[ad_1]

Up to date on February twenty sixth, 2023 by Samuel Smith

Revenue buyers typically discover high-yielding shares to be enticing, because of the earnings that these investments can produce. However generally the necessity for earnings can blind buyers to the problems with the corporate itself. If that is so, then buyers could be blindsided when the corporate cuts its dividend.

The identical could be mentioned for month-to-month dividend paying corporations. Traders would possibly overlook weak fundamentals with an organization with a purpose to receive month-to-month dividend funds. Month-to-month dividend shares could be interesting as they create extra common money move for buyers.

There are 50 month-to-month dividend shares that we cowl. You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

However buyers shouldn’t purchase a excessive yield month-to-month dividend paying inventory merely due to its month-to-month funds. That is notably true in terms of oil and gasoline royalty trusts.

Permian Basin Royalty Belief (PBT) suits the outline of a dividend inventory with a questionable outlook. Distributions fluctuate on a month-to-month foundation primarily based on profitability. Shares presently yield 4.8% primarily based on its dividends over the previous twelve months.

This text will have a look at Permian Basin’s enterprise, development prospects and dividend to point out why buyers ought to keep away from this inventory.

Enterprise Overview

Permian Basin holds overriding royalty curiosity in a number of oil and gasoline properties in the US. The belief is a small-cap inventory which trades with a market capitalization of $559 million. The belief has oil and gasoline producing properties in Texas.

The belief was established in 1980 and has a 75% internet revenue royalty curiosity within the Waddell Ranch properties. These properties encompass over 300 internet productive oil wells, over 100 internet producing gasoline wells and 120 internet injection wells.

Permian Basin additionally holds a 95% internet revenue royalty curiosity within the Texas Royalty Properties, which consist of roughly 125 separate royalty pursuits throughout 33 counties in Texas overlaying 51,000 internet producing acres.

The property of the belief are static, i.e., the belief can’t add new properties in its asset portfolio. PBT had royalty earnings of $12.0 million in 2020 and $11.8 million in 2021.

Development Prospects

As an oil and gasoline belief, it goes with out saying that Permian Basin will carry out in direct relation to grease and pure gasoline costs. Investments like Permian Basin are designed as earnings autos. Greater power costs will seemingly result in increased royalty funds, driving up demand for items. In the identical manner, decrease power costs will result in decrease dividend funds.

Distributions are primarily based on the costs of pure gasoline and crude oil. Permian Basin is impacted in two methods when the worth of both declines. First, distributable earnings from royalties is decreased, decreasing dividend funds. As well as, plans for exploration and improvement could also be delayed or canceled, which might result in future dividend cuts.

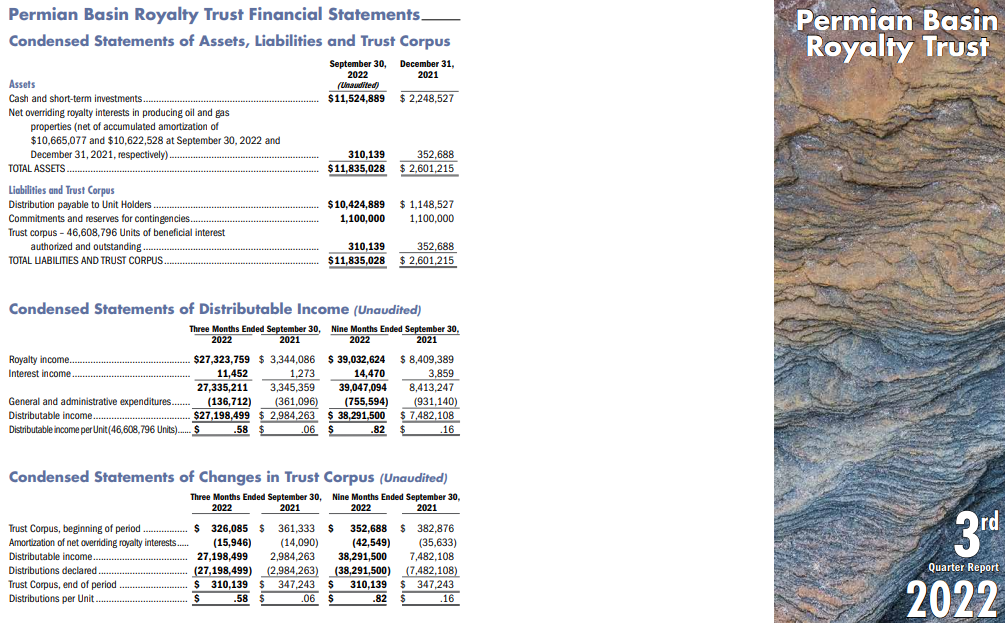

PBT launched on 11/14/22 its monetary outcomes for the third quarter of fiscal yr 2022. The corporate skilled a major enhance in its common realized costs of oil and gasoline, up 59% and 96% respectively, from the identical quarter within the earlier yr. This enhance was attributed to the multi-year excessive benchmark costs ensuing from the sanctions imposed by Europe and the U.S. on Russia for its invasion in Ukraine. The corporate’s oil volumes practically doubled, whereas its gasoline volumes greater than doubled, leading to a bounce in distributable earnings per unit from $0.06 to $0.58.

Supply: Investor presentation

Regardless of disappointing distributions in recent times, which have been impacted by excessive working bills on the Waddell Ranch properties, PBT has lastly elevated its distributions lately. The rally of the oil value has resulted from the restoration of worldwide demand from the pandemic, tight international provide and the invasion of Russia in Ukraine. As Russia produces ~10 million barrels of oil per day and exports ~5 million barrels of oil per day (~5% of worldwide provide), the sanctions of western nations on Russia have tremendously tightened the oil market.

The rally of the worth of pure gasoline has resulted from the sanctions of western nations on Russia. Europe, which generates 31% of its electrical energy from pure gasoline supplied by Russia, is presently doing its greatest to diversify away from Russia. Consequently, there was an enormous enhance within the variety of LNG cargos directed from the US to Europe. Consequently, the U.S. pure gasoline market has change into exceptionally tight and therefore the worth of U.S. pure gasoline has rallied to a 13-year excessive recently. Total, PBT can’t hope for a extra favorable enterprise atmosphere than the present one.

Due to the restoration in commodity costs and ongoing geopolitical uncertainty, we anticipate PBT to proceed producing stable outcomes for the foreseeable future.

However, given the numerous cyclicality of those costs, buyers ought to preserve conservative development expectations from PBT. Furthermore, PBT suffers from the pure decline of its fields in the long term. Over the last six years, its manufacturing of oil and gasoline has decreased at a mean annual charge of 6% and a couple of%, respectively. The pure decline of output is a powerful headwind for future outcomes.

Dividend Evaluation

Royalty trusts are normally owned for his or her dividends. These investments are usually not prone to have a number of many years of dividend development just like the extra well-known dividend paying corporations akin to Johnson & Johnson (JNJ) or Procter & Gamble (PG). That’s as a result of trusts like Permian Basin rely solely on the costs of oil and gasoline to find out dividend funds.

Listed beneath are the belief’s dividends per share during the last seven years:

- 2014 dividends per share: $1.02

- 2015 dividends per share: $0.34 (67% decline)

- 2016 dividends per share: $0.42 (24% enhance)

- 2017 dividends per share: $0.63 (50% enhance)

- 2018 dividends per share: $0.66 (5% enhance)

- 2019 dividends per share: $0.42 (36% decline)

- 2020 dividends per share: $0.235 (44% decline)

- 2021 dividends per share: $0.23 (2% decline)

- 2022 dividends per share: $1.1487 (399% enhance)

Dividends come straight from royalties, so increased oil and gasoline costs will seemingly result in distribution development. Given this, it shouldn’t come as a shock that shareholders of Permian Basin noticed a major decline in dividends in the course of the 2014 to 2016 oil market downturn.

As oil costs stabilized following this downturn, the dividends returned to development once more. And, as you’ll be able to see, the dividend development was extraordinarily excessive as power costs improved.

The belief has distributed $0.0782 per share within the first two months of 2023. Annualized, this may come out to a distribution of $0.4692 per share for the total yr. This may mark a major lower from the prior yr, however it will nonetheless be considerably increased than the distribution in 2021.

This anticipated dividend per share equates to a yield of 1.9% primarily based on the current share value. Whereas the yield compares favorably to the 1.3% common yield of the S&P 500 Index, it’s a markedly low yield for an oil and gasoline royalty belief, which carries a lot larger danger than the S&P 500.

Last Ideas

Month-to-month dividend paying shares may also help buyers even out money flows in contrast with shares that comply with the normal quarterly funds. Month-to-month funds can even assist buyers compound earnings at a sooner charge.

Excessive yield shares can present buyers extra earnings, one thing that’s necessary to these buyers dwelling off dividends in retirement. Permian Basin does provide a yield that’s increased than that of the market index.

Traders with the next urge for food for danger would possibly really feel that the massive dividend raises anticipated amid favorable commodity costs and the 1.9% yield are a stable tradeoff for the steep declines that happen when power costs fall.

With that mentioned, Certain Dividend believes that the danger shouldn’t be well worth the reward in terms of royalty trusts. Permian Basin does provide a month-to-month dividend however doesn’t present certainty of what the cost could appear like. The dividend funds rely completely on the worth of oil and gasoline. When one or each are down, so are dividend funds. Traders who want regular, dependable earnings are strongly inspired to take a position elsewhere.

In case you are curious about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases can be helpful:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link