[ad_1]

vzphotos

In our earlier evaluation of Micron Expertise, Inc. (NASDAQ:MU), we discovered that the corporate’s elevated stock resulted from a drop in demand progress in comparison with provide progress, affecting DRAM and NAND costs in 2023. Regardless of this, we anticipated pricing to stabilize as main reminiscence producers lowered spending, resulting in a restoration in profitability after FY2023.

On this evaluation, we centered on the corporate in mild of the latest restrictions positioned on Micron’s merchandise in China. We assessed the potential implications on Micron’s income, considering its publicity to China and the extent of the imposed restrictions. Moreover, we scrutinized its opponents within the reminiscence market to judge their capability to fulfill the demand arising from these restrictions. Lastly, we delved into reminiscence market pricing developments to find out if the ban may contribute to pricing progress.

Income Influence from New Restrictions

In Could, Micron said in a submitting that the Cybersecurity Administration of China (‘CAC’) that its merchandise “current a cybersecurity danger” and the regulatory physique had “notified crucial data infrastructure operators in China to cease utilizing Micron merchandise”. In accordance with the BBC, the precise dangers talked about weren’t disclosed within the official translated CAC press launch. Furthermore, The Guardian highlighted the broad definition of “crucial data infrastructure”:

The choice may have an effect on Micron merchandise in sectors starting from telecoms to move and finance, in response to China’s broad definition of crucial data infrastructure. – The Guardian

In accordance with Sensible Legislation, the CAC is tasked with “our on-line world safety and web content material regulation” underneath the supervision of the Chinese language authorities’s Central Our on-line world Affairs Fee. Whereas it doesn’t have jurisdiction over Hong Kong, the CAC and Hong Kong’s tech bureau had lately agreed to cooperate to create guidelines facilitating information stream between mainland China and Hong Kong.

Based mostly on its newest earnings briefing, the corporate said that its prospects corresponding to cellular OEMs had been notified by crucial data infrastructure operators and the federal government relating to the CAC determination as defined within the quote beneath.

The influence of the Could 21 determination by the Our on-line world Administration of China on Micron’s enterprise stays unsure and fluid. A number of Micron prospects, together with cellular OEMs, have been contacted by sure crucial data infrastructure operators or representatives of the federal government in China regarding the future use of Micron merchandise. – Sanjay Mehrotra, President and Chief Govt Officer

Regardless of that, administration did emphasize the uncertainty relating to the state of affairs and reiterated it may nonetheless proceed to evolve and was working to mitigate the dangers. Nonetheless, administration anticipates that roughly half of the income from prospects headquartered in China may face potential impacts.

Geographic Income

Firm Knowledge, Khaveen Investments

|

Micron Geographical Income Breakdown ($ mln) |

2018 |

2019 |

2020 |

2021 |

2022 |

Common |

|

United States |

17,116 |

12,451 |

10,381 |

12,155 |

16,026 |

|

|

Progress % |

-27% |

-17% |

17% |

32% |

1% |

|

|

Taiwan |

3,918 |

2,703 |

3,657 |

6,606 |

6,185 |

|

|

Progress % |

-31% |

35% |

81% |

-6% |

20% |

|

|

Mainland China (Excluding HK) |

3,607 |

3,595 |

2,337 |

2,456 |

3,311 |

|

|

Progress % |

0% |

-35% |

5% |

35% |

1% |

|

|

Japan |

1,761 |

1,614 |

1,387 |

1,652 |

1,696 |

|

|

Progress % |

-8% |

-14% |

19% |

3% |

0% |

|

|

Hong Kong |

1,265 |

958 |

1,792 |

2,582 |

1,665 |

|

|

Progress % |

-24% |

87% |

44% |

-36% |

18% |

|

|

Different Asia Pacific |

1,458 |

1,032 |

1,157 |

1,420 |

1,223 |

|

|

Progress % |

-29% |

12% |

23% |

-14% |

-2% |

|

|

Different |

1,266 |

1,053 |

724 |

834 |

652 |

|

|

Progress % |

-17% |

-31% |

15% |

-22% |

-14% |

|

|

Whole |

30,391 |

23,406 |

21,435 |

27,705 |

30,758 |

|

|

Progress % |

-23% |

-8% |

29% |

11% |

2% |

Supply: Firm Knowledge, Khaveen Investments

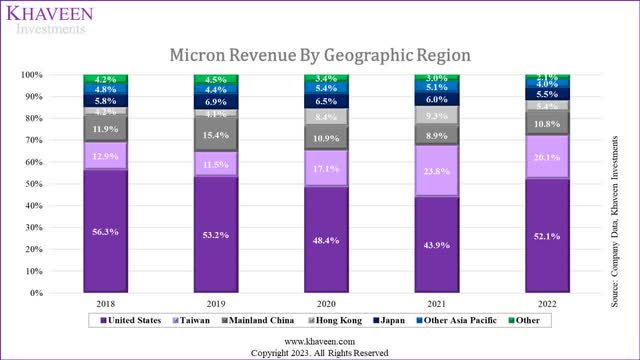

Based mostly on the corporate’s annual studies, the corporate breakdowns its income “based mostly on the geographic location of consumers’ headquarters”. We compiled the corporate’s geographical income breakdown within the desk above previously 5 years. As seen above, the corporate’s income from the US is the best, representing 52.1% of its whole income in FY2022. Its income from China and Hong Kong accounted for a mixed 16.2% of income and had elevated solely barely from 16% mixed in 2018. Nonetheless, in response to the corporate’s submitting, Micron guided that its income publicity to China and Hong Kong was “roughly 1 / 4” or 25% of its whole income. That is larger in comparison with its income breakdown from its annual report by 8.8%. We imagine one of many causes could possibly be that the corporate included oblique income by way of distributors as said within the submitting. For instance, Arrow Electronics (the biggest digital elements distributor) is likely one of the firm’s distributors and as much as 40% of its revenues are derived from China.

Finish Market Breakdown

Micron

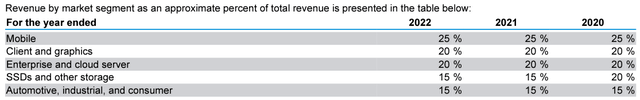

By way of its income breakdown by finish markets from its annual report, the biggest is Cellular at 25% of income adopted by Shopper and graphics, Enterprise and cloud server in addition to SSDs and different storage at 20% of income every. Lastly, the Automotive, industrial and shopper phase is the smallest at 15% of income. As talked about, the CAC embargo covers “crucial data infrastructure” which incorporates community amenities, thus we imagine this impacts the Enterprise and cloud server phase. Moreover, we imagine the Cellular phase could possibly be impacted in addition to highlighted by the corporate in its newest earnings briefing.

Income Influence

Subsequent, on this part, we derived an estimate of the corporate’s income influence as a result of CAC determination in a bear, base and bull case state of affairs:

- Bear Case: For the bear case influence, we assumed the brand new restrictions on Micron have an effect on its publicity in China and Hong Kong and will influence all segments because the scope of the tip markets impacted just isn’t clearly outlined. Subsequently, we estimated the income influence by multiplying Micron’s said income publicity to China (25%) and finish markets publicity of 100%.

- Base Case: For the bottom case influence, we assumed the Chinese language restrictions on Micron have an effect on its publicity in China and Hong Kong and will influence its Cellular and Enterprise and cloud server segments. Subsequently, we estimated the income influence by multiplying Micron’s said income publicity to China (25%) and finish markets publicity of 45%. Total, we estimate an influence of 11.3% for the bottom case which is consistent with administration steerage of a “low double-digit proportion” influence.

- Bull Case: For the bull case influence, we assumed the Chinese language restrictions on Micron could possibly be restricted because the scope of the restrictions stay unclear with the official announcement by the CAC solely stating that the community operators ought to cease utilizing Micron’s merchandise somewhat than explicitly saying that it should not use Micron’s merchandise. Additionally, Micron talked about that the state of affairs stays unsure and was partaking with the federal government and prospects to mitigate the influence. Subsequently, we estimated the income influence by multiplying Micron’s said income publicity to China (25%) by 50% as an assumption and finish market publicity of 45% to acquire a complete influence of 5.6% of revenues.

|

Micron Income Influence Estimate |

Bear Case |

Base Case |

Bull Case |

|

Micron Income ($ bln) |

30,758 |

30,758 |

30,758 |

|

Share of China Income |

25.0% |

25.0% |

12.5% |

|

Finish Markets Influence ($ bln) |

100% |

45% |

45% |

|

Estimated Influence |

7,690 |

3,460 |

1,730 |

|

Estimated Influence % of Whole Income |

25.0% |

11.3% |

5.6% |

Supply: Micron, Khaveen Investments

Total, we estimate a income influence of between 5.6% (bull case) to 25% (bear case) for Micron as a result of new Chinese language authorities restrictions. Moreover, our base case income influence estimate of 11.3% based mostly on our assumption of Micron’s said income publicity to China (25%) and mixed Cellular and Enterprise and cloud server segments publicity (45%) is consistent with administration steerage of the “low double-digit proportion” or 12.5% estimated income influence. Thus, our base case estimate of a 4.8% income influence is just barely decrease by 1.2% of revenues in comparison with administration’s steerage.

Key Rivals May Profit

In accordance with Evercore ISI (EVR), the brand new Chinese language restrictions may danger Micron’s prospects shifting to South Korean opponents corresponding to SK Hynix and Samsung (OTCPK:SSNLF). Thus, we examined whether or not Micron’s opponents may benefit from the restrictions on the corporate.

|

Micron Income Breakdown |

2022 |

|

DRAM |

72.78% |

|

NAND |

25.4% |

Supply: Firm Knowledge, Khaveen Investments

Micron’s reminiscence income is damaged down into DRAM and NAND the place its DRAM share of revenues is bigger than its NAND share of revenues. Its DRAM revenues consisted of 73% of its whole revenues adopted by NAND at 25.4% of whole revenues in 2022.

Market Share

DRAM

TrendForce, Khaveen Investments

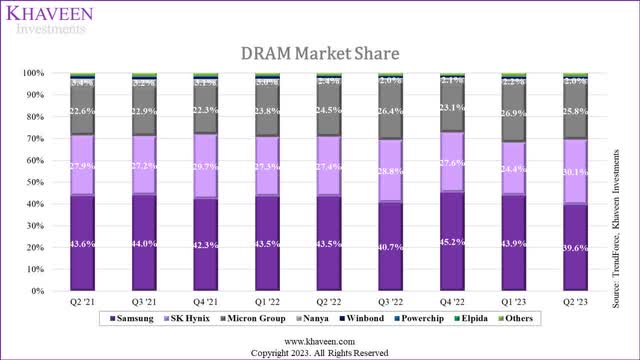

By way of market share, the DRAM market consists of three main massive gamers that are Samsung, SK Hynix and Micron which cumulatively account for over 95% of the DRAM market. The Chinese language corporations’ share in DRAM was nonetheless insignificant. In Q2 2023, Micron’s market share declined barely by 1.1% within the prior quarter and Samsung additionally misplaced share whereas SK Hynix’s share elevated to 30.1% as the corporate had larger shipments and ASPs on account of DDR5 and HBM in response to TrendForce.

NAND

TrendForce, Khaveen Investments

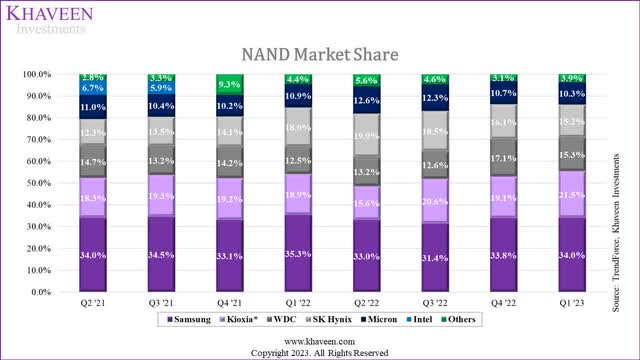

For the NAND market, Samsung, SK Hynix and Micron are additionally among the many high corporations out there however it’s extra numerous in comparison with the DRAM market. These 3 corporations accounted for 59.5% of the market share mixed in Q1 2023. YMTC’s market share is included within the others and has risen since 2021 however nonetheless pales compared in comparison with bigger opponents.

Expertise

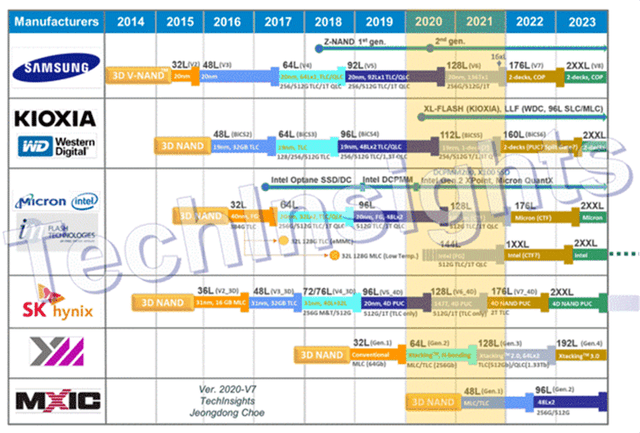

NAND

TechInsights

Based mostly on the NAND know-how roadmap by TechInsights, a lot of the high corporations have a 232L course of for NAND. Superior course of know-how nodes are essential for NAND know-how as they carry important enhancements in efficiency, energy effectivity and manufacturing prices. As an example, Micron said that its 232L NAND tech achieves quick NAND I/O speeds and permits for larger design flexibility. Moreover, it claims to realize the best TLC density per sq., leading to quicker, extra environment friendly reminiscence in units and cost-effective manufacturing. Based mostly on the roadmap, YMTC was anticipated to solely have 192L NAND by 2023 however has as a substitute made a leap skipping it on to 232L NAND in 2023 in response to TechInsights which highlights its spectacular technological feat.

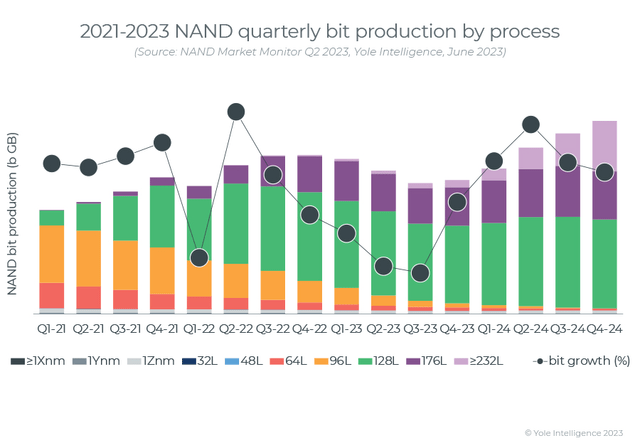

Yole Growth

However, based mostly on the chart above of the breakdown of the NAND market manufacturing by course of know-how, nearly all of the market manufacturing continues to be on a 128L NAND course of whereas the 176L NAND course of is smaller however has been growing over the previous years from 2021. Moreover, 232L NAND course of applied sciences are anticipated to extend considerably by way of 2024 in response to Yole Growth.

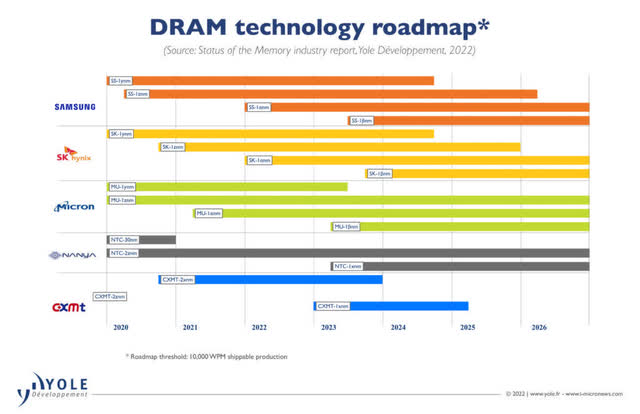

DRAM

Yole Growth

The chart by Yole Growth above exhibits the method roadmap of DRAM the place the highest three corporations are main with a cutting-edge 1-beta nm course of know-how in 2023. In distinction, opponents like Nanya (OTCPK:NNYAF) and CXMT, based mostly in Taiwan and China respectively, are utilizing a 1-x nm course of know-how in 2023, which locations them considerably behind the highest three gamers, as 1x nm (19nm-17nm) lags 4 generations behind the most recent 1-beta nm course of.

Having essentially the most superior course of know-how node is essential for DRAM because it brings substantial enhancements in efficiency, energy effectivity, and manufacturing price. As an example, Micron’s 1-beta DRAM know-how affords roughly a 15% energy effectivity enhancement and over a 35%-bit density enchancment, that includes a 16Gb per die capability in response to the corporate. This interprets to units utilizing this know-how having quicker, extra environment friendly reminiscence, whereas additionally being cheaper to fabricate.

Geopolitics

Whereas it’s anticipated that the restrictions on Micron may benefit opponents from South Korea corresponding to Samsung and SK Hynix, the US authorities has suggested South Korea towards filling the hole left by Micron. Moreover, the US Division of Commerce was reported to be planning to interact with the Chinese language authorities in addition to US allied nations to deal with the actions by the Chinese language authorities. The South Korean authorities has indicated that it’s going to not encourage its corporations to fill demand but additionally has not discouraged them from doing so both in response to the South China Morning Put up. Nonetheless, within the firm’s newest quarterly earnings, each Samsung and SK Hynix had not explicitly highlighted the China restrictions and whether or not they would capitalize on the influence on Micron to fill the demand.

Regardless of the reported strain from the US authorities towards South Korean corporations to fill the demand as a result of China restrictions, the US authorities is reportedly permitting chipmakers corresponding to Samsung and SK Hynix to proceed and increase their DRAM and NAND operations in China, letting them purchase gear from US suppliers. In accordance with WSJ, the Division of Commerce meant to increase waivers initially granted to overseas chipmakers corresponding to South Korea, which exempt them from US export controls to China. These waivers, on account of expire in October, allow US semicon gear producers to export chip-making instruments to China underneath sure circumstances. Subsequently, in mild of the studies of US authorities strain on South Korean chipmakers, we imagine the US may change its stance because it had finished so with the manufacturing gear export exemptions Samsung and SK Hynix benefitted from and highlighting their robust bargaining energy.

|

Firms |

Q2 2022 |

Q2 2023 |

YoY |

|

Samsung (KRW tln) |

21.08 |

8.97 |

-57.4% |

|

SK Hynix (KRW tln) |

13.81 |

7.31 |

-47.1% |

|

Micron ($ bln) |

8.64 |

3.75 |

-56.6% |

Supply: Firm Knowledge, Khaveen Investments

Moreover, we compiled the income progress of Micron, Samsung’s reminiscence phase and SK Hynix in Q2 2023 to check their efficiency following the announcement of the commerce restrictions. As seen within the desk, all 3 corporations had considerably massive destructive progress within the interval. SK Hynix carried out the most effective amongst them 3 whereas Samsung carried out the worst. Total, we imagine this highlights Samsung or SK Hynix didn’t considerably profit from the restrictions within the quarter.

Chinese language Authorities Subsidies

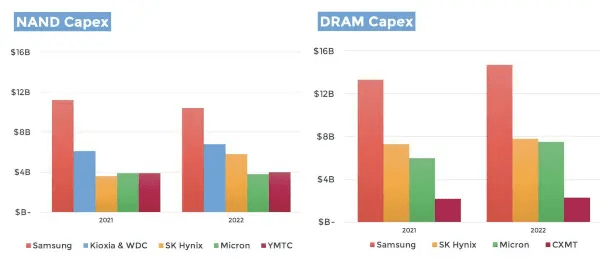

Yole Growth

Based mostly on the chart above of the NAND and DRAM capex by firm from Yole Growth, Micron’s capex is ranked fifth in NAND and third in DRAM. Curiously, YMTC is forward of Micron in NAND with the next capex than the corporate. Moreover, in DRAM, CXMT, regardless of having a really low market share has fairly substantial capex compared to Micron.

In 2023, in response to The Register, regardless of US commerce restrictions, YMTC is about to obtain a considerable monetary enhance of CNY49 bln ($7 bln) from traders with relations with the federal government, together with CNY12.9 bln ($1.9 bln) from China’s semiconductor funding group (the Huge Fund). Moreover, different Chinese language entities are additionally investing $5.1 bln within the firm.

These investments will double YMTC’s registered capital, surpassing CNY105 bln based mostly on the South China Morning Put up. Thus, we imagine this highlights the robust monetary backing of Chinese language reminiscence makers particularly YMTC which may pose a risk to Micron.

Abstract

Total, following the newly imposed restrictions on Micron’s merchandise by the Chinese language authorities, we imagine that the corporate’s opponents may benefit from the influence on Micron. We imagine Micron’s high opponents, Samsung and SK Hynix would have the ability to fill the demand of Chinese language prospects given their robust market place in DRAM and NAND. Nonetheless, these South Korean chipmakers have been reported to be warned towards doing so by the US authorities, however we imagine it could change its stance with the robust bargaining energy of those corporations because it had offered them with exemptions from the US semiconductor gear export controls to China. Moreover, we imagine Chinese language chipmakers are additionally positioned to capitalize on the ban on Micron’s merchandise. In NAND, we imagine YMTC has robust technological capabilities with its 232L NAND and capex that’s larger than Micron in NAND and had acquired further important funding from China which may spur its enlargement to reap the benefits of the demand hole as a result of ban in NAND. Nonetheless, in DRAM, we imagine CXMT nonetheless lags behind the highest 3 DRAM corporations by way of course of know-how, being 4 generations behind them.

Early Indicators of Enhancing Reminiscence Pricing Outlook

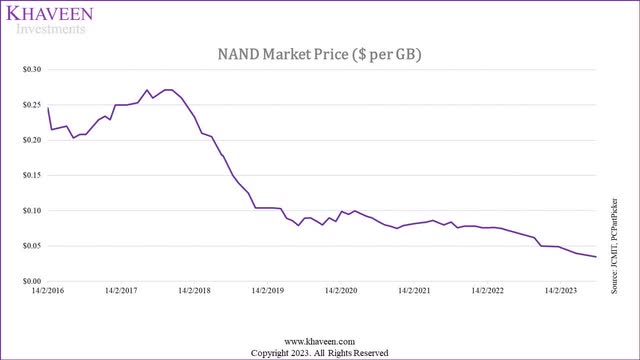

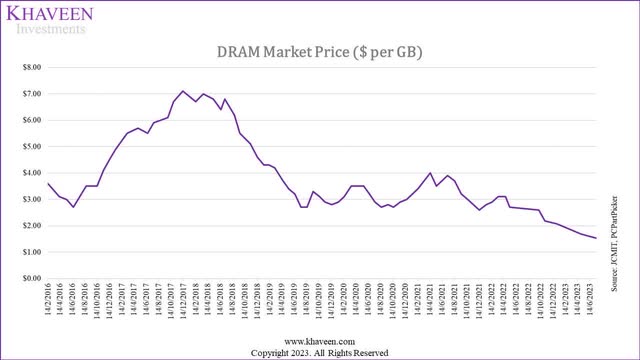

On this part, we examined the reminiscence market pricing and analyzed whether or not the brand new restrictions have had an influence on the reminiscence market pricing developments. We compiled and up to date our pricing information from JCMIT and PCPartPicker within the charts beneath.

NAND

JCMIT, PCPartPicker, Khaveen Investments

Based mostly on the chart above, the NAND market pricing has been trending downwards since 2022. The pattern continued all through 2023 till August 2023. Over the previous 1 yr, NAND pricing had declined by 58.9% YoY and had not proven any indicators of enchancment regardless of the introduced restrictions by China on Micron’s merchandise in Could 2023. From Could to August 2023, NAND pricing additional declined by 6.5%.

DRAM

JCMIT, PCPartPicker, Khaveen Investments

Moreover, the DRAM market pricing has additionally been trending downwards since 2022 and has continued all through 2023. Over the previous 1 yr, DRAM pricing had declined by 60.8% YoY and had not proven any indicators of enchancment regardless of the introduced restrictions by China on Micron’s merchandise in Could 2023. From Could to July 2023, NAND pricing additional declined by 9.1%.

Stock Ranges

|

Days Stock Ratio |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

TTM |

Common |

|

Micron |

138.02 |

136.72 |

158.38 |

218.42 |

207.37 |

163.30 |

208.83 |

307.94 |

167.25 |

|

Samsung |

68.49 |

69.72 |

94.49 |

87.98 |

91.15 |

105.32 |

116.03 |

136.98 |

84.22 |

|

SK Hynix |

66.82 |

67.05 |

84.91 |

94.22 |

98.93 |

114.25 |

154.73 |

172.25 |

92.68 |

|

Stock Turnover Ratio |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

TTM |

Common |

|

Micron |

2.64 |

2.67 |

2.30 |

1.67 |

1.76 |

2.24 |

1.75 |

1.19 |

2.47 |

|

Samsung |

5.33 |

5.23 |

3.86 |

4.15 |

4.00 |

3.47 |

3.15 |

2.66 |

5.09 |

|

SK Hynix |

5.46 |

5.44 |

4.3 |

3.87 |

3.69 |

3.19 |

2.36 |

2.12 |

4.57 |

Supply: Firm Knowledge, Morningstar, Khaveen Investments

We examined the effectivity ratios associated to stock for the main reminiscence producers: Micron, Samsung, and SK Hynix. In accordance with the info, all three corporations have skilled an increase of their stock, reaching the best ranges noticed over the past decade. Notably, Micron stands out with the best days stock ratio in comparison with its opponents, surpassing its personal 10-year common. Moreover, the stock turnover ratios for all three corporations have decreased, reaching their lowest factors previously decade. In comparison with our earlier evaluation, their days stock ratio had elevated TTM and stock turnover had decreased, which means that the stock ranges had not but proven any important enchancment.

Nonetheless, Micron offered a optimistic outlook for stock ranges within the reminiscence market, stating that its finish market prospects had made progress in lowering their stock ranges previously quarters.

Clients continued to make progress in lowering their extra stock in fiscal Q3. Most buyer inventories within the PC and smartphone segments are near regular ranges now, in keeping with our forecast six months in the past. A few of these stock ranges can get distorted by buyer makes an attempt to leverage present costs, that are deemed to be transient and unsustainable at these ranges, to buy further volumes earlier than costs rise considerably. Knowledge heart buyer stock can also be bettering and can seemingly normalize across the finish of this calendar yr or considerably thereafter, relying on the expansion in conventional information heart spending. – Sanjay Mehrotra, President and Chief Govt Officer

Based mostly on Micron’s annual report, the corporate’s merchandise are bought to prospects straight together with smartphone makers like Apple (AAPL) and reminiscence module makers, or by way of distributors. Its high prospects are DRAM module market chief Kingston (KINS) with a 78% market share (12% of revenues) and distributor WPG Group (OTC:WPGHF) (11% of revenues). Seagate (STX), the market chief in HDD (43% market share), additionally procures NAND flash chips from Micron. Seagate’s stock ranges had decreased by 27% to $1.14 bln in comparison with $1.57 bln in comparison with a yr in the past, which highlights the lowering stock ranges of the corporate. Furthermore, in our earlier evaluation of TSMC (TSM), we highlighted the lowering stock ranges within the PC and smartphone finish markets. In accordance with TrendForce, PC and smartphone makers have been lowering their reminiscence stock.

Moreover, in response to TF Worldwide Securities, Micron and Samsung had begun elevating their worth quotes by 10%. This follows after YMTC reportedly raised its NAND costs by as much as 5% in response to the Taiwan Financial Occasions. Beforehand, Micron, Samsung and SK Hynix have been believed to be reviewing their costs based mostly on Enterprise Korea. In relation, NH Funding & Securities claimed that Micron would “cease accepting low-price orders for each DRAM and NAND” from Could 2023.

All in all, regardless of the brand new commerce restrictions by China on Micron’s merchandise, we imagine that the market pricing had not been impacted considerably by the restrictions as NAND and DRAM pricing continued to lower since Could 2023 when the restrictions have been introduced. We imagine the restricted influence could possibly be attributed to the elevated market stock state of affairs the place the highest 3 corporations nonetheless have excessive stock ranges as indicated by their above-average days stock and stock ratios. However, we proceed to count on a pricing restoration with studies indicating that high reminiscence makers, together with Micron, have began elevating costs. We imagine the corporate was not taking orders as a result of the costs have been too low and may benefit from larger costs in addition to larger shipments as soon as market pricing recovers.

Threat: Tougher Crackdown by China

We imagine one of many crucial dangers following the latest developments by Chinese language regulators on Micron is the uncertainty of the state of affairs. As mentioned, we estimated a base case income influence of 11.3% as a result of new restrictions on the corporate. Nonetheless, the corporate said that its whole income publicity to China is 1 / 4 of its revenues. Given the obscure scope of the restrictions which even administration acknowledged, we imagine the corporate could be impacted considerably if the regulators impose a broader crackdown towards Micron amid excessive geopolitical tensions between the US and China. We recall that Micron beforehand guided a “low-single to high-single digit proportion” influence however raised it to a “low double-digit proportion” influence. That mentioned, the corporate did spotlight that it was partaking with regulators and prospects to mitigate the influence. Total, the state of affairs stays extremely unsure.

Valuation

|

Micron Income Projection ($ bln) |

2020 |

2021 |

2022 |

2023F |

2024F |

2025F |

|

DRAM |

14.51 |

20.04 |

22.39 |

14.18 |

15.98 |

17.92 |

|

Progress % |

38.1% |

11.7% |

-36.6% |

12.7% |

12.1% |

|

|

NAND |

6.13 |

7.01 |

7.81 |

5.41 |

5.84 |

6.50 |

|

Progress % |

14.3% |

11.5% |

-30.8% |

7.9% |

11.3% |

|

|

Others |

0.79 |

0.66 |

0.56 |

0.37 |

0.25 |

0.27 |

|

Progress % |

-17.0% |

-14.9% |

-34.9% |

-32.9% |

||

|

Whole Income |

21.44 |

27.71 |

30.76 |

19.95 |

22.06 |

24.68 |

|

Whole Progress % |

29.25% |

11.02% |

-35.12% |

10.57% |

11.86% |

Supply: Firm Knowledge, Khaveen Investments

We up to date our projections from our earlier evaluation with its Q3 FY2023 outcomes and in addition factored in our base case influence to Micron’s revenues at 11.2% of revenues ranging from This fall FY2023 and revised our income progress forecast to -35.12% however we nonetheless anticipate a optimistic restoration past that at 10.57%.

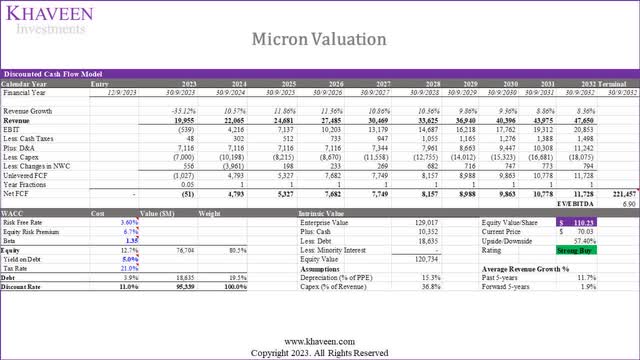

Khaveen Investments

Based mostly on our DCF mannequin, we obtained an upside of 57.4% based mostly on a reduction charge of 11.2% (firm’s WACC). Moreover, we utilized a reduction of 30% to account for the Molodovsky Impact as defined in our earlier evaluation, wherein we derived an upside of 10.18%.

|

Present Worth |

Valuation Worth |

Upside |

|

|

Valuation (‘DCF’) |

$ 70.03 |

$ 110.23 |

57.40% |

|

Molodovsky Impact Low cost (30%) |

$ 77.16 |

10.18% |

Supply: Khaveen Investments

Verdict

All in all, we imagine that new Chinese language authorities restrictions could influence Micron’s income starting from our bear case of 25% of income to five.6% of income within the bull case. Our base case estimate of an 11.3% income influence aligns with Micron’s steerage of a “low double-digit proportion” or 12.5% influence, solely barely decrease by 1.2% in comparison with administration’s steerage. In mild of those restrictions, we anticipate that Micron’s opponents, significantly Samsung and SK Hynix, may benefit on account of their robust positions within the DRAM and NAND markets. Regardless of reported warnings from the US authorities, we imagine they could rethink, given these corporations’ bargaining energy and former exemptions from US export controls to China. Moreover, we imagine that Chinese language chipmakers, together with YMTC in NAND, are additionally poised to capitalize on the ban, with technological capabilities and funding for enlargement. Regardless of the restrictions, NAND and DRAM pricing has not been considerably impacted, seemingly on account of excessive market stock ranges among the many high 3 corporations. Nonetheless, we anticipate a pricing restoration, with reminiscence makers, together with Micron, already elevating costs. Thus, we imagine Micron may benefit from larger costs and elevated shipments as soon as market pricing rebounds.

Total, we keep our Purchase score on the corporate however with a cheaper price goal of $77.16 which is barely decrease in comparison with our earlier evaluation of $83.97 on account of a decrease progress forecast at a 5-year ahead common of 1.9% (6.8% beforehand) accounting for the potential influence from the brand new Chinese language restrictions on Micron in addition to its dismal Q3 FY2023 efficiency which noticed its whole income declined by 57% YoY. However, we forecasted the corporate’s income to get better past 2023 as we anticipate the market to stabilize.

[ad_2]

Source link