[ad_1]

Updated on October 19th, 2022 by Nate Parsh

Investors are likely familiar with the standard Real Estate Investment Trusts, or REITs. Most REITs own physical real estate, lease the properties to tenants, and derive rental income which is used to pay dividends.

But there is a different set of REITs that investors may not be as familiar with: mortgage REITs. These REITs do not own physical properties, but rather buy mortgage securities.

Mortgage REITs typically have much higher dividend yields than standard REITs, but this does not necessarily make them better investments.

For example, Orchid Island Capital (ORC) is a mortgage REIT, with an extremely high dividend yield of almost 20%. Orchid Island pays dividends each month, which gives it the compelling combination of a a high yield with monthly dividend payments. It is one of the 49 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Orchid Island has an exceptionally high dividend yield and is one of the highest-yielding stocks that we cover.

However, the outlook for mortgage REITs is challenged, and Orchid Island’s dividend yield may still not be sustainable even after multiple dividend cuts in the past several years.

This article will discuss why income investors should not be lured by Orchid Island’s extremely high dividend yield.

Business Overview

Whereas traditional REITs own a portfolio of properties, mortgage REITs are purely financial entities. Orchid Island is an externally-managed, specialty finance REIT. Orchid Island invests in residential mortgage-backed securities, either pass-through or structured agency RMBSs.

Source: Investor Presentation

An RMBS is a debt instrument that collects cash flows, based on residential loans such as mortgages, home-equity loans, and subprime mortgages. Mortgage-backed securities are an investment product representing a basket of pooled loans.

As investors saw first-hand during the 2008 financial crisis, mortgage-backed securities can be highly volatile and risky. That said, mortgage REITs were among the biggest winners as interest rates were falling during the aftermath of the Great Recession.

Growth Prospects

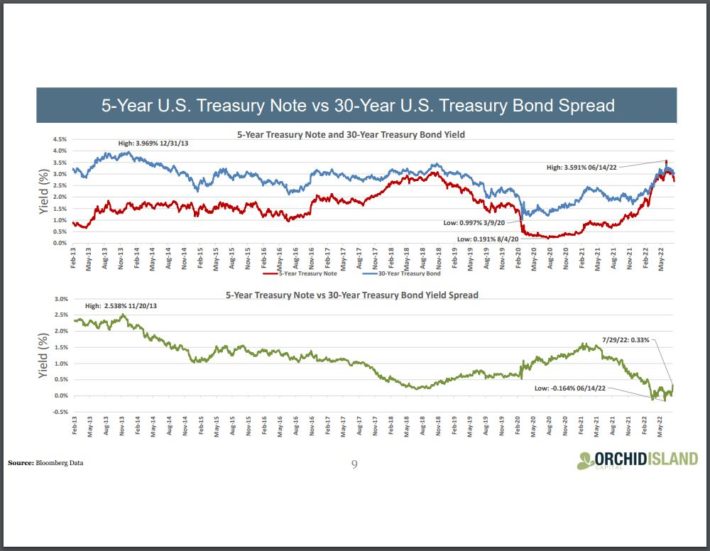

Mortgage REITs make money by borrowing at short-term rates, lending at long-term rates, and pocketing the difference, or the spread between the two.

When the spread between short-term rates and long-term rates compresses, profitability erodes. This is why mortgage REITs can be dangerous if short-term interest rates are about to increase.

Source: Investor Presentation

Interest rates are increasing, and likely will continue to rise in the coming year. Short-term bond yields have risen, sometimes offering a higher yield then longer-term bonds. This is known as an inverted yield curve, which can be a precursor to a recession. Because of this, the stock price for ORC has fallen 58.5% year to date.

Shares had fallen so much, that trust executed a 1-for-5 reverse stock split on August 30th, 2022.

Orchid Island has not been able to produce meaningful growth in the past several years. The trust has experienced extreme earnings volatility over the past several years, with a net loss in 2013 and 2018, along with multiple years in which the trust barely generated a profit.

Orchid Island’s inability to perform well with interest rates at zero makes it unlikely that the trust can regain its footing as interest rates continue to rise.

This thesis played out as Orchid Island Capital announced preliminary Q3 results on October 12th, 2022. The trust estimates that it will post a Q3 net income loss of $84.5 million. This equates to a net loss of $2.41 per share, which includes an estimated $2.66 per share of net realized and unrealized losses on RMBS and derivates instruments. Return on equity is projected to be -16.7%.

Meanwhile, Q3 book value stood at $11.42. Adjusting for the reverse stock split, book value is forecasted to be $2.28, which compares unfavorably to $4.77 in Q3 2021 and $2.87 in Q2 2022. The trust did authorize a share repurchase program of up to 4.3 million shares. Finally, Orchid Island Capital declared a $0.16 per share monthly dividend to be payable on November 28th, 2022.

Dividend Analysis

Orchid Island’s eroding fundamentals have caused a significant drop in its dividend payments to shareholders in the past several years.

Orchid Island currently pays a monthly dividend of $0.16, well above the prior monthly payment of $0.045 per share. However, this is an adjustment on account of Orchid Island’s reverse stock split.

Overall, this is still 51% lower than the same monthly payout level from one year ago. The trust also decreased its dividend earlier this year. Thus, the trust has had two dividend cuts this year. Orchid Island’s dividend payout still remains below the split adjusted monthly dividend it was paying prior to 2021.

Source: Investor Presentation

Looking back further, Orchid Island’s monthly dividend payout reached a high of $0.18 per share in 2014, but has been reduced multiple times since then.

On an annualized basis, the trust has a current dividend payout of $1.92 per share. Based on its recent closing price, the stock offers a 19.9% dividend yield. This is a huge dividend yield, considering the average dividend yield of the S&P 500 Index is currently 1.8%.

However, there are too many red flags for Orchid Island to be considered an attractive investment, including the trust’s multiple dividend cuts over the past few years and inconsistent profitability in that time.

In addition, Orchid Island has issued shares at a high pace in recent years. While the trust reduced its shares outstanding 7.4% in 2018, Orchid Island’s share count has skyrocketed since 2013. This comes at a steep cost to shareholders, in the form of heavy dilution.

With a volatile dividend history, Orchid Island is not an appealing choice for investors looking for steady dividend payouts from year to year.

Orchid Island stock appears to be the definition of a yield trap. While the stock’s consistently high yield may lure income investors, total annualized returns in the past 5 years have been negative 9.7%, even when including dividend payments.

The stock has badly lagged the S&P 500 Index, and we believe this underperformance is likely to continue.

Final Thoughts

Sky-high dividend yields can be deceiving. Orchid Island’s 19.9% dividend yield is enticing, but this stock has all the makings of a yield trap.

The trust has a sizable amount of debt on the balance sheet, and is issuing shares at an alarming pace. The outlook for mortgage REITs has improved in recent years due to low-interest rates, but this is now changing as the FED has singled that it will be increasing the interest rates. However, Orchid Island’s performance remained poor during the low-interest rates environment. The trust’s most estimated results for Q3 show a significant decline in net interest income and per-share book value.

Orchid Island has cut its dividend several times in the past few years due to poor fundamental performance. Investors should tread very carefully with mortgage REITs like Orchid Island. As a result, income investors would be better served buying higher-quality dividend stocks, with more sustainable payouts.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link