Up to date on September 24th, 2024 by Felix Martinez

The economic aerospace trade isn’t well-known for prime dividends and even dividend progress, each within the U.S. and Canada. Alternate Revenue Company (EIFZF) is a novel Canadian enterprise that acquires corporations within the Aerospace & Aviation and Manufacturing sector.

The acquisition and progress technique of Alternate Revenue has allowed the corporate to reward shareholders with common dividend will increase since its IPO. Mixed with the excessive dividend yield of practically 5%, this inventory ought to pique the curiosity of any revenue investor.

Past its excessive dividend yield, the inventory can also be fairly distinctive as a result of it pays month-to-month dividends as a substitute of the standard quarterly distribution schedule. Month-to-month dividend funds are extremely superior for traders that have to finances round their dividend funds (corresponding to retirees).

There are at the moment solely 78 month-to-month dividend shares. You possibly can see the complete record of month-to-month dividend shares (together with vital monetary metrics corresponding to dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

Alternate Revenue Company’s excessive dividend yield and month-to-month dividend funds are two huge the explanation why this firm stands out to potential traders.

That is very true contemplating the common S&P 500 Index yields simply 1.3% proper now. By comparability, Alternate Revenue has a yield of greater than thrice the common dividend yield of the S&P 500.

That stated, correct due diligence continues to be required for any high-yield inventory to make sure its sustainable payout. Luckily, the dividend payout seems sustainable, making the inventory enticing to revenue traders.

Enterprise Overview

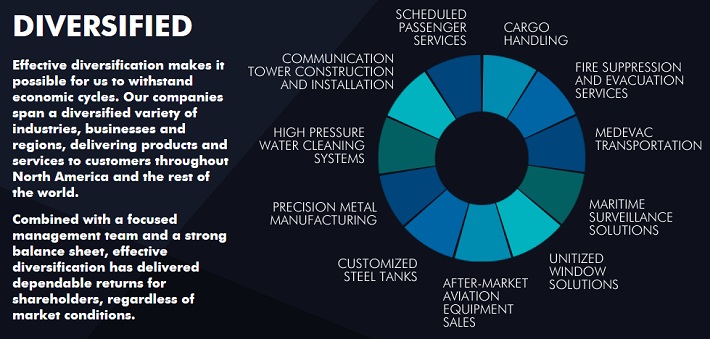

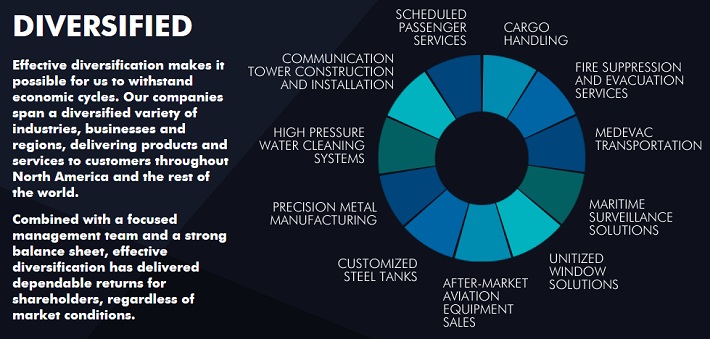

Alternate Revenue Company engages in aerospace and aviation companies by providing scheduled airline and constitution companies, emergency medical companies, after-market plane & engines, and pilot flight coaching companies.

Moreover, the corporate is invested in manufacturing window wall techniques utilized in skyscrapers, vessels, and different industrial functions.

Lastly, Alternate Revenue additionally owns telecom towers, which it leases to America’s and Canada’s main telecom suppliers. The corporate generates simply over $1 billion in annual income and relies in Winnipeg, Canada.

The company has two working segments: Aerospace & Aviation and Manufacturing.

Supply: Investor Relations

Aerospace and aviation make up the majority of the corporate’s EBITDA. The corporate’s technique is to develop its portfolio of diversified area of interest operations by way of acquisitions to offer shareholders with a dependable and rising dividend.

The businesses acquired are in defensible area of interest markets, and EIC has remodeled 33 acquisitions since its inception in 2004.

Acquisition candidates will need to have a monitor file of earnings and robust, continued money move era with dedicated administration centered on constructing the enterprise post-acquisition.

Development Prospects

Alternate Revenue’s outcomes lagged in 2020 because of the destructive impacts of COVID-19 on the aviation trade. Since then, the corporate has not solely recovered however has additionally proceeded to realize new high and bottom-line data.

On August eighth, 2024, the corporate launched its Q2 outcomes for the interval ending June thirtieth, 2024. Revenues for the yr grew by 5% (in fixed forex) to $482.8 million, pushed by a 15% enhance in aerospace income, which offset a 12% decline within the manufacturing section.

Adjusted earnings per share (EPS) fell to $0.59 from $0.74 final yr, primarily because of greater working and curiosity bills, together with a 9% enhance within the common variety of shares. For fiscal 2024, administration reaffirmed their steering, anticipating adjusted EBITDA to achieve between C$600 million and C$635 million, with confidence in hitting the higher vary. Primarily based on this outlook, adjusted EPS might attain $2.27, excluding any one-time objects. All different figures within the tables replicate GAAP requirements.

The annual dividend price of C$2.64 equals roughly $1.91 on the present CAD/USD alternate price.

The payout ratio was 84% in FY2024, implying that dividend coated with earnings.

We now have set our estimated 5-year compound annual progress price of adjusted EPS to three%, as a lot of the corporate’s post-pandemic restoration has now taken place.

We retain our dividend-per-share progress projections at round 2% throughout that interval, barely decrease than the corporate’s historic (Canadian) common. The decrease dividend progress price will enhance the dividend’s security over the long run, making certain ample dividend protection.

Dividend Evaluation

As with many high-yield shares, the majority of Alternate Revenue’s future anticipated returns will come from its dividend funds. Administration has been dedicated to growing the dividend and rewarding shareholders, and so they have performed so since inception.

The money dividend cost has elevated 16 instances since 2004, and it’s spectacular that the corporate was capable of keep the dividend even through the pandemic.

Supply: Investor Relations

Right now, the annualized dividend payout stands at C$2.64 per share yearly in Canadian {dollars}. In fact, U.S. traders have to translate the dividend payout into U.S. {dollars} to calculate the present yield.

Primarily based on prevailing alternate charges, the dividend payout is roughly $1.96 per share in U.S. {dollars}, representing a excessive dividend yield of 5.2%. Alternate Revenue’s dividend progress has been secure and constant over the long run.

Utilizing projected 2024 earnings-per-share of $2.27, the inventory has a dividend payout ratio of roughly 84%. This implies underlying earnings cowl the present dividend payout with an honest cushion.

We view the inventory as barely overvalued. From a complete return perspective, we see potential for mid-single-digit whole returns on an annual foundation transferring ahead. This may encompass the 5.2% dividend yield, 3% annual EPS progress, and a low single-digit offset from a declining P/E a number of.

Closing Ideas

Alternate Revenue Corp’s excessive dividend yield and month-to-month dividend funds are instantly interesting to revenue traders corresponding to retirees.

Associated: 3 Canadian Month-to-month Dividend Shares With Yields Up To six%.

This evaluation means that the corporate’s dividend is protected, as measured by the non-GAAP metric Free Money Stream much less Upkeep Capital Expenditures.

The corporate seems barely overvalued on a price-to-earnings foundation. On the identical time, the corporate has a strong whole return projection. In consequence, Alternate Revenue Company seems to be a superb inventory choose for revenue traders, however whole returns are usually not notably spectacular given the present overvaluation.

Don’t miss the assets under for extra month-to-month dividend inventory investing analysis.

And see the assets under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].