[ad_1]

Up to date on March eighth, 2023 by Samuel Smith

Worldwide REITs may very well be a precious possibility for buyers focused on diversifying their portfolios. There are lots of worldwide Actual Property Funding Trusts based mostly exterior the U.S. with high quality enterprise fashions and excessive dividend yields.

One instance is Granite Actual Property Funding Belief (GRP.U) (GRT-UN.TO), a REIT based mostly in Canada. Not solely does Granite have a confirmed enterprise mannequin, but it surely additionally pays a 3.9% dividend yield, which is about twice the extent of the S&P 500.

Granite additionally pays its dividend month-to-month; a extra enticing dividend schedule than REITs which pay dividends quarterly.

Granite is considered one of solely 69 shares that pays month-to-month dividends. You possibly can entry the total database of month-to-month dividend shares (together with vital monetary metrics corresponding to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

Granite is listed in each Toronto and New York, and for this text, we’ll be utilizing the New York itemizing and US {dollars}.

This text will define Granite’s enterprise mannequin and focus on its deserves as a dividend inventory.

Enterprise Overview

Granite owns and manages predominantly industrial actual property properties in North America and Europe. It transformed to a REIT on January 3, 2013, and has reworked itself right into a leaner, extra environment friendly belief, with higher-quality property.

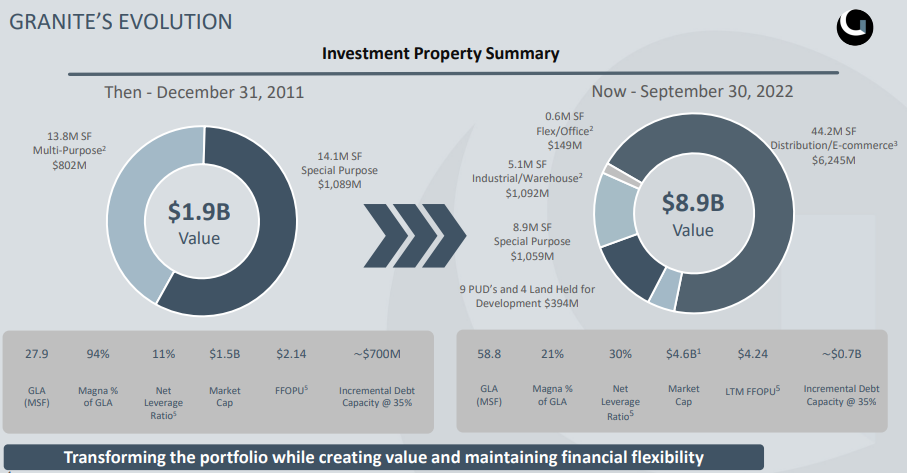

Supply: Investor presentation

Over time, Granite has grown from a smaller, much less precious portfolio that was virtually solely dependent upon one tenant (Magna), to a diversified, a lot bigger portfolio with considerably increased common property values. The belief has undergone a metamorphosis in recent times to achieve these targets, and it’s clear that effort has paid off.

Magna is now 21% of the portfolio, and the portfolio as an entire is meaningfully extra diversified between tenants and property sorts.

The belief’s income-producing portfolio consists of Multi-Function, Logistics and Distribution Warehouses and Particular-Function amenities. It owns a complete of 58.8 million sq. toes unfold throughout 134 properties in Europe, Canada, and the U.S. Mixed, these properties have a carrying worth of about $8 billion.

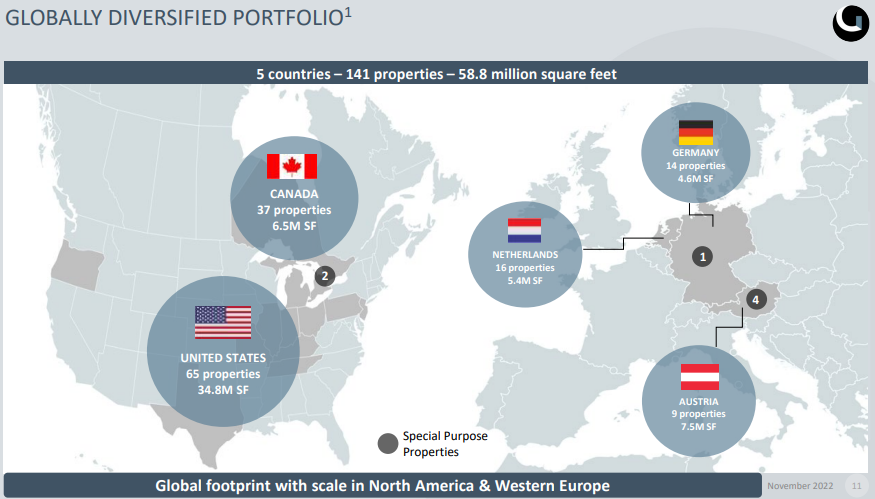

Supply: Investor presentation

Granite is current solely in nations with little or no geopolitical threat and in properties and industries with sturdy long-term fundamentals. It’s nonetheless very closely concentrated within the US and Canada, with just a little greater than two-thirds of its property’s sq. footage positioned in North America.

Nonetheless, its worldwide publicity offers a diversifying part to the belief’s outcomes. Granite focuses on properties that help e-commerce improvement and are positioned strategically to help such companies in one of the best markets.

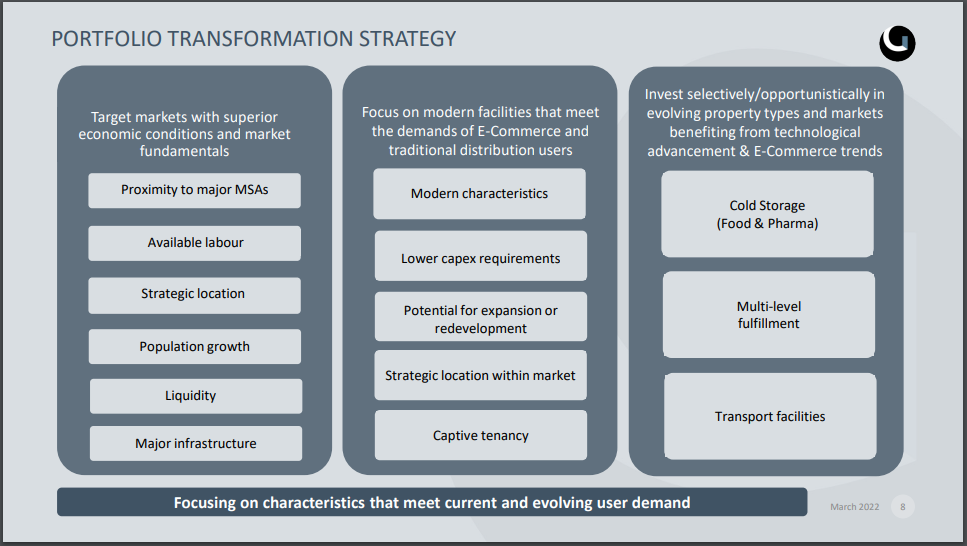

Supply: Investor presentation

Granite seeks out areas which have proximity to main cities and have favorable demographics, together with main infrastructure and out there labor swimming pools. As well as, it buys already fashionable properties, that means capital expenditure wants are low, with tenants with excessive switching prices.

These traits imply that Granite chooses solely probably the most favorable properties to personal with long-term tenants with one of the best likelihood of thriving in varied financial climates. Lastly, it focuses on the big shift to e-commerce, with a selected give attention to meals and prescribed drugs.

Briefly, Granite is betting that these traits will gas its future progress, and outcomes have actually supported that notion.

Development Prospects

Granite’s outlook is optimistic from a basic perspective, with the belief within the midst of a metamorphosis. Granite is within the ultimate phases of its years-long transformation through which it’s optimizing its value of capital, leverage on the steadiness sheet, and reaching what it considers a saturation level in essential goal markets.

The belief went by a interval of great transition in recent times, switching out its CEO, board, and management staff. Right now, the belief is targeted on remodeling its portfolio by the sale of non-core property, enhancing its presence within the U.S, and making purchases in choose European markets.

Granite delivered on its prior said objective of boosting the portfolio to greater than 40 million sq. toes and carrying worth of greater than $4 billion, and is now at roughly $8 billion, so we imagine the very best ranges of progress are doubtless behind the corporate. That stated, future progress will likely be comprised primarily of rental will increase, and selective acquisitions which might be accretive to FFO. Acquisitions make up a big a part of the corporate’s progress technique, as they’ve accomplished billions of {dollars} in acquisitions over the previous few years in key places.

Granite seems to have achieved its progress targets sooner than anticipated, and consequently, we anticipate incremental funding to sluggish considerably within the coming years. There’s nonetheless a improvement pipeline in progress, with some properties in Europe and North America. Nonetheless, Granite’s transformative strikes have largely been accomplished.

Developments for e-commerce stay overwhelmingly optimistic and given the affect on bodily retailers of COVID-19, it seems the development in the direction of e-commerce has solely accelerated, which is a optimistic for Granite. It’s subsequently concentrating property that match its funding standards to capitalize.

Granite’s progress outlook is favorable, on condition that it ought to proceed to see increased lease costs and a bigger funding guide by acquisitions and improvement.

Dividend Evaluation

Granite presently pays a month-to-month dividend of $0.2667 per share in Canadian {dollars}, which equates to ~$0.19 month-to-month in US {dollars}.

On an annualized foundation, the present common dividend cost is $3.2004 per share in Canadian foreign money. In U.S. {dollars}, this works out to roughly $2.32 per share. This equates to a 3.9% yield.

If U.S. buyers personal the inventory, returns will likely be topic to foreign money threat as it’s translated from Canadian {dollars} to U.S. {dollars}. The dividend to U.S. buyers will rely partially upon prevailing change charges, which presently stand at $1 CAD = $0.73 USD. One other vital consideration for investing in worldwide shares is withholding taxes.

Notice: As a Canadian inventory, a 15% dividend tax will likely be imposed on US buyers investing within the firm exterior of a retirement account. See our information on Canadian taxes for US buyers right here.

Granite’s 3.4% dividend yield is supported with underlying money move. Based mostly on adjusted FFO for 2021, Granite’s payout ratio is 71%. That’s barely beneath earlier years and regarded secure within the REIT universe.

We imagine Granite goes to develop FFO within the coming years and scale back the payout ratio, so at the side of the present honest payout ratio, we see the distribution as secure.

Remaining Ideas

Traders can obtain excessive ranges of revenue and diversification advantages by contemplating REITs based mostly exterior the USA. Granite REIT is an effective instance of a world REIT with a high-quality enterprise mannequin, and a good dividend yield of three.9%.

The belief has largely accomplished its transformation effort that diversified its portfolio, diminished threat, and enhanced its earnings progress prospects. We see this as supportive of future dividend will increase, because the payout ratio has been diminished considerably. Because of this, Granite stays a beautiful possibility for buyers on the lookout for month-to-month dividends and a 3%+ dividend yield.

If you’re focused on discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases will likely be helpful:

The foremost home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link