Up to date on March tenth, 2022 by Nikolaos Sismanis

Melvin Capital Administration LP is a registered funding advisor headquartered in New York Metropolis. The partnership makes use of a bottom-up method to discovering enticing investments on each the lengthy and brief sides of equities, specializing in fundamentals.

Melvin Capital was based in late-2014 by Gabriel Plotkin, who continues to function the partnership’s chief funding officer, and is the agency’s principal proprietor. The fund was began with $1 billion in seed cash however has since grown to greater than $24.5 billion in belongings underneath administration (AUM) within the seven years since.

Plotkin was as soon as a dealer at Steven Cohen’s Point72 hedge fund, the place he centered on client shares and managed over $1 billion. After attaining success at Point72, Plotkin went out on his personal and based Melvin Capital Administration, which he named after his grandfather.

Buyers following the corporate’s 13F filings during the last 3 years (from mid-February 2019 by means of mid-February 2022) would have generated annual whole returns of twenty-two.55%. That is above the S&P 500’s annualized whole returns of 18.17% over the identical time interval.

Notice: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You’ll be able to obtain an Excel spreadsheet with metrics that matter of Melvin Capital’s present 13F fairness holdings beneath:

Preserve studying to study extra about Melvin Capital.

Desk Of Contents

Melvin Capital’s Investing Technique

Melvin Capital seeks to ship superior, risk-adjusted returns by using a long-short fairness technique. The agency primarily invests within the frequent inventory of US-based issuers, but in addition employs different devices, similar to depository receipts, rights, warrants, choices, derivatives, fastened revenue securities, international exchanged hedges, commodity hedges, and different debt devices.

Melvin Capital serves because the administration firm with discretionary buying and selling authority to non-public pooled funding autos and individually managed accounts. Its shoppers are typically establishments, pension plans, excessive web price people, and different refined traders. Its minimal preliminary funding is mostly $1 million, and for managed accounts, that minimal is mostly in extra of $50 million.

Its funds embrace Melvin Capital LP, Melvin Capital Offshore Ltd, Melvin Capital Grasp Fund Ltd, Melvin Capital II LP, Melvin Capital II Offshore Ltd, and Melvin Capital II Ltd. The offshore and onshore funds make investments all of their belongings considerably by means of the grasp funds.

Melvin Capital’s Portfolio and Prime Holdings

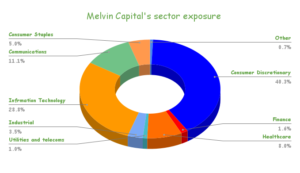

As of its February 2022 13F submitting, Melvin Capital had 41 whole reported positions in US equities for a complete market worth of $20.4 billion. That’s 11 fewer particular person holdings than final quarter, implying that the fund is concentrating its portfolio. The portfolio is now extra concentrated, with Shopper Discretionary, Expertise, and Communications overlaying nearly all of its sector publicity.

Supply: Firm filings, Creator

Throughout the quarter, Melvin made the next notable portfolio changes:

Noteworthy New Buys:

- Uber Applied sciences Inc (UBER)

- Advance Auto Elements, Inc. (AAP)

- Marvell Expertise Group Ltd (MRVL)

- Atlassian Corp Plc (TEAM)

- Lowe’s Corporations, Inc. (LOW)

- Monster Beverage Corp. (MNST)

Noteworthy New Sells:

- Mastercard Inc (MA)

- Alphabet Inc. Class A (GOOGL)

- TJX Corporations Inc. (TJX)

- Vimeo Inc (VMEO)

- Sq. Inc (SQ)

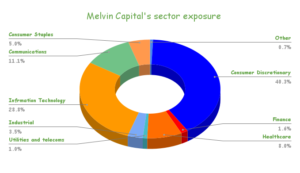

The fund closed extra positions than it initiated, however the portfolio stays fairly diversified. Its largest place, Dwell Nation Leisure Inc (LYV), accounts for 9.9% of the portfolio, whereas its prime 10 ten holdings account for just below 51.6% of the entire portfolio weight.

Supply: Firm filings, Creator

Melvin’s prime 10 holdings as of its newest 13F submitting are the next:

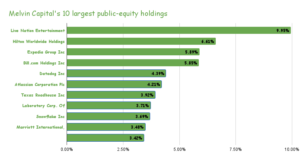

Dwell Nation Leisure Inc (LYV)

Dwell Nation Leisure, Inc. serves as a dwell leisure firm. The corporate works by means of Concert events, Ticketing, and Sponsorship & Promoting divisions. The corporate was materially impacted in the course of the pandemic amid the restrictions imposed on dwell occasions. Nonetheless, restoration indicators are already seen.

Melvin boosted its place in Dwell Nation by a considerable 64% over the past quarter, lifting the inventory to be its largest holding. The fund owns round 4.3% of the corporate’s whole shares excellent.

Hilton Worldwide Holdings (HLT)

Hilton Worldwide Holdings is a hospitality firm, that owns, leases, manages, develops, and franchises resorts and resorts. The corporate runs by means of two divisions, Administration and Franchise, and Possession. Hilton operates resorts underneath the Waldorf Astoria Resorts & Resorts, Cover by Hilton, Tempo by Hilton, Motto by Hilton, Signia by Hilton, and Hilton Resorts & Resorts amongst others.

The corporate advantages from a capital-light financial mannequin and a robust steadiness sheet. Melvin’s place was boosted by lower than 6% in the course of the quarter. Shares are at present buying and selling close to all-time excessive ranges, regardless of the preliminary catastrophe-like considerations in the course of the COVID-19 outbreak.

Shares are at present buying and selling for a ahead P/E of ~34.3. Nonetheless, that is positively an expanded valuation, which might endure a possible correction. It’s additionally price noting that the corporate has round $1.20 billion in money and equivalents in its struggle chest. This needs to be sufficient for administration to refuel the corporate’s progress because the journey {industry} recovers whereas making certain that Hilton doesn’t face any solvency points if the restoration takes longer than anticipated.

Hilton is Melvin’s second-largest holding. The inventory includes 6.6% of the fund’s holdings.

Expedia (EXPE)

Journey-industry service supplier Expedia was a major sufferer of COVID-19. Journey restrictions and the stay-at-home financial system collapsed the demand for reserving resorts, automotive leases, and desk reservations. Consequently, the corporate noticed its revenues greater than halve throughout 2020. Restoration has thus far been first rate, however the firm has but to report significant profitability ranges.

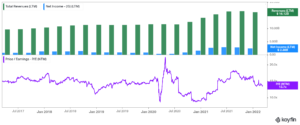

Throughout the newest quarter, Melvin trimmed its place in Expedia by 6%. Expedia’s This autumn outcomes revealed additional enhancements, nonetheless, with revenues rising by 150% to $2.28 billion, and bookings rising by 131% to $17.4 billion, following a continued restoration from the challenges arising from the pandemic.

Contemplating that the inventory accounts for round 5.9% of the entire portfolio, Melvin appears to stay assured about Expedia’s long-term prospects.

Invoice.com Holdings, Inc. (BILL)

Invoice.com Holdings, Inc. affords cloud-based software program that streamlines, digitizes, and automates back-office monetary processes for small and medium-sized companies internationally. The corporate affords a synthetic intelligence-enabled monetary software program platform that varieties frictionless connections amongst customers, suppliers, and clients.

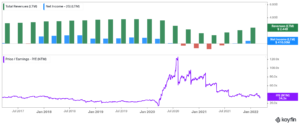

The corporate’s revenues have been snowballing quarter-over-quarter. In reality, Invoice.com’s progress has been accelerating, as proven within the final quarter’s report year-over-year progress of 189.5%. Nonetheless, the corporate stays unprofitable on a GAAP foundation because of the rising prices attributable to buying new shoppers in addition to as a consequence of its excessive stock-based compensation bills.

Melvin boosted its place by 15% in the course of the quarter. Invoice.com now accounts for five.9% of the fund’s public fairness portfolio.

Datadog, Inc. (DDOG)

Datadog affords a monitoring and analytics platform for builders, I.T. groups, and enterprise customers within the cloud globally. The corporate’s SaaS platform incorporates and automates infrastructure, software efficiency, log administration, and safety monitoring to provide real-time observability of shoppers’ tech stack.

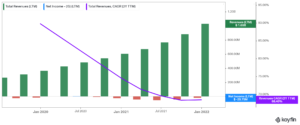

The corporate includes a 2-year income progress CAGR of practically 68.4%, although the corporate reinvests all working money flows again into the enterprise. Due to this fact, it stays unprofitable.

Datadog is Melvin’s fifth-largest holding, comprising 4.4% of its whole holdings.

Atlassian Company Plc (TEAM)

Atlassian Company Plc is a British-Australian-based firm that designs, develops, licenses, and helps numerous software program merchandise internationally. The corporate’s merchandise comprise JIRA, a workflow administration system for groups to design, observe, collaborate, and supervise work and tasks, Jira Service Administration, a service desk product for creating and working service experiences for various service crew suppliers, and Jira Align for enterprise agile planning.

Atlassian has been rising its prime line for years constantly, although it stays unprofitable as a consequence of reinvesting nearly all of its working money flows again into the enterprise.

Atlassian is a comparatively new holding for melvin, although the fund has already amassed round 1% of the $66.3 billion firm’s whole shares. Atlassian is now Melvin’s sixth-largest holding.

Texas Roadhouse, Inc. (TXRH)

Texas Roadhouse runs informal eating eating places all around the world, however primarily in the US. Its franchised eating places embrace the Texas Roadhouse, Bubba’s 33, and Jaggers manufacturers. As of its newest filings, it operated 566 home eating places and 101 franchise areas.

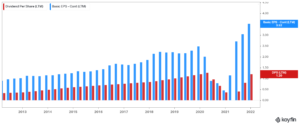

The corporate has managed to develop its EPS constantly. Whereas the dividend was suspended within the midst of the pandemic following weaker income, it has now been rising once more whereas EPS is seeing new information these days.

Melvin elevated its stake within the firm by 18% in the course of the quarter. It now holds 6.89% of the corporate’s whole shares and is the fund’s seventh-largest holding.

Laboratory Company of America Holdings (LH)

Laboratory Company of America Holdings features as a scientific laboratory enterprise globally. Whereas not a pharma firm producing direct therapies, Labcorp is paid to conduct scientific trials. Benefiting from a rising {industry}, revenues grew 15.4% to $13.98 billion final yr. The corporate additionally offered a assured FY2022 adjusted EPS steering starting from $17.25 to $21.25.

Shares are buying and selling at 13.7 instances their ahead web revenue, which is a quite cheap a number of contemplating Labcorp produces steady and rising money flows.

Labcorp is Melvin’s eighth-largest holding. It accounts for 3.7% of its whole portfolio, with the corporate mountain climbing its fairness stake by 4% final quarter.

Snowflake Inc. (SNOW)

Snowflake affords a cloud-based information platform the Knowledge Cloud. Knowledge Cloud is an ecosystem that permits clients to capsulize information right into a single supply of fact to drive important enterprise insights, create data-driven purposes, and share information.

The corporate’s enterprise mannequin is extremely regarded, as it’s margin-rich and extremely scalable. Nonetheless, the sky-high hype driving the inventory has resulted in shares buying and selling extraordinarily excessive valuation multiples. Whereas revenues are rising within the triple-digits, the inventory trades at a loopy ahead P/S of ~31, even following the current correction.

Melvin trimmed its SNOW place by 13% in the course of the previous quarter. It’s now the fund’s ninth-largest holding. It makes up round 3.7% of Melvin’s public-equity portfolio.

Marriott Worldwide, Inc. (MAR)

Much like Melvin’s Hilton place, Marriott Worldwide manages, franchises, and licenses resort, residential, and timeshare properties worldwide. The corporate was once extremely worthwhile, primarily as a consequence of licensing its model to different resort operators. Its efficiency was impacted materially between 2020 and 2021 because of the COVID-19 pandemic. Nonetheless, the corporate has recovered notably, with profitability already current and rising.

Marriot Worldwide is Melvin’s tenth-largest holding, accounting for 3.5% of its whole portfolio.

Ultimate Ideas

Melvin Capital seeks to generate robust risk-adjusted returns by specializing in basic traits that assist future progress. The agency’s long-term efficiency has been robust, however its portfolio just isn’t as diversified as maybe some traders would really like, and it’s not centered on dividend-paying shares. The agency’s efficiency over the long run has been fairly spectacular and has made its founder, Gabriel Plotkin, a billionaire.

Buyers following Melvin Capital’s 13F filings would do properly to contemplate the comparatively excessive focus of its prime 10 holdings and excessive publicity to tech shares.

Nonetheless, for traders looking for progress shares, Melvin Capital’s historical past of returns warrants a better take a look at its holdings for potential funding concepts.

You’ll be able to obtain an Excel spreadsheet with metrics that matter of Melvin Capital’s present 13F fairness holdings beneath:

Further Assets

See the articles beneath for evaluation on different main funding companies/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].