Igor Kutyaev

The rally in bonds to shut out 2023 displays the US Federal Reserve’s (“Fed’s”) validation of starting a rate-cutting cycle in 2024. Bond markets anticipate extra cuts than the Fed is signaling, and this expectation largely displays a return to pre-COVID dynamics of low inflation, huge central financial institution help, and suppressed time period premia. That will turn into the case however modifications in financial and monetary constructions rising within the post-COVID setting might disrupt the return of “previous” bond market dynamics—and probably require a special investor playbook than for previous rate-cutting cycles.

Key factors

- Three sorts of cuts: Cuts, damned cuts, and recessions – a twist on Mark Twain’s “three sorts of lies” quote on statistics illustrates the bond market outlook for 2024. Market consensus expects the Fed to chop rates of interest both to (1) keep restrictiveness as inflation falls, (2) calibrate financial coverage to a much less restrictive stance within the face of falling inflation and a slowing economic system, or (3) transfer to simpler financial coverage within the face of a recession.

- Structural modifications underpinning a “new” bond market regime: Every of those three situations results in an outlook for decrease charges and optimistic returns for bonds. However as one other Twain aphorism goes, historical past could rhyme, however it would not repeat. Publish-COVID international financial and monetary structural modifications counsel the potential for a really totally different bond market playbook throughout a cycle of worldwide central financial institution price cuts.

- A “new” conundrum for bonds? Inside the consensus outlook for declining charges can be a consensus for price declines to be led by the quick finish of the curve. We have a look at the potential for a “new” conundrum—taking part in out within the reverse method of the “previous” Greenspan conundrum from the 2004/2005 mountaineering cycle. Again then, price hikes on the quick finish weren’t met by rising charges on the lengthy finish, prompting the now well-known “conundrum” (non) rationalization. The influence of structural modifications on the worldwide market may equally argue for longer-term charges not falling as a lot (and even probably rising) throughout this reducing cycle.

Meet the brand new bond, similar because the previous bond?

Regardless of heady expectations for bond returns in 2023, the near-consensus “bonds are again” narrative didn’t ship the type of returns that will validate bonds being “again.”

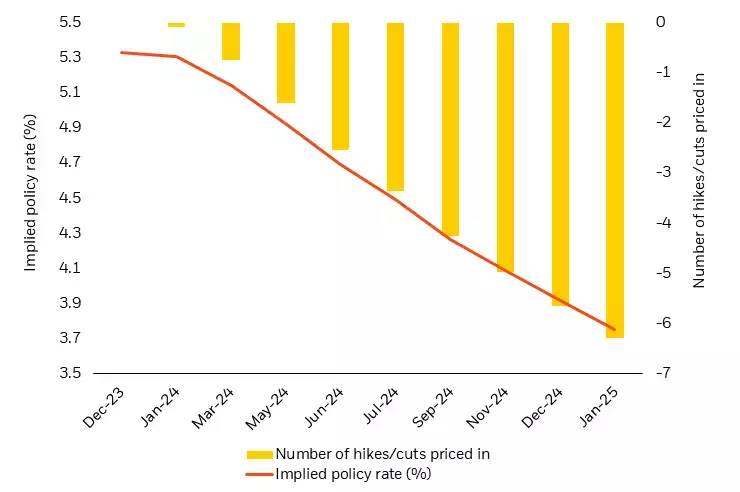

Now, following the stellar bond returns of November, “bonds are again” is again once more as buyers sit up for the everyday bottom of the Fed’s rate of interest cycle. That cycle “sometimes” entails a number of hundred foundation factors of Fed price cuts which at the moment are mirrored in bond market pricing of the quick finish of the yield curve (Determine 1).

Determine 1: Bond markets have priced in six price cuts for 2024, with the primary reduce anticipated in March

Implied coverage price and variety of cuts priced

Supply: BlackRock, with information from Bloomberg, as of December 18, 2023.

Why all the speed cuts?

The fuss within the bond market over cuts displays a number of developments which have accelerated on the finish of 2023.

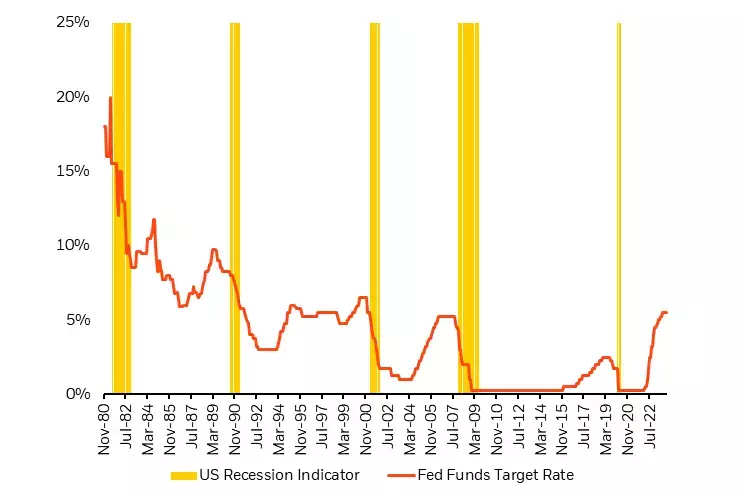

Determine 2 highlights the “typical” post-peak Fed price cycle sample which is fueling expectations for cuts subsequent 12 months. Whereas the best variety of cuts seems to comply with the Fed “overshoot” (the place overtightening leads to a tough touchdown for the economic system right into a recession), the Fed has additionally sometimes delivered some price cuts following the height of the speed mountaineering cycle within the absence of a recession.

Determine 2: Historic peak Fed cycles counsel price cuts in 2024

Fed funds goal price

Supply: BlackRock, with information from Bloomberg, as of 11/30/2023.

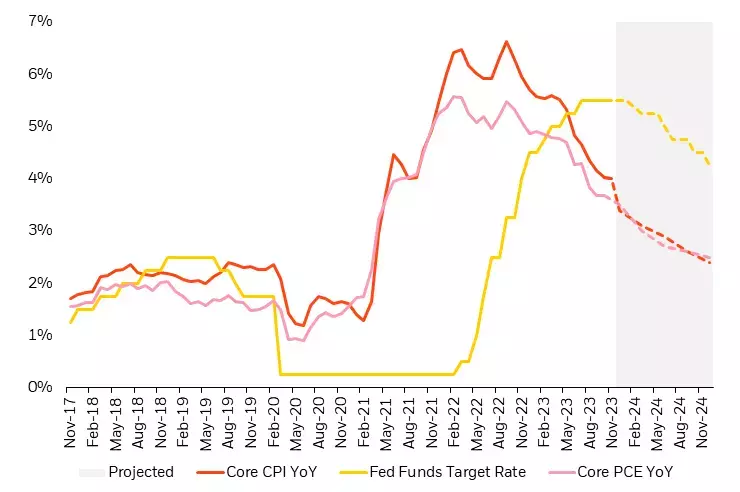

Nevertheless, the COVID boom-bust cycle of right this moment defies historic comparisons. Moderately, the provision and demand-induced inflation cycle throughout this era has been the principal determinant of financial and monetary efficiency. Lately, the driving force has been the sooner declines in inflation than the market – and the Fed – had been forecasting. And as highlighted in Determine 3, the bond market’s expectations for price cuts in 2024 largely comply with forecasts for inflation to proceed falling and comparatively uneventfully reaching the Fed’s pre-COVID 2% inflation goal.

Determine 3: Charge reduce expectations comply with expectations for declining inflation

Realized and anticipated core Inflation and coverage charges

Supply: BlackRock, with information from Bloomberg, as of 11/30/2023. Core Shopper Worth Index (“CPI”), Core Private Consumption Expenditures (“PCE”) and Fed Funds Goal Charge.

Three sorts of price cuts

With the expectation for price cuts, we will contemplate three totally different sorts of reducing situations that would happen:

1. Upkeep cuts.

Take into account this expectation for price cuts – what many time period “upkeep” cuts – as the primary kind of rate-cutting situation. “Upkeep” implies that the Fed is reducing charges to not present lodging, however to easily hold the coverage price in actual phrases from rising as it might below the forecasted situation of continued declines in inflation. Beneath this situation, the Fed would reduce charges to keep up a comparatively fixed stage of actual Fed funds charges (outlined as nominal Fed coverage charges much less inflation). This situation interprets the Fed’s continued language round remaining “restrictive for longer” as implying a necessity for vigilance round bringing down inflation sustainably by sustaining the true coverage price. Most of what we see at the moment priced into bond market price reduce expectations displays one of these rate-cutting motion by the Fed in 2024. Notably, this path can be per the “gentle touchdown” financial situation anticipated below the consensus outlook.

2. Calibration cuts.

If upkeep holds the true coverage price roughly fixed as inflation declines, additional rate of interest cuts might happen below two further situations. First, slowing financial progress worries the Fed that coverage has change into too restrictive. Beneath this situation, the Fed – satisfied of sustained success in taming inflation – would pivot to prioritizing the expansion facet of its mandate and recalibrate coverage to maneuver from restrictive to in search of “impartial.” The cuts implied below this situation are bigger than people who merely comply with the trail of declining inflation as they happen below the situation of a desired change within the stance of financial coverage from “sufficiently restrictive” to “impartial.”

3. Recession cuts.

“Recessionary” cuts lengthen these situations to the subsequent stage of progress slowdown. As Determine 2 beforehand highlighted, these are the situations the place the biggest rate of interest cuts and largest mounted revenue returns have traditionally come. The dearth of such massive cuts at the moment priced in displays the transfer away from recession expectations that accelerated all through 2023 – making the bottom case financial expectations for 2024 firmly align with the ”soft-landing” situation.

One widespread assumption: 2% inflation

The widespread assumption underlying every of those situations is that the anticipated path of inflation meets the Fed’s 2% goal. That is an expectation of a return to pre-COVID dynamics – and together with that, a return to “divine coincidence”1 in financial coverage the place the flexibility to chop charges to handle progress deviations is unburdened by considerations over inflation as there may be (but once more) too little inflation. What may disrupt this handy market expectation (which can be handy for the outlook for monetary market efficiency) is an inflation trajectory that fails to cooperate.

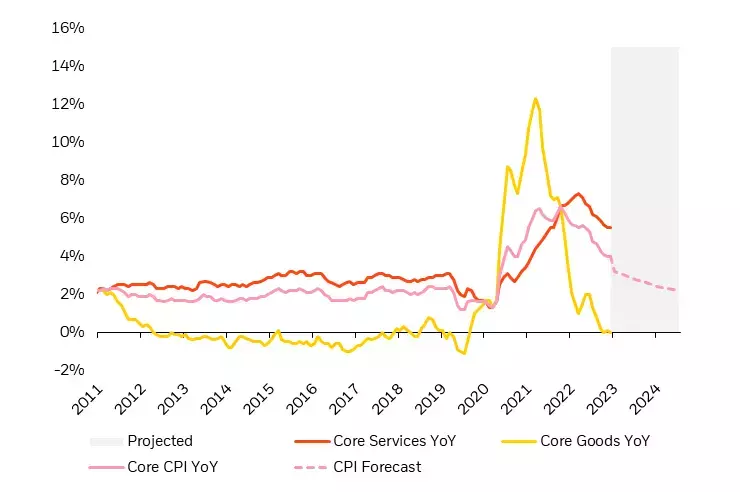

We proceed to look at the divergence in companies and items inflation as key to this outlook, as sooner declines in items inflation have largely been to credit score for the sooner declines in core inflation which are underpinning total financial coverage expectations for 2024 (Determine 4). Providers inflation can be anticipated to say no because the lagged influence of falling shelter inflation makes its method into the inflation metric. But when these companies and items inflation declines (and outright deflation) have been to not sustain with expectations, continued stickier inflation might up-end the market consensus narrative that upkeep cuts will gas bullish outcomes for each bonds and shares.

Determine 4: Collapsing core items leads core companies inflation decrease, and normalizing shelter inflation pushes forecasted core inflation decrease

Core CPI, items and companies CPI parts, and forecasted CPI

Supply: BlackRock, with information from Bloomberg, as of 11/30/2023. Chart exhibits year-over-year core Shopper Worth Index (“CPI”) realized and forecasted measures, and core CPI items and companies measures.

Structural modifications underpinning a “new” bond market regime

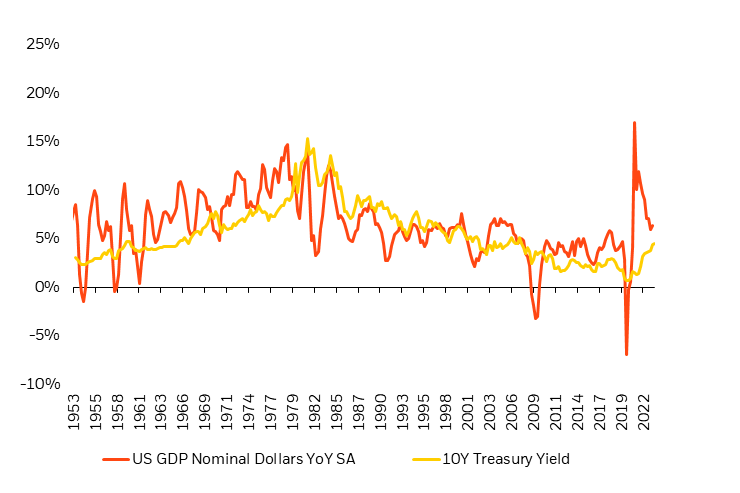

The market consensus outlook for bonds primarily displays a return to pre-COVID dynamics of two% progress and a couple of% inflation – albeit with a better rate of interest construction. A decomposition of time period rates of interest generally explains the upper rate of interest expectations alongside the scale of actual impartial charges + inflation compensation + time period premia. However an easier empirical statement relates the extent of time period rates of interest (on this case 10-year charges) to nominal GDP (Determine 5).

Determine 5: Publish-COVID larger rate of interest expectations mirror rising time period premia

US Nominal GDP and 10-year Treasury yield

Supply: BlackRock, with information from Bloomberg, as of 11/30/2023.

This method considers the “truthful worth” for 10-year rates of interest merely as the extent of nominal GDP +/- a premium (low cost). General, rates of interest observe the extent of nominal GDP within the economic system. In different phrases, the bottom price of risk-free financing tracks the typical nominal return within the economic system. Whether or not charges are above (premium) or beneath (low cost) that common, nominal return is dependent upon structural traits governing the relative provide of funding capital vs. the calls for on that capital.

The pre-COVID and post-2000 setting displays what Larry Summers has described as a interval of “secular stagnation” with too little progress, too little inflation, and an extra of worldwide financial savings relative to funding demand. This led to a persistent low cost of 10-year Treasury charges relative to nominal GDP. The historical past exhibits this isn’t “regular,” however relatively a operate of the structural parts of the time. And people structural parts change over time relatively than reverting again to this explicit “low cost” setting.

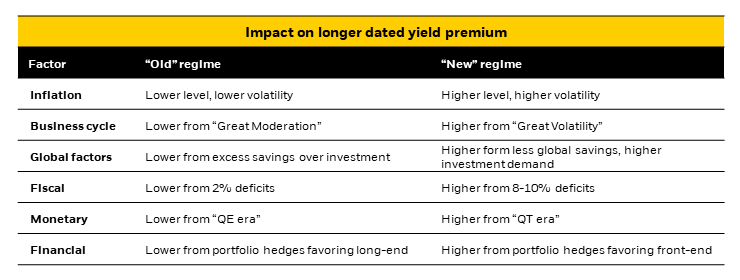

Publish-COVID larger rate of interest expectations then mirror a number of of the structural modifications that seem like occurring. These embrace elements throughout international economics, financial and monetary coverage, in addition to monetary concerns resembling debt issuance and portfolio hedging. In every case, the pre-COVID construction supported decrease rates of interest and flatter time period premia, that’s, a decrease diploma of further yield compensation for extending debt maturities (Determine 6).

Determine 6: Structural determinants of rates of interest and the time period premia

The influence of things on longer-dated yield premium within the “previous” vs. “new” rate of interest regime

Supply: BlackRock, for illustrative functions solely, as of December 2023.

Inflation. This one is clear and clear. The post-COVID setting has seen each larger inflation and better inflation volatility in a departure from the prior period of sustained low readings in each. Certainly, the interval previous to COVID was an period marked by a deficit of inflation.

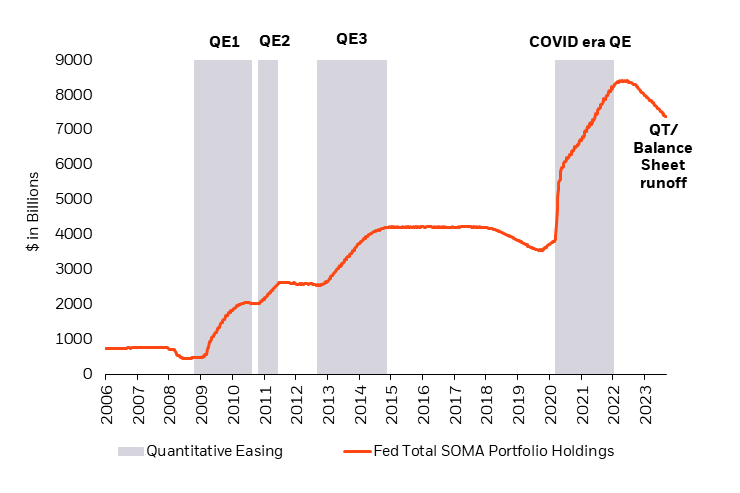

Financial. Too little inflation allowed for financial elements (Quantitative Easing (“QE”) period) to increase to cope with the inflation goal persistently lacking from beneath. That made a bigger arsenal of instruments out there to cope with the deficit of inflation – together with zero and unfavourable rate of interest coverage, prolonged ahead steerage (promising an extended interval of that accommodative coverage), and bigger and bigger quantities of express bond purchases (and debt monetization) by international central banks.

Monetary. The mix of “divine coincidence” from too little inflation and the central bankers’ use of an arsenal of instruments to fight it, led buyers to extend their expectations for a central financial institution insurance coverage coverage within the type of lengthy authorities bonds. This period was characterised by considerably unfavourable inventory/bond correlation and a excessive Sharpe ratio of returns in long-dated authorities bonds. This additional led to portfolio hedging favoring long-maturity devices for his or her capital effectivity and efficiency efficacy, reinforcing present tendencies and additional lowering time period premia.

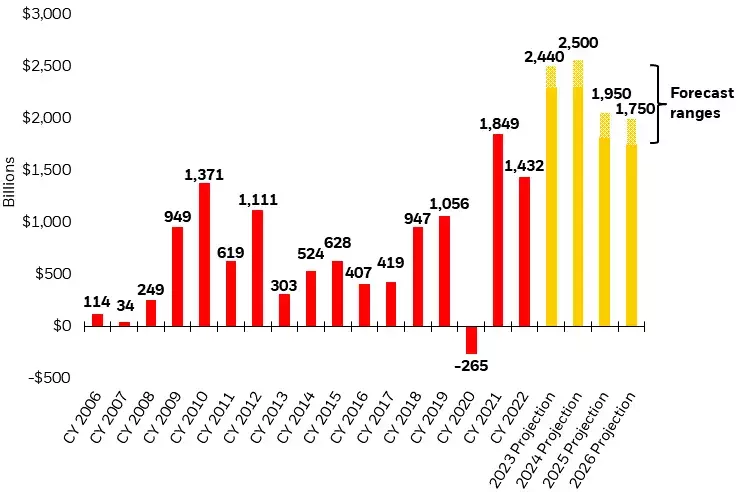

Fiscal. Dealing with each decrease longer-term and short-term borrowing prices reflecting zero or unfavourable rate of interest coverage, fiscal policymakers deferred the price of profligacy. Some took this to an excessive, arguing for a “Trendy Financial Concept” which held further spending shouldn’t be constrained by considerations over debt and deficits. Financial coverage contributed to rising long-term spending within the QE period as recycled short-term “income” from QE insurance policies of “borrowing” prices beneath invested asset yields decreased Federal deficits, flattering near-term deficit estimates, and decreasing near-term issuance necessities. A normalizing financial coverage now exacerbates the implications of structurally larger deficits resulting in better issuance absorption required from personal buyers – the other as in the course of the QE period.

World elements. World elements within the pre-COVID period contributed to those dynamics by means of the globalization of provide chains. This led to falling prices, falling funding demand, and recycled international surpluses fueling an extra of financial savings over funding. In the present day, these elements are reversing as concerns resembling constructing resilient provide chains (“onshoring” and “buddy shoring”) are prioritized over value. As nicely, heightened geopolitical battle will increase protection spending, additional driving up funding demand. The power transition results in a big improve in funding demand to cope with damages from local weather change and investments in inexperienced infrastructure relative to the pre-COVID period.

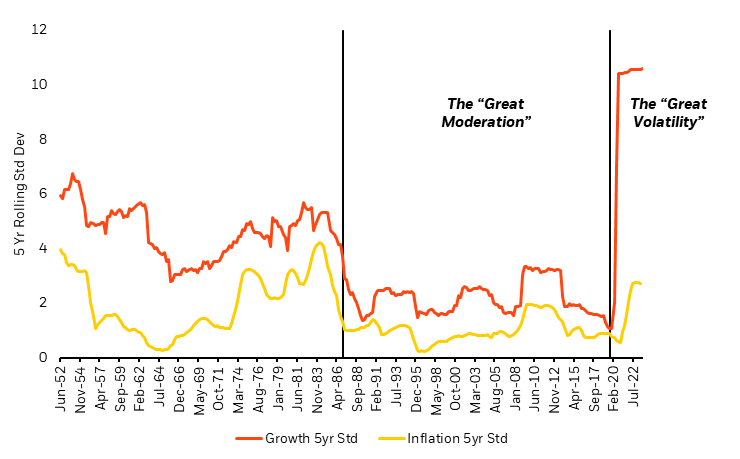

Enterprise cycle. Enterprise cycle volatility could also be growing in a departure from the post-2000s “Nice Moderation.” Restoration from the 2008 World Monetary Disaster (“GFC”) stability sheet recession led to non-public capital extra financial savings over funding to restore stability sheets even at zero and unfavourable rates of interest, a course of not going repeated this cycle. Catch-up Capex following this decade of underinvestment and stability sheet restore and funding the rising deficits from getting old populations all improve funding demand relative to produce—probably additional growing buyers’ compensation for time period and inflation premia relative to pre-COVID.

Determine 7: Structural elements underpinning new bond market dynamics

Macro uncertainty strikes from low (the “Nice Moderation”) again to excessive

Supply: BlackRock, with progress and inflation information from Bloomberg, as of 11/30/2023.

Treasury coupon issuance financed by the personal sector

Supply: BlackRock, with information on Treasury coupons from SIFMA, US Dept of the Treasury, and Bureau of the Fiscal Service, as of 11/30/2023.

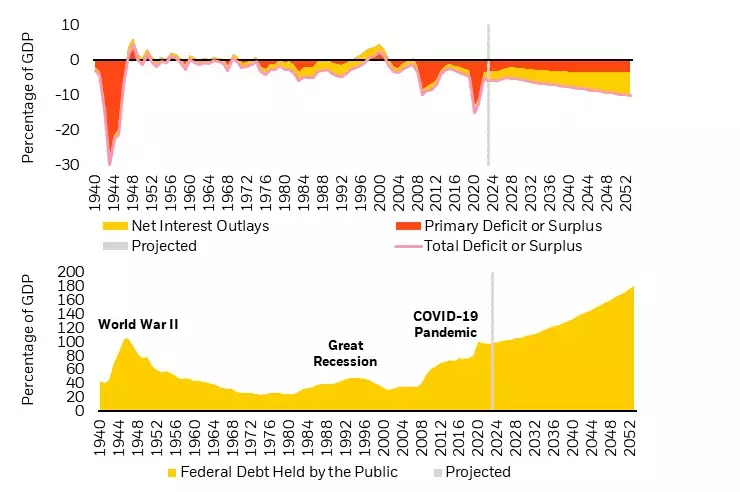

Fiscal tailwinds to headwinds: deficits and debt

Supply: BlackRock, with information from the Congressional Finances Workplace, as of June 2023.

QE period turns to QT

Supply: BlackRock, Fed portfolio holdings from Bloomberg, as of September 2023.

A “new” conundrum for bonds?

The mixed influence of all these elements may result in what we’ll name the potential for a brand new conundrum for bond buyers. Recall the previous conundrum, coined by then Fed Chair Greenspan in the course of the 2004-2005 mountaineering cycle at his February 2005 Humphrey Hawkins Congressional Testimony: “The broadly unanticipated conduct of world bond markets stays a conundrum… Long run rates of interest have trended decrease in current months even because the Federal Reserve has raised the extent of the goal Federal Funds Charge by 150 foundation factors. This improvement contrasts with most expertise, which means that, different issues being equal, growing quick time period rates of interest are usually accompanied by an increase in long run yields.”

In the present day, in fact, the circumstances are reversed. The Fed is broadly anticipated to chop charges in 2024, and long-term rates of interest are broadly anticipated to comply with these cuts decrease as nicely. Nevertheless, the potential for the above-outlined elements to say themselves could result in lagging declines in long-term charges and even the potential for “conundrum” kind conduct – the place long-term charges transfer larger even because the Fed lowers short-term coverage charges.

Now the primary situation the place declines in longer-term charges are lower than the declines in shorter-term charges could possibly be thought of “regular.” Certainly, this anticipated “steepening” of the yield curve is the consensus view for 2024. However a “twist steepening” – the place short-term charges fall however longer-term charges rise – could be extra of a conundrum as it might be at odds with each expectations and historic expertise. Nevertheless, it’s exactly for the structural causes outlined above that bond market efficiency could not transfer in step with historic expertise.

Moreover, once we take into consideration the three sorts of price cuts as outlined within the first part (upkeep, calibration, recession), these could have very totally different implications for the conduct of the lengthy finish of the curve. Upkeep cuts significantly have the best potential to exhibit “conundrum” curve conduct as these cuts mirror falling inflation with no decline in progress. Beneath such a situation, the anticipated advantages from longer period may fail to be realized. This may imply much less demand for portfolio flows to drive long-term charges decrease – one of many key elements outlined as a structural supply of previous bond market long-end outperformance.

Beneath calibration (financial slowing resulting in cuts) or recession-induced cuts, we’d anticipate extra of a return to “regular” bond market conduct of long-end outperformance. Whereas not a conundrum of rising charges, this end result would nonetheless frustrate market consensus outlooks for outperformance within the entrance finish of the curve. Certainly, that market consensus positioning (and its unwinding below this situation) may contribute to flattening curves below calibration or recession situations.

However there are different situations as nicely to contemplate. Most significantly, inflation failing to fall so far as consensus expects. Such a situation would undermine price reduce expectations and consensus positioning for each long-duration and steeper curves. Such expectations have change into consensus and embedded in market pricing as a result of the inflation information has validated the “immaculate disinflation” narrative the place inflation falls with out vital labor market or financial weak spot.

Taking the opposite facet of the consensus recession views in 2023 proved to be appropriate. Taking one other contrarian view in 2024 (however this time in the direction of the bearish facet) will likely be appropriate once more if the present inflation trajectory fails to carry.

The present market consensus for 2024 expects normalizing progress and fading inflation to underpin an optimistic case for monetary returns because the recession is averted, inflation proves transitory, and a soft-landing fuels Fed price cuts. How might that go improper? If the present inflation trajectory fails to carry from sticky companies inflation and fewer items deflation. Stronger-than-expected progress that holds up inflation expectations might additional undermine each expectations for Fed cuts and consensus expectations for monetary market returns in 2024.

Implications for buyers

Publish-COVID structural financial and monetary modifications could result in lagged declines (and even will increase) in long-term charges relative to short-term charges as cuts happen. On this “new” regime for bond buyers, buyers could discover higher risk-adjusted efficiency and diversification potential in shorter-maturity bonds relative to longer maturities – significantly if a soft-landing financial situation performs out. Traders may additionally contemplate including sources of defensive alpha that benefit from right this moment’s extra unstable and better price regime to hunt uncorrelated, diversifying returns that may assist construct portfolio resiliency amid uncertainty.

Conclusion

The market consensus expectation for price cuts comes with the expectation of a return to pre-COVID bond market dynamics characterised by long-end outperformance and a persistently unfavourable stock-bond correlation.

The narrative that “bonds are again” is rooted in historical past and “previous” bond market dynamics that help declining long-term charges throughout Fed-cutting cycles. However just like the Mark Twain quote on statistics suggests, previous examples aren’t all the time illustrative of what’s to come back.

Within the post-COVID period, the influence of structural modifications within the economic system and monetary markets might not be absolutely appreciated by the consensus outlook for bonds. Adjustments throughout international economics, financial and monetary coverage, in addition to monetary concerns resembling debt issuance and portfolio hedging are contributing to persistently larger rates of interest and time period premia. This has the potential to restrict declines in longer maturity bonds as charges are reduce, and even trigger long-term charges to rise – particularly if the consensus view for a gentle touchdown performs out and results in “upkeep” cuts.

When contemplating the outlook for bonds, the consequences of a structurally totally different financial and market backdrop could also be shaping a “new” regime for bond buyers that requires a special playbook than previous cycles.

This publish initially appeared on the iShares Market Insights.

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.