[ad_1]

Rasi Bhadramani/iStock through Getty Photographs

Metacrine (NASDAQ:MTCR) is an intriguing and mispriced merger arbitrage that I initially lined on Particular State of affairs Investing in September. The unfold used to face at 22% and has been absolutely eradicated since then producing very strong IRR. Nevertheless, not too long ago, some sudden developments got here to mild and added a unique angle right here which I imagine is kind of fascinating.

MTCR is merging with one other nanocap biopharma Equillium (NASDAQ:EQ) in a stock-for-stock deal. The change ratio will rely upon MTCR’s web money ranges at closing and is at present anticipated to be 0.282x. For EQ the deal is much like an fairness increase as it’s only desirous about MTCR’s money. Merger closing circumstances embrace shareholder approvals on each side in addition to Metacrine’s web money being not less than $23m upon closing (the money situation must be simply happy). MTCR shareholder assembly is about for December 20, with the anticipated time limit on December 23.

The primary nuance right here is that because of a decline in EQ share value because the merger announcement, the all-stock bid now values MTCR at a large 45% low cost to its web money. At present EQ value of $1.23/share, MTCR shareholders are solely receiving $15m price of EQ shares in comparison with MTCR’s web money of $27m (anticipated at merger closing). Not surprisingly, not too long ago activist investor BML Funding Companions raised its stake from 5.9% and 15.2% and stated it is going to vote in opposition to the merger until the change ratio/consideration is improved. After this announcement, the merger unfold promptly turned detrimental with MTCR now buying and selling barely above the provide value. The market clearly expects EQ to boost the provide with a purpose to safe the shareholder approval.

Given how lowball the present provide is in comparison with MTCR web money, there appears to be adequate headroom for a better provide. For instance, if the consideration is raised to twenty% low cost to web money, it could end in 30% acquire for arb buyers. EQ is a medical stage biopharma with its essential candidate in section 3 (began in Q1’21). The corporate is a money burning machine and will positively use the additional liquidity ensuing from MTCR acquisition. So there’s a probability the client will increase the worth.

The primary threat is that EQ may determine that continuing with MTCR deal at a better value is just not well worth the wrestle anymore and it’ll quite look to boost money by way of different methods (e.g. current partnership with Ono Pharmaceutical).

If the merger breaks (will get voted down by shareholders), the draw back appears considerably protected by MTCR’s low cost to web money and there’s a respectable probability that the corporate would pursue a liquidation after that. Notably, current merger proxy reveals MTCR’s liquidation worth is estimated at $27.3m – very near the web money place. The presence of the activist that already owns 15.2% provides confidence that MTCR administration will not waste the money, as an example, on any worth destructing acquisitions.

Some particulars on change ratio calculations

The present merger with EQ is structured as an all-stock transaction by which Equillium will subject inventory at a 25% premium above Metacrine’s web money at closing. Administration estimates MTCR’s web money will likely be $27 million at shut.

The quantity of EQ shares obtained for every MTCR share will likely be based mostly on an change ratio equal to MTCR’s web Money on the 25% premium divided by EQ’s VWAP for the ten days earlier than closing after which divided by MTCR’s absolutely diluted share rely.

The necessary nuance is that EQ’s VWAP is topic to a collar between $2.70-$4.50, a variety properly above the place the inventory at present trades. The underside finish of the vary was set across the ranges the place EQ traded on the time of the merger announcement ($2.73). The activist is arguing that EQ ought to increase the decrease restrict of the collar with a purpose to elevate up the change ratio.

Within the current merger proxy, MTCR has assumed 0.282x because the change ratio.

BML Funding Companions

BML Funding Companions is a small funding agency centered on small-caps and biopharma liquidations particularly. It held/holds positions in a number of biopharma liquidation performs, together with FBRX, ABIO, IMRA (this one labored out notably properly not too long ago leading to multi-bagger features for the activist).

Metacrine

Metacrine develops therapies to deal with gastrointestinal ailments. Their essential focus is MET642 – a farnesoid X receptor platform. Equillium might search a strategic companion to advance Metacrine’s MET642 agent for treating inflammatory bowel ailments, however they may probably wind down Metacrine’s different applications to cut back incremental opex following the transaction. Notably, EQ has clearly said that its essential goal in buying MTCR is to extend its money runway – from the merger convention name:

And from the Equillium perspective, that is what we take into account to be largely an acquisition for the money and runway extension we get out of this transaction. We expect to onboard roughly $33 million in money [author’s note – gross cash] at closing. I ought to make clear that closing is anticipated to take a few months right here as we undergo the formal means of regulatory submissions after which shareholder votes that will likely be required to finish the transaction. However this is a vital addition to our steadiness sheet as we take into consideration our working plans going into the long run, whereas this extends our runway into—comfortably into the 2024 timeframe.

Equillium

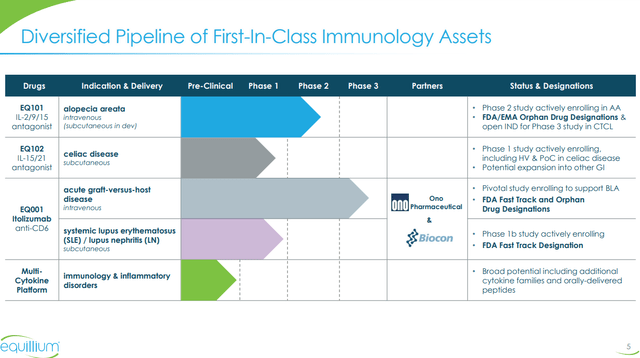

Equillium is specializing in remedies for extreme autoimmune and inflammatory issues. Their main potential product Itolizumab (EQ001) is concentrated on the therapy of acute graft-versus-host illness and has not too long ago entered a section 3 research. EQ’s improvement pipeline is proven under.

Equillium Investor Presentation, December 2022

Conclusion

MTCR presents an fascinating alternative with potential for both a merger arb or a liquidation. Added confidence in a good consequence for MTCR shareholders comes from the involvement of a good activist BML. In the meantime, the draw back appears to be protected by MTCR’s web money place, suggesting that at present MTCR share value ranges this example may need an uneven threat/reward.

[ad_2]

Source link