The most recent knowledge is sticky, however the markets have solely delayed relatively than canceled that the Federal Reserve will begin trimming rates of interest within the close to future.

Some analysts are pushing again on the thought, together with forecasts in some quarters that the Fed could go away charges larger for longer.

However judging by implied market estimates for adjustments in financial coverage, the central financial institution continues to be on observe to chop within the close to time period.

The primary minimize is anticipated for the June 12 FOMC assembly, in response to Fed funds futures, that are presently pricing in a roughly 77% likelihood for alleviating on that date, based mostly on CME knowledge this morning.

Against this, the futures market anticipates that no adjustments within the goal price are possible on the March 20 and Might 1 conferences.

Fed Fund Futures Possibilities

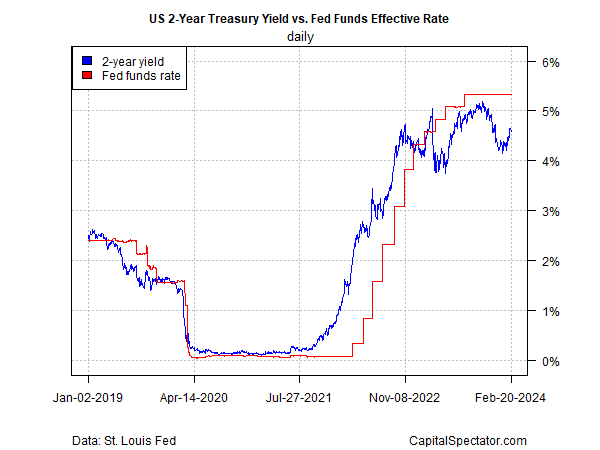

The Treasury market continues to cost in price cuts as properly, based mostly on the policy-sensitive , which is taken into account essentially the most delicate spot on the yield curve for anticipating near-term coverage.

The two-year yield was 4.59% yesterday (Feb. 20), considerably beneath the Fed’s present 5.25%-to-5.50% goal price (or roughly 5.33% on the median).

US 2-Yr Yield vs Fed Funds Efficient Price

The implication: the Treasury market expects price cuts within the close to time period. In fact, the market has been anticipating that for greater than a 12 months, based mostly on the 2-year yield, and the implied forecast has but to play out as anticipated.

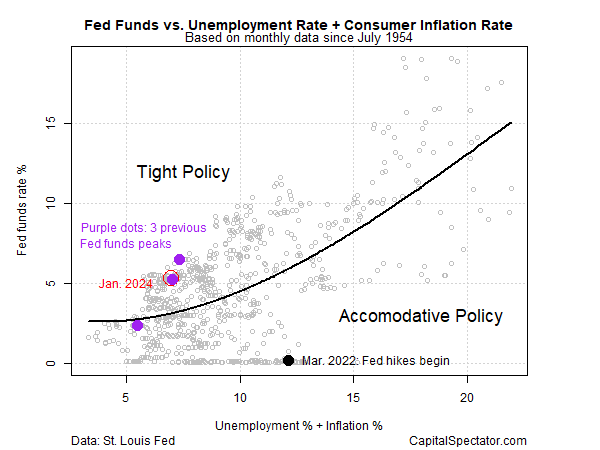

Reviewing a easy mannequin that compares the Fed funds price to inflation and unemployment means that coverage is tight and so price cuts are cheap at this level.

Fed Funds vs Unemployment Price+Shopper Inflation Price

A number of financial coverage guidelines calculated by the Cleveland Fed paint the same image. The essential model of the so-called Taylor rule, as an illustration, suggests the present Fed funds price needs to be considerably decrease.

Nonetheless, there’s room for debate. Begin with the Cleveland Fed estimates: one mannequin (First distinction rule) suggests charges ought to go larger nonetheless.

Former Treasury Secretary Larry Summers says there’s a 15% likelihood that the Federal Reserve will proceed to boost rates of interest to tame inflation, which has slowed lately however step by step so, elevating issues that disinflation has stalled.

“There’s a significant likelihood — possibly it’s 15% — that the subsequent transfer goes to be upwards in charges, not downwards,” he informed Bloomberg Tv on Friday. “The Fed goes to need to be very cautious.”

Atlanta Fed President Raphael Bostic, a present voting member on the Fed, on Friday mentioned:

“We’ve seen a whole lot of progress when it comes to inflation,” however the pattern will probably be a “little bumpy” all through 2024.

For now, he nonetheless expects price cuts within the “summertime” he informed CNBC, and presently sees two cuts for 2024, which is fewer than implied by the full-calendar 12 months outlook through Fed funds futures.

The subsequent main actuality examine on expectations through knowledge releases arrives subsequent week (Feb. 29) with the January launch of knowledge.