[ad_1]

koya79

Middlesex Water (NASDAQ:MSEX) is a New Jersey-based water and wastewater utility company. After years of fairly unremarkable performance, shares started to rocket higher in 2016 and have remained a surprisingly strong performer up to today.

Over the past decade, MSEX stock has appreciated an eye-catching 376%. This might make investors think that this water company has some special formula that is leading it to these tremendous returns. Unfortunately, however, much of the gains have simply come from a higher valuation multiple, and thus leave the stock vulnerable to significant downside going forward.

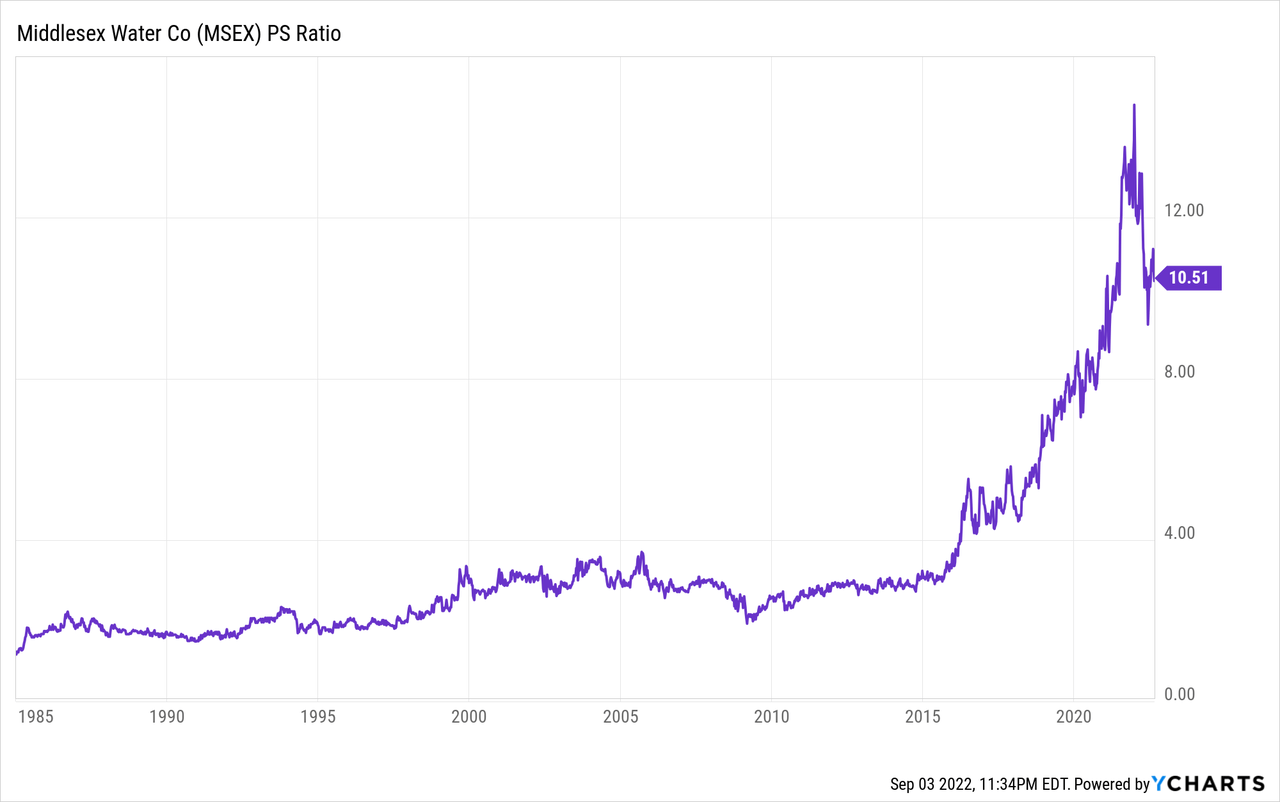

This is arguably most clear from looking at the company’s price-to-sales ratio. Normally, people might not use P/S for utilities. However, I find it interesting since utilities tend to be regulated and earn stable returns and profit margins off their businesses. Top-line revenues are a very good judge of what a utility will be able to earn over the long term since there is minimal fluctuation in profit margins.

In the case of Middlesex, after decades of trading at a 2-3x P/S ratio, this figure has suddenly exploded to 10.5x today:

I find this hard to justify, given that the profit margin on water tends to be limited. A utility will struggle to deliver all that much shareholder value creation beyond what it can achieve in terms of growing its top-line results. And, as the chart shows, Middlesex’s valuation has run far ahead of its actual business growth.

Earnings Growth Is Slower Than It First Appears

A bull on the company could point to its earnings growth, which has been much quicker than its revenues in recent years. However, there is a specific factor driving this above-average earnings growth which investors should be aware of.

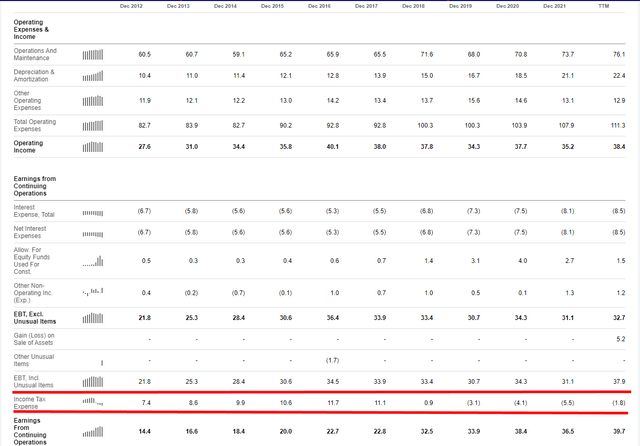

Here’s a portion of Middlesex’s income statement so you can see the key factor:

MSEX Income Statement (Seeking Alpha)

I highlighted the income tax expense line as it has been the crux of Middlesex’s earnings growth in recent years. Up until 2017, Middlesex was paying out roughly a third of its earnings before tax (“EBT”) in income tax. In 2018, however, Middlesex had almost no tax liability, and since 2019, it has received a net tax benefit.

Middlesex still owes normal statutory tax; in 2021, it paid $6.5 million of tax at the statute rate. It paid another $1.5 million in state tax. However, Middlesex received tax benefits of $12.3 million for tangible property repairs and another $1.3 million benefit for utility plant repairs. On net, Middlesex received a sizable tax rebate rather than having an expense. There’s significant discussion in Middlesex’s 10-K about the regulatory treatment and IRS handling of accounting relating to these tangible assets.

I’m no tax expert and can’t speak to specifics of this situation. I’d simply note that it’s not especially common for American companies to have negative effective tax rates for all that long and investors might want to double-check their research before assuming that the company will enjoy such a favorable net taxation rate indefinitely.

Why does this change in tax rate matter? Between 2012 and 2021, Middlesex Water grew its earnings from continuing operations from $14 million to $36 million. Sounds great, that’s a more than 150% increase.

However, earnings from continuing operations over that period only increased from $28 million to $35 million. This is a closer to 30% increase in the actual ongoing pre-tax profits of Middlesex’s business. This is still fine and decent growth, but it’s far less than you’d think just from looking at the company’s reported earnings per share.

Total Returns Likely Minimal Going Forward

Let’s put this math together. Realistically, what sort of returns could an investor expect from MSEX stock over the next five years?

Middlesex has grown revenues at a 3.4% compounded rate over the past decade, and earnings growth was in the same ballpark if you adjust for the change in the company’s tax rate.

Middlesex also pays a 1.3% dividend yield, and investors can expect small annual increases to that dividend going forward as well. Combine 3% top-line growth with the dividend and we could expect total returns in the 5% annualized range if the stock’s valuation stayed where it is today.

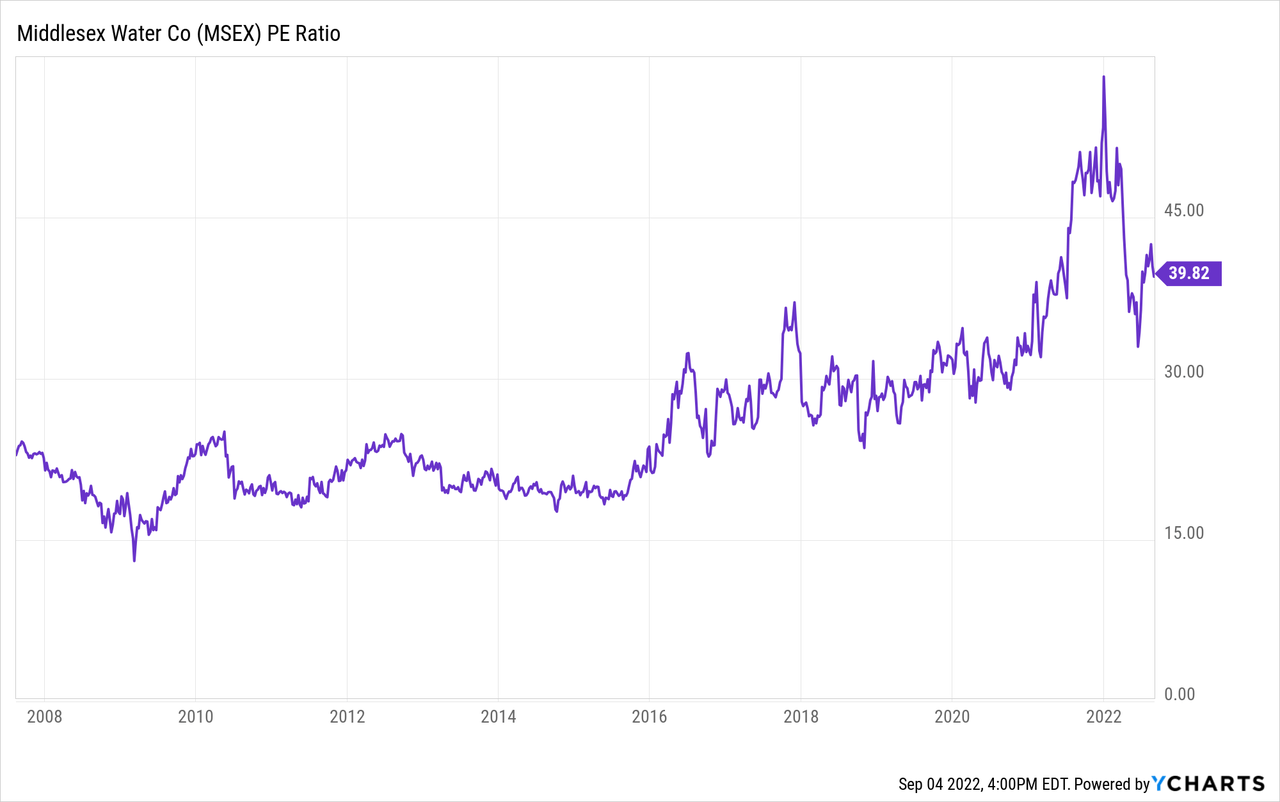

That’s where the other issue comes in, however. The firm’s P/E ratio has now spiked to nearly 40, versus far lower averages in the past:

Prior to 2015, Middlesex tended to have a P/E ratio around 20. From 2016 and on, the company’s P/E ratio reset to around a median of 30. Now, it’s pushing 40.

If we figure earnings grow from a projected $2.52 this year to $3.00 over the next five years, that would be respectable growth in-line with the company’s past performance. However, if MSEX stock goes back to a 30x P/E ratio, the stock would trade for just $90 in 2027, offering virtually no upside from today’s $89 stock price. And if Middlesex goes back to a 20x P/E ratio, like it traded at for much of the 2008-14 period, that would put the stock at $60 in 2027, which would represent a sizable loss even including the company’s dividend.

Is Middlesex Water Stock A Good Short Sale Candidate?

If MSEX stock is significantly overvalued compared to both its own past history and other water utilities’ valuations, does that make MSEX stock a good short?

Certainly, some people think so. As of this writing, more than 4% of MSEX stock’s float has been sold short. That’s quite a high figure for a sleepy utility company such as this one.

I’d imagine that some managers are using Middlesex Water as a funding short. That is to say that they probably own other more attractively priced utility stocks and are hedging their bets by taking a short position on Middlesex. That seems reasonable as a strategy.

But, this isn’t a slam dunk short candidate. As Middlesex only has 17 million shares of stock outstanding, the price can move around fairly quickly on any positive catalysts.

One such example happened in July 2021, when the S&P 600 SmallCap Index added Middlesex to its holdings. In doing so, this forced a ton of passive funds to buy into MSEX stock. Shares soared from $80 to $110 in the span of a month thanks primarily to this index inclusion event.

For another thing, there has been some chatter of potential consolidation in the water industry. There aren’t that many publicly traded companies available, so Middlesex could rally if any water deal rumors bubble up.

On balance, I’d expect a short sale of Middlesex Water shares to perform reasonably well within a broader long/short equity portfolio. However, I’d also say that it isn’t so simple as saying it’s a slam dunk short because it’s a water utility at a high 30s P/E ratio. The valuation seems too high, I’d agree. But without an obvious catalyst to correct it, this sort of low-volatility stock can remain disconnected from underlying fundamentals for quite a while. Particularly in a bear market, these types of low beta defensive stocks can outperform longer than you might expect.

MSEX Stock Verdict

I’m generally hesitant to use the word sell when it comes to Dividend Aristocrats. It’s admirable when a company can pull off the feat of increasing its dividend for so many years in a row and speaks to a management team’s prudent nature and ability to manage a business through the economic cycle. This is not a knock on the company’s business strategy or leadership at all.

I just don’t see how the math works out even holding over a five-year period from here. Assuming the company grows its core operations in line with its historical results, Middlesex would need to trade with a nearly 30x P/E ratio in 2027 for shareholders to merely break even from today’s starting price.

For a holder with a long enough time horizon, maybe there is still a case for holding the stock. Water utilities are something of a fixed income alternative, since they usually offer a stable cash flow stream off irreplaceable assets with regulated returns on equity. That’s an equation that adds up to being a sleep well at night holding. In the case of Middlesex, I’d argue this cash flow stream is significantly overvalued. But, it’s still something you can own and have high confidence that it will be producing steady dividends a decade from now.

So, for very long-term investors or people that have capital gains tax concerns, maybe shares are a hold. For most folks, though, the prospect of little to no total returns through 2027 on this stock should be reason enough to consider redeploying the capital to other more attractive opportunities.

[ad_2]

Source link