quantity promoting ranked as distribution on each each day and weekly timeframes. If the November swing low fails as assist, then the 200-day MA (or 50-week MA) is the subsequent port of name.

The ultimate chart I will present is the weekly . It has been hugging the 50-week MA for a number of weeks, however it appears primed for an enormous weekly loss.

A difficult week lies forward for indices. With weekly breakdowns in some markets, it is probably going to take a number of weeks to see how this performs out. It has been some time since we’ve got seen an undercut of 200-day MAs in indices, and it is solely pure to count on such undercuts sooner relatively than later.