[ad_1]

Meta, previously referred to as Fb, is all set to launch its incomes report for the second quarter on July 26, 2023. The corporate is anticipating a big deceleration in its income progress, primarily because of a continued lack of sturdy progress momentum.

Moreover, Meta might face headwinds from regulatory challenges and platform modifications, notably iOS updates, that are anticipated to have a better influence in Q2 in comparison with the primary quarter.

The corporate foresees its expenditures to be within the vary of $95-100 billion, pushed by varied elements together with content material prices, client {hardware}, product expertise, technical, and infrastructure bills. Furthermore, Meta’s capital expenditure for 2023 is predicted to be round $21-23 billion, reflecting its investments in {hardware} manufacturing, community and server infrastructure, and knowledge facilities.

Income and Earnings Expectations

Based on Zacks Consensus Estimate, Meta’s Q2 income is projected to be roughly $30.84 billion, indicating an increase of 7.01% from the identical quarter within the earlier yr. The earnings per share (EPS) are anticipated to face at $2.85, representing a 15% improve in comparison with the year-ago quarterly report.

Analyst Predictions

In a report from Financial institution of America Merrill Lynch, Meta’s Q2 outcomes are anticipated to beat expectations, pushed by positive aspects in digital advert spending stability. Because of this, they have raised their inventory worth expectations from $375 to $400 whereas sustaining a purchase ranking. Furthermore, they’ve additionally elevated their income and EPS expectations for the corporate for the years 2023 to 2025, forecasting income to succeed in $31.5 billion and EPS to be at $3.03 for the second quarter of 2023. [2]

Key Components for Upbeat Efficiency

Meta’s upbeat efficiency in Q2 could be attributed to a number of elements:

- Elevated engagement throughout its household of apps, together with Fb, Instagram, WhatsApp, and Messenger, particularly within the Asia Pacific and Remainder of World areas.

- Development in advert impressions delivered throughout its apps because of larger person exercise and product improvements comparable to Reels.

- Diversification of income streams via new choices like Threads (a microblogging platform), Meta Verified (a subscription service), Oculus Quest (a VR headset), and Horizon (a VR social platform).

- Continued investments in technical and product expertise, infrastructure, client {hardware}, and content material prices to help its long-term imaginative and prescient of constructing the metaverse.

Challenges Confronted by Meta

Regardless of the constructive outlook, Meta additionally faces some challenges:

- A decline in revenues in comparison with prior intervals of upper progress.

- Apple’s iOS privateness coverage modifications, making it more durable to trace person habits.

- Rising bills and decreased margins because of rising expertise and infrastructure prices.

- Regulatory and authorized threats, together with privateness and taxation considerations.

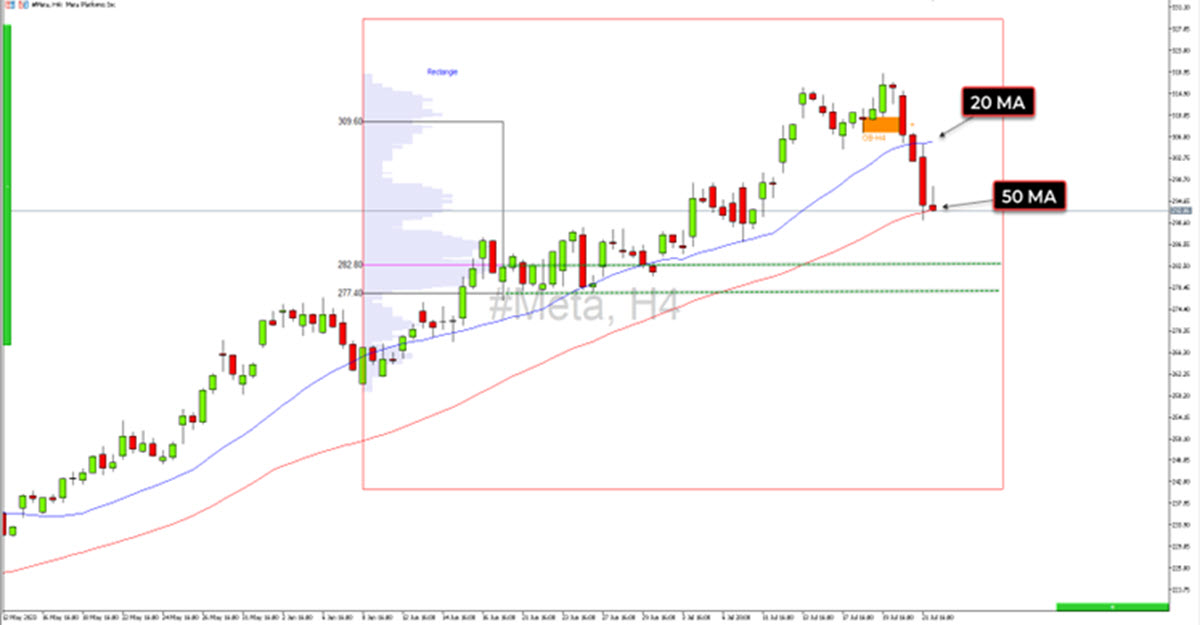

Meta Technical Evaluation

From a technical perspective, Meta’s inventory worth has been sustaining a bullish pattern, remaining above the 50-day and 20-day shifting averages. Nevertheless, the Relative Energy Index (RSI) is nearing 70 on the each day chart, suggesting a possible consolidation because of slight overbought situations.

Trying on the worth ranges, the $290 area seems to be a strong help space for the asset, coinciding with the previous resistance noticed in April-Could and the decrease boundary of the ascending channel. Then again, the resistance stage lies round $360-370, aligning with the higher boundary of the channel.

Because the incomes report approaches, traders are eagerly anticipating Meta’s monetary efficiency and intently monitoring each the constructive drivers and potential challenges confronted by the corporate. The technical evaluation gives extra insights for traders to make

META, Each day

Click on right here to entry our Financial Calendar

Adnan Rehnan

Market Analyst – Instructional Workplace / Pakistan

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link