Oil costs rose with inventory markets final week as tightening expectations had been reigned in. Provide restrictions are additionally beginning to chew, though China’s weak restoration continues to weigh on sentiment, and the IEA minimize its forecast for world demand for the primary time this yr. European fuel costs in the meantime proceed to slip. For agricultural commodity costs, the Black Sea Grain Initiative is as soon as once more in focus, as Russia at present refused to increase the deal, whereas demanding adjustments to the circumstances for its personal exports.

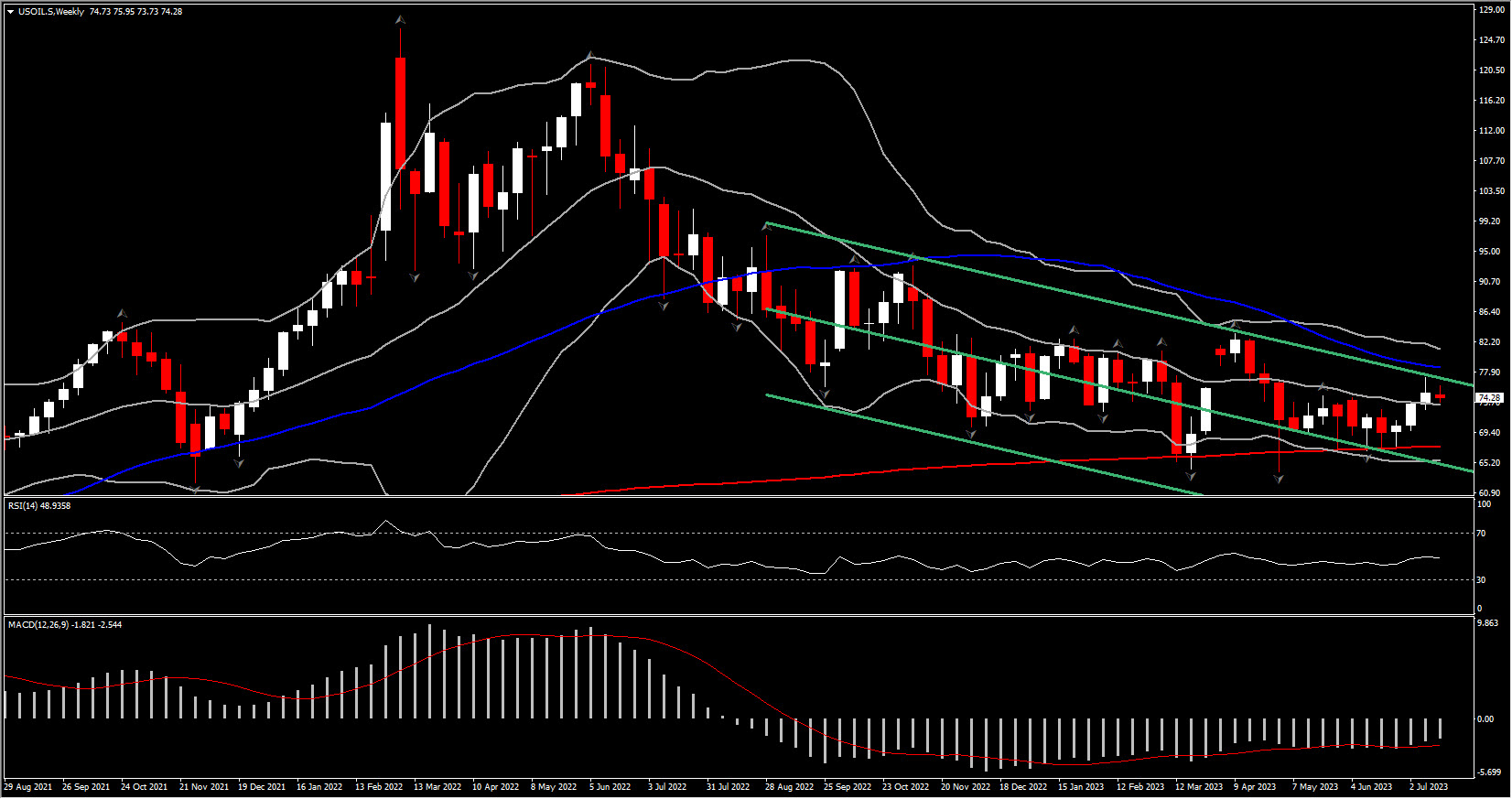

USOIL continued to maneuver larger final week, as output cuts are beginning to take impact. The IEA stated in its newest month-to-month report that “world oil provide rose 480 kb/d to 101.8 mb/d in June however is ready to fall sharply this month as Saudi Arabia makes a pointy 1 mb/d voluntary output minimize.” There are additionally indicators that Russia is lastly making true on its output minimize announcement. Up to now Russia’s restrictions have been falling wanting what Moscow introduced, however vessel monitoring information confirmed shipments by Russia’s western ports falling considerably within the 4 weeks to July 9.

The IEA nonetheless expects world manufacturing “to extend by 1.6 mb/d to 101.5 mb/d, as non-OPEC+ expands by 1.9 mb/d. In 2024, world provide is ready to rise by 1.2 mb/d to a brand new file of 102.8 mb/d, with non-OPEC+ accounting for all the improve.” Demand in the meantime is prone to be decrease than beforehand thought. The IEA now expects world demand to “climb by 2.2 mb/d in 2023 to succeed in 102.1 mb/d, a brand new file. Nevertheless, persistent macroeconomic headwinds, obvious in a deepening manufacturing stoop”, have led the group to revise its “2023 development estimate decrease for the primary time this yr, by 220 kb/d. Buoyed by surging petrochemical use, China will account for 70% of world beneficial properties, whereas OECD consumption stays anemic. Progress will sluggish to 1.1 mb/d in 2024”, based on the report.

Bloomberg at present reported that Japan plans to suggest a gl obal stockpile for pure fuel, just like the emergency oil stockpile, which requires member nations, such because the US and Japan to carry an oil reserve equal to not less than 90 days of web imports. The federal government will reportedly recommend that the IEA ought to create an equal fuel framework for member nations, with a proposal as a result of be set out through the LNG Producer-Shopper Convention with the IEA in Tokyo tomorrow. Bloomberg stated Japan is pushing for its proposal to be included within the agenda for an IEA ministerial assembly in February.

obal stockpile for pure fuel, just like the emergency oil stockpile, which requires member nations, such because the US and Japan to carry an oil reserve equal to not less than 90 days of web imports. The federal government will reportedly recommend that the IEA ought to create an equal fuel framework for member nations, with a proposal as a result of be set out through the LNG Producer-Shopper Convention with the IEA in Tokyo tomorrow. Bloomberg stated Japan is pushing for its proposal to be included within the agenda for an IEA ministerial assembly in February.

The USOIL contract is at the moment at $74.36, barely larger on the day, however nonetheless down -0.6% in comparison with Tuesday final week as China’s sluggish restoration is holding a lid on demand expectations. On high of that two of the three Libyan oil fields that had been shut final week re-opened over the weekend, which lifted output capability this week.

Gold costs jumped larger final week, because the US Greenback declined on rising conviction that the Fed is approaching peak charges. US information on shopper sentiment on Friday halted the slide within the USDIndex and capped the advance of gold, with costs little modified on the day on Monday at round $1,960 per ounce. Immediately bullion received a lift from the rally in bonds, triggered by feedback from ECB hawk Knot, who pushed again towards expectations of a September hike. Treasuries underperformed versus Eurozone peripherals particularly, however the US Greenback nonetheless struggled and held under 100 at at the moment 99.25. Gold is at the moment between 1963-1972, the highest stage because the center of June. International central financial institution outlooks, and particularly the Fed’s coverage path, will stay in focus.

Base metals in the meantime are holding an in depth eye on China’s development indicators, and costs dropped at present after second-quarter GDP numbers missed estimates. Hopes of stimulus from Beijing had helped to spice up sentiment earlier within the month, however to this point official bulletins of help have been falling wanting expectations.

Agricultural commodity markets stay targeted on the Ukraine warfare and climate circumstances. The FAO’s Meals Value Index dropped -1.7 factors (-1.4%) in June, however wheat costs have jumped in latest days following Russia’s refusal to increase the Black Sea Grain initiative that secures a secure commerce hall for Ukrainian exports through Black Sea ports. Russia at present pulled out of the UN brokered deal that had stored meals deliveries flowing from the Ukraine to the broader world. Russia claimed that its personal meals and fertilizer exports had been undermined by “hidden” Western sanctions and had successfully began to strangle the deal earlier than killing it off at present – simply earlier than the beginning of this yr’s harvest.

Kremlin spokesman Dmitry Peskov stated that till Russia’s calls for for alterations to its memorandum of understanding (MOU) with the UN had been met, it will now not help the initiative. “The grain deal has halted”, Peskov stated, though he added that “as quickly because the Russian a part of the deal is fulfilled, the Russian facet will resume the achievement of this deal directly”. Turkey, which helped to interrupt the unique deal, remained optimistic {that a} answer might be discovered, forward of a gathering with Russia tonight. The USDA in the meantime lifted home provide and output forecasts for wheat for the 2023/24 season, and steered that latest dry climate circumstances are unlikely to hamper manufacturing.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.