The Nasdaq 100, a house to 100 cutting-edge firms, is a snapshot of innovation in motion. These aren’t your run-of-the-mill companies; they’re the vanguards of expertise, communication, and extra. From the tech titans to the disruptors, this index mirrors the cradle of innovation, representing the forefront of progress.

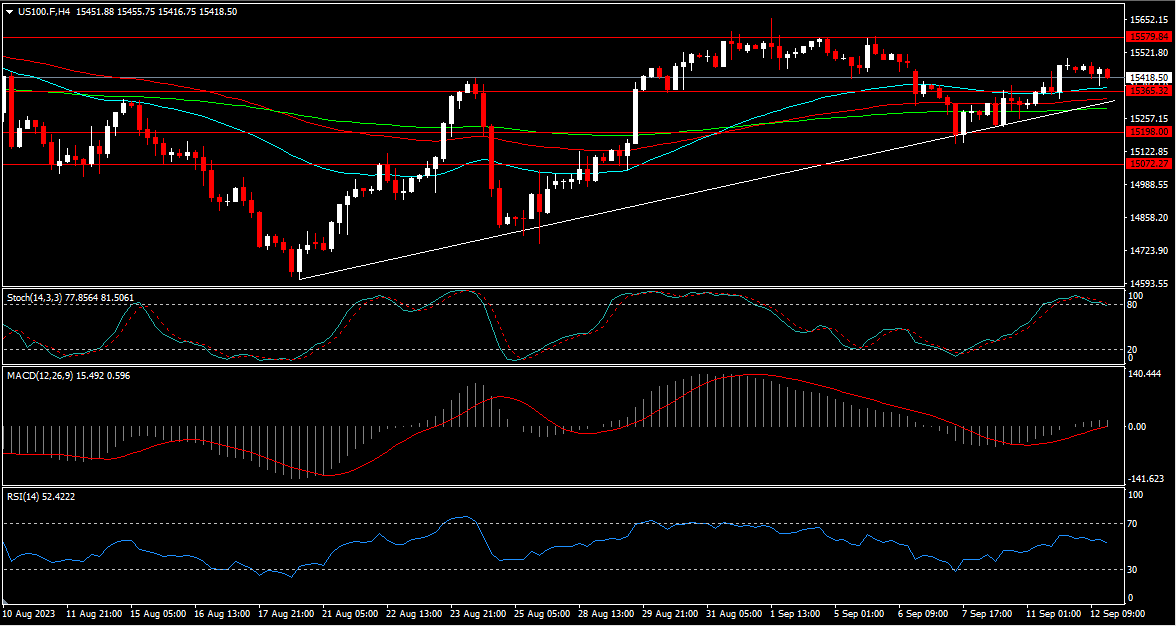

As of September 12, 2023, the Nasdaq 100 stands tall at 15,465. A exceptional journey unfolds from its latest previous – an ascent that began in August 2023 from the low at 14,612. A resilient climb of 4.9% has adopted, surmounting resistance ranges, together with the 50, 100, and 200 transferring averages on the 4 hour timeframe. It has even breached the formidable psychological barrier at 15,500. Now, it’s approaching the July 2023 excessive level of 16,059. Will it conquer this peak, unveiling additional potentialities at 16,300 and 16,600?

The technical indicators inform a bullish story. The MACD alerts optimistic momentum, staying above the zero line and sign line. The RSI additionally leans bullish, above the 50 degree. But, a phrase of warning – the Stochastic indicator lingers in overbought territory, suggesting a potential pause or reversal.

Fundamentals are essential. The U.S. financial system’s efficiency issues tremendously. It confirmed an annual GDP progress charge of two.6% in June 2023, surpassing the earlier studying, and a slight enhance within the unemployment charge coming in at 3.8% August 2023. Nonetheless, the shadow of inflation, standing at 3.2% in August 2023, looms, albeit partly on account of transitory components like rising vitality costs.

Earnings stories and steering of the Nasdaq 100 elements are the heartbeat of this index. In Q2 2023, these firms’ Earnings Per Share elevated by a formidable 19.11%. Earnings and income progress charges surpassed estimates, showcasing the power of sectors like expertise and healthcare. Optimistic steering for the long run instils confidence.

So, what’s the decision? Within the quick time period, optimism prevails, pushed by a technical uptrend, sturdy earnings, and optimistic threat sentiment. Nonetheless, there are warning indicators – profit-taking, inflation, and unsure threat sentiment might pose short-term challenges. Due to this fact, we cautiously charge the index as impartial to bullish within the quick time period, recognizing the ever-changing market dynamics.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.