[ad_1]

by confoundedinterest17

Former Federal Reserve Chair and present Treaury Secretary Janet “The Evil Hobbit” Yellen has created quite a few catestrophic messes because of Fed coverage errors, each at The Fed and now as Treasury Secretary.

For instance, the huge nearly hysterical overreaction of The Fed below Powell (following Yellen’s Reign of Error) to the Covid financial shutdowns resulted in a large surge in M2 Cash development [green line].

The outcome? REAL US housing costs soared whereas REAL averge hourly wage development was unfavourable for twenty-four straight months. THAT is the Fed error induced housing coverage blunder. But it surely did improve the US homeownership charge (blue line).

An enormous spike in REAL dwelling costs coupled with 24 straight months of unfavourable REAL hourly wages is hitting millenials exhausting. Actually, millennials are the slowest era to hit 50% homeownership charge.

Actually, in response to House Listing, millenial rents are giving up on homeownership.

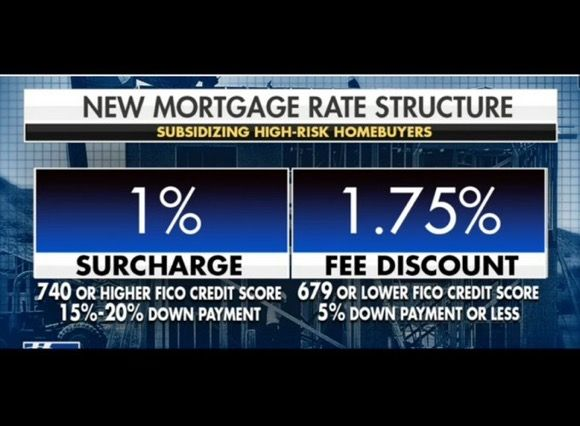

Consequently, The Federal authorities is making yet one more idiotic coverage error to deal with the results of Fed cash printing. Subsidizing high-risk homebuyers — at the price of these with good credit score.

Below the brand new guidelines, high-credit consumers with scores starting from 680 to above 780 will see a spike of their mortgage prices – with candidates who place 15% to twenty% down cost experiencing the largest improve in charges.

“This was a blatant and vital minimize of charges for his or her highest-risk debtors and a transparent improve in a lot better credit score high quality consumers – which simply clarified to the world that this transfer was a fairly vital cross-subsidy pricing change,” added Stevens, who can be the previous CEO of the Mortgage Bankers Affiliation.

Jeder nach seinen Fähigkeiten, jedem nach seinen Bedürfnissen (German for “From every in response to his means, to every in response to his wants” – Karl Marx.

Keep in mind, the US bought into bother within the early 2000s by pushing homeownership and reducing credit score requirements for decrease revenue households. It was a Clinton-era coverage error known as “The Nationwide Homeownership Technique: Companions within the American Dream.” There’s a video of then HUD Secretary Andrew Cuomo (sure, THAT Andrew Cuomo) saying that the US ought to danger increased mortgage defaults so low revenue households might purchase a house … then default. Frankly, Washington DC ought to get out of the housing enterprise altogether. However nooooo. They’re now going to make issues even worse.

Janet Yellen: Probably the most terrifying particular person on the earth!

[ad_2]

Source link