[ad_1]

Up to date on March eighth, 2023 by Aristofanis Papadatos

Whitestone REIT (WSR) has three interesting funding traits:

#1: It’s a REIT so it has a good tax construction and pays out the vast majority of its earnings as dividends.

Associated: Checklist of publicly traded REITs

#2: It’s a excessive yield inventory primarily based on its 5.1% dividend yield.

Associated: Checklist of 5%+ yielding shares

#3: It pays dividends month-to-month as an alternative of quarterly.

Associated: Checklist of month-to-month dividend shares

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Whitestone REIT’s trifecta of favorable tax standing as a REIT, a excessive yield, and a month-to-month dividend make it interesting to particular person traders.

However there’s extra to the corporate than simply these elements. Hold studying this text to be taught extra about Whitestone REIT.

Enterprise Overview

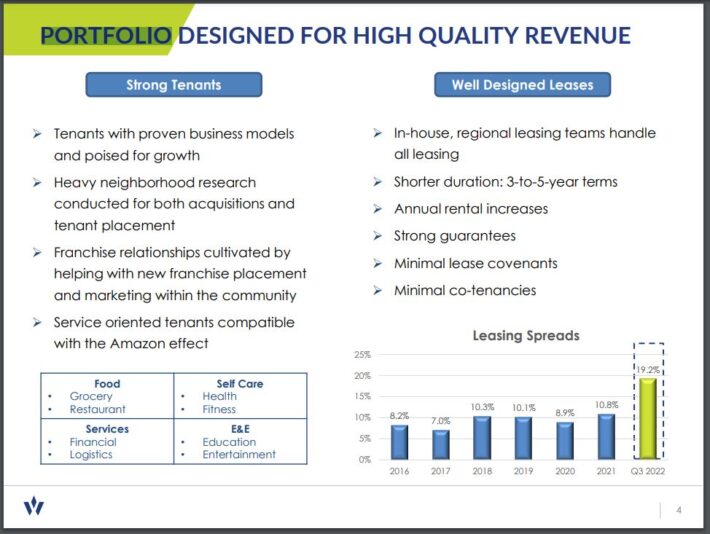

Whitestone is a industrial REIT that acquires, owns, manages, develops, and redevelops properties it believes to be e-commerce resistant in metropolitan areas with excessive charges of inhabitants progress. The REIT presently owns 57 properties with about 5.1 million sq. toes of gross leasable space.

Its properties are situated primarily within the southern United States, in areas with favorable demographics, corresponding to earnings and financial progress. The belief’s properties are situated primarily in Phoenix and Houston, with smaller allocations to different main cities in Texas.

The corporate’s acquisition standards embody community-centered properties which are visibly situated in creating and various areas. Properties are usually within the 50,000-200,000 sq. foot vary, and from $5 million to $180 million in value.

Whitestone believes its funding properties are “e-commerce resistant” as a result of they’re go-to locations that present needed items.

Supply: Investor Presentation

Furthermore, the corporate believes these are services and products that aren’t available on-line. In actual fact, Whitestone sees itself because the least prone to on-line substitute amongst its peer group.

Its properties are situated in densely-populated, high-income areas, that are experiencing robust progress. Its portfolio is very diversified, with about 1,500 tenants. The highest 5 industries are restaurant & meals service (23% of annual base lease), grocery (9%), monetary providers (9%), salons (8%), and medical & dental (8%).

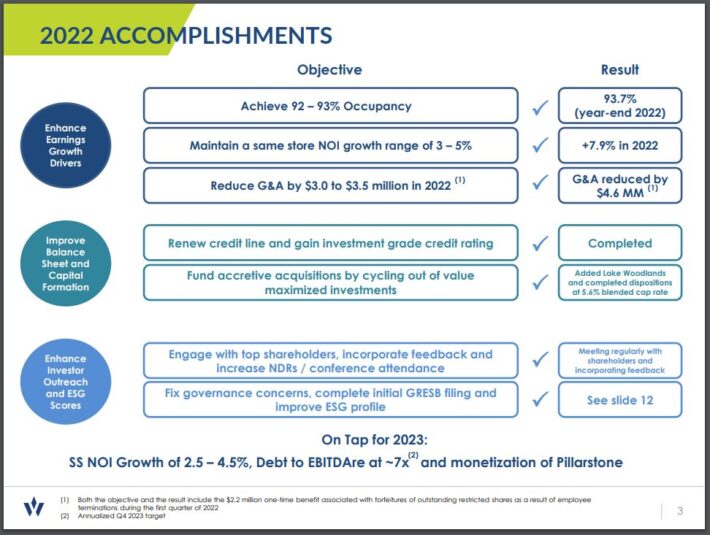

Whitestone reported its fourth-quarter outcomes on 2/28/23. For the quarter, the REIT witnessed an all-time excessive occupancy charge of 93.7% versus 91.3% within the prior yr’s quarter. Whitestone grew its income by 4.8% and its funds from operations (“FFO”) per share by 9.5%, from $0.21 to 0.23. Similar-store web working earnings (“SSNOI”) rose 7.1% whereas rental charge progress was 23.5%, up from 14.9% a yr in the past, pushed by a soar in rental charge progress in renewal leases (23.2% vs. 15.7% a yr in the past) and new leases (24.3% vs. 11.2% a yr in the past).

Whitestone offered lackluster steerage for 2023, anticipating 2.5%-4.5% progress of same-store web working earnings and FFO per share of $0.95-$0.99. The REIT forecasts an ending occupancy of about 94% and doubtlessly larger unhealthy debt of 0.75%-1.50% of income (versus 0.83% in 2022). It additionally forecasts normal and administrative expense to rise by about 8% and curiosity expense to rise roughly 19% as a consequence of a lot larger rates of interest. We anticipate Whitestone to publish FFO per share of $0.97 in 2023.

Development Prospects

Whitestone’s progress technique is centered round:

- Investing in places with stable inhabitants progress

- Buying properties which are mismanaged, overleveraged, or in foreclosures or receivership

- Enhancing worth property

From 2012 by way of 2015 Whitestone acquired 2.465 million sq. toes of gross leasable space. From 2016 by way of 2019 Whitestone acquired 0.778 million sq. toes of gross leasable space.

The decline in acquisitions is due partly to a concentrate on deleveraging. The leverage ratio (Internet Debt to EBITDA) of the REIT is presently standing at 7.0, which is extreme.

Supply: Investor Presentation

With additional deleveraging anticipated, it’s possible that Whitestone will preserve its modest acquisition tempo.

Administration believes that post-pandemic investments in acquisitions, re-development, and improvement initiatives can drive returns of at the very least 10%. We’d first wish to see the same-store web working earnings stay optimistic, which can possible be helped by a extra supportive macro atmosphere.

We’re additionally involved over the influence of the excessive debt load on the outcomes of the REIT. Because of the aggressive rate of interest hikes applied by the Fed, Whitestone noticed its curiosity expense develop 11% in 2022, with additional progress anticipated within the upcoming years, because the REIT shall be pressured to refinance its debt at a lot larger rates of interest.

For now, we anticipate Whitestone to develop its FFO per share by 3% per yr on common over the following 5 years. Whitestone’s present concentrate on deleveraging coupled with a distribution progress historical past that was flat for almost a decade (earlier than the onset of the pandemic) means progress expectations are low for Whitestone.

Dividend & Valuation Evaluation

As a retail REIT, Whitestone was not spared from the coronavirus pandemic of 2020. On account of the steep financial influence of the pandemic, Whitestone REIT lowered its month-to-month dividend by 63% in April 2020, from $0.095 to $0.035.

The discount was anticipated. Whitestone’s distribution had remained larger than its FFO yearly between 2013 and 2019. A discount throughout COVID-19 was each prudent and needed. Because the pandemic has subsided, Whitestone’s monetary place has improved, which has allowed the corporate to boost its month-to-month dividend modestly to $0.04, the place it presently stands.

The distribution seems safe going ahead. We anticipate Whitestone to take care of a dividend payout ratio of 49% for 2023, primarily based on our projected FFO-per-share of $0.97 for the total yr. A dividend payout ratio beneath 50% is very uncommon for REITs, and sure implies a excessive degree of dividend security.

With such a low payout ratio, we consider the distribution will nearly definitely improve from its present low base over the following a number of years. Whitestone presently has a 5.1% yield. Extra distribution progress would solely improve traders’ yield on value.

One other interesting issue is valuation. The REIT is presently buying and selling for simply 9.8 occasions its fiscal 2023 anticipated FFO-per-share. This a number of is far decrease than the 5-year common of 11.4 of the inventory.

However with years of stagnation on a per unit foundation and a current distribution discount, we conservatively forecast a good worth worth to FFO of 11.0 for Whitestone. Subsequently, if the valuation a number of had been to broaden from 9.8 to 11.0 over the following 5 years, this is able to raise shareholder returns by 2.3% per yr on common.

Including within the 3% annual FFO-per-share progress, potential shareholder returns may attain 10.0% per yr by way of 2028. It is a tempting anticipated charge of return, which makes Whitestone an interesting inventory for worth and earnings traders, albeit with an elevated degree of danger.

Last Ideas

With a 5.1% distribution yield, optimistic EPS progress expectations, and potential valuation a number of returns, Whitestone provides traders an anticipated complete annual return of 10.0% over the following 5 years.

And that is with out any improve within the distribution over the following 5 years. We consider distribution will increase are possible within the medium time period as a result of the payout ratio of Whitestone is abnormally low for a REIT.

The safety has proven it could possibly proceed to pay shareholders at this distribution charge even throughout COVID-19. The month-to-month dividends are a bonus for traders on the lookout for earnings. As well as, a budget valuation ought to enchantment to worth traders.

If you’re inquisitive about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link