[ad_1]

Revealed on April seventh, 2023 by Aristofanis Papadatos

Bridgemarq Actual Property Companies (BREUF) has two interesting funding traits:

#1: It’s a high-yield inventory primarily based on its 9.6% dividend yield.

Associated: Checklist of 5%+ yielding shares.

#2: It pays dividends month-to-month as an alternative of quarterly.

Associated: Checklist of month-to-month dividend shares

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

The mix of a excessive dividend yield and a month-to-month dividend render Bridgemarq Actual Property Companies interesting to income-oriented traders. As well as, the corporate has a powerful enterprise mannequin, with most of its revenues being recurring in nature. On this article, we’ll talk about the prospects of Bridgemarq Actual Property Companies.

Desk of Contents

You’ll be able to immediately bounce to any particular part of the article through the use of the hyperlinks beneath:

Enterprise Overview

Bridgemarq Actual Property Companies supplies varied companies to residential actual property brokers and REALTORS in Canada. It affords data, instruments, and companies that help its prospects within the supply of actual property companies. The corporate supplies its companies beneath the Royal LePage, Through Capitale, and Johnston and Daniel model names. The corporate was previously generally known as Brookfield Actual Property Companies and altered its identify to Bridgemarq Actual Property Companies in 2019. Bridgemarq Actual Property Companies was based in 2010 and is headquartered in Toronto, Canada.

Bridgemarq generates money move from mounted and variable franchise charges from a nationwide community of almost 21,000 REALTORS working beneath the aforementioned model names. Roughly 81% of the franchise charges are mounted in nature, and thus they end in pretty predictable and dependable money flows. Franchise payment revenues are protected through long-term contracts.

Bridgemarq has a stable enterprise relationship with its companions, and thus it enjoys remarkably excessive renewal charges. The corporate has traditionally achieved a 98% renewal charge at any time when a contract has expired.

Supply: Investor Presentation

Furthermore, the franchise agreements of Royal LePage, which comprise 94% of the REALTORS of the corporate, are 10-20 12 months contracts, and therefore they supply nice money move visibility.

Bridgemarq has a dominant enterprise place in Canada. To make certain, by means of its immense community of REALTORS, the corporate participated in 72% of the whole house resales that befell in Canada in 2022. The manufacturers of Bridgemarq entice franchisees because of their status and the technological benefits they supply to them.

Regardless of its robust enterprise mannequin, Bridgemarq was severely damage by the fierce recession attributable to the coronavirus disaster in 2020. The actual property market of Canada confronted an unprecedented downturn that 12 months. Consequently, the corporate noticed its earnings per share plunge 47%, from $0.34 in 2019 to $0.18 in 2020.

Nonetheless, the recession proved short-lived because of the immense fiscal stimulus packages provided by the Canadian authorities and the huge distribution of vaccines. Consequently, Bridgemarq recovered strongly from the pandemic in 2021.

In 2022, Bridgemarq grew the variety of REALTORS from 20,159 in 2021 to twenty,686. Nonetheless, the income of the corporate slipped 0.6% over the prior 12 months, as a weaker actual property market offset the expansion within the variety of REALTORS. Consequently, distributable money move per share dipped by 4% however nonetheless marked top-of-the-line years within the historical past of the corporate.

Development Prospects

Bridgemarq pursues progress by repeatedly growing the variety of its companions.

Supply: Investor Presentation

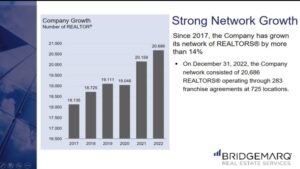

Since 2017, the corporate has grown the variety of REALTORS by greater than 14%. Consequently, it now has 20,686 companions working by means of 283 franchise agreements at 725 areas.

As talked about about, the overwhelming majority of the franchise charges of Bridgemarq are mounted, and therefore they render the money flows of the corporate pretty predictable. Nonetheless, that is simpler stated than executed.

Bridgemarq has exhibited a considerably unstable efficiency file during the last 9 years as a result of skilled volatility within the circumstances of the actual property market in addition to the swings of the change charge between the Canadian greenback and the USD. Nonetheless, the corporate has been capable of greater than double its adjusted earnings per share, from $0.35 in 2013 to $0.92 in 2022.

Given the robust enterprise place of Bridgemarq, its long-term efficiency file, and a few progress limitations as a result of firm’s dimension, we count on roughly 4.0% common annual progress of earnings per share over the following 5 years.

Dividend & Valuation Evaluation

Bridgemarq is providing an exceptionally excessive dividend yield of 9.6%, six occasions the 1.6% yield of the S&P 500. The inventory is thus an attention-grabbing candidate for income-oriented traders however U.S. traders must be conscious that the dividend they obtain is affected by the prevailing change charge between the Canadian greenback and the USD.

Bridgemarq has a payout ratio of 61% and has a wholesome stability sheet. Its curiosity expense consumes 32% of its working earnings, whereas its web debt is $80 million, which is simply 60% of the inventory’s market capitalization. General, the dividend of the corporate will not be more likely to be diminished considerably within the absence of a extreme recession.

However, traders must be conscious that the dividend has remained basically flat during the last 9 years. It’s thus prudent to not count on significant dividend progress going ahead.

In reference to the valuation, Bridgemarq is at present buying and selling for 12.0 occasions its earnings per share within the final 12 months. We assume a good price-to-earnings ratio of 14.0 for the inventory. Due to this fact, the present earnings a number of is decrease than our assumed honest price-to-earnings ratio. If the inventory trades at its honest valuation stage in 5 years, it is going to get pleasure from a 3.1% annualized acquire in its returns.

Bearing in mind the 4.0% annual progress of earnings per share, the 9.6% dividend yield and a 3.1% annualized enlargement of valuation stage, Bridgemarq might supply a 13.5% common annual complete return over the following 5 years. That is a beautiful anticipated complete return and therefore we advise traders to contemplate shopping for the inventory round its present value.

Ultimate Ideas

Bridgemarq has a dominant place in its enterprise and enjoys pretty dependable money flows because of the recurring nature of most of its charges. It’s also providing an exceptionally excessive dividend yield of 9.6%, with an honest payout ratio of 61%. As the corporate additionally has a wholesome stability sheet, it’s enticing for income-oriented traders.

Furthermore, Bridgemarq appears attractively valued proper now, because it has an anticipated 5-year annual complete return of 13.5%. A budget valuation of the inventory has resulted primarily from a deceleration within the enterprise momentum currently however we count on the corporate to return to progress mode within the upcoming years because of its constant file of rising the variety of its companions. Due to this fact, traders ought to reap the benefits of a budget valuation of Bridgemarq and wait patiently for enterprise momentum to speed up once more.

However, Bridgemarq is characterised by extraordinarily low buying and selling quantity. Because of this it could be onerous to determine or promote a big place on this inventory.

If you’re concerned with discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

The foremost home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link