Just a little over three weeks in the past, we discovered for the by utilizing the Elliott Wave (EW) Precept,

“… though we can not predict or rule out any extension of the wave from the Might 26 and June 23 lows, we anticipate the inexperienced W-3/c to complete within the subsequent few days. Since EW evaluation relies on value motion, we don’t must second-guess; as a substitute, we will depend on our warning ranges to determine when the following corrective section—the inexperienced W-4—begins.

Quick ahead, and the index exceeded the 200.00% extension goal zone of 22915-23004, regardless of much more unfavourable divergences (purple dotted arrows). Nonetheless, it didn’t drop under the grey (2nd) warning stage for the Bulls at 22587, because the low on July 16 was 22669. See Determine 1 under. Due to this fact, we stayed lengthy. Moreover, when a Fibonacci extension is exceeded, the market typically strikes towards the following greater stage, which on this case is the inexperienced 223.60% stage at 23545.

Determine 1. NDX day by day chart with our most well-liked Elliott Wave depend and a number of other technical indicators

The index peaked final Thursday at 23589, simply 0.19% under the inexperienced 223.6% Fib extension, and dropped to Friday’s low of 22673, falling under our beforehand set third (orange) warning stage of 22953.

Because the EW relies on value and we solely commerce value, we should depend on value ranges fairly than information or opinions for market entries and exits. Our EW evaluation and warning ranges present precisely that. On this case, falling under the orange warning stage signifies there’s now a 75% likelihood that the inexperienced W-4 is underway. Corrections all the time transfer in not less than three waves (abc). Due to this fact, Friday’s low was most probably the grey W-a of the inexperienced W-4, and now the multi-day grey W-b, to ideally 23025-380, is occurring. We anticipate the present countertrend, also called a “dead-cat bounce,” to be bought off.

This remaining W-c ought to attain 21650-22200, relying on the place precisely W-b will high and what Fib extension the W-c will take (from 1.0 to 1.62 x W-a). Regardless, the W-c goal zone is at present exactly within the best inexperienced W-4 goal zone. Please observe that the day by day RSI5 is already getting into the low-risk/high-reward purchase zone. As soon as the potential inexperienced W-4 bottoms out, the following inexperienced W-5 ought to rally to 24560-25575. Remember that for the reason that index is now doubtless in a corrective section, the warning ranges are for the bears. These are set at (blue) 22972, (grey) 23176, (orange) 23345, and (purple) 23589. We’ll use these ranges equally to how we did in the course of the previous Bull run.

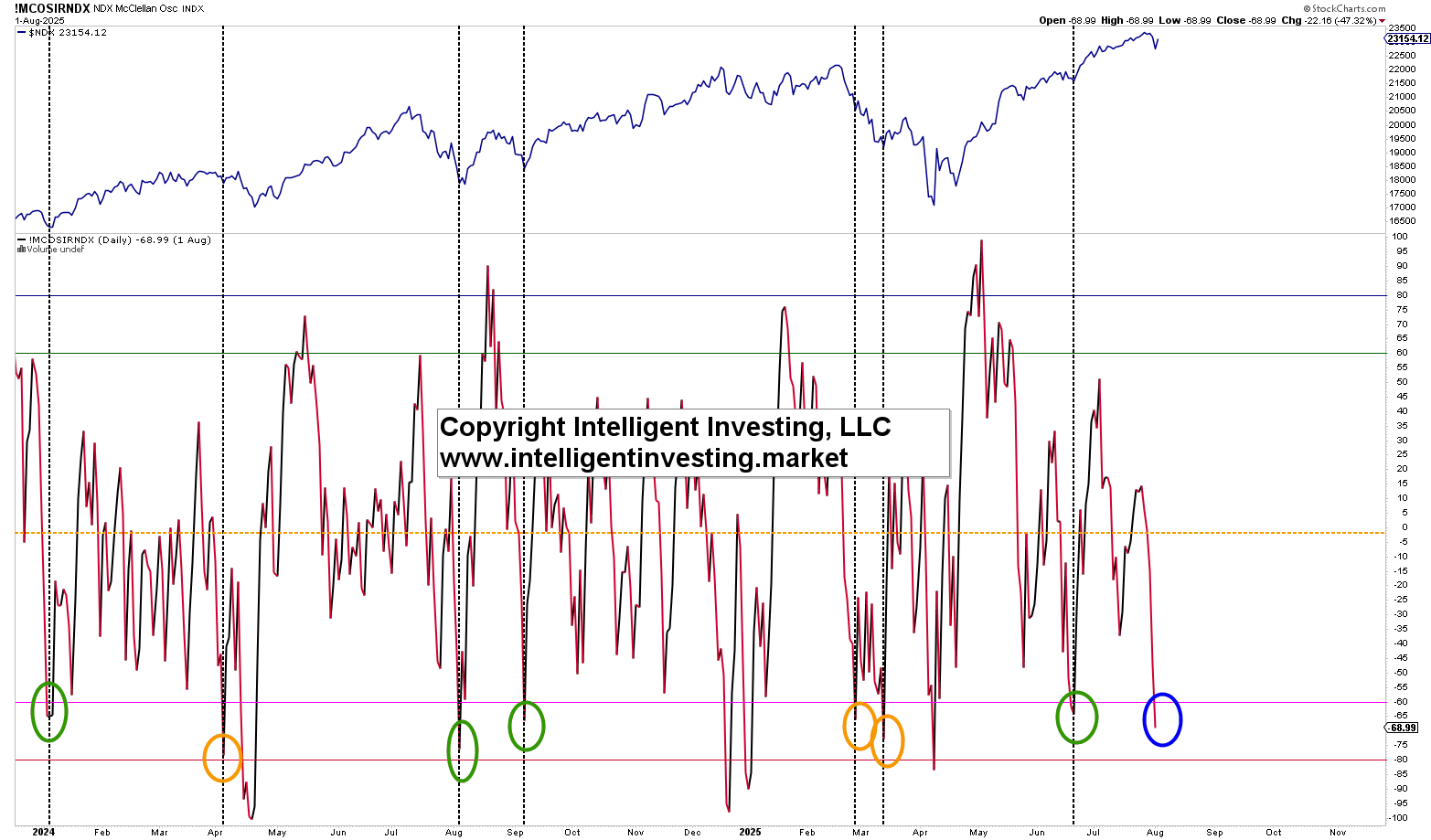

Determine 2. NDX McClellan Oscillator.

Lastly, the McClellan Oscillator for the NDX—a market breadth indicator primarily based on the variety of shares advancing (+) or declining (-)—closed at -69 on Friday. See the blue circle in Determine 2 above. Earlier day by day closes between -60 and -80 since 2024 present that in 4 instances, a brand new rally began (inexperienced circles), whereas in three instances, it was only a bounce, adopted by a decrease low, after which the rally started (orange circles). Due to this fact, the chances favor a brand new rally sooner fairly than later, consistent with our EW depend. Excluding the February-April >20% decline, the probabilities of a renewed rally grow to be much more favorable.