[ad_1]

Up to date on March 4th, 2023 by Nikolaos Sismanis

Month-to-month dividend shares are extremely interesting to people reminiscent of retirees as a result of they make it considerably simpler to finances dividend earnings in opposition to dwelling bills. We’ve compiled an inventory of all 69 month-to-month dividend shares.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Superior Plus Company (SUUIF) is one such firm whose administration crew has determined to pay a month-to-month dividend to shareholders. And, the corporate has a considerable dividend yield.

As of right this moment, Superior Plus yields 6.5% – about 4 instances the 1.6% dividend yield of the S&P 500. The excessive dividend yield and the month-to-month dividend funds of Superior Plus are two the reason why buyers may take curiosity on this inventory.

This text will analyze the funding prospects of Superior Plus intimately to find out whether or not the corporate deserves consideration for the portfolios of income-oriented buyers.

Enterprise Overview

Superior Plus Company is a comparatively small industrial firm however one of many bigger propane distributors in North America. The corporate is the dominant distributor in Canada (30% of EBITDA), has vital operations within the U.S. (60% of EBITDA), and can be a propane wholesaler (10% of EBITDA). Superior Plus generates round $3.8 billion in annual revenues and relies in Toronto, Canada.

The corporate beforehand had a big Specialty Chemical compounds section however bought this enterprise in 2021 as a part of a broader restructuring. Superior Plus is reorganizing its enterprise to develop into a pure-play distribution firm.

Superior Plus’ Vitality Distribution section is concerned within the distribution and retail advertising and marketing of propane merchandise, fuels (together with heating oil and propane gasoline), and wholesale liquids advertising and marketing companies. This section operates primarily in Canada however has been increasing into the US via a collection of acquisitions that started in 2009. The Vitality Distribution section is operated beneath the commerce names ‘Superior Propane’ or ‘Superior Gasoline Liquids’.

It needs to be famous that Superior Plus is a global inventory – the corporate trades on the Toronto Inventory Change beneath the ticker SPB and experiences financials in Canadian {dollars}. Shopping for shares primarily based outdoors the U.S. presents plenty of distinctive dangers, reminiscent of forex danger. Throughout tough financial durations, most foreign exchange weaken in opposition to the USD, and thus the earnings of worldwide corporations in USD lower. Regardless, all figures on this article have been transformed to USD.

Progress Prospects

Like many power corporations, Superior Plus was negatively impacted by the coronavirus pandemic and the resultant recession in the US. Because of this, the corporate incurred a 26% lower in its earnings per share, from $1.63 in 2019 to $1.21 in 2020.

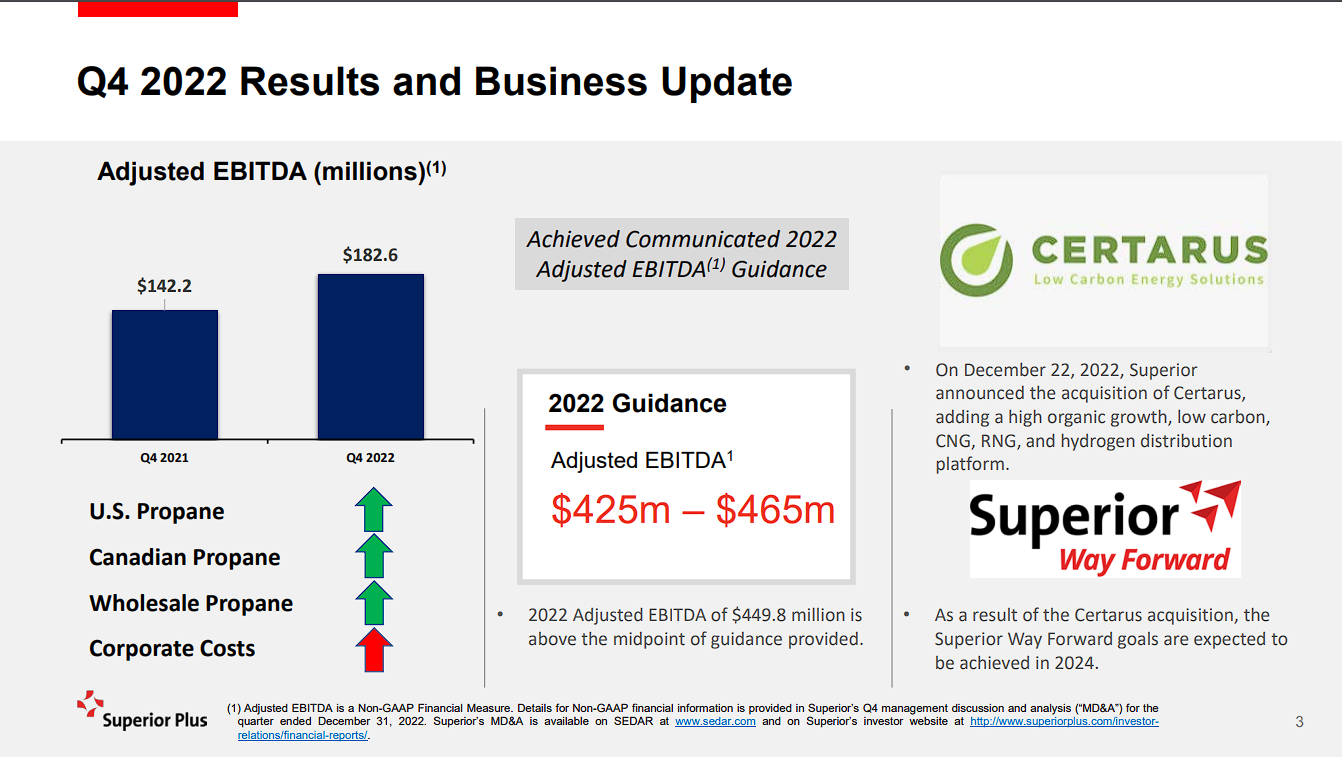

Nonetheless, the corporate has stabilized its efficiency in latest quarters. In This fall of 2022, the corporate generated an adjusted EBITDA of $135.7 million, a $30 million enhance in comparison with the prior-year quarter.

Supply: Investor Presentation

The rise was on account of decrease Adjusted EBITDA from all three segments following a number of acquisitions over the previous 4 quarters. Adjusted working money circulation per share totaled $0.25, in comparison with $0.45 final 12 months, primarily on account of transaction, restructuring, and different prices associated to the corporate’s latest acquisitions, in addition to the next share rely.

For the 12 months, AOCF per share was $0.91, down from $1.22 in fiscal 2021, for a similar causes. Given the sturdy restoration of oil and gasoline shares in 2022, the decline in Superior Plus’s AOCF is considerably disappointing. General, the propane enterprise has proved far more resilient to the pandemic than the oil business however has a lot much less upside throughout growth instances.

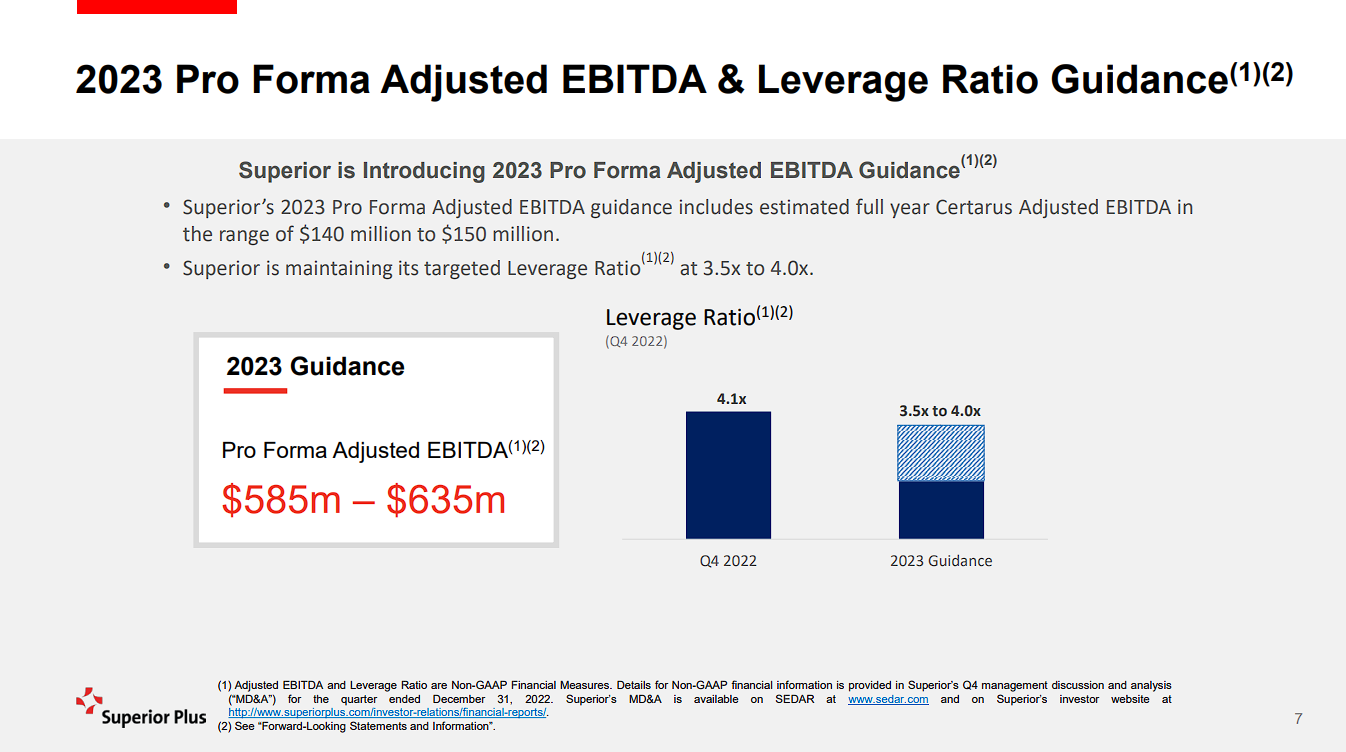

On the intense aspect, administration launched its FY2023 outlook, anticipating adjusted EBITDA to be within the vary of C$585 million to C$635 million, suggesting a 35.6% enhance year-over-year in its midpoint. Accordingly, for the 12 months, we respect CFPS/share of about $1.00, which takes under consideration the latest dilution and the chance for extra prices to accrue amid additional acquisitions.

Supply: Investor Presentation

Our CFPS/share estimate implies a year-over-year enhance of 9.9% in comparison with fiscal 2022.

Aggressive Benefits & Recession Efficiency

As an operator within the power distribution business, Superior Plus has aggressive benefits, benefiting from regulatory obstacles to entry and vital upfront capital outlays to enter the market. Sadly, Superior Plus has not proved resilient to all financial environments.

An organization exhibiting such outsized earnings-per-share declines may be anticipated to additionally reduce its dividend when it experiences losses. Certainly, Superior Plus reduce its dividend twice in 2011. Extra not too long ago, the corporate did make it via 2020 with out decreasing its dividend, a outstanding accomplishment gave the fierce recession brought on by the pandemic.

Alternatively, Superior Plus has elevated its monetary leverage currently. Administration has raised its goal leverage ratio (Complete Debt to Adjusted EBITDA) from 3.0-3.5 to three.5-4.0 so as to carry out extra acquisitions. The ratio is elevated proper now, standing at 4.1. The elevated leverage of Superior Plus has considerably decreased its resilience to unexpected downturns.

Dividend Evaluation

The dividend yield will probably make up a lot of the returns of Superior Plus going ahead, given the shortage of share value development during the last decade. Superior Plus at the moment distributes a month-to-month dividend of $0.06 per share in CAD, or C$0.72 per share annualized. At current alternate charges, this works out to roughly $0.54 per share in U.S. {dollars}.

The corporate has distributed the identical dividend for a number of years in a row. U.S. buyers have to understand that the corporate pays its dividend in Canadian forex, which is able to have an effect on precise capital acquired primarily based on the fluctuations in alternate charges. Primarily based on an annualized dividend payout of $0.54 per share, Superior inventory has a present dividend yield of 6.5%.

Superior Plus is anticipated to earn $1.00 this 12 months in U.S. {dollars}, giving the corporate a projected payout ratio of 54% for 2023. The dividend seems to be protected for the foreseeable future, due to the low payout ratio. Alternatively, Superior Plus has not raised its dividend for years and isn’t anticipated to within the close to future.

As such, we really feel that Superior Plus is a dangerous inventory for earnings buyers to carry, significantly throughout a downturn in commodities or a world recession.

Closing Ideas

The excessive dividend yield and the month-to-month dividend funds of Superior Plus assist this inventory to face out relative to different dividend investments, significantly for income-focused buyers like retirees.

That stated, our due diligence reveals that this explicit safety has an underwhelming observe document. Buyers mustn’t count on a dividend increase anytime quickly.

Furthermore, we don’t count on materials earnings-per-share development or an increasing valuation a number of, leaving dividends as the first supply of anticipated returns. However, for buyers solely occupied with earnings, the inventory of Superior Plus may very well be interesting on that foundation.

If you’re occupied with discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link