[ad_1]

S&P 500 OUTLOOK:

- The S&P 500 and Nasdaq 100 completed the way in which barely decrease as bullish momentum continued to fade

- Quarterly earnings from megacap tech will steal the limelight subsequent week

- Merchants ought to focus their consideration on monetary outcomes from Microsoft, Alphabet, Meta and Amazon within the coming days

Really useful by Diego Colman

Get Your Free Equities Forecast

Most Learn: USD/JPY Jumps on US PMI Knowledge Beat as US Treasury Yields Resume Rally

Value motion has been unimpressive for the S&P 500 and Nasdaq 100 in latest days regardless of Tesla’s steep sell-off following disappointing quarterly efficiency. Each indices have lacked clear directional conviction, no less than since early April, although they headed modestly decrease this week, with the previous sliding 0.10% to 4,133.5 and the latter dropping 0.6% to 13,000.8.

Within the grand scheme of issues, shares have been buoyant regardless of severe headwinds comparable to excessive charges, elevated inflation, slower progress and shrinking income, however the constructive impetus, which led to a strong rally within the main U.S. fairness benchmarks since mid-March, is clearly waning. It seems that traders are ready to see extra company earnings earlier than committing further capital to threat belongings.

S&P 500 & NASDAQ 100 CHART

Supply: TradingView

On that notice, merchants may have a chance to raised assess the well being of Company America and the broader outlook within the coming classes when a number of massive corporations disclose their previous-quarter monetary outcomes and challenge forward-looking commentary.

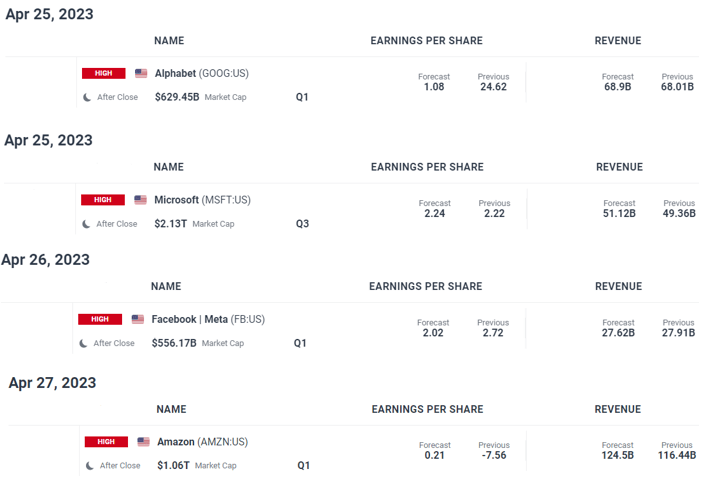

Whereas there are lots of key releases to concentrate to, the highlights of the week forward can be earnings reviews from Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META) and Alphabet (GOOGL), the guardian firm of Google. Collectively, these names account for practically 14% of the S&P 500’s weight, so they might definitely set the near-term market path and buying and selling bias.

Beneath is a abstract of subsequent week’s key company reviews price watching, however for a extra full checklist of upcoming occasions, together with Wall Avenue’s expectations, take a look at the DailyFX’s Earnings Calendar.

Supply: DailyFX Earnings Calendar

| Change in | Longs | Shorts | OI |

| Each day | -7% | 2% | -1% |

| Weekly | 0% | 5% | 3% |

Megacap tech has been one of the crowded trades in 2023, maybe on the idea that the sector will proceed to be resilient even when financial progress slows down extra noticeably later this yr. This has helped maintain Wall Avenue afloat in latest months regardless of the banking sector turmoil that erupted in March.

To make sure sentiment stays benign, market heavy hitters should ship sturdy outcomes and, extra importantly, constructive steerage, in any other case, the S&P 500 and Nasdaq 100 might be in for a impolite awakening.

When analyzing incoming earnings reviews from the likes of Microsoft and Alphabet, there’s one other variable merchants ought to take into account: administration’s outlook for synthetic intelligence (AI) and associated merchandise.

Microsoft’s fast foray into AI has been the speak of the city and has triggered a race for management of what might be the subsequent massive revolution within the tech trade. If key gamers within the house fail to stay as much as the hype and traders’ excessive expectations or are unable to plan a transparent technique to monetize the expertise, Wall Avenue’s endurance may run out, setting the stage for a significant sell-off.

Written by Diego Colman, Contributing Strategist for DailyFX

[ad_2]

Source link